Introduction

In recent months, at least four managers have started or went public via an IPO with a Business Development Company. Trapping Value covered Blue Owl Capital Corporation III (OBDE). Two others were covered by me:

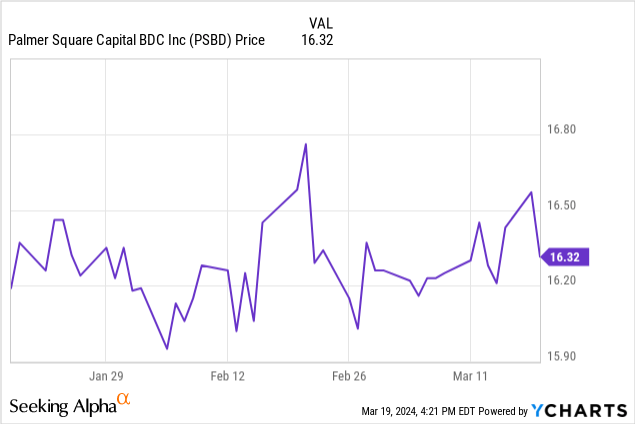

This article covers the fourth new Business Development Company fund that I became aware of, the Palmer Square Capital BDC Inc. (NYSE:PSBD). As with other new issues, my rating is a Hold until this BDC proves itself.

Palmer Square Capital BDC Inc. review

Seeking Alpha briefly describes this BDC as:

Palmer Square Capital BDC Inc. is a business development company specializing in direct investment. The Fund prefers to invest in corporate debt securities, collateralized loan obligation, and structured credit. The Fund prefers to invest in the United States.

Source: seekingalpha.com PSBD

Palmer Square Capital provides this description:

Palmer Square Capital BDC Inc. (PSBD) is a business development company that primarily invests in corporate debt securities across private companies in the U.S. through broadly-syndicated loans (BSLs) and large cap direct lending. We are managed by our investment adviser, Palmer Square BDC Advisor LLC, a majority-owned subsidiary of Palmer Square Capital Management LLC.

Source: palmersquarebdc.com

PSBD has market-cap of $540m with a yield over 12%. The fee structure is outlined next.

Following completion of this offering, our income-based incentive fee will be calculated at a rate of 12.5% of pre-incentive fee net investment income above a quarterly hurdle of 1.5% with certain lookback requirements as compared to most externally-managed, publicly-traded BDCs, which typically charge the income-based incentive fee at a rate of 17.5% to 20.0% of pre-incentive fee net investment income above a quarterly hurdle of 1.5% to 2.0% in many instances with no lookback requirements. We believe this lower fee structure is well-aligned with an investment strategy focused primarily on corporate debt securities.

Source: sec.gov PSBD

Holdings review

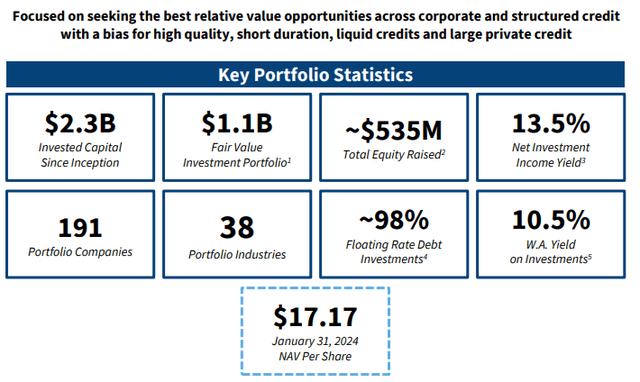

Palmer Square’s 4th quarter’s review included the following about the 12/31/23 portfolio, of which all the following charts are based on.

palmersquarebdc.com 4Q EPS PDF

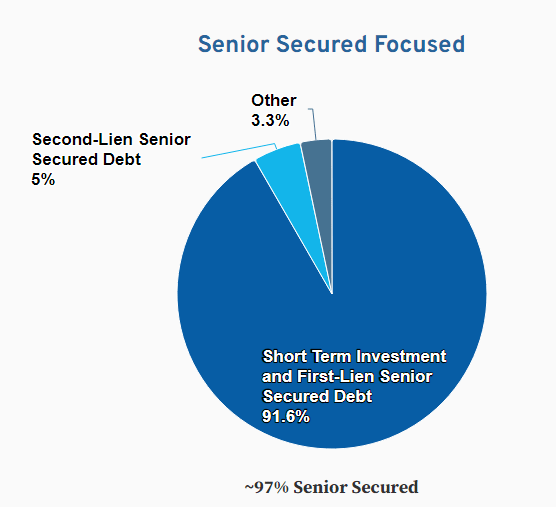

Fixed or Floating rate allocations do differ between BDCs and are an important data point to use when comparing such investments, especially when we could be at an inflection point for interest rates. PSBD is almost exclusively in floating rates at around 98%. An important investment strategy of any BDC is what kind of debt to hold, with First Liens being one of the safest, where PSBD has 91.6% of their portfolio.

palmersquarebdc.com loans

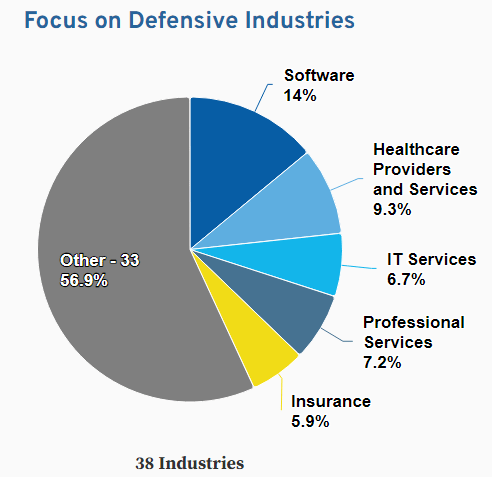

The next risk reduction strategy is diversification across industries. Here PSBD has exposure to 38 different ones, with only Software topping 10%. That said, I suspect the failure to gain market traction could be substantial for new software firms. PSBD is somewhat concentrated as the Top 5 industries account for just under 44% of the loan volume.

palmersquarebdc.com industries

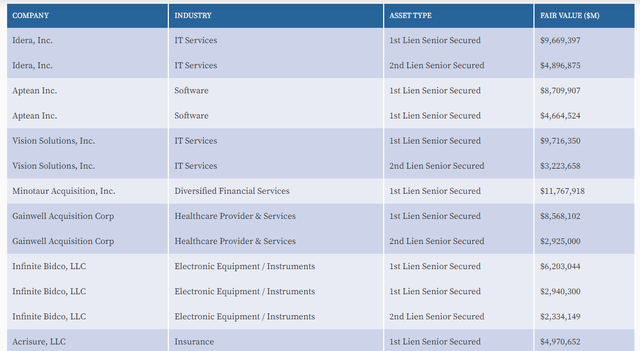

Top holdings

palmersquarebdc.com holdings

I found the following descriptions for the top three holdings.

- Idera, Inc. is the parent company of a portfolio of brands that offer B2B software including database tools, application development tools, test management tools, and DevOps tools. It is headquartered in Houston, Texas and has offices in Australia, Austria, and the United Kingdom.

- Aptean, Inc. provides software solutions. The Company offers platform for marketing, administration, supply chain, material requirements planning, accounting, and product configuration processes. Aptean serves clients worldwide.

- Vision Solutions is a full-service Information technology company that provides strategic, custom Information Technology, consulting and educational services to private, commercial, and governmental organizations.

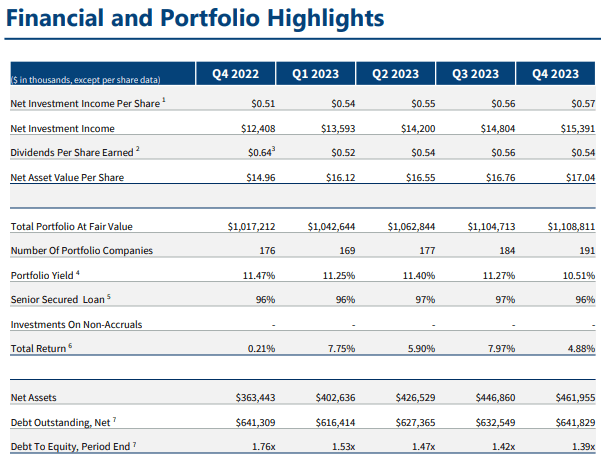

Financial review

palmersquarebdc.com 4Q EPS PDF

Since late 2022, I see these changes in the financials:

- Growth in Net Income has been steady with EPS growing slower, indicating the successful issuance of more common stock.

- Net Assets has shown growth each quarter listed.

- The debt -to-equity ratio has shown steady improvement.

- Despite 98% in floating-rate loans, the Portfolio yield has been dropping and is down almost 100bps since the end of 2022.

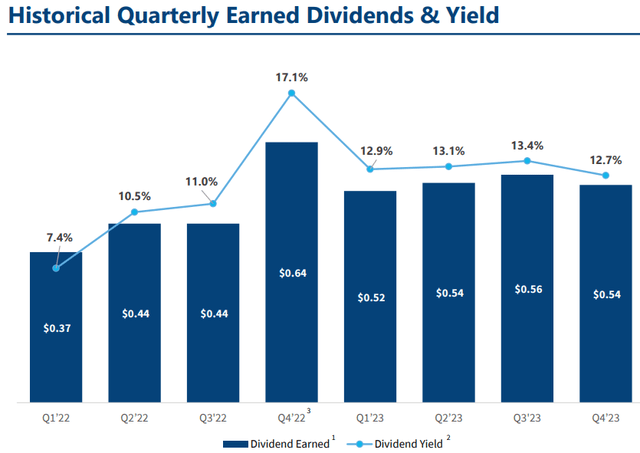

Distributions review

palmersquarebdc.com 4Q EPS PDF

The Q4’22 payout includes $0.04 of capital gains and $0.07 of spillover income. Investors should be aware that shareholders are automatically enrolled in the dividend reinvestment plan, with an opt-out option.

My analysis of PSBD

The Company is externally managed by Palmer Square BDC Advisor LLC. That can lead to a conflict-of-interest with its investors as some fees are based on AUM, thus there exists incentive to issue more stock regardless of the ability to deploy it properly. Fees, on average, are also higher compared to internally managed BDCs. That said and as PSBD explained, their overall fee structure is lower than what the average BDC sponsor collects per AUM.

PSBD recently announced their latest dividend: $.42 base amount with $.07 bonus, which targets 50% of net investment income above the base quarterly distribution. That is the lowest quarterly payout since the 3rd quarter of 2022. With the base amount set, NII will need to nearly double from the last quarter’s level to match the average total quarterly distribution investor’s saw in 2023!

As of the end of February, PSBD was trading at a 6.8% NAV discount, slightly more than its 3-year average of 5.1%. The recent average Price/NAV for externally-managed BDCs like PSBD is about 94%, meaning PSBD is neither cheap by its own history nor compared to similar BDCs.

On the positive side, assuming the $.49 payouts continue, PSBD is giving investors an 11.8% yield, compared to BDCs having an average yield under 10.4%. That said, its yield only ranks 19th out of the 49 listed.

At the end of 2023, PSBD did not have any loan in non-accrual status, a good sign with 98% of the portfolio being floating-rate debt during a period of rising interest rates. During 2023, 78 new commitments were booked with an average coupon over ten with 5+ years to maturity. If rates start to fall later in 2024, these new investments should help fund the payout near the current level.

Their portfolio’s internal rating is 3.6 on a scale of 1 to 5, placing it between Hold and Add Where Possible categories. I didn’t find historical data to know how that has changed recently.

PSBD reports they had a 25+% turnover rate for each of the last two years. That churn rate increases the cost of managing the portfolio and also increases their correlation to the movement in interest rates. If rate fall, maintaining the dividend will get harder to achieve.

Where that is hurting PSBD is in the cost of financing and managing their portfolio. Ratio of operating expenses to average net assets without waiver has climbed from 5.69% at the end of 2021 to over 13% at the end of 2023. Despite that and other headwinds, the NAV has improved from $14.96 to $17.04, a jump of 14% in 2023.

Portfolio strategy

While I assume most readers understand what a BDC is, for others here is a common definition:

A business development company invests money in privately owned, small- and medium-sized companies. Generally, the businesses are facing challenges and need help to grow or get back on track, and they may not be able to obtain financing through traditional means, like bank loans or bond issues.

BDCs aim to generate income and capital gains when the companies they invest in are sold, much like venture capital or private equity funds. Business development companies are attractive choices because almost anyone can invest in them. That’s because they are public companies, traded on major stock exchanges. Venture capital and private equity are only available to accredited investors with large net worths.

Business development companies were created by Congress in 1980 to jumpstart America’s sputtering economy by helping fledgling small businesses raise money to scale and create jobs. Today, there are 47 publicly traded BDCs with a combined market capitalization of more than $49 billion as of April 2021, according to Closed-End Fund Advisors, which tracks BDC data and research.

Source: forbes.com/advisor/investing/ BDC

Like REITs, BDC are not subject to double taxation like common stocks dividends; only the shareholder is taxed. Things to consider and understand before investing in any BDC include the following pros and cons:

Pros:

- BDCs offer some of the highest yields available to the investing public.

- BDCs offer easy exposure to a potentially vibrant part of the market, private market investments.

- Since BDCs are required by law to provide their investors with extensive information about their financial health, they offer superior transparency to direct private market assets.

Cons:

- BDCs rely heavily on debt when they invest in their portfolio companies, which are privately held or thinly traded, making them largely illiquid.

- BDCs are sensitive to interest rate spikes, hurting their margins and ability to invest as rates climb.

- BDC dividends, unlike common stock dividends are taxed as ordinary income rates. When yield comparing, this fact needs to be considered.

Final thoughts/conclusion

I own several BDCs, such as the Ares Capital Corporation (ARCC). I see including a BDC as part of the fixed income allocation, it adds asset diversification to that segment of my portfolio since most of the held assets within the BDC are loans. Until PSBD has more public history, sticking with proven BDCs seems smarter while the FOMC is expressing uncertainty as what 2024 will bring, thus a Hold rating for PSBD.

Read the full article here

Leave a Reply