Investment Rundown

The revenues are hopefully about to start increasing for Aeva Technologies, Inc. (NYSE:AEVA) as they begin to make decent progress on their productions and in 2024 the first major revenues are set to begin. However, the company is still trading at a pretty rich valuation based on just p/s of nearly 10x based on 2024 forecasted numbers of around $29 million.

AEVA engages in the electronic equipment and instruments industry where it offers 4D LiDAR-on-chips to an international customer base. The company is right now increasing product levels to take advantage of demand and the possibility of strong market growth. However, for those investors that seek a value play right now, I don’t think AEVA is one, unfortunately. The company is yet to generate a positive net income, and with production only really starting in 2024 I think there is a strong likelihood of there being a few years at least until the first positive EPS is seen. That boosts the risks associated with the stock right now and brings a buy thesis down to a hold instead in my opinion.

Company Segments

AEVA has a global customer base with some notable ones being the United States, Thailand, Europe, the Middle East, and Asia, as it designs and development of advanced 4D LiDAR-on-chips. This cutting-edge technology is founded on frequency-modulated continuous wave sensing, allowing the company to create innovative solutions with a wide array of applications.

The focus for AEVA is its 4D LiDAR sensing system, which is augmented with embedded software, specialized to a diverse spectrum of industries. These industries include automotive, where the technology plays a pivotal role in enabling advanced driver assistance systems and autonomous driving features. AEVA 4D LiDAR systems are also well-suited for industrial applications, contributing to enhanced automation and efficiency across various sectors. Furthermore, the technology extends its reach into security applications, where it plays a crucial role in surveillance and threat detection.

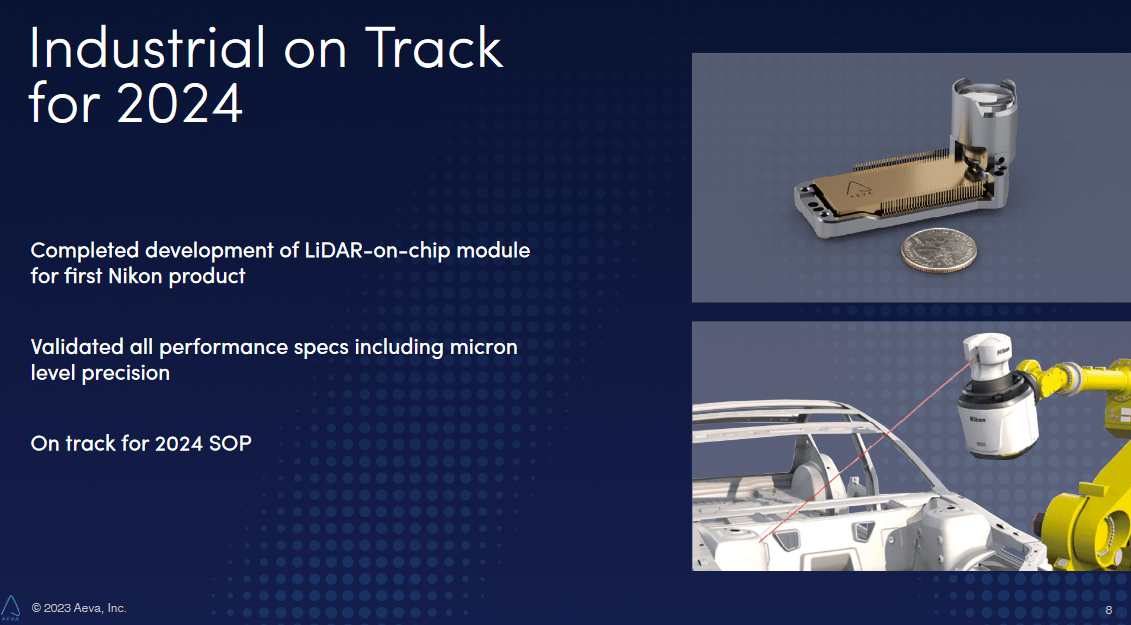

Company Plans (Investor Presentation)

The company is making strong moves to increase production and become a leader in the space quickly. In 2024 there will be a lot of eyes on the company to see how it can meet expectations deliver an increase in production and boost revenues as a result.

Company Growth (Investor Presentation)

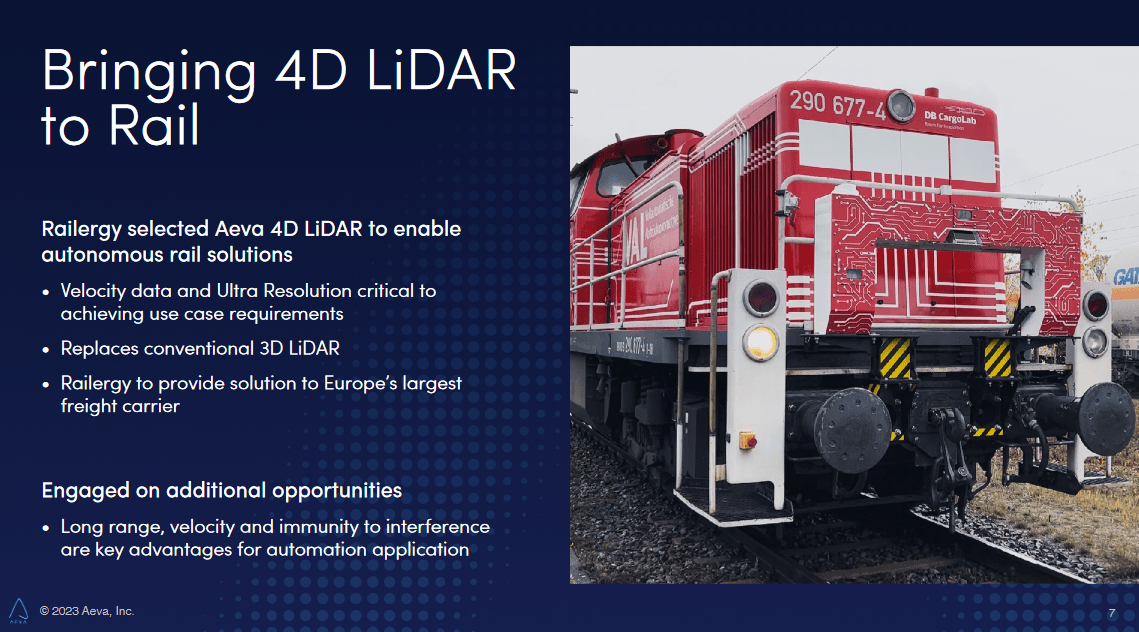

Besides that, however, AEVA is also moving into other key markets where their product can be applicable. The rail industry is one of them. The total market size for the LiDAR is at just $1.4 billion right now but is expected to display a near 20% CAGR up until 2028 which would value it at $3.8 billion instead. This sort of growth is possible for AEVA I think in regards to the top line. I think we are still some time away from the bottom line to display the same growth as production and operations need to be established before significant margin expansions can be considered I think.

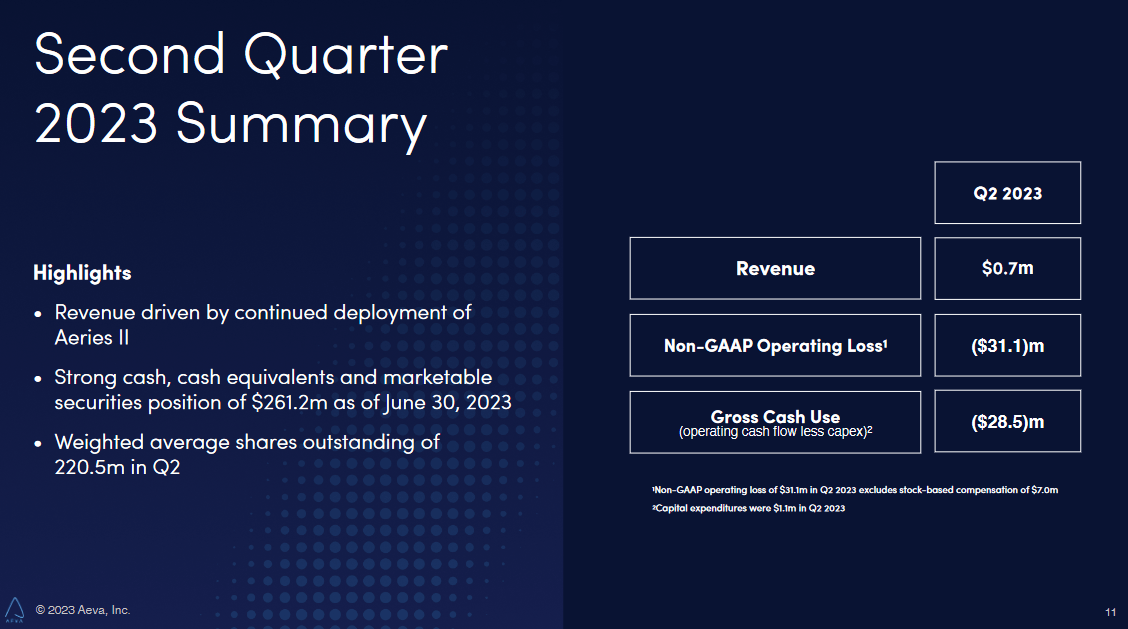

Q2 Results (Investor Presentation)

As we can see, the revenues for the last quarter are not something to cheer about. But to give some positives at least, AEVA is experiencing some revenue growth driven mostly by more deployment of Aeries II. With a strong cash position though, I think AEVA remains in a position where they will be able to finance operations up until production begins next year. The shares dilution by the company has been decreasing at a decent rate and this has in my opinion helped reduce the risk profile of the business and leads it to be a hold rather than a sell at least.

Looking at a peer in the industry like Luminar Technologies, Inc. (LAZR) we can compare some of the numbers between the two. LAZR seems to be suffering from a lot of the same issues as AEVA, lacking profitability but with strong growth outlooks. For both of them, the first positive EPS is to be in 2026 but it seems AEVA is projected to grow faster and reach a p/e of under 2 with the current price in mind, whilst LAZR has a p/e of nearly 8 in 2027 instead. Besides that, LAZR has a long-term debt position of over $600 million which I think could weigh on the growth potential in comparison to AEVA as they have none. That leaves LAZR in a less flexible financial position to operate from and ultimately makes me more bullish on the prospects of AEVA instead.

Risks

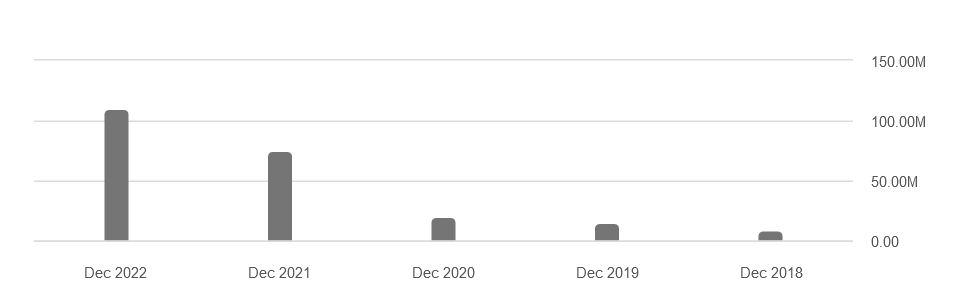

AEVA, with a market cap of just around $230 million with 219 million shares outstanding, presents an intriguing case for investors seeking an attractively valued opportunity. However, this seemingly advantageous valuation also comes with its own set of challenges, primarily related to the potential need for additional capital infusion. While the compact market capitalization paints an alluring picture from a valuation perspective, it does raise concerns about the company’s financial flexibility and ability to meet its capital requirements without resorting to dilutive measures. The company lacks significant revenues and that perhaps may force them to raise capital to cover operational expenses. R&D expenses are at an all-time high of $110 million in the last 12 months. I expect this to continue being a larger part of the expenses, and will likely keep the valuation somewhat suppressed until AEVA can outpace it by expanding and gaining market share.

R&D Expenses (Seeking Alpha)

Besides debt and the risk of share dilution, I think that AEVA may also be prone to significant challenges coming from competition. The space that the company operates in is quite small, valued at around $1.4 billion. If AEVA can capture more of the market share it could be huge for the revenue growth and generate a strong ROI for investors. However, there is still a pretty decent risk that major players start to see the sector as something they can enter, and with more capital readily available to spend AEVA will need to perform incredibly well and have a superior product to get some leverage and advantage.

Final Words

AEVA is still a developing company that is establishing its production levels very well right now and I think we will see strong top-line growth in the next year. However, the company is not generating a sufficient amount of revenue in 2024 as estimated to make the current valuation reasonable in my opinion. With a p/s of nearly 10 given 2024 numbers, I would rather stay holding shares right now and potentially add more if it reaches a more reliable level of around 2 – 3x sales instead. For this reason, I am rating the company a hold for now.

Read the full article here

Leave a Reply