AbbVie Inc. (NYSE:ABBV) investors breathed a sigh of relief as ABBV has recovered remarkably from its June 2023 lows despite posting a prelim-Q2 earnings release in early July that likely spooked some investors.

However, ABBV dip buyers held those lows robustly, demonstrating to unconvinced investors that the market had already priced in significant pessimism. In my early July update, I encouraged investors to buy more shares, discussing why I saw buyers accumulating quietly. I maintained my conviction that ABBV’s “June bottom remains robust, forming a bear trap or false downside breakdown.” As such, investors who failed to observe ABBV’s buying momentum and sold at its June lows didn’t manage to participate in its recent upward surge.

Accordingly, ABBV has risen nearly 10% on a total returns basis, outperforming the S&P 500’s (SPX) (SPY) 3% rise over the same period since my previous article. I believe the optimism is justified, as I argued previously that ABBV was “no longer significantly overvalued” at its early July lows.

AbbVie upped the ante in its Q2 earnings release by raising its full-year guidance, corroborating the robust growth drivers in its ex-Humira portfolio. Humira posted a revenue decline of 25% in Q2 due to intensifying biosimilar competition. However, AbbVie’s immunology portfolio held up well, attributed to the spectacular performance of Skyrizi and Rinvoq, as both posted revenue growth exceeding 50%.

In addition, management’s commentary suggests the company increased its confidence in a better-than-anticipated outcome despite the biosimilar entries, which led to an improved outlook. In addition, the company also saw a strong performance from its aesthetics portfolio, particularly in the international markets, highlighting the resilience of its well-diversified portfolio.

Revised analysts’ estimates suggest AbbVie’s revenue decline could bottom out in FY23 before reversing upward toward a flat YoY growth in FY24. However, the headwinds on Humira’s erosion are expected to continue playing out before stabilizing between 2025-26. Hence, I assessed that while investors’ sentiments are expected to remain cautious, the worst in ABBV is likely over. Therefore, dip buyers who bought into ABBV’s June lows are encouraged to keep holding on to their positions and wait for steep pullbacks reflecting panic/market capitulation to add more positions.

Furthermore, AbbVie’s adjusted EPS is expected to reach its nadir in FY23 before inflecting upward to growth through FY26. Analysts’ estimates on AbbVie are assessed to be more cautious despite management’s confidence in achieving high-single-digit growth on average through 2030.

Investors should also consider the impact of the recent developments in the Medicare price negotiations, as the initial list of drugs was unveiled. It includes Imbruvica, which experienced a revenue decline of more than 20% in Q2.

Management’s commentary suggests it’s likely not unanticipated, as the company stressed, “Imbruvica is a product that is close to the cutoff point for inclusion in the first 10 products.” Despite that, the company telegraphed that it “anticipates being able to manage the effects through strategies such as inflation penalties, party benefit redesign, and negotiations.” Moreover, these challenges are not likely to intensify near-term challenges as the “negotiated” pricing discounts are expected to be effective only in 2026.

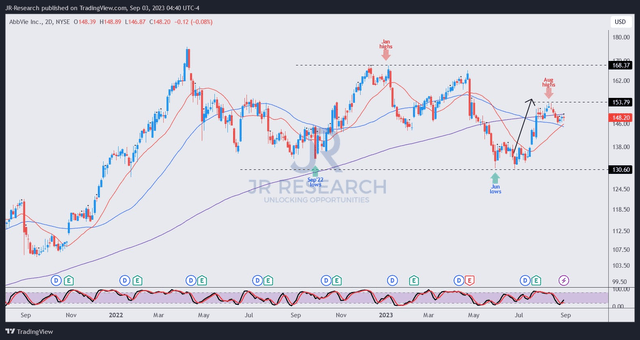

ABBV price chart (weekly) (TradingView)

As seen above, ABBV has surged from its June lows, corroborating my thesis that it was at peak pessimism, as investors “likely reflected substantial headwinds relating to Humira’s patent expiration.”

Therefore, astute dip buyers who ignored the market’s pessimism and capitalized on the fantastic buying opportunities have performed well.

That said, ABBV has moved closer to being overvalued again. Despite that, I anticipate investors holding on to their exposure as it continues its recovery from its hammering.

With my Buy thesis playing out, I encourage investors to keep their exposure. I will reassess another opportunity for dip buyers to re-enter moving ahead if I glean a steeper pullback.

Rating: Downgraded to Hold. Please note that a Hold rating is equivalent to a Neutral or Market Perform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here

Leave a Reply