It has been well over a year since I last covered Spotify (NYSE:SPOT) for Seeking Alpha. At that time, the company was in the thick of the Joe Rogan n-word controversy.

Q2 Shareholder Letter (Spotify)

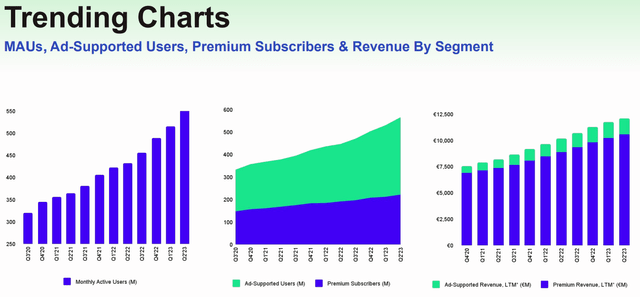

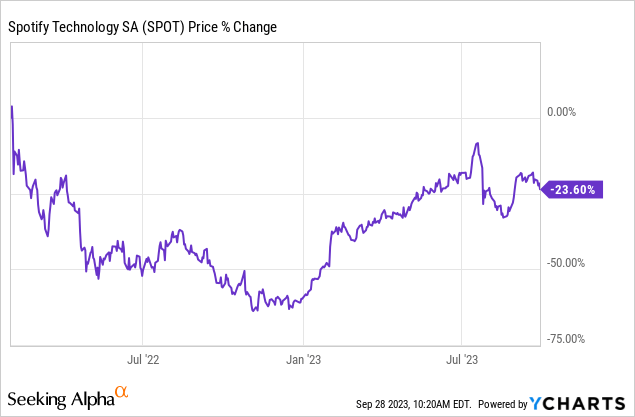

While Spotify hasn’t skipped a beat in MAU growth in the time since that article, the stock performance has not been great if you went long on my dip “buy” call.

Timing is important in the markets, and the timing of that trade was not great. To be fair, 2022 was a bad year across the board and SPOT shareholders have actually done very well so far in 2023. As we approach what I believe is a fairly obvious economic slowdown, I think it’s worth revisiting Spotify to assess possible headwinds for the underlying business in the shorter term. There are numerous articles on Seeking Alpha that have detailed the financial performance of Spotify’s second quarter earnings. In this article, I’d like to instead focus specifically on the ad-supported business.

Ad-Streamer Gross Margin

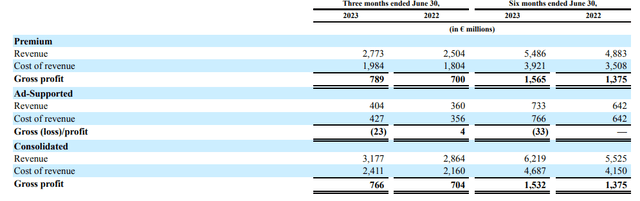

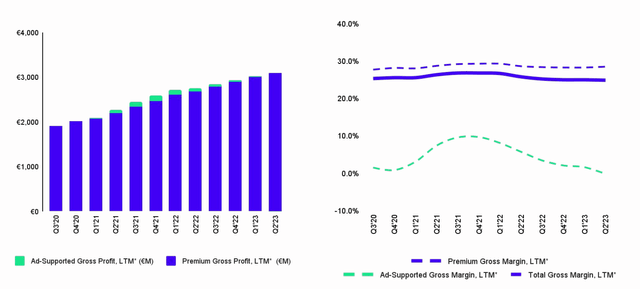

One of the concerns noted in the company’s Q2 report was the decline in gross profit. Specifically, gross margin in the ad-supported tier flipped negative in the second quarter for the first time since 2020 when ad budgets were slashed due to COVID lockdowns:

Spotify 10-Q

In the three months ended June 30th, gross profit margin on Spotify’s €404 million from the ad-supported segment was -5.7%. However, the company did note that the quarter included non-recurring charges due to efficiency measures.

Q2 Shareholder Letter (Spotify)

Still, the broader trend in ad-supported margin isn’t all that encouraging. In part because at 343 million ad-supported MAUs, Spotify’s free user makes up 62% of the platform’s user base. Additionally, at 34% year-over-year growth, the ad-supported user has grown twice as fast as Spotify’s premium user. To a certain degree, some of this is may be good for the company longer term. On the Q2 call, management mentioned free users converting to premium users as the largest driver of subscriber growth:

It is a really powerful funnel where the more our users discover and engage, the more they’re willing to pay for an enhanced experience.

There are three levers Spotify can pull to grow revenue; user growth, new monetization models, and higher prices. To this point, the company’s preference has been user growth in conjunction with the use of promotional efforts to convert free users to paid. However, we’re now seeing price increases become a part of the revenue growth strategy.

Price Hikes Leading To User Churn?

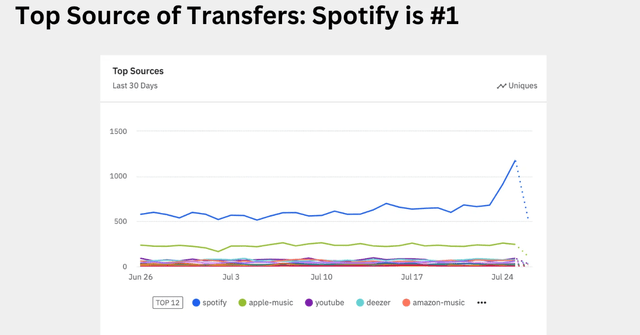

In late July, Spotify announced it would be raising prices for its premium subscription service. According to playlist migration company FreeYourMusic, the immediate reaction to the price increase announcement generated a spike in Spotify users migrating playlists to other services.

Playlist Migrations (July) (FreeYourMusic)

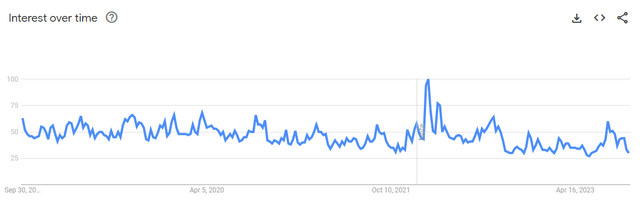

While FreeYourMusic has not publicly provided an update with its internal migration data, it’s important to keep the chart above in context. The spike in migrations is essentially showing a doubling from 500-600 transfers to somewhere between 1-1.3k. If we utilize data from Google (GOOG) (GOOGL) Trends, it appears as though search interest in “cancel Spotify” did spike in late July but has since normalized:

Worldwide: “Cancel Spotify” (Google Trends)

The chart above is showing a 5-year trend. We can observe the obvious Rogan-related spike in late January and early February 2022. While there was a slight bump up to the interest index of 60 the week of the price hike announcement, we do not see a sustained move since then and the interest index has returned to pre-announcement lows. Furthermore, the interest index spike to 100 following the Joe Rogan controversy last year didn’t ultimately impact Spotify’s subscriber growth the way some may have believed it would.

While it’s fair to point out that Spotify’s Q2 earnings call was right after the price hike announcement, the company is still guiding for 572 million MAUs, 224M subscribers, and a gross margin of 26% in Q3. CEO Daniel Ek also mentioned the impact from the price hike won’t be reflected in the company’s earnings until Q4.

Future Ad Growth Potential

I recently covered Rumble (RUM) for Seeking Alpha. One of the things that stood out to me was the degree to which Rumble is reliant on advertisers for total revenue. For Spotify, it’s the complete opposite. Even though the majority of the company’s user base isn’t paying for the service, 88% of Spotify’s total revenue comes from premium subscriptions. Personally, I think it would be beneficial for Spotify to balance that out better. And there is potential for the company to grow its advertising business.

Not just because most of its users are on the ad tier, but also because of AI technology and the efficiencies that can come from generative content. Daniel Ek spoke to the possibilities from AI during the Q&A and specifically mentioned how the technology can lower production costs for advertisers:

The cost of generating new advertisements on Spotify is quite a big thing, especially on audio ads. By using generative AI and our tools here, I think you’re going to be able to see that we can significantly reduce the cost that it takes for advertisers to develop new ad formats. And that obviously means that you as an advertiser instead of having one ad, you can imagine having thousands and tested across the Spotify networks, things that you could easily do today using text but you haven’t been able to do over video or in audio.

The important thing here is that when a marketing campaign can reduce production costs, that money that would have gone to production can instead be spent on more ads that generate a higher margin for the business. Given this, it’s noteworthy that Spotify is also partnering with Roku (ROKU) to create the “Spotify CTV Partner Network” that will allow Spotify to serve video ads through connected TVs. This program will also allow for retargeting audiences through other devices. Spotify’s head of ad development and partnerships Emma Vaughn was quoted in Adage and noted that Spotify’s CTV consumption is “growing massively.” From where I sit, this seems like a very logical step forward.

Economic Risks

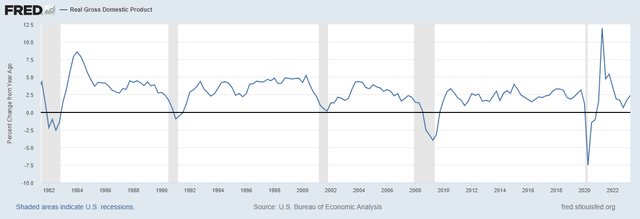

Federal Reserve

Of course, there are shorter to medium-term headwinds facing the advertising market. Real GDP growth, while off the Q4-22 low of 0.65% year over year is still below long-term averages. The trend has slowed in recent quarters, but we’ve seen widespread layoffs over the last two years, particularly in the tech sector. Furthermore, 30-year mortgage rates are at two-decade highs, student loan forbearance is ending, and delinquency rates on credit cards were at the highest level in over ten years last quarter. These are not indicative of a consumer that has much wiggle room. In my view, consumer belt tightening is imminent, and ad spending is going to be a casualty of that.

Summary

At some point, Spotify is going to have to actually generate a profit. And in my view, the path to profitability has to include properly monetizing the free users rather than eating a loss on the ad-based segment and raising prices on premium subscribers to maintain margins – that’s a clear path to churn over time. Getting more into the CTV game is probably a good direction for Spotify, and I’m curious to see how that plays out for the company down the line. All that said, I think there are quite a few headwinds to consider; softness in the economy and the poor trend in gross margin of the ad-based segment. We also can’t rule out the possibility that paid subs could churn given higher prices and deteriorating economic data. For now, I think Spotify is a hold.

Read the full article here

Leave a Reply