Investment Thesis

The semiconductor equipment industry is a fast and fierce game, where you need to keep up with the latest innovations and technologies. Some big names like Applied Materials (AMAT), Lam Research (LRCX) and KLA (KLAC) have a strong hold on the market and loyal customers. But there is also room for new players, especially in China. ACM Research is one of them, and they specialize in producing wafer cleaning equipment and other products such as plating, furnace, track, and PECVD.

In this report, we will take a close look at ACM Research and see if it is worth investing in. We will explore their business model, what makes them stand out, their financials, and what risks they face. We hope you enjoy our report.

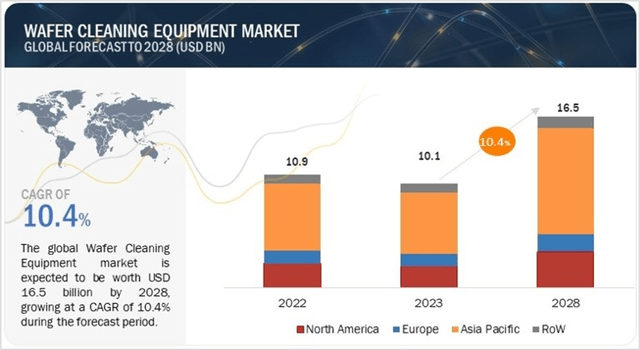

Wafer Cleaning Market – 10.4% CAGR

According to a market research report, the global market for semiconductor wafer cleaning equipment was worth $10.1 billion in 2023 and is projected to reach $16.5 billion by 2028, representing a CAGR of 10.4%.

Water Cleaning Equipment Market Size (Markets and Markets)

As per the report, one of the main factors contributing to this growth is the increased demand for memory and storage devices used by AI servers. Other drivers include the development of more complex and smaller semiconductor devices, the need for faster and more efficient chips, and the adoption of new materials and techniques in semiconductor fabrication. Some of the leading companies in this field are Lam Research, Tokyo Electron (OTCPK:TOELF), Applied Materials, SCREEN Holdings (OTCPK:DINRF) and Onto Innovation (ONTO).

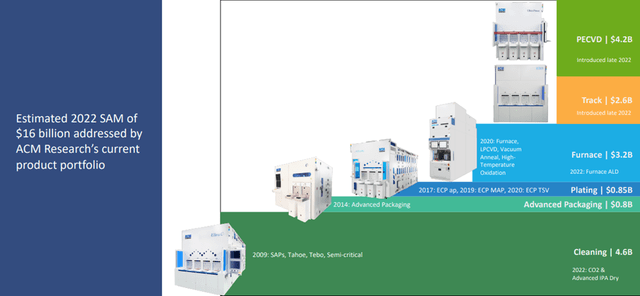

The figure below shows how ACM Research is going after this $16.5B total addressable market and their product positioning for each category. Their market segmentation is as follows: Wafer cleaning equipment ($4.6 billion), PECVD ($4.2 billion), Furnace equipment ($3.2 billion), Track equipment ($2.6 billion), ECP ($850 million), and Advanced packaging equipment ($800 million). ACM Research aims to achieve $1B in revenue from this market, which we think is a very ambitious goal for the company’s growth.

ACMR Addressable Market (ACMR Investor Presentation)

Expanding Opportunities with a Strategic Portfolio

ACM Research has a strategic portfolio that we are confident will sustain its current growth. The company has shown its agility and innovation in launching new products rapidly, thanks to its cutting-edge R&D capabilities. Since 2020, the company unveiled several new products that enabled it to expand its revenue potential with Chinese semiconductor manufacturers. As per ACM management, ACM has one of the broadest cleaning product portfolio in the industry, covering nearly 90% of all cleaning process.

Another key advantage of ACMR’s products is that they are built on proprietary and patented technologies, such as SAPS, TEBO, Tahoe and ECP to name a few. These technologies enhance the performance and yield of advanced semiconductor devices, especially for 3D NAND, DRAM, logic and foundry applications.

Also we think that ACMR has a very customer-centric approach to product development, where it works closely with its existing customers to understand their needs and challenges, and delivers customized solutions that are then productized. This product lifecycle creates a flywheel effect and diversifies the company’s market opportunity, as well as strengthen its competitive edge in the industry.

China: A Key Market for ACM Research

ACM Research has a strong position in China, which is the fastest-growing market for semiconductor equipment. The company has established a loyal customer base in China, which includes some of the top domestic semiconductor manufacturers, such as YMTC, SMIC and HLMC. The company also enjoys government subsidies, domestic preference and lower pricing in China, which give it a cost advantage over its foreign competitors. We also believe that the U.S. chip restrictions on China is creating an opportunity for ACMR company to gain market share, as it is a domestic supplier that can bypass US controls.

The Global Expansion Plan

ACMR Management says they’re not just into the Chinese market, even though that’s where they get most of their money from. They are aware of the risk of relying solely on China and they are working hard to expand to other regions. The positive thing is that they have a strategy to grow globally, by collaborating with other international companies in the industry, as well as establishing sales offices in the US and Europe. The company has already made impressive sales to SK Hynix, one of the world’s top memory chip makers, based in Korea.

ACMR did provide an update on their global expansion plan during their Q2 earnings call, see below;

“In the U.S., evaluation at our key customer is progressing well, and we remain optimistic for qualification later this year.

In Europe, we announced an order for our first evaluation tool from a major semiconductor manufacturer in the first quarter of this year. The tool is planned to — for deliver in early Q4, and we are beginning to build a local service team to support effort”

We are confident that ACMR has a solid global expansion plan that will diversify its revenue sources and reduce its dependence on China.

R&D-driven Company

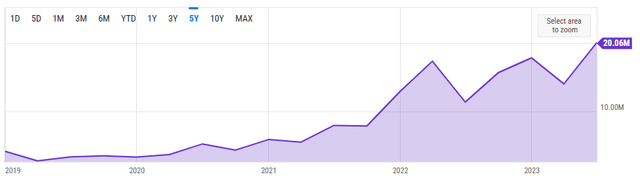

ACM Research is a company that invests heavily in R&D. It allocates a large portion of its resources to R&D to develop new products. See below the R&D spending trajectory which is self-explanatory.

ACMR R&D Expenses – quarterly (YCharts)

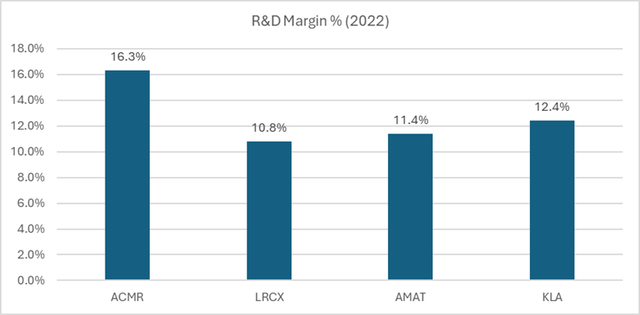

The company’s R&D budget ratio is also higher than its peers in the semiconductor equipment industry. ACM Research’s R&D budget as a percentage of revenue was 16% in 2022, while KLA’s was 12%, LAM’s was 11%, and AMAT’s was 11%. (Source:Finbox) This shows that ACM Research is more committed to investing in R&D than its competitors.

R&D Margin (Author)

The company operates state-of-the-art R&D facilities in Shanghai and is constructing a new R&D and production center in Lingang. The new center will have a total area of 100,000 square meters and have advanced testing and cleanroom facilities to support the development of new products. The company expects the new center to be completed by the end of 2023. (see below).

Lingang R&D Center (ACMR Investor Presentation)

Impressive Growth Trajectory

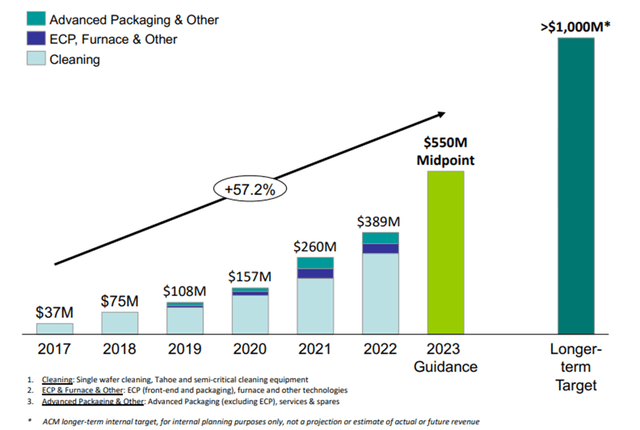

ACM Research is growing faster than the semiconductor equipment industry average, as it has a strong presence in China, where the demand for advanced semiconductor devices is increasing. Company has delivered remarkable growth and profitability in recent years, driven by its innovative solutions and great execution. As you can see below, the company is growing very fast at a 57% CAGR and aiming to reach $1B revenue in a few years. We think this is impressive and demonstrates ACMR leadership’s vision for the company’s growth.

ACMR Growth Trajectory (ACM Research Investor Presentation)

Healthy Financials and Balance Sheet

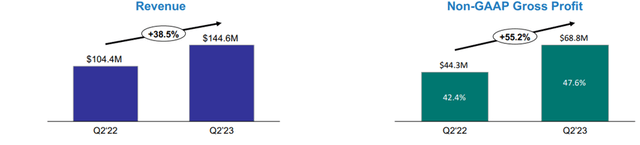

ACM Research delivered strong growth and margin expansion in its Q2 financial performance. The company achieved a revenue of $144.6 million for the quarter, which was a 39% YoY increase. The revenue growth was driven by increased demand for the company’s products across all segments. The company also improved its gross margin to 47.5%, up from 42.3% due to better revenue mix between product categories.

Q2 Revenue and GM Performance (ACMR Q2 Earnings Presentation)

The company also did well for operating margin, which was 21%, reflecting improved operating leverage and cost efficiency. ACMR revenue guidance for 2023 is between $515 million to $585 million, which shows that it is sure about its growth potential. For the balance sheet, the company ended the quarter with $258 million in cash and equivalents and $81 million in debt. We couldn’t see anything concerning on the balance sheet.

Compelling Valuation

We want to see how ACMR compares to its main rivals in the semiconductor equipment industry. These companies below are the big players and compete with ACM Research for market share:

- Lam Research Corporation: Leader in etch, deposition, and clean technologies.

- Applied Materials, Inc.: Leader in materials engineering solutions.

- KLA Corporation: Leader in process control and yield management solutions.

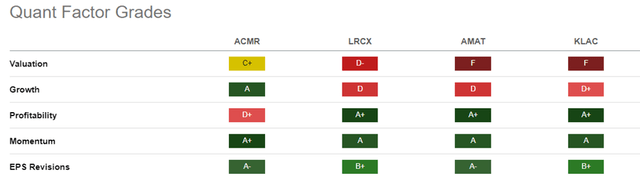

Using Seeking Alpha’s Quant grades, we can see how the big players of this industry are struggling because of the semiconductor market downturn. Their growth has stalled and valuations have become expensive. ACMR is the only company that is growing (49% YoY) and has a reasonable price valuation.

Quant Comparisons (Seeking Alpha)

ACMR’s profitability grade is the only negative, but we have to say that it is normal for a fast-growing company to re-invest its cashflow back in business expansion activities (building R&D centers and factories). It will probably take some time before ACMR achieves similar profitability as it peers but we know they are making progress.

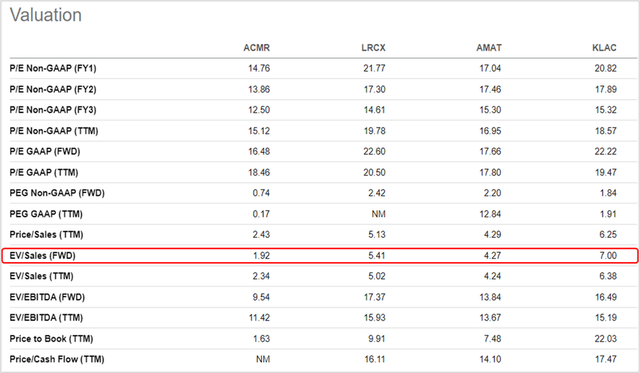

In terms of valuation, we want to look at the EV/Sales multiple. As we can see below, ACMR’s forward EV/Sales is 1.92x, lowest among its rivals. Its closest rival, AMAT, is at 4.27x.

Valuation Multiples (Seeking Alpha)

ACMR sales for FY23 is expected to be $550M and growth for FY24 is predicted to be around 19%. If we use a conservative sector median multiple of 3x and apply it to the current EV, we get a compelling price target of $32.

Key Risks

Risks to our buy rating include:

- ACMR has higher exposure to the China market. Geopolitical tensions or trade disputes could adversely affect its business.

- ACMR faces intense competition from established players who have larger scale, resources and customer relationships.

- ACMR’s growth strategy relies on continuous innovation and R&D investment, which may not yield expected results or may be subject to intellectual property disputes.

Conclusion

ACM Research presents a compelling investment opportunity in the dynamic semiconductor equipment industry. With its innovative product portfolio, strategic foothold in the rapidly growing Chinese market, and a robust global expansion plan, the company is poised for substantial growth.

Considering its strong growth prospects and comparatively favorable valuation, we recommend a Buy rating for ACM Research with a price target of $32. Investors looking for exposure to a high-growth, innovative player in the semiconductor equipment sector would find ACMR an attractive addition to their portfolios.

Read the full article here

Leave a Reply