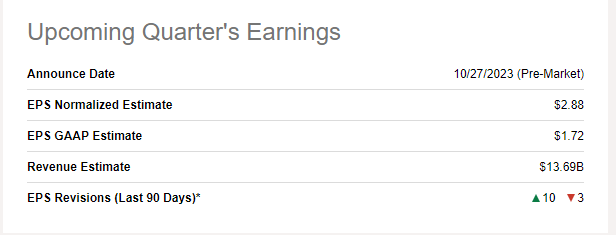

AbbVie Inc. (NYSE:ABBV) is expected to report its FQ3 2023’s earnings pre-market on Friday, October 27th. Analysts expect the company to report a (Non-GAAP) EPS of $2.88 on the back of $13.69 billion in revenue. Should AbbVie meet these expectations, it’d represent an EPS decline of 21% and revenue decline of 7.56%. While that does not please me as a long, it is on the expected lines with the Humira situation.

ABBV Q3 Preview (Seekingalpha.com)

My previous coverage on AbbVie was in March this year when I rated the stock a “Buy”, backed by its safe 4% dividend. Since then, the stock has lost about 1% (including dividends) compared to the market’s 10% gain. With that background out of the way, let’s preview AbbVie’s upcoming Q3 report.

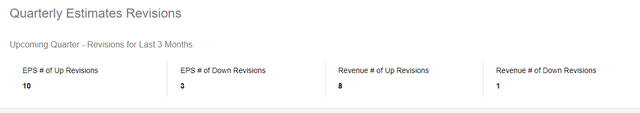

Surprisingly Strong Revisions Heading Into Q3 Report

Given the stock’s recent price action (covered below) and the general focus on Humira’s lost patent, I expected AbbVie to have more muted expectations heading into the Q3 report. However, 10/13 EPS revisions and 8/9 revenue revisions have been to the upside. Overall, since the beginning of the year, Q3’s EPS projection have gone up about 5% to reach $2.88/share. Do analysts expect a surprise from the company or are they adjusting for previous excesses on the downside? I believe it is the latter.

ABBV Q3 Estimates Revisions Count (Seekingalpha.com)

ABBV Q3 EPS Trend (Seekingalpha.com)

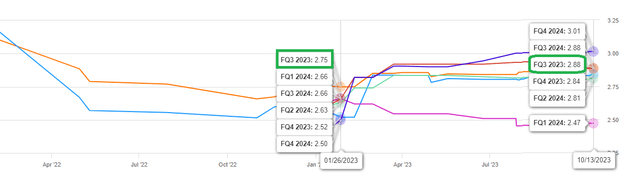

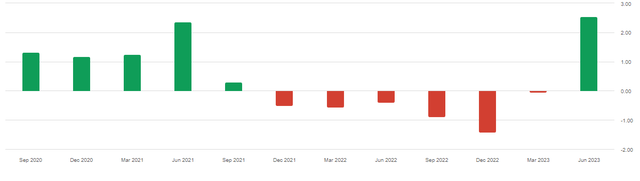

Beat or Miss? Let’s Toss A Coin

AbbVie has beaten EPS estimates 11 times in the last 12 quarters while revenue has been to the upside just 6 times in the same time period. This usually suggests that the company operated with discipline (AKA reducing expenses) when revenue was expected to be weak. However, as can be seen in the charts below, the beats and misses have been by very small margins. So, I am going to hold my cards close to my chest and not predict anything here but will just say the numbers are unlikely to surprise the market. The stock’s price action post-earnings will come down to the market’s overall mood and the company’s tone, especially around the new drugs covered below.

ABBV EPS Surprise (Seekingalpha.com)

Revenue Surprise History (Seekingalpha.com)

Things To Watch

- AbbVie has not been deterred by the Humira patent expiration as the company started touting its immunology drugs Skyrizi and Rinvoq as the next stars in its lineup. The two drugs are expected to bring in at least $21 billion in 2027. And early numbers are promising from these two drugs as summarized below:

- Q1: $1.40 billion in 2022 -> $2.046 billion in 2023.

- Q2: $1.844 billion in 2022 -> $2.80 billion in 2023.

- Q3: $2.092 billion in 2023 -> ? in 2023.

Based on this trend (QoQ and YoY growth across the board), it is safe to expect the two drugs to bring in well above $3 billion in combined revenue in the upcoming Q3 report.

- It is safe to continue expecting Humira to be under pressure from generics. Since I am a huge sports fan, this is like the field ganging up on a champion whose biggest weapon was barred after he/she conquered the world for two decades. While a YoY decline of 25% or so is expected for Humira, its revenue seems to have found a base between $3.5 billion and $4 billion based on the last two quarters.

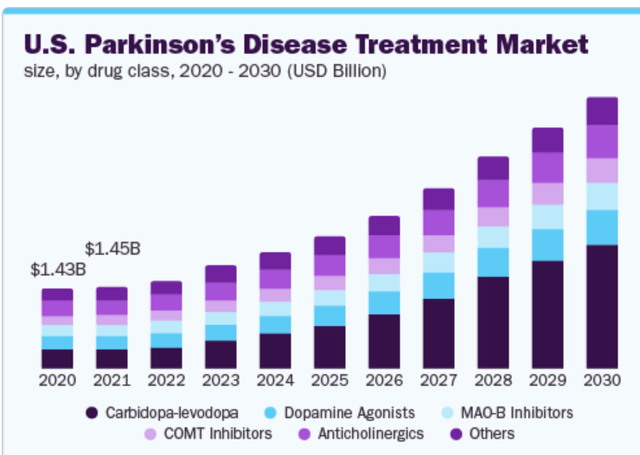

- AbbVie recently acquired Parkinson’s disease drug developer Mitokinin to strengthen its neuroscience portfolio. The Parkinson’s disease treatment market is set to grow at a CAGR of 12% between now and 2030 to reach at least $12 billion in Total Addressable Market [TAM]. It is obviously too early to expect this acquisition to have a material impact, but it will be interesting to hear the company’s thoughts on this given the TAM and the current size of its neuroscience portfolio, which contributed just 13% to the overall revenue in Q1 2023.

Parkinson’s Treatment TAM (grandviewresearch.com)

Valuation

- Heading into the Q3 report, it is safe to say AbbVie’s stock is one of the cheapest among well-known pharmaceutical stocks with a forward multiple of 13, except the even more beaten-down Pfizer, Inc. (PFE). Merck & Co., Inc. (MRK), for example is trading at a forward multiple of 34 and Johnson & Johnson (JNJ) at 16.

- The median price target of $167 from 25 analysts means AbbVie’s stock is heading into Q3 report nearly 13% away from the consensus target. Add the 4% yield, the stock appears enticing heading into the Q3 report.

- AbbVie has now paid the same quarterly dividend of $1.48/share for the last 4 quarters. That means, going by its history over the last 10 years, a dividend increase announcement is on the cards anytime now. The 5-year dividend growth average is at an impressive 10.52% and if a similar increase is announced soon, AbbVie’s annual dividend will be around $6.50/share or $1.625 cents/quarter. That would push the stock’s yield to 4.40% based on a current price of $148. For your reference, the stock’s 5-year average yield is 4.31%. Overall, this is not a bad time to be buying the stock if you believe the dividend is safe, like I do based on the following:

- Given the forward EPS of $11.07, an annual dividend of $6.50 would give ABBV stock a payout ratio of 58.70%. A fairly comfortable zone.

- Given the total shares outstanding of 1.765 billion and my projected new quarterly dividend of $1.625/share, AbbVie would need $2.86 billion in quarterly FCF to cover its dividend. The company’s average quarterly FCF over the last 5 years has been $4.69 billion. Despite the threats of generics to Humira, I believe there is sufficient dividend safety here.

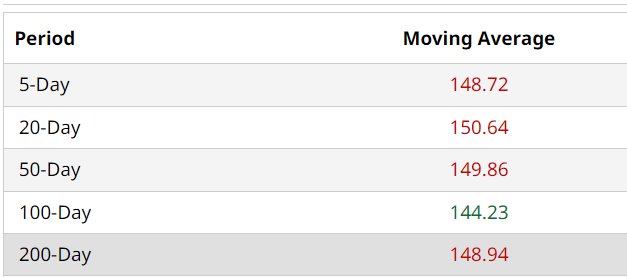

Weak Technical Indicators But Forming A Base

AbbVie’s stock has struggled for a while now as the stock is down:

- Almost 9% YTD.

- 9% in the last 6 months, and

- 3.40% in the last month.

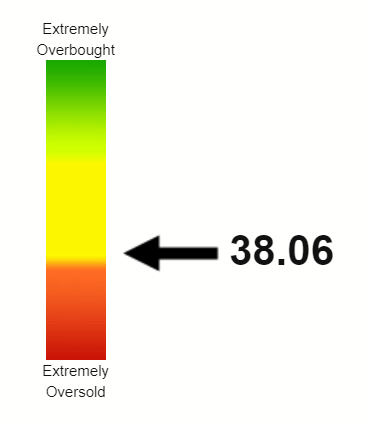

So, no wonder the stock’s technical indicators are not too favorable as we head into the Q3 report with its Relative Strength Index [RSI] trending towards the oversold zone and the current price below all but the 100-Day moving average. However, the bright spot here is that the moving averages are in a very tight range between $144 and $150.

ABBV Moving Avgs (barchart.com)

ABBV RSI (Stockrsi.com)

Conclusion

In my opinion, AbbVie’s stock has been unfairly punished for a well-known cliff with Humira. The company’s sales growth, minus Humira, was in the high single-digits in the most recent quarter and that’s not bad for a stock trading at a forward multiple of 13 and yielding a safe 4%. I am looking forward to monitoring the growth in Global Skyrizi and Global Rinvoq revenue in Q3 and beyond. Venclexta is also showing strength in the market and as a result, in numbers, as it reported 13% growth in both Q1 and Q2 and should be monitored.

I am also looking forward to the company’s 11th consecutive dividend increase soon (as a stand-alone company). Overall, I am retaining my “Buy” rating on the stock as I believe weaknesses like the present situation are to be taken advantage of by those with long term focus.

Read the full article here

Leave a Reply