I’m writing this from Portugal this week – as we had a trip planned months ago to visit Lisbon, Algarve and Sintra. Being in this game long enough – you come to understand that the market and your positions will only go in one direction (down) the minute you go on vacation! If you work in the business, you are chuckling as you read this. By the time your flight lands on the home tarmac, the selling pressure is over and markets recover leaving you with not a thing to do. Pain when you want to golf, pleasure when you want to work. God has a sense of humor…

Sometimes it’s nice to leave NYC and CT to get some perspective. In summary, no one cares about the markets outside of Wall Street! They are living their lives in the sunshine (I guess knowing that sooner or later good companies resolve to the upside). Okay, that’s my commentary! But in all seriousness, the time difference is ideal. Get in 18 holes before the market open, work, then family time for the rest of the day. Rinse and repeat.

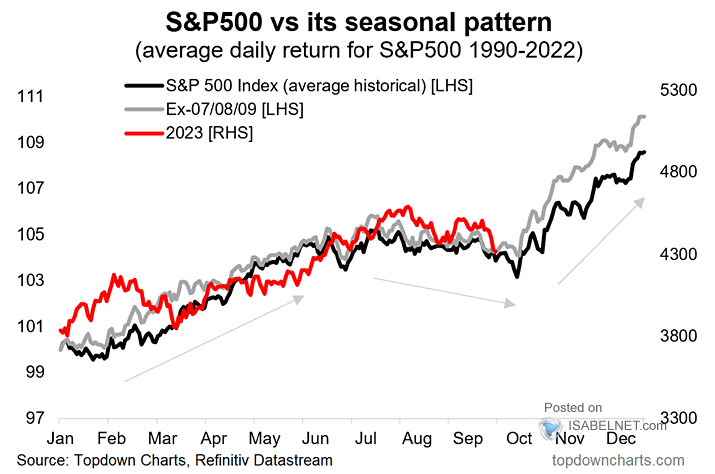

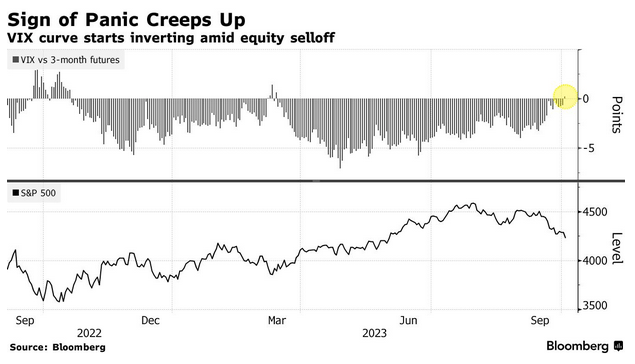

As I keep a pulse on the markets, it is apparent that things have gotten stretched to the downside and that a reversal is in sight. If you’re trying to pin it to the day, I land in Newark on Sunday!

MoneyShow “Inside Alternatives”

Today I joined the MoneyShow’s special virtual segment on Alternative Asset Managers. Thanks to Debbie Osborne for having me on:

Here were my notes ahead of the session. You’ll see that the host took it in a spontaneous direction:

*Please tell our audience a little bit about your firm and your investment strategy.

“In simple terms, ‘we buy straw hats in the winter!’” Durable, quality, predictable cash generative assets when they are temporarily impaired or out of favor. We usually own 8—12 companies that make up 80-90% of the portfolio – and when appropriate a long dated derivative overlay to juice returns without taking on material leverage. We take short positions from time to time when the risk is asymmetric in our favor and we express with long premium only where we can limit risk (i.e. 1% outlay has EV of 3-5x). As much as everyone wants to be short now, I don’t think an environment where M2 money supply is running $3T above the long-term trend is the right environment to do that!

*The low interest rate environment of the last 15 years favored long-duration assets like bonds and growth stocks while challenging many value strategies. Eighteen months ago, everything changed—and dramatically so. How has the advent of inflation and a new central bank regime influenced your investments.

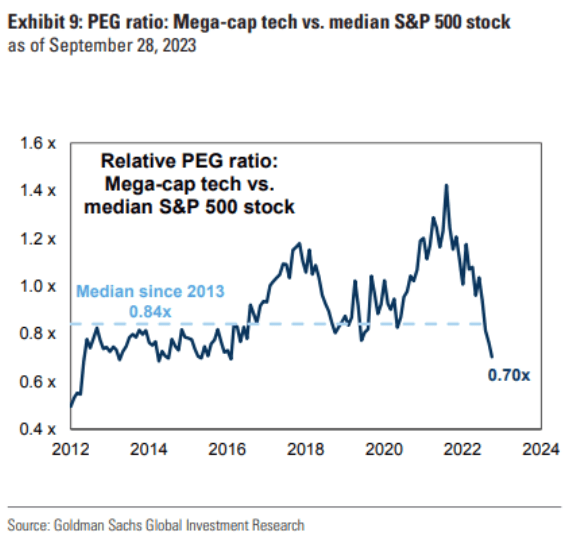

The simple answer is you now have to do BOTH. Last fall when Tech/Semis were hated and out of favor we bought large positions in AMZN, GOOGL, INTC. Now that many value names are out of favor we are loading up on names like GNRC, SWK, DIS, BAC, BABA, etc. We try to spend less time on macro and more time on cash generation/business performance. You wouldn’t buy an apartment building or a farm (or any other cash producing asset) on the basis of this week’s put/call ratio and vix level would you (apt. example)? We think about businesses in the same way and buy when Mr. Market is in his manic mood.

- Ali and Tom, both of you are in Europe. Is the outlook any different there?

Europeans are more pessimistic generally. If you want to get depressed, read any market strategist from SocGen, BNP, or CS (whoops)!

- Do you expect a U.S. recession?

Already had it in 2022.

*Please elaborate upon how you view the market opportunity set over the next 1-3 years. Where do you the biggest opportunities and the most worrisome red flags?

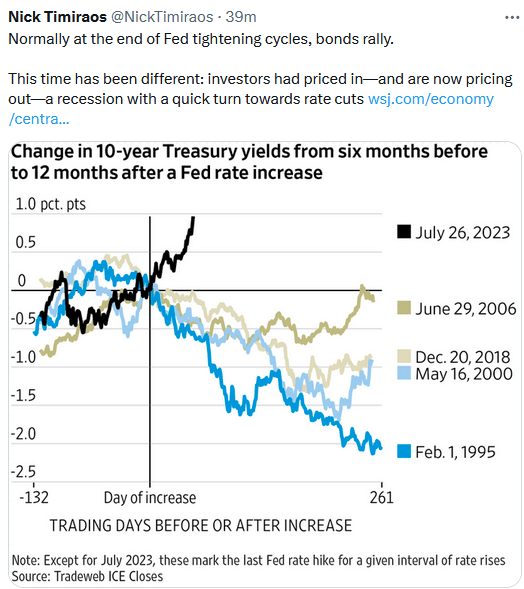

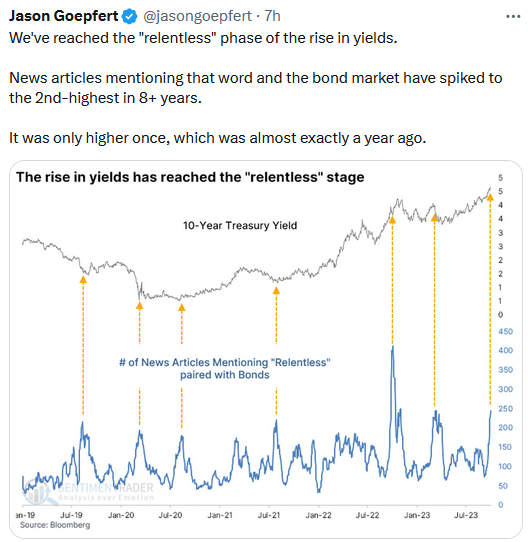

The biggest surprise between now and the end of the year is is that the rout in bonds is coming to an end. Hedge Funds are overcrowded short, commercials are long. Pension demand will come in to lock >4.5% yield for their long-dated liabilities. We would also not be surprised to see central bank intervention step in as we are at the “breaking things” level of yields. BoJ stepped in at last October’s lows to defend the Yen, markets took off/dollar collapsed. We would not be surprised to see a redux of this action now. This has MAJOR implications: 1) a bid in bonds and compression in yields will help banks, utilities, reits (all hated just as much as tech last fall). 2) Emerging Markets will rocket higher the minute this short-term counter-trend rally in the dollar stops.

The framework we are using for the next 3 years is similar to 2001-2007 – massive rally in Emerging Markets, Value and Small Caps. More subdued returns in tech (but will do fine).

*Shorting stocks is one of the more challenging undertakings in investing, but it can be very profitable. How would you describe your short selling philosophy? Are there any specific traits or characteristics you look for or screen for?

Well above average historic multiple with slowing growth and a downside catalyst.

*Some sectors ranging from banks to biotechs tend to move fairly closely together. Do you typically favor going long or short individual companies or entire sectors?

Biotech (sector of lottery tickets/basket – “deals and drugs as catalysts”), others company by company.

*Looking out over the next three to five years, what do think will be the biggest surprise for mainstream investors?

- The market is going to go up a lot more than people expect due to the millennials housing/family formation (pig in the python concept).

- China will have one last parabolic move up (like Japan) in late 80’s before crashing from demographic debacle.

Burdened By the Facts

Goldman Sachs

Topdown Charts

Bloomberg

Nick Timiraos

Jason Goepfert

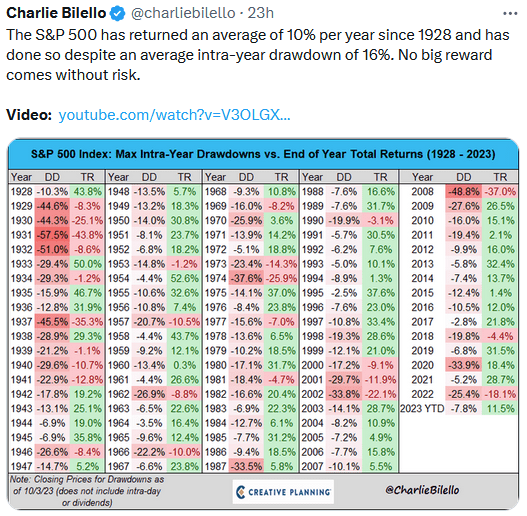

Charlie Bilello

BofA

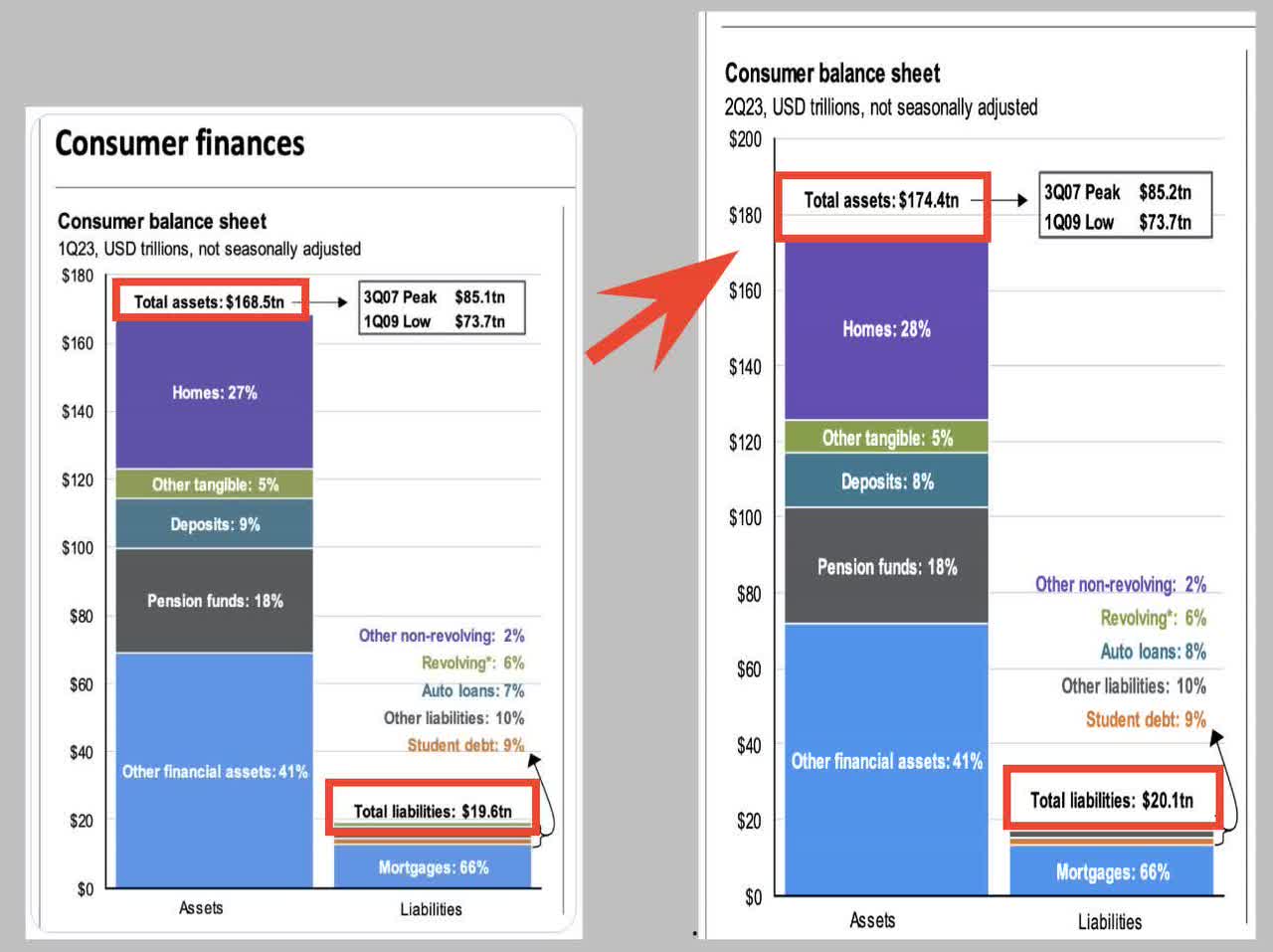

From @SethGolden on Twitter: “All we hear is savings rate and excess savings falling, consumer stressed more so than ever with repayment of student loans kicking in again October… and yet from Q2 to Q3 Household net assets value climbed ~$6trn while liabilities only climbed ~$500bn… with Equity and Bond market prices lower.”

Seth Golden

Now onto the shorter term view for the General Market:

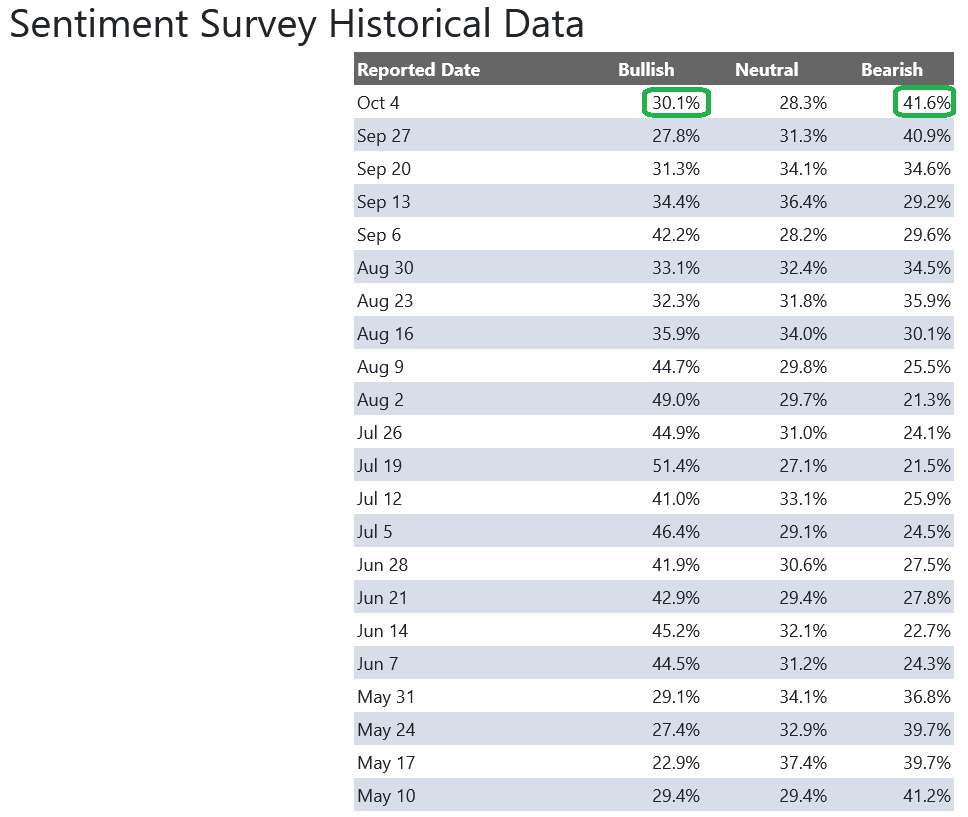

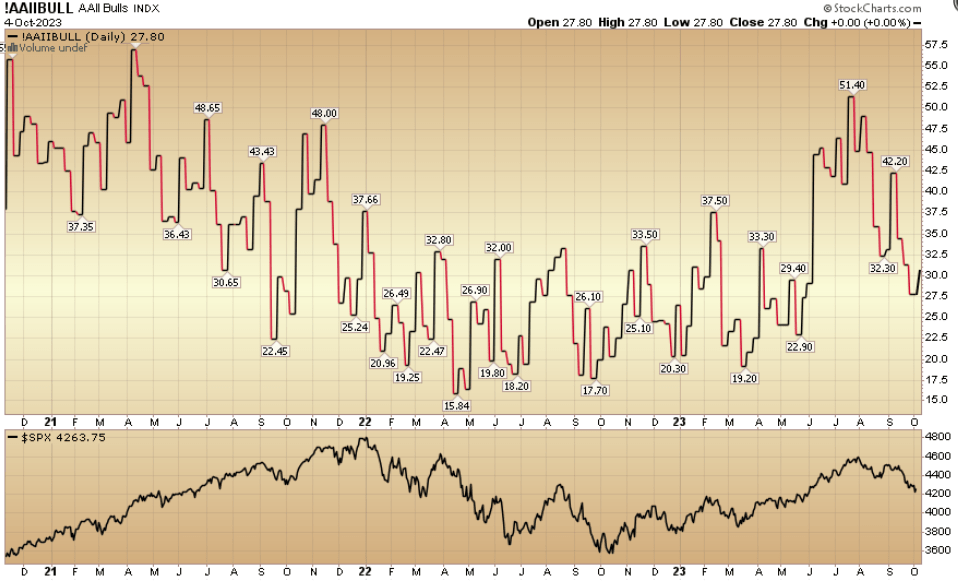

In this week’s AAII Sentiment Survey result, Bullish Percent rose to 30.1% from 27.8% the previous week. Bearish Percent moved up to 41.6% from 40.9%. Retail investors are fearful.

AAII.com

Stockcharts

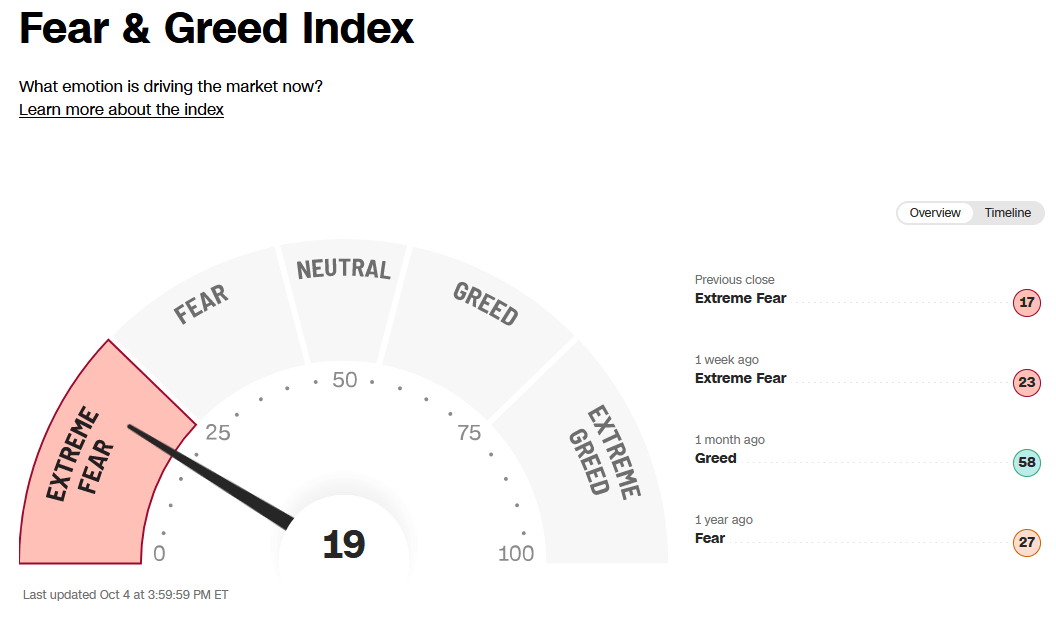

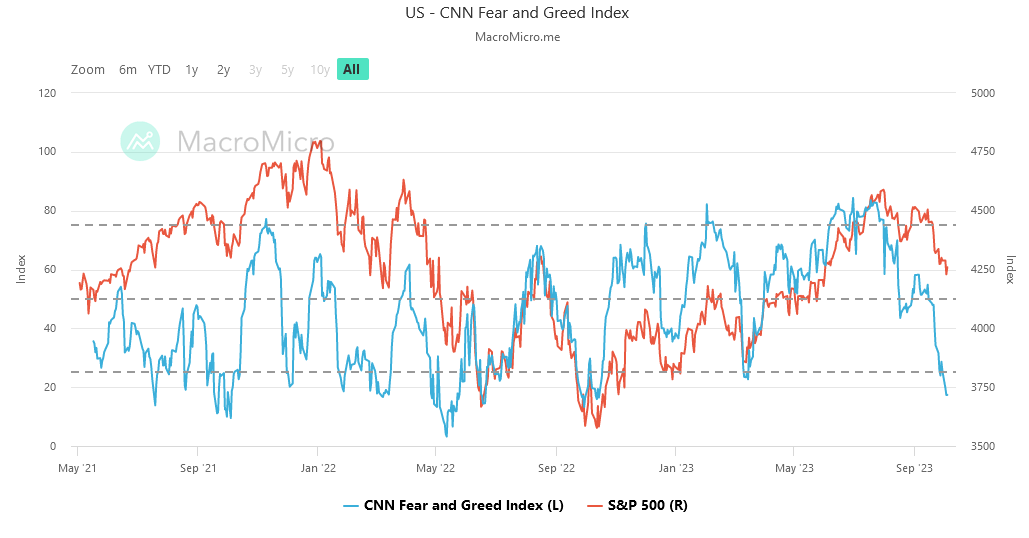

The CNN “Fear and Greed” dropped from 25 last week to 19 this week. Investors are fearful.

CNN

MacroMicro

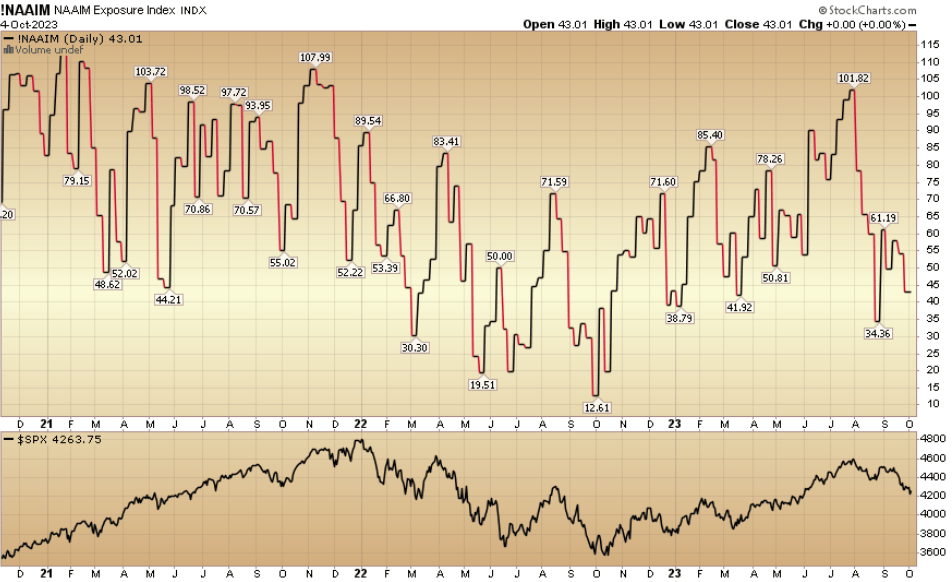

And finally, the NAAIM (National Association of Active Investment Managers Index) dropped to 43.01% this week from 54.33% equity exposure last week. When the tide turns, the “end of year chase” will be on full force.

Stockcharts

Opinion, Not Advice.

Read the full article here

Leave a Reply