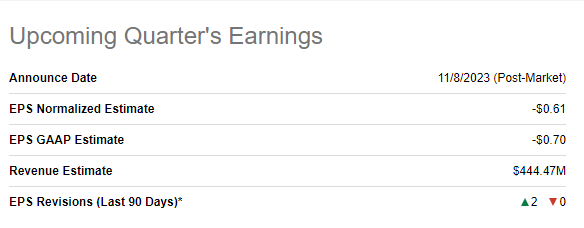

Affirm Holdings, Inc. (NASDAQ:NASDAQ:AFRM) will report earnings for fiscal Q1 that ended September 30th, 2023, post-market on Wednesday, November 8th. Analysts expect Affirm to report a non-GAAP EPS loss 61 cents on revenue of ~$445 million. Should Affirm meet these numbers, it would represent a YoY growth in EPS (or decrease in loss) of 30% and a revenue growth of 23% YoY.

AFRM Q1 Preview (Seekingalpha.com)

In my last coverage of Affirm, I had reviewed the company’s then upcoming Q4 report and rated the stock a “Hold”. Since then, the stock has gained 50% compared to the market’s 1% loss. Will this outperformance continue post Q1 earnings? With that background out of the way, let’s preview Affirm’s Q1 without any further ado.

Still Expected To Lose Money, Adjusted Too – Again

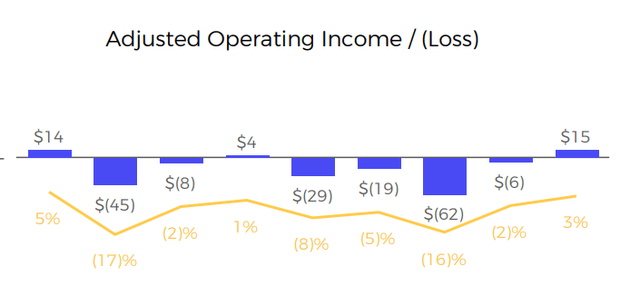

I had the exact same heading for this section in my Q4 review, except for the “Again” at the end. Because the story remains the same. As noted above, Affirm is expected to lose money on adjusted, non-GAAP basis in Q1 2024 as well. One thing to note is that in my Q4 review, I predicted that Q4 2023 was likely to be a positive quarter based on the company’s short history as a public company. That turned out to be true as Affirm reported $15 million in adjusted operating income in Q4 2023.

More importantly now, Q1 has been the weakest or the second weakest quarter historically based on the data available on Affirm’s website. For example, Q1 2022 had a loss of $45 million, the highest in that FY. Q1 2023 reported a loss of $19 million, the 2nd highest for that FY. Will affirm report one of its weakest quarters again in a few days? History suggests so.

AFRM Adj Operating Income (investors.affirm.com)

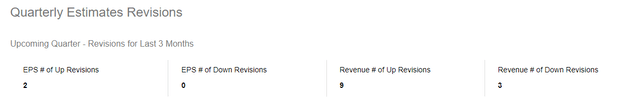

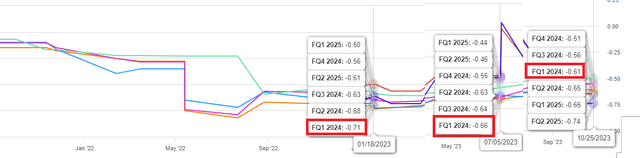

Analyst expectations are trending in the positive direction heading into Q1 as indicated by the numbers below with two EPS revisions being to the upside and 9/12 revenue revisions to the upside. Q1 2024’s EPS expectations have improved over the course of the year as shown in the chart below, with the expected loss narrowing from 71 cents/share to 61 cents/share.

AFRM Revisions Count (Seekingalpha.com)

AFRM Q1 EPS Trend (Seekingalpha.com)

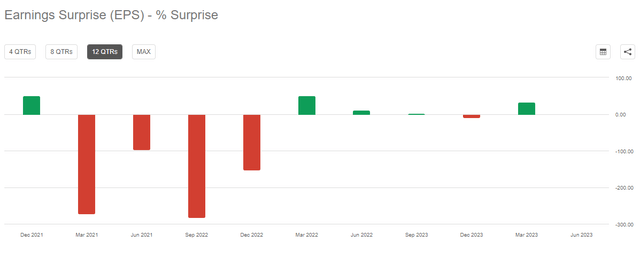

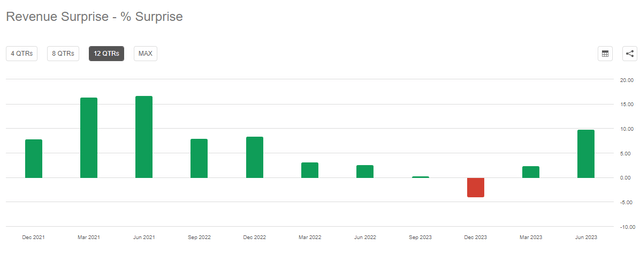

Beat or Miss? Let’s Toss A Coin

Over the last 11 quarters, Affirm has beaten EPS estimates 5 times and revenue estimates 10 times. I am predicting a beat on revenue based on history as well as the company’s age (or stage of its business cycle). Predicting EPS is a coin toss though as operational discipline at this stage is rare.

AFRM EPS Surprise (Seekingalpha.com)

AFRM Revenue Surprise (Seekingalpha.com)

Main Stories – Interest Rates, Amazon, Expenses, and Debt

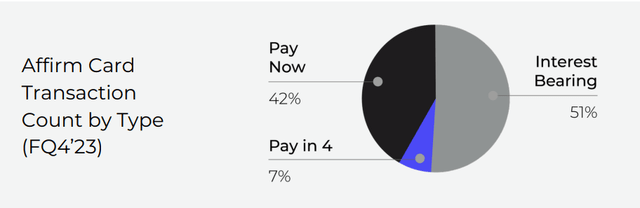

- In my Q4 preview, I noted a worrying trend that Affirm’s reliance on interest bearing transactions was getting bigger with the number going from 64% to 67% to 69% in the first three quarters of FY 2023. This trend suddenly and strongly reversed course in Q4 as interest bearing transactions made up just 51% of the total in Q4.

- Interest rates have gone up a little since Q4, so it will be interesting to in the Q1 report whether the drop in Q4 was a one-off or a reversal with consumers pushing back against high rates by opting to pay in full. Affirm investors would obviously want the 51% to go down lower in Q1 but let’s wait and watch.

AFRM Transaction Type (investors.affirm.com)

- Amazon.com (AMZN)’s Amazon Business chose Affirm Holdings as its first partner to offer BNPL choices to its customers. This news helped AFRM stock gain more than 13% as covered here by Seeking Alpha. This deal obviously materialized after Q1 ended but is likely to be a hot topic with analysts in the Q&A session.

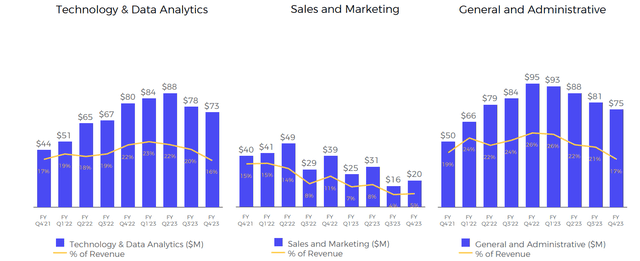

- Affirm’s expenses have been trending down over the last few quarters as depicted in the charts below. Will the trend continue in Q1 2024 or will a new FY release some additional funds for the company to invest with or indulge in? I predict Q1 2024’s expenses to come in higher than in Q4 2023 primarily due to the new budget that typically becomes available at the beginning of a FY but should still come in far lower than the numbers in Q1 2023.

AFRM Expenses Trend (investors.affirm.com)

- Affirm’s net debt has been going higher every single quarter since March 2021, despite the total debt showing a QoQ decline occasionally. This means that the general debt level remains elevated even as the company’s cash and equivalents have been reducing over this two and a half year stretch. Will Q1 continue the trend? I believe so given that the macro conditions have generally been the same, at best, for consumers and paying off debt would not have been a high priority for the company in Q1.

AFRM Net Debt (Seekingalpha.com)

Valuation – Still Overvalued For Current Environment

- Using 2023’s gross revenue of $1.59 billion, Affirm is currently valued at 4.25 times sales. For comparison, PayPal Holdings, Inc. (PYPL) is trading at 2 times 2022’s gross revenue and recently delivered a strong report that pushed its stock up a little. PayPal has deeper pockets and a stronger ecosystem to outlast the current environment. I am not sure Affirm does though. Overall, the glory days of FinTech stocks being awarded rich multiples backed by easy borrowing are long gone.

- AFRM stock has a median price target of $16.75 from 18 analysts, representing significant downside from here should the market start punishing riskier names again. PayPal is still trading 28% below its median price target and offers a bigger margin of safety in comparison.

- AFRM stock has gone up nearly 150% YTD and I believe the company fundamentally hasn’t changed that much in 2023 (calendar or fiscal). Short squeeze could be a potential catalyst as this article suggests but in an environment where even the most profitable company needs “fans” to support it, I am not sure investing for a short squeeze is the right strategy for most of us.

AFRM Chart (Seekingalpha.com)

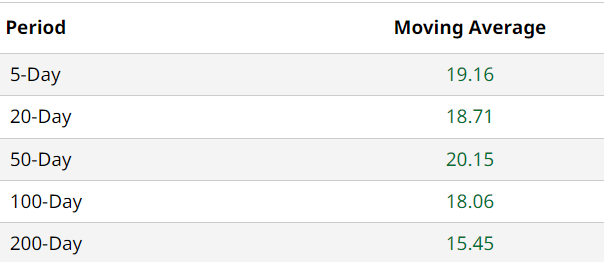

Technical Strength

Given the stock’s run in the last 3 months, it is not surprising that the stock has cleared all the commonly used moving averages. Generally speaking, this is good news, especially when combined with the fact that AFRM’s Relative Strength Index [RSI] is well below the overbought level. But one thing to note is that the 200-Day moving average is more than 30% below the current trading price while the 100-Day moving average is nearly 20% below the current market price. This means, should the upcoming report disappoint, AFRM stock has a long way down before it finds strong, long-term support.

AFRM Moving Avgs (barchart.com)

AFRM RSI (barchart.com)

Conclusion

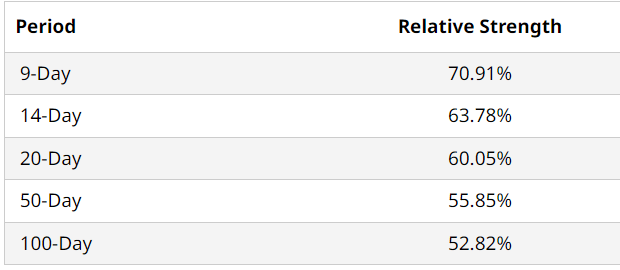

I wrote in my Q4 preview that I don’t expect the rates to take the elevator down once they stop climbing the stairs. Since then, rates have take at least a stair or two up but have leveled off a little. But there are no immediate signs that rates will even take a stair down anytime soon, much less the elevator. That means, companies like Affirm that thrive on consumers’ ability to borrow freely are going to get squeezed (not the type of squeeze longs would want). I am tempted to downgrade the stock to a “Sell” but I am retaining my “Hold” rating given the market’s reversal last week with riskier assets catching more bids than safer names. If you are sitting on sizeable gains though, I recommend trimming before the Q1 report and evaluate the rest of the position after Q1 report is in.

US Fed Fund Rates (tradingeconomics.com)

Read the full article here

Leave a Reply