Introduction

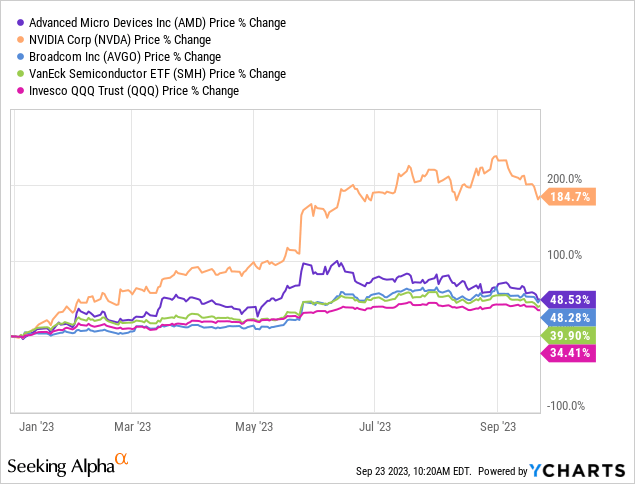

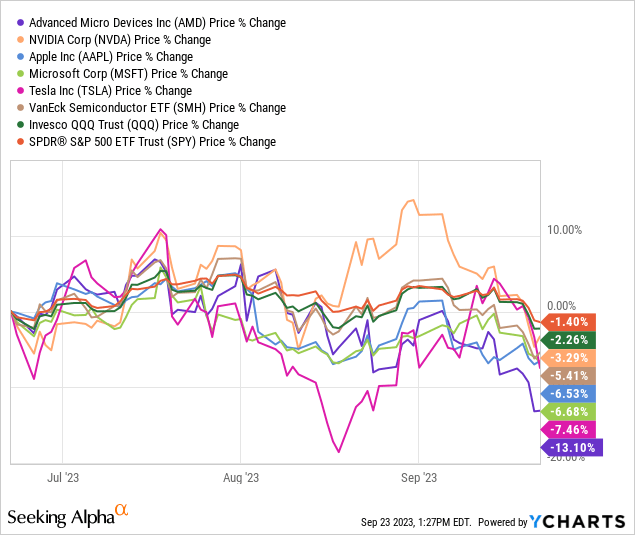

In 2023, a red-hot generative AI hype cycle has powered semiconductor stocks like Advanced Micro Devices, Inc. (NASDAQ:AMD), Nvidia (NVDA), and Broadcom (AVGO) higher, with the VanEck Semiconductor ETF (SMH) handily outperforming the mega-cap tech-dominated Invesco QQQ ETF (QQQ).

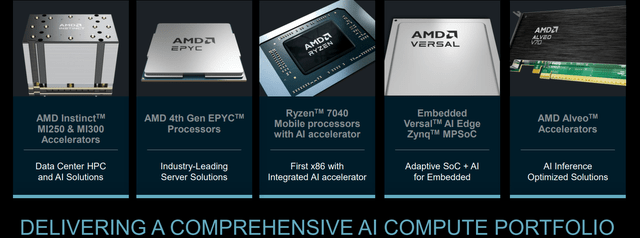

Recent breakthroughs in generative AI have triggered a rush for AI chips (primarily GPUs) this year, and semiconductor giants are naturally benefitting as the “picks and shovels” providers of this AI rush. In Nvidia: The Magnificent One Delivers On Its AI Promise, we reviewed Nvidia’s latest blowout quarterly results, which substantiated the AI rush and NVDA’s dominance in the data center AI chips market. While Nvidia is the clear leader right now, Advanced Micro Devices, Inc. [AMD] has a good shot at becoming the Pepsi (PEP) to Nvidia’s Coke (KO) in the humongous data center AI chips market, which is expected to grow at a 50% CAGR over the next five years to become a $150B market!

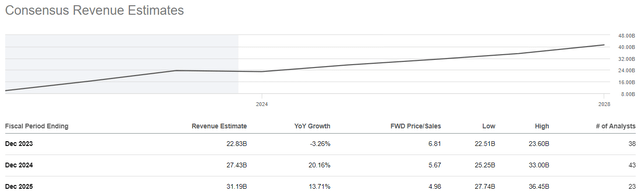

As you may know, AMD is set to launch its Mi300 AI chip in the near future to stake its claim in this emerging market. While AMD’s share gains in the data center AI chips market are likely to be limited to 10-20% over the long run, playing second fiddle to Nvidia may still represent an amazingly good outcome for AMD shareholders. According to consensus estimates, AMD’s revenue growth is all set to re-accelerate back up to 20% next year on the back of strong demand for its data center GPUs, with EPS projected to grow by 52%.

SeekingAlpha

SeekingAlpha

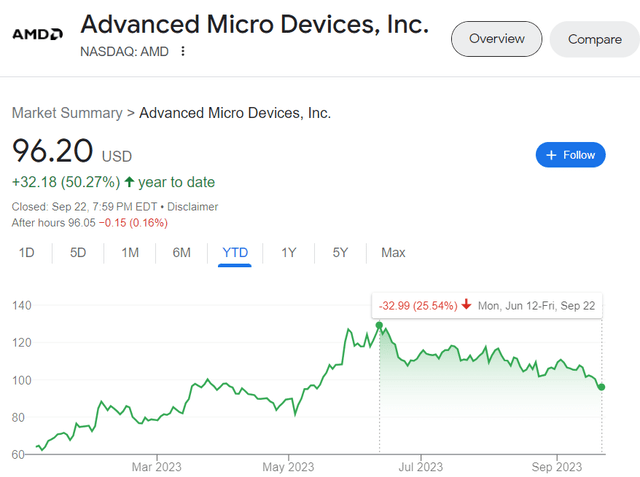

Now, despite having a healthy business outlook, AMD’s stock has tanked by more than 25% from its recent peak of ~$129 over the last three months or so. And investors are naturally pondering if this is a good buying opportunity.

Google Finance

In this note, we will investigate the dip in AMD stock, and then re-assess the stock using our proprietary process.

Why Is AMD Stock Crashing So Hard?

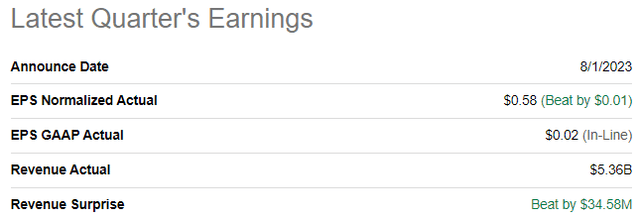

Despite beating its top and bottom line expectations for Q2 2023, AMD’s stock has tanked by ~25% from its recent highs of ~$129 per share in just over three months. While this move could be a corrective pullback, the velocity and depth of this move resonate with a crash.

SeekingAlpha

AMD Q2 2023 Earnings Release

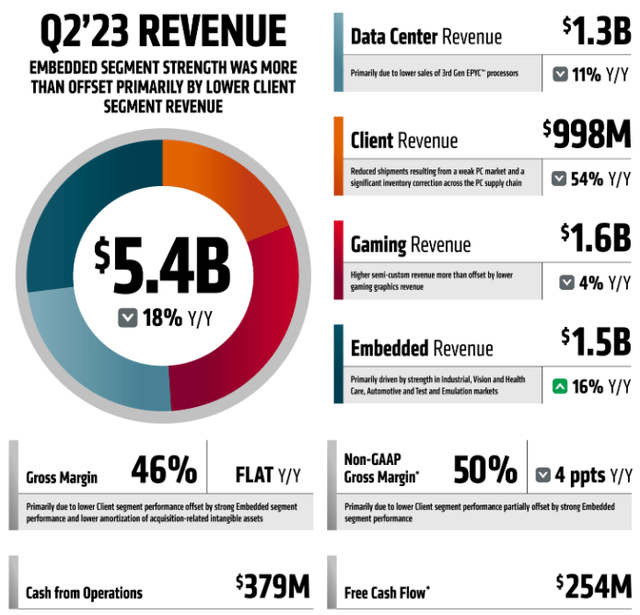

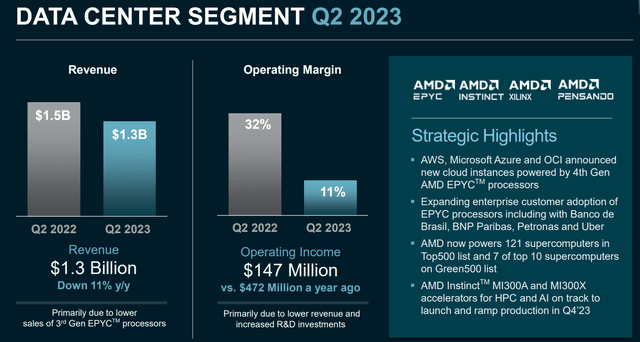

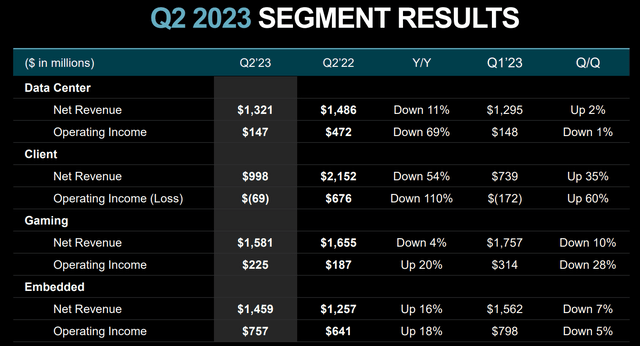

The common bearish narrative floating around in the media is that AMD is not a real beneficiary of the generative AI trend, with its financial performance (especially data center revenue) still in decline. In Q2 2023, Nvidia’s data center revenue grew at +171% y/y to more than $10.3B; whereas, AMD’s data center revenues declined by -11% y/y to $1.3B.

AMD Q2 2023 Earnings Presentation

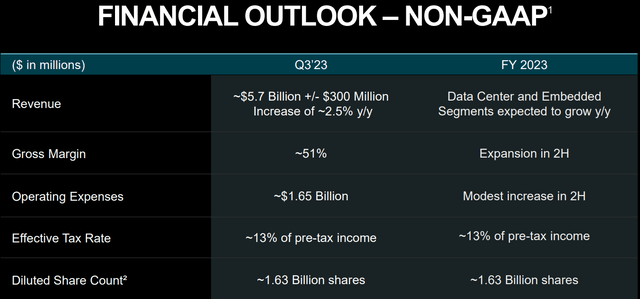

While the numbers clearly show that AMD is nowhere close to Nvidia, AMD has a comprehensive AI compute portfolio that’s set to drive healthy growth at the company for several years to come. Now, AMD’s financial reports haven’t showcased an AI boost just yet; however, the Mi300 AI GPU chip is on track to scale in Q4 2023, and I think AMD’s data center revenues are set to rebound sharply in 2024.

AMD Q2 2023 Earnings Presentation

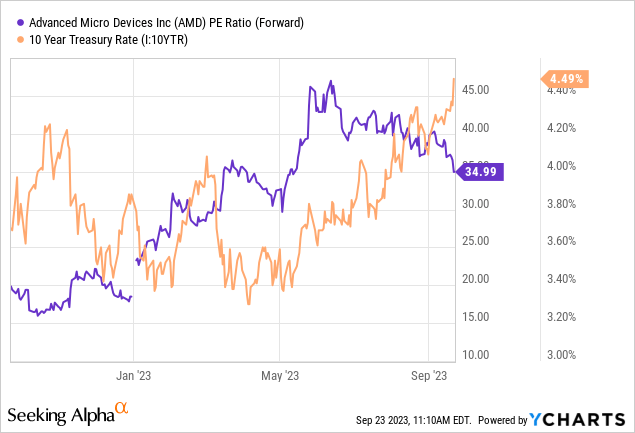

In my view, AMD’s recent stock price decline is not down to weak financial performance at all. The big year-to-date jump in AMD’s stock price was driven primarily by trading multiple expansion; however, with long-duration treasury yields climbing rapidly in recent weeks, trading multiples have been contracting lower.

And negative price action in Nvidia (despite its blowout quarter and guidance) and other mega-cap tech names support my view that this move in AMD is driven by a change in the interest rate environment [higher discount rate = lower asset prices].

Now, let’s run AMD through our process to see if this ongoing sell-off is a buying opportunity for investors.

Running AMD Through Our Analysis Process

As a long-term investor, I like to fine-comb every stock idea using a mix of fundamental, quantitative, technical, and valuation analysis in order to make informed investing decisions. Let’s start this exercise for AMD.

1. Fundamental Analysis

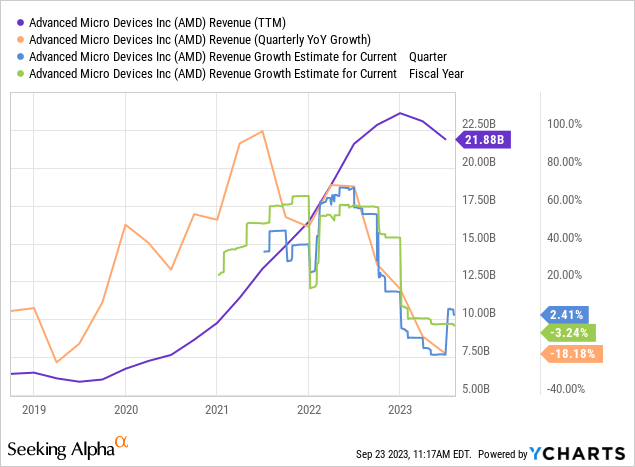

After several years of rapid growth, AMD’s growth story hit a painful snag in H1 2023, with revenue down -18% y/y in Q2 2023 primarily due to weakness in Client and Data Center businesses.

AMD Q2 2023 Earnings Presentation

Over the years, AMD’s business has been shifting toward the data center segment; hence, weaker sales of 3rd Gen EPYC processors were having an outsized negative impact on AMD’s results in Q2 2023. And in the Client segment, a drastic shift from supply constraints to a supply glut in the PC market has led to under-shipping from the likes of AMD and Intel (INTC) in recent quarters.

While the PC market [and AMD’s Client business] is only likely to recover gradually over time, we are likely past the trough here. And more importantly, AMD’s data center business is all set to return to positive growth this quarter on the back of stronger adoption of AMD’s 4th Gen EPYC processors from cloud hyperscalers such as Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure.

AMD Q2 2023 Earnings Presentation

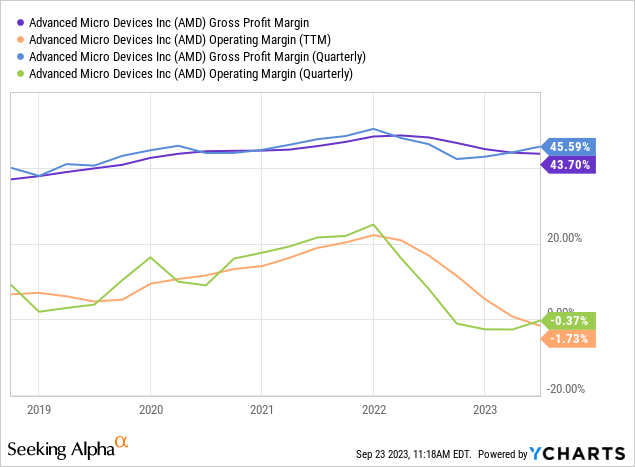

In addition to an imminent recovery in revenue growth, AMD is set to experience a margin expansion in H2 2023 as channel inventory gets back in the balance (price discounting ends). And we have already seen early signs of margin improvement at AMD in Q2 2023:

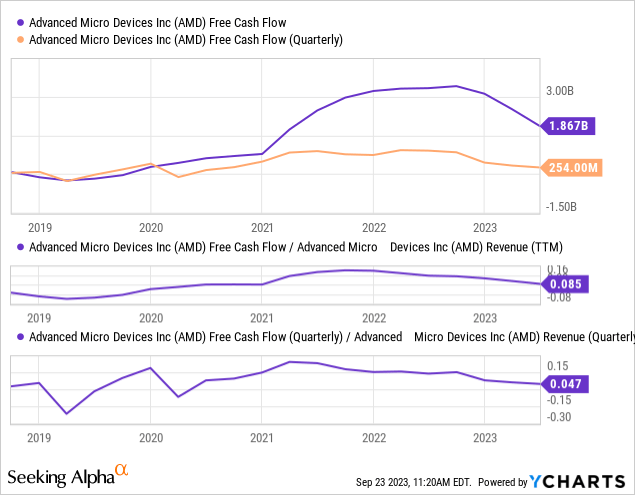

Now, as you can see below, declining revenues and shrinking margins have pressured AMD’s cash flow generation in recent quarters, with TTM and Quarterly FCF margins falling to 8.5% and 4.7% in Q2 2023.

In upcoming quarters, a return to positive sales growth coupled with margin expansion should lead to stronger free cash flow generation at AMD. And with that, I would expect the company to resume its stock buyback program.

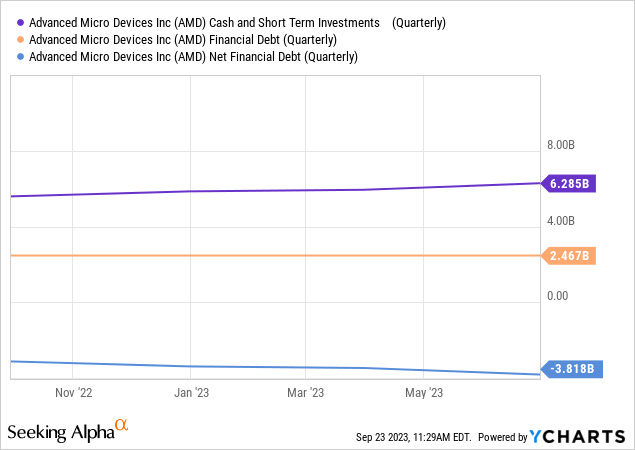

As of Q2 2023, AMD had a net cash balance of $3.8B on its balance sheet, giving the chip giant a strong financial foundation. With AMD likely to deliver increasing amounts of free cash flows in upcoming quarters, I see no liquidity issues for the foreseeable future.

From a fundamental perspective, AMD remains a sound business. With a broad product portfolio, AMD is well-positioned to survive and thrive in the era of AI, and financial performance is likely to improve significantly in the short term as inventory headwinds subside. A recession could throw a spanner in the works for AMD’s 2024 growth story; however, as of now, AMD looks all set to re-accelerate sales growth and boost profitability [earnings & free cash flows].

2. Valuation Analysis

Generally, equities are valued on a relative and/or absolute basis. In this exercise, we shall value AMD via both of these perspectives.

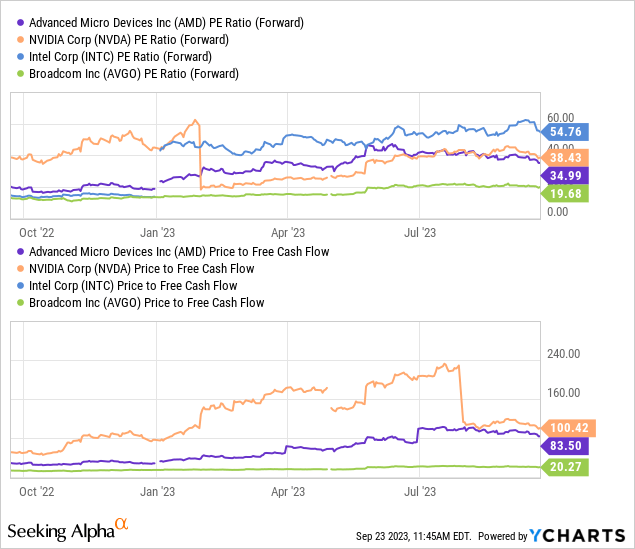

From a relative valuation standpoint, AMD appears to be richly valued at ~35x forward P/E (normalized EPS) and ~83x P/FCF especially in a rising interest rate environment where the long-duration treasury yields are >4%.

Now, let’s consider AMD’s absolute valuation.

AMD’s Fair Value And Expected Returns

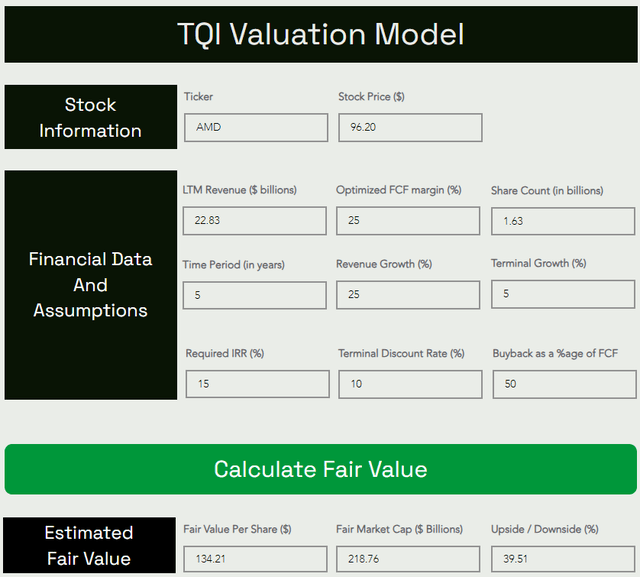

In light of Nvidia’s blowout quarter (and high demand for AI chips), I have upgraded AMD’s 5-year CAGR sales growth expectations from 15% to 25% in our model. As I see it, AMD’s data center business is all set to return to rapid growth in upcoming quarters, with demand for AI GPUs set to drive revenues higher. With $1T worth of cloud & data center infrastructure set to be replaced over the next 10 years, AMD has a long runway for growth.

Here’s my updated valuation model for AMD:

TQI Valuation Model (TQIG.org)

As you can see above, AMD stock is currently trading at a significant discount to its fair value of ~$134 per share.

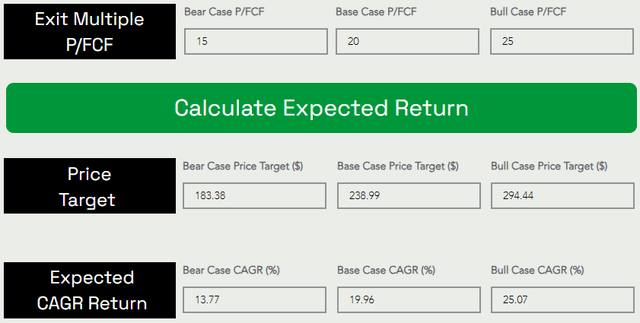

Assuming a base case P/FCF exit multiple of ~20x, we get to a 5-year price target of ~$239 per share, which implies a CAGR return of ~20%.

TQI Valuation Model (TQIG.org)

Since its expected CAGR return handily beats my investment hurdle rate of 15%, I like AMD from a long-term risk/reward standpoint.

Now, let’s evaluate AMD’s near-term risk/reward using technical analysis.

3. Technical Analysis

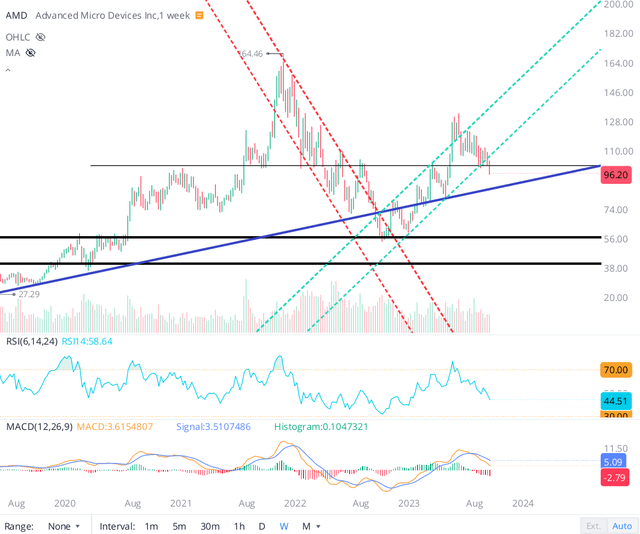

After striking a bottom at the top end of its multi-year support zone in the $40-60 range back in late 2022, AMD’s stock has rallied higher in a wide channel marked in dotted green lines on the chart below. With RSI and MACD indicators rolling over on the weekly chart, the ongoing sell-off in AMD stock could quite easily extend to the multi-year support trendline at ~$80-85 and a re-test of the $40-60 range cannot be ruled out either (given the rising possibility of an economic recession).

WeBull Desktop

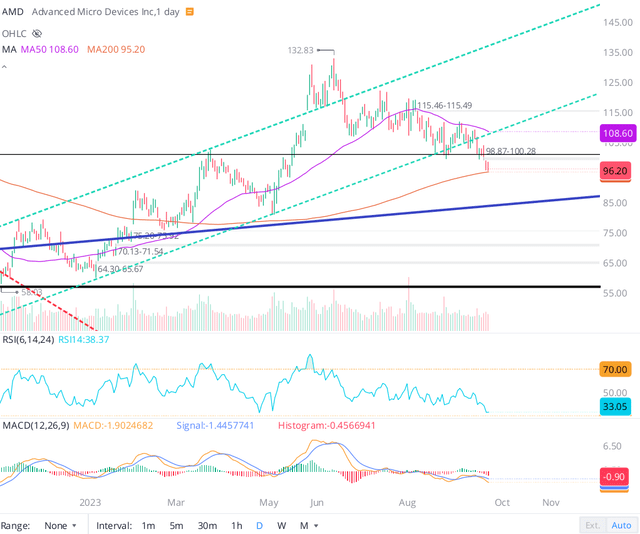

That said, AMD is currently sitting at the 200-DMA support level and is very close to oversold territory (RSI: 33) on the daily chart. A technical bounce here could materialize in the upcoming session; however, if the broad market sell-off intensifies, I can see AMD sliding down to the low $80s.

WeBull Desktop

Overall, AMD’s technical setup is looking bearish, with the stock losing momentum in recent weeks and breaking below the lower end of the upward channel it’s been trading in since hitting a bottom in October 2022. If we do end up in an economic recession, AMD’s expected sales growth and earnings rebound may fail to materialize in 2024. And in that scenario, I think a re-test of the October lows is possible.

Technically, AMD stock looks primed for further downside in upcoming weeks, and so, I view the near-term risk/reward in AMD stock as unfavorable.

4. Quant Factor Grade Analysis

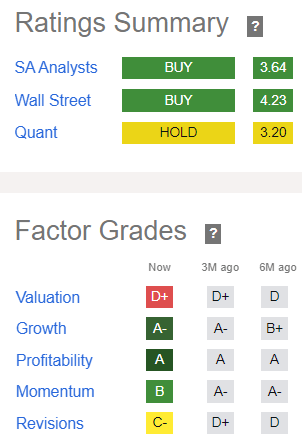

In addition to its ominous technical setup, AMD’s quant factor grades are currently unsupportive for fresh buying. According to SA’s Quant rating system, AMD is rated a “Hold” with a score of 3.20/5. While its “Profitability” and “Growth” grades have held up at “A” and “A-” over the last three months, AMD’s (technical) “Momentum” grade has deteriorated from “A-” to “B” offsetting the improvement in (earnings) “Revisions” grades from “D+” to “C-“.

AMD’s Quant Factor Grades (SeekingAlpha)

As we saw earlier in this note, AMD looks expensive on a relative valuation basis, and that’s what is reflected in its quant factor grade of “D+” for “Valuation”. However, from an absolute valuation standpoint, AMD is significantly undervalued, and for this reason, I think investors can choose to ignore the quant factor grades in this instance and buy AMD here if they are putting capital to work for the long run [3-5+ years].

Concluding Thoughts: Is AMD Stock A Buy, Sell, or Hold?

Advanced Micro Devices, Inc. has had a spectacular turnaround over the past decade, and despite hitting a snag in 2023, the growth story is set to resume next year, with revenue growth set to rebound to 20%+ on the back of strong demand for AI GPU chips and a stabilization in the PC markets. AMD has a strong balance sheet (solid financial foundation) and its business remains a free cash flow generating machine.

AMD’s transition to a data-center-centric business should enable it to remain far more resilient through an economic downturn compared to previous cycles. And demand for AMD’s products is likely to grow rapidly over the coming years as ground-breaking, compute-intensive technologies such as generative AI come to markets.

While AMD’s technical charts and quant factors grades do not support a near-term long position in the stock, the long-term risk/reward [~20% expected CAGR return] and business fundamentals remain healthy. Hence, I rate AMD stock a buy at current levels, with a preference for dollar cost averaging.

Key Takeaway: I rate Advanced Micro Devices, Inc. stock a “Buy” at ~$96 per share, with a strong preference for slow, staggered accumulation.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Read the full article here

Leave a Reply