It has been an unsettling summer for anyone with a stake in the movie, television, and broadcasting businesses. The strike by screen actors and writers which started in July is now almost into its third month, with no end in sight, putting at risk the pipeline of movies and shows that were expected to hit theaters and streaming platforms in the next few months. On August 31, Disney (DIS) pulled its television channels from Spectrum (owned by Charter (CHTR), the second-largest cable company in the US, after Comcast (CMCSA)) after a dispute about payments for carrying these channels. Tennis fans, getting ready to watch the US Open on ESPN, were apoplectic, as their televisions went blank in the middle of matches, and Disney, in addition to encouraging them to complain to Spectrum, offered them an option of switching to Hulu+ Live TV, a streaming service alternative to cable. While actors and writers have been on strike before, and contractual disputes between content makers and cable providers are par for the course, the news stories of this summer seem more consequential, perhaps because they reflect longer time shifts in the movie and broadcasting businesses.

Speaking of Disney, a company that has found itself in the crosshairs of political and cultural disputes, the stock hit $80 on September 7, close to a ten-year low. To add to the angst, the threat of artificial intelligence (AI) overhangs almost every aspect of the business and is one of the contested issues in the strike. The recent troubles in entertainment, though, reflect a longer-term disruption that has occurred in the business, with the rise of streaming as an alternative to the traditional platforms for movies and television shows. In this post, I will focus on how streaming has not only changed the way we consume content, but has also modified the way that content gets made. In the process, it has altered the financial characteristics of the companies in the business in ways that the market is still trying to come to terms with, which may explain the market turmoil this year.

A Cautionary Tale: The Music Business and Streaming

If, as you watch the broadcasting business go through its struggles with streamers, you get a sense of deja vu, it is because the music business in the 1990s found itself similarly challenged, and its upending by streaming may offer lessons for the movie business. In the twentieth century, the music business followed a well-honed script. It was composed of companies which scouted for music talent, signed these musicians to music label contracts, and then worked with them in their studios to produce record albums that were sold in music stores across the country. The music companies provided marketing support, seeking out radio stations that would carry their music, and distributional backing to get albums to retailers. In many ways, it was impossible for a musician to break through, without studio backing, and that power imbalance allowed the latter to claim the lion’s share of the revenues.

The disruptor who upset the music business was Napster, a platform that delivered pirated streams of music to its customers, effectively undercutting the need to go into music stores and buy expensive albums. While Napster downloads left much to be desired in terms of audio quality, and the company walked to (and often beyond) the very edge of legality, it exposed the weaknesses in the music business, from how new artists were found and marketed, to how their music was packaged and finally, how that music was sold. When the music companies of the day were able to shut Napster down in 2001, citing digital piracy, they were undoubtedly relieved, but their weaknesses had been exposed. Apple (AAPL) created the iTunes Store in 2001, allowing customers to buy individual songs, rather than entire albums, and the unbundling of the music business began. In the years that followed, music albums and music retailers became rarer, and the advent of the internet allowed musicians to bypass the gatekeepers at the music studios and go directly to customers. As smartphones and personal devices became more plentiful, Spotify (SPOT) and Pandora introduced the music streaming model, and the game was forever changed, and the consequences for the music business have been staggering:

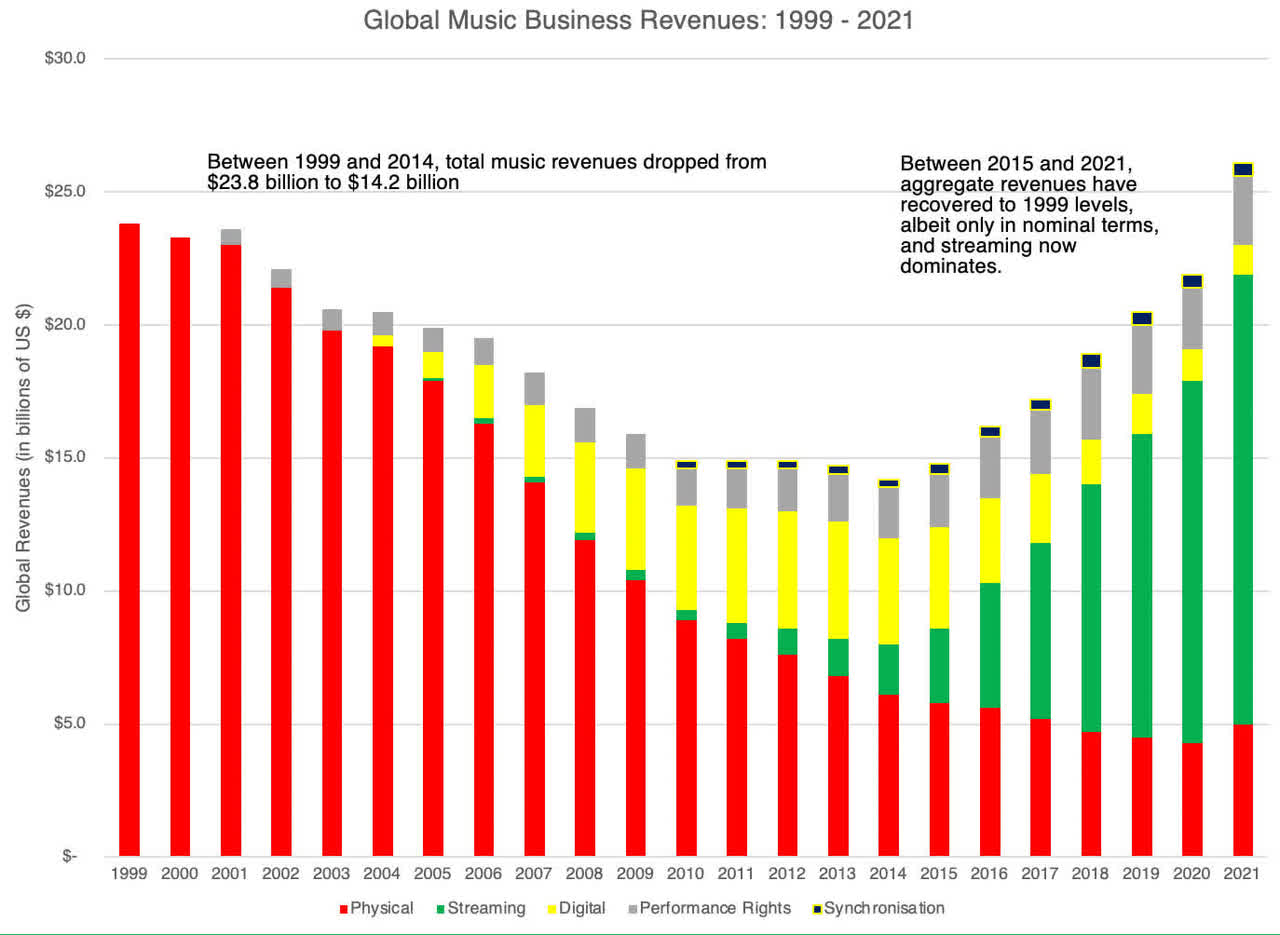

- The music business shrank and the center of gravity shifted: The entry of streaming companies changed the economics of music, since it largely removed the need to buy music, even in the single-song format. Spotify and Pandora allowed subscribers access to immense music libraries, with high audio quality, and as they grew, revenues to existing music labels dropped.

- As you can see, music revenues shifted (unsurprisingly) from studios to music streaming, but in a more troubling sign, the aggregate revenues of the music business dropped by almost 40% between 2000 and 2016. On a more optimistic note, the revenues are now back to pre-2000 levels, albeit not on an inflation-adjusted basis, and 65% of all revenues in 2021 came from streaming. It is undeniable that streaming, by removing many of the intermediaries in the old music business model, has shrunk the business.

- The status quo crumbled: As revenues shrunk, and moved from the studios to the streamers, the companies that represented the status quo imploded. The music studio business, which had a dozen or more active players in the last century, has consolidated into a handful of firms, most of which are small parts of much bigger entertainment companies (Sony (SONY), Vivendi (OTCPK:VIVEF)), and many of the biggest labels in music (Abbey Roads, EMI buys last of Motown catalog – UPI.com) are historical artifacts that have sold their music rights to others. The music retail business was decimated, as music retailers like Tower Records shut down, and as artists looking to replace lost revenues from record sales with live performances and merchandising sales, companies like Live Nation (LYV) stepped in to fill the need.

- The divergence in musician take became larger: As revenues shrunk and partially recovered, not all musicians shared in the new pie equally. The top one percent of musicians account for ninety percent of all music streams and close to sixty percent of revenues from concerts. A business that has always been top-heavy in terms of rewarding success, has become even more so.

- Personalities became bigger than music labels: The advent of social media has allowed the highest profile performers to break free of most of the intermediaries in the music business. When you are Beyonce, and you have 15.3 million followers on Twitter and 317 million followers on Instagram, you have more reach and persuasive powers than any music company on the face of the earth. While it is true that social media has allowed a few musicians to break through and become successful, I think it is undeniable that social media is exacerbating the differences between big name musicians and unknowns more than it is helping close the gap.

You could see these last two phenomena at play, this year, in the Taylor Swift Eras Tour, where Taylor has effectively cut out most of the middlemen in the concert business and laid direct claim to the hundreds of millions of dollars in revenues from the tour.

As movie and broadcast business executives look over their shoulders at what streaming has in store for them, a few of them are undoubtedly looking at the implosion of the music business and wondering whether a similar fate awaits them. The more optimistic among them will point to differences between the music and movie businesses that will make the latter more resilient, but the more pessimistic will note the similarities. To put it in more existential terms, if the movie business resembles the music business in how it responds to streaming, there is a boatload of pain that is coming for the status quo, with the key difference being that a meltdown similar to the one seen in music will wipe out hundreds of billions of dollars in value, rather than the tens of billions in the music business.

Movie and Broadcasting – The Twentieth Century Lead In

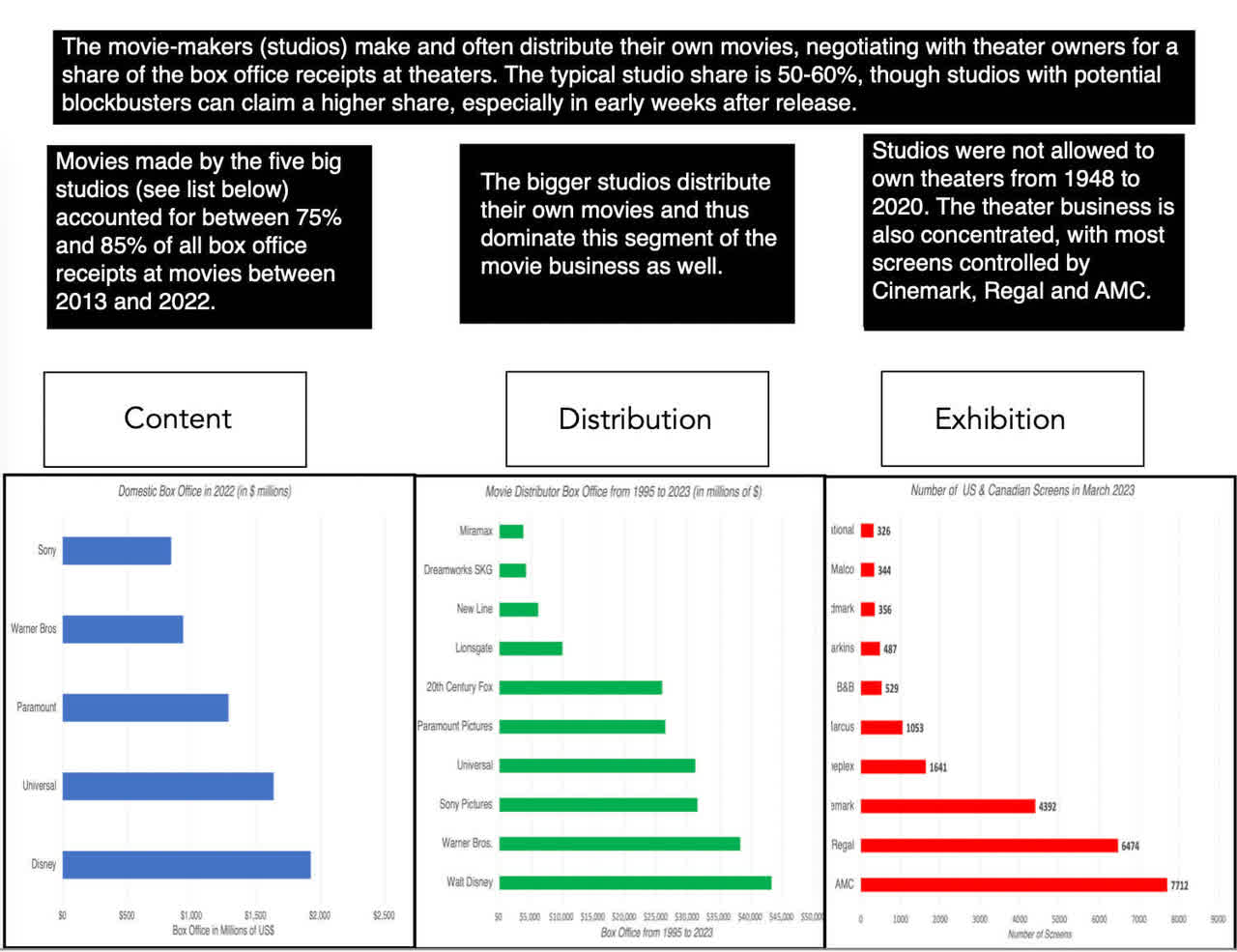

The movie business had its beginnings in the early 1900s when the first movies were made and Hollywood became the destination of choice for movie makers, at least in the United States. In the years after, the great movie studios had their beginnings, with the precursor to Paramount (PARA) being created by Cecil B. DeMille and others in 1915, followed soon by Metro Goldwyn Mayer (MGM), RKO, 20th Century Fox, and Warner Bros. (WBD)(creating the Big Five), as well as by smaller players (Universal, United, Columbia). In the golden age (at least for the studios), these five studios controlled almost every aspect of the movies, including content, distribution, and exhibition with movie actors effectively owned and controlled by the studios that discovered them. It took the US Supreme Court and use of the antitrust law, in 1948, to first force studios out of the movie theater ownership business, and then to release movie stars from their bondage, and in the process, it ended the Studio Age.

Forced to divest themselves of movie theaters and of their control of movie stars, the studios were able to offset the negatives with the positives from new technologies (Technicolor, stereo sound) and an almost unchallenged claim on American leisure time, with close to two-thirds of Americans going to the movies at least once a week in the 1950s. In the 1970s, Hollywood discovered the payoff from blockbuster movies, and the movie business became increasingly dependent on the biggest blockbusters delivering enough revenues and profits to cover a whole host of movies that either lost money or broke even. While Jaws and the first three Star Wars movies (A New Hope, The Empire Strikes Back, and The Return of the Jedi) were not the first mega-hits in history, they accelerated the trend toward the blockbuster phenomenon that continues through today. In the 1980s, the birth of video players created ways for studios to supplement revenues at movie theaters with revenues from selling videos and DVDs while opening the door to illegal copying and piracy.

Through this period, the big studios still controlled a large share of the content business, but independent studies, often more daring in choice of topics and settings, took a share. That said, the movie business remained concentrated, with the biggest players dominating each segment of the business.

That movie business was built around box office receipts at movie theaters, split between the movie makers and the theater owners. The latter were capital intensive, since they occupied valuable real estate, owned or leased by the theater companies. Though the theater-owners were nominally independent, studios retained significant bargaining power with these exhibitors and the sharing of supplemental revenues.

The broadcasting business lagged behind the movie business, in terms of development, because televisions did not start making their way into households in sufficient numbers until the 1950s, but it too was built around a system of content production, distribution, and exhibition, but with advertising at the heart of its revenue generation. The dominance of the three big networks (ABC, CBS, and NBC) in television viewing meant that television shows had to reach the broadest possible audiences to be successful, and television show success was measured with (Nielsen) ratings, measuring how much they were watched, and an entire business was built around these measurements. That business was disrupted in the 1970s and 1980s with the arrival of cable television, and cable’s capacity to carry hundreds of channels, some of which catered to niche markets, shaking the major networks’ hold on viewers and changing content again. At the start of 2010, it was estimated that close to 75% of all US households received their television through a cable or satellite provider, setting the stage for the next big disruption in the business.

Movie and Broadcasting: The Streaming Era

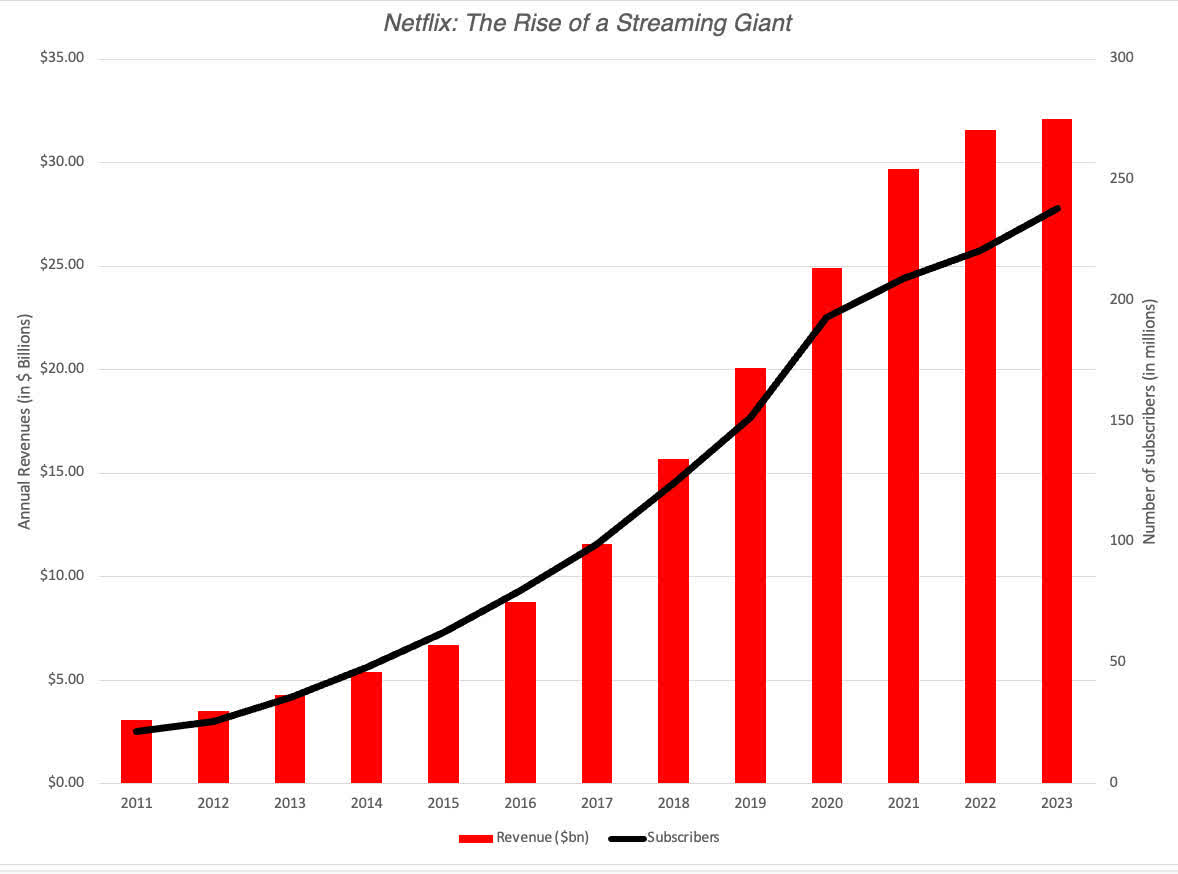

Netflix (NFLX), which is now synonymous with the streaming threat to movies, started its life as a video rental company, more of a threat to Blockbuster video, the lead player in that business, than to any of the larger players in the content business. It is worth remembering that Netflix’s entry into the business was initially on the US postal system, with the innovation being that you could have the videos you wanted to watch mailed to you, instead of going into a video rental store. As the capacity of the internet to send large files improved, Netflix shifted to digital distribution, albeit with angst on the part of some existing customers, but it still relied entirely on rented content (from the traditional studios). It was in response to being squeezed by the studios on payments for this content that Netflix decided to try its hand at original content, with House of Cards and Orange is the new Black representing their first major forays, and set in sequence the events that have led us to where we stand today.

The Netflix Disruption

The rise of Netflix as a streaming giant has been meteoric, and it can be seen both in the growth in subscribers and revenues at the company, especially in the last decade.

Embedded in these numbers are two other trends worth noting. The first is that the percent of content that Netflix produced (original content) increased from almost nothing in 2011 to close to 50% of content in 2022. The second is that growth in recent years, in subscribers and revenues, has come from outside the US, with the US declining from 52% of all subscribers in 2018 to 33.6% of subscribers in 2022.

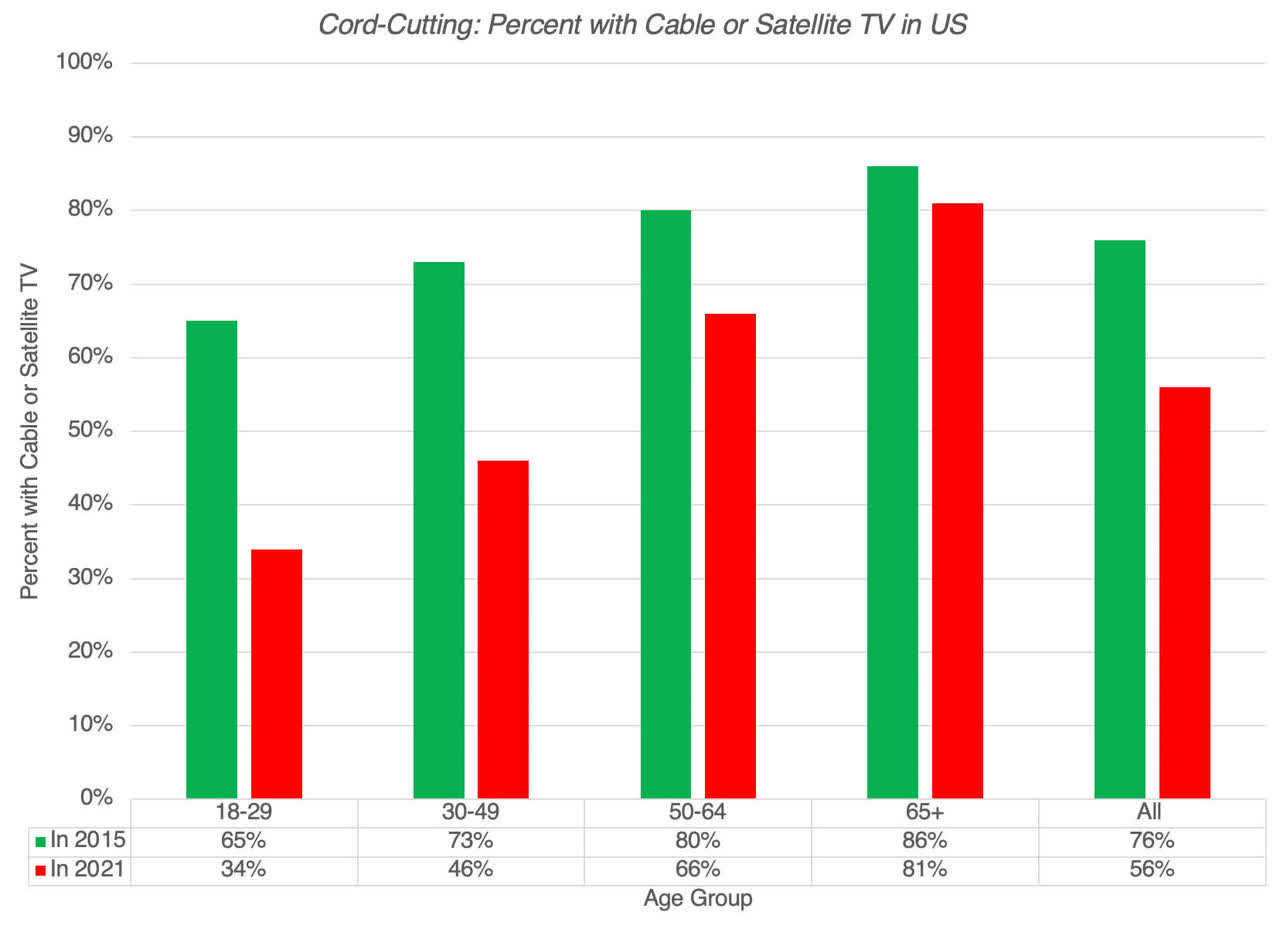

As Netflix has grown, it has drawn competition not only from traditional content makers, with the largest studios offering their own streaming services (Disney -> Disney +, Paramount -> Paramount+ & Showtime, Warner -> (HBO) Max, Universal -:> Peacock, MGM -> MGM+), but also from large technology companies (Apple TV+ and Amazon Prime). While Netflix remains the most watched streaming service, many customers subscribe to multiple streaming services, and as streaming choices proliferate, more and more US households have started weaning themselves away from cable TV. This cord-cutting phenomenon’s effects can be seen in the percent of households that have no cable or satellite TV:

Between 2015 and 2021, about 20 percent of all US households dropped their cable or satellite television subscriptions, with the drop-off being dramatic in younger households. In August 2022, for the first time in history, Nielsen reported that more people watched streaming than cable or broadcast TV, and there is every reason to believe that this trend will only get stronger over time. As a final note, there are two reasons why cable and satellite television has not suffered an even steeper fall. The first is that aging households continue to stick with their television-watching habits, and relatively few older Americans have cut their cable subscriptions. The second is live sports, especially (American) football, where cable continues to retain a foothold, though even that advantage is under threat, as sports franchises create their own streaming platforms (MLB) or find streaming venues (MLS soccer on Apple TV, the NFL on Amazon Prime). It is in this context that Disney’s battle with Charter over ESPN takes on a larger relevance since ESPN and cable TV have had a symbiotic relationship for more than two decades.

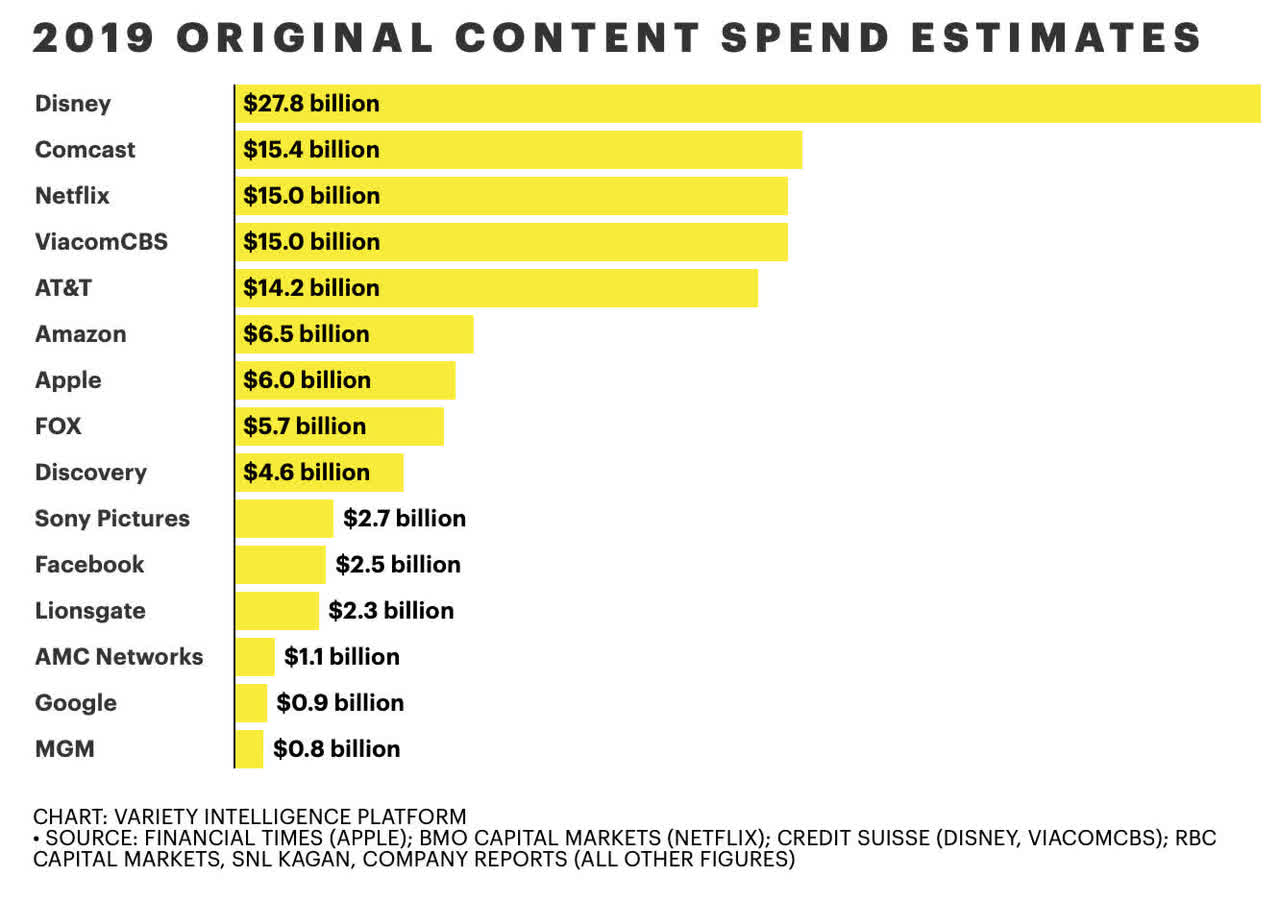

As streaming has breached the broadcasting business, you may wonder how it is affecting the movie business. In the early years, streaming allowed studios to augment the value of their content by renting it out to streamers (Netflix, in particular) for substantial revenues. As its subscription base grew, Netflix turned to making original movies, mostly for its own platform, and in 2019, it spent close to $15 billion on original content, rivaling the spending of large movie makers.

The COVID shutdown of 2020, in particular, changed the dynamic further, as traditional studios, faced with the shuttering of movie theaters, released their movies directly into streaming. That phenomenon has outlasted COVID, and as it develops as a viable alternative for content distribution, it not only strikes at the heart of the traditional movie business but may also be changing consumer behavior.

The Streaming Effect

As streaming disrupts both the broadcasting and movie businesses, let us look at how it is changing these businesses from the inside, starting with content (types of movies, movie budgets, number of movies), moving on to talent (actor and writer demand and compensation) and then to customers (how much and how we watch content).

Content

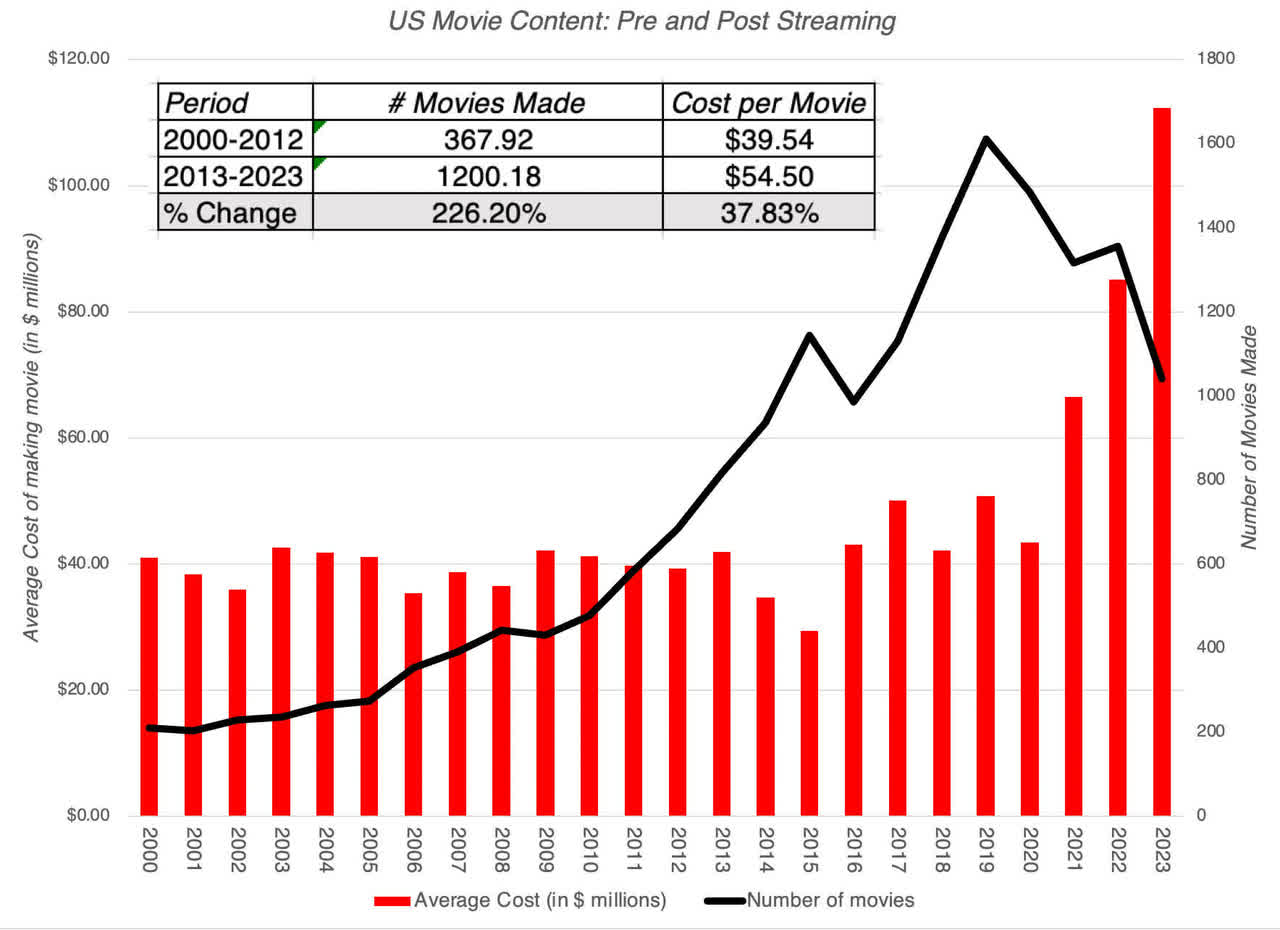

The growth of streaming platforms has altered content (movies and broadcasting) in significant ways., with the first being an increase in the total volume of content, as streaming platforms try to fill their content libraries. With Netflix leading the way on original content, this has translated into a jump in movies being made, as can be seen in the graph below, from an annual average of 367 movies a year, in the United States, between 2000 and 2012 to 1,200 movies a year between 2013 and 2023.

That increase in demand for content has been accompanied by an increase in costs of movie-making, with the average cost for making a movie increasing from $39.5 million between 2000 and 2012 to about $54.5 million between 2013 and 2023.

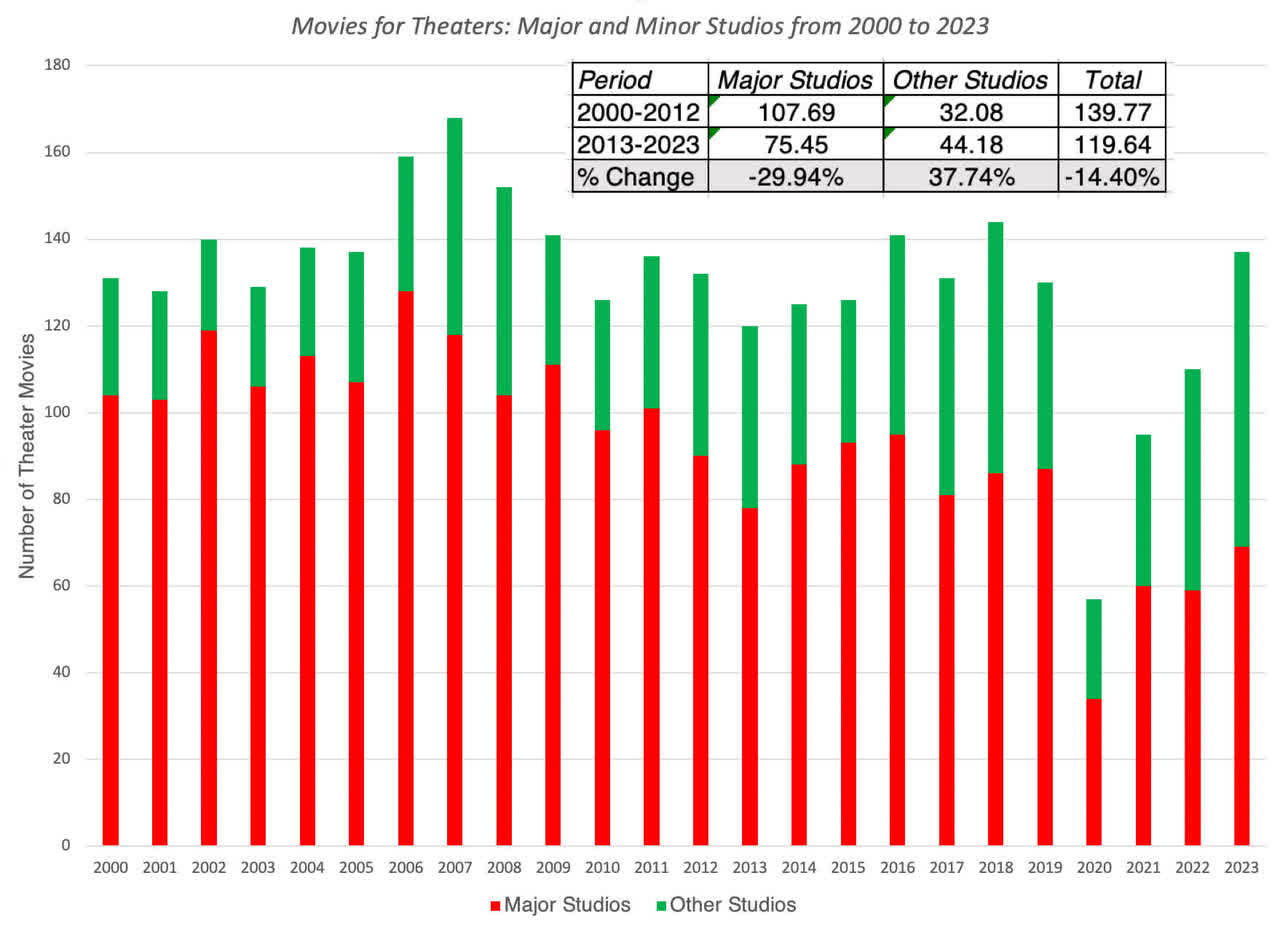

If you are wondering why you have not seen an explosion of movies at theaters, it is because fewer of these movies are being made for movie theaters, with big studios, reducing theater movie production by almost 30%, from 108 movies a year, on average from 2000 to 2012, to about 75 movies a year, from 2013 to 2023. While independent studies increased their production over the period, the overall number of movies reaching movie theaters has seen a significant drop-off.

While the 2020 drop can be attributed to the shutdown, movie production has not bounced back in the years since.

Finally, the most interesting effects of streaming may be occurring under the surface in terms of the content that is produced, and they can be traced to the very different economics of making movies for theaters (or shows for broadcasting) as opposed to creating content for streaming services. With the former, the question of whether to make content can be answered by forecasting the revenues that will be generated by that content, either as gate receipts and ancillary revenues (for movies) or in advertising revenues (for broadcasting). With streaming, the end game with new content (movies or shows) is to add new subscribers to the service, and/or induce existing subscribers to renew their subscriptions, and it is difficult to link either directly to individual shows. Even within streaming services, there seems to be no consensus on what strategy best delivers these results, perhaps because success is so difficult to measure.

- Netflix has chosen what can be best described as the shotgun approach to content, producing vast amounts of content, often in the form of entire seasons, of shows, with the hope that some portion of that content would be a binge-watching hit. That approach has delivered results in terms of higher subscriber count, but at a huge content cost, with content costs growing at the same rate, or higher rates, than subscriber count, until very recently.

- HBO has used a more curated approach to content, making fewer shows, albeit with less divergence in quality, and releasing episodes on a weekly basis, hoping for more viral reach from successful shows (Game of Thrones and Succession qualify as big successes). The plus of this approach is lower content costs but with much lower subscriber numbers than in the shotgun model.

- Disney Plus started with the premise that a massive library of content would allow the platform to draw and keep subscribers, but early on, the company discovered that to compete with Netflix on subscriber numbers, it needed new content, and much of that content has come from high-profile, expensive shows from its Avengers and Star Wars franchises. If success is measured in subscriber count, Disney Plus has succeeded, but the spending on content has exploded, dragging Disney’s profitability down with it.

- With Apple TV+ and Amazon Prime, the game is even more difficult to gauge. Both companies spend large amounts in content and clearly lose money on their streaming platforms, but their benefits may come from tying users more closely into their platforms with the benefits showing up in other products and services they sell to those in their ecosystems.

Given that all of these approaches have had difficulty delivering sustained profitability, it is fair to say that while streaming has succeeded in delivering subscriber growth and changing content-watching habits, it has not developed a business model that can deliver sustained profitability.

Talent

The angst that many actors and writers have about the sharing of streaming revenues can be best understood by considering how they have historically received residual payments on content. Built around a pay structure negotiated in 1960, actors and writers are paid residuals each time a show runs on broadcast or cable TV, or when someone buys a DVD or videotape of the show. With streaming, that old structure has buckled, as the benefits from a show or movie are more difficult to measure since subscription revenue or subscriber count cannot be directly connected to individual shows. (There are exceptions, where added subscriber numbers can be attributed to a hit show, say Game of Thrones at HBO, or even a high-profile individual, with Lionel Messi pushing up MLS subscriptions on Apple TV+.) To the counter that you can measure how many people watch a show or movie on Netflix or Disney+, note that streaming companies do not make money from viewers, but only from added subscription revenues. With the more diffuse link between viewership and revenues in streaming, the question of how to structure residuals to actors and writers has become a key point of contention, and one of the central elements of the current strike.

In 2019, the Screen Actors Guild made an agreement with Netflix that applied to any scripted projects produced and distributed by the platform where residuals were calculated based on the amount that a performer was originally paid and how many subscribers the streaming platform has. That agreement though has yielded wildly divergent payments to actors, with some taking to social media to showcase how little they received, even on widely watched shows, while other bigger-name stars are being well compensated. One of the demands from strikers is that streaming services be more transparent about viewership on shows and that they tie compensation more closely to viewership, but this dispute will not be easily resolved. Given the stakes, an agreement will eventually be reached where actors and writers will receive more than what they are receiving now, but to the extent that streaming gets its value from adding and holding on to subscribers, I expect the divergence in pay between the stars of streaming shows and the rest of the content makers to get worse over time, just as it did in the music business.

Consumption

Has streaming changed the way that we watch movies and broadcast content? I think so, and here are a few generalizations about those viewing changes:

- More choice, but less quality control: The fact that Netflix has built its content production around the shotgun approach, and is being copied by other streamers, you and I as consumers will be spending far more time starting and abandoning shows, before finding ones to watch than we used to. Not surprisingly, quite a few of us are overwhelmed by that search for watchable content and choose to go with the familiar (explaining the success of old network shows like The Office, Friends and Suits on Netflix) or with the herd, often watching what everyone else is watching (the ten most watched shows and movies that Netflix highlights every day create feedback loops that lead them to be watched more).

- Copycat Productions: The content business has never been shy about imitation and sequels, trying to remake successful content with slight variations or add sequels to hits, but that has notched up with streaming. Thus, the success of a show on Netflix gives rise not only to more seasons of that show, but to a whole host of imitations. If you add to this the reality that streaming platforms track what you watch and have algorithms that feed you more of the same, you may very well have the misfortune of being caught in a version of Groundhog Day, where you watch the same movie, with mild variations, over and over again for the rest of your life.

- YouTube and TikTok: As the content on streaming platforms dilutes quality and shifts to reality shows, it should come as no surprise that viewers are spending less time on streaming platforms and more on Twitch, YouTube, and TikTok, where you get to watch people put out reality shows of their own, sometimes in real-time.

Finally, the early promise of streaming was that it would allow us to save money, by cutting the cable cord, but as with most things that technology has promised us, those financial savings have become a mirage. If you add together the cost of multiple streaming services to the higher price that you paid to get higher-speed broadband, to watch your streaming shows, I am sure that many of you are paying more on your entertainment budget than you did in pre-streaming days.

The Streaming Effect: Business Models and Profitability

The effects of streaming on movies and broadcasting content and distribution are showing up in the financial statements of these companies and in the market pricing of these companies. In this section, I will start by looking at how the operating metrics of entertainment companies, with the intent of detecting shifts in growth and profitability, and then turn my attention to how investors are pricing in these changes.

Operating Effects

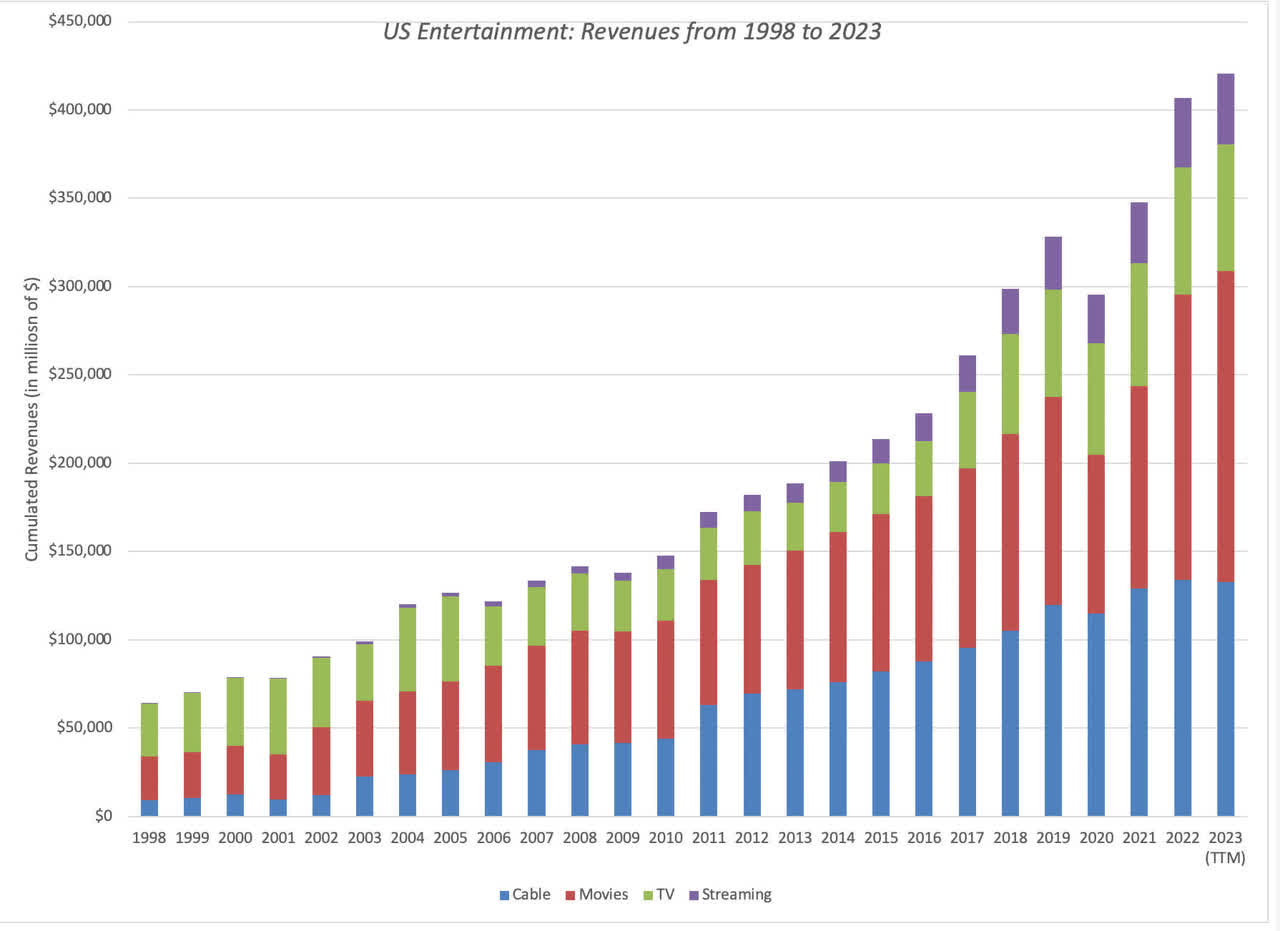

For those who are concerned about a music business-like implosion in movie business revenues, I will start with the good news. At least so far, the cumulative revenues across all entertainment companies have held up to the streaming disruption, as can be seen in the graph below, where I look at the cumulative revenues of all movie and broadcasting-related companies from 1998 to 2023:

Note that since companies are classified based upon their core business in this graph, the streaming component of revenues are understated, since the revenues that Disney, Paramount, and Warner get from their streaming businesses are counted as movie revenues. As you can, aggregate revenues did see a drop in 2020, because of COVID, but have come back since. If you are wondering why cable company revenues have been resilient in the face of cord-cutting and the loss of cable TV subscriptions, it is because cable companies remain the prime providers of broadband, without which there is no streaming business.

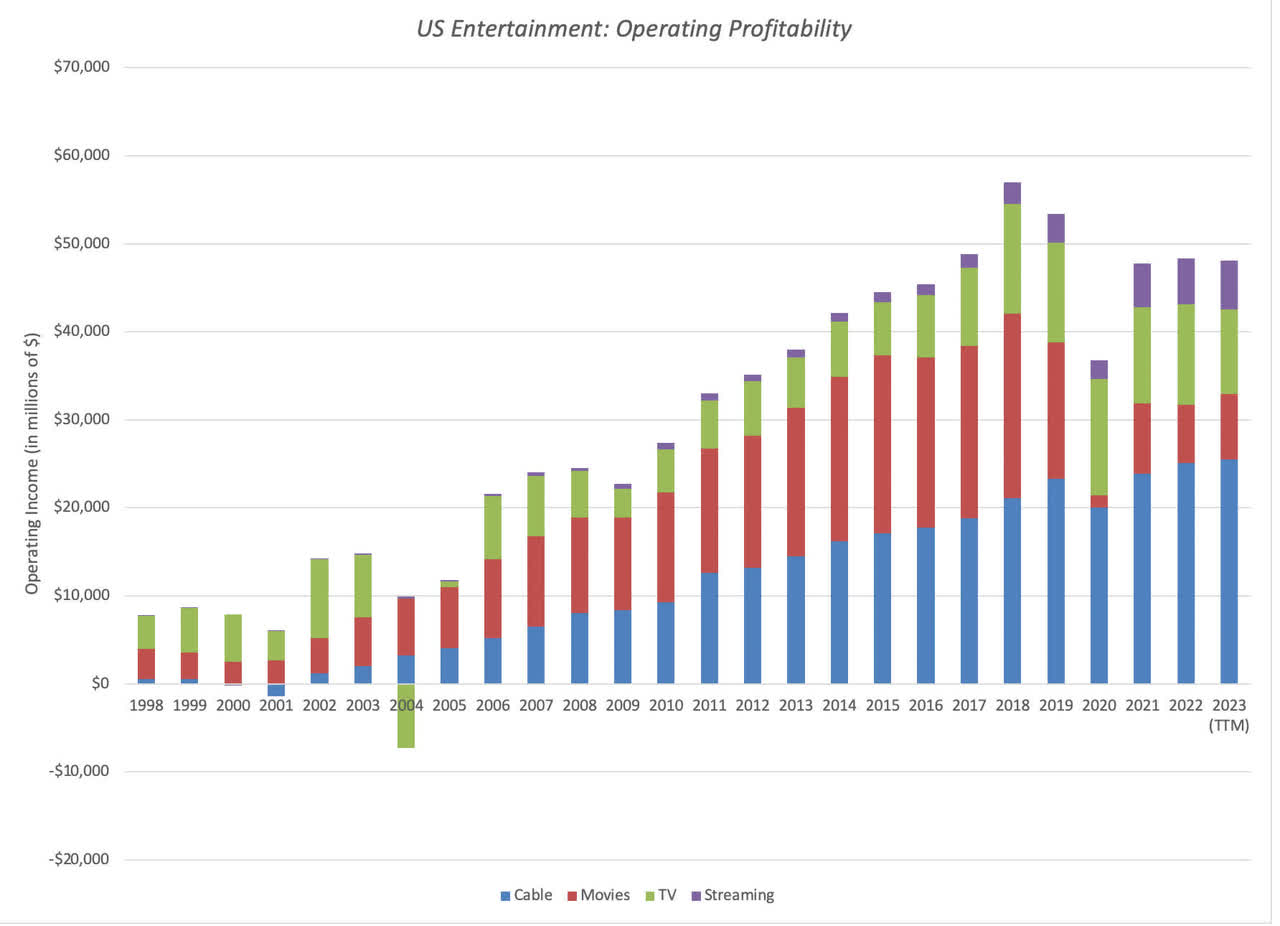

On a less upbeat note, looking at profitability at these companies, the cumulative operating profits have been less resilient, especially in the post-COVID years, with cumulative operating profits in 2022 and 2023 well below operating profits in 2019:

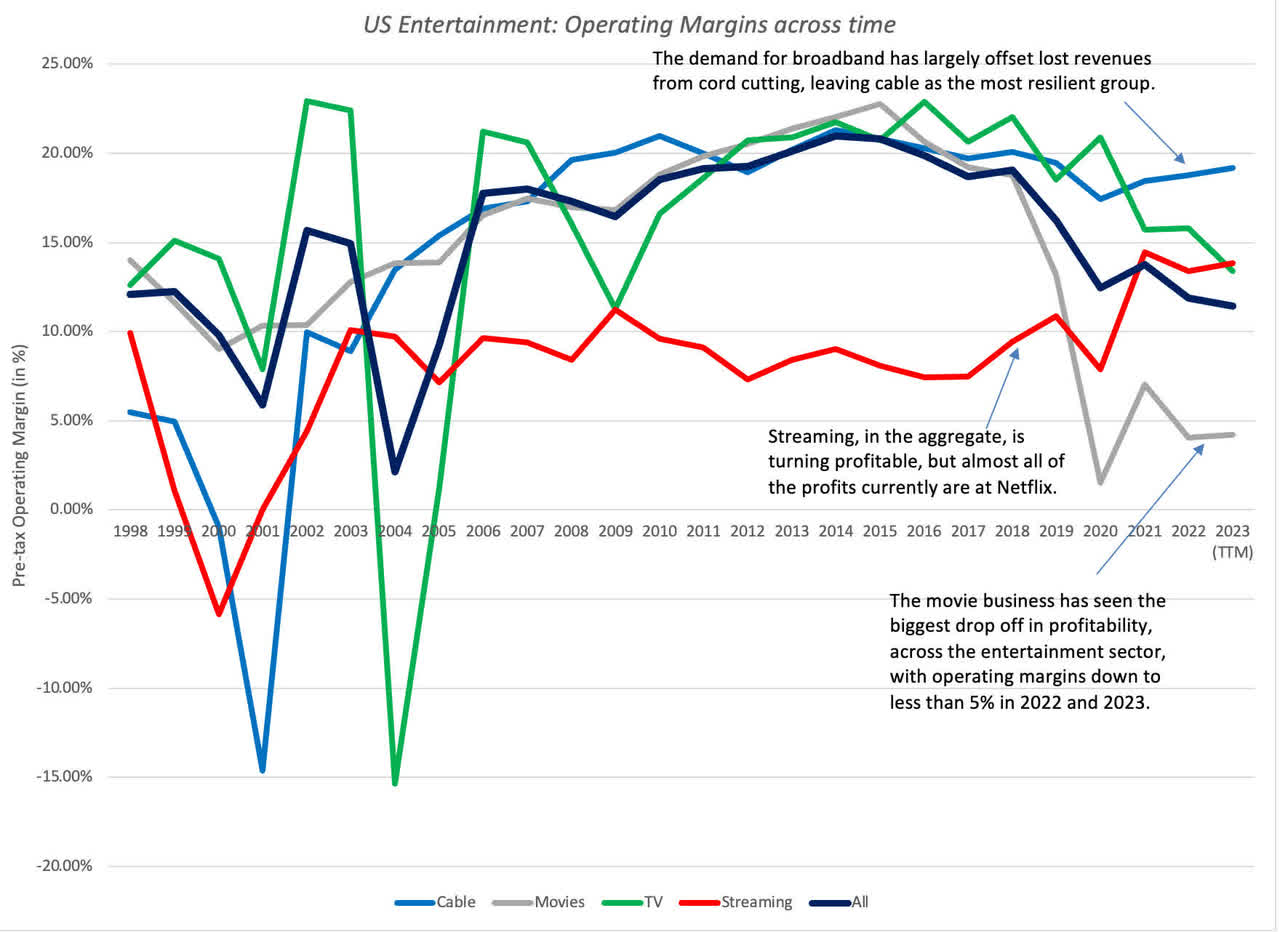

If you bring the revenues and operating numbers together to compute operating margins, you start to get a clearer sense of why movie companies, in particular, are facing a crisis:

The profitability of the movie business has collapsed in the years since COVID, with operating margins dropping below 5% in 2022 and 2023, from more than 15% in the years before COVID. Streaming seems to be settling into a modicum of profitability, but here again, we may be overstating the profitability of streaming by not bringing into the metric the losses that Disney, Warner Bros., and Paramount are facing in their streaming segments.

In sum, entertainment companies are delivering higher revenues overall, with revenues from streaming and new technologies increasing enough to offset lost revenues in legacy businesses that are being disrupted, but the entertainment business overall is becoming less profitable.

Market Effects

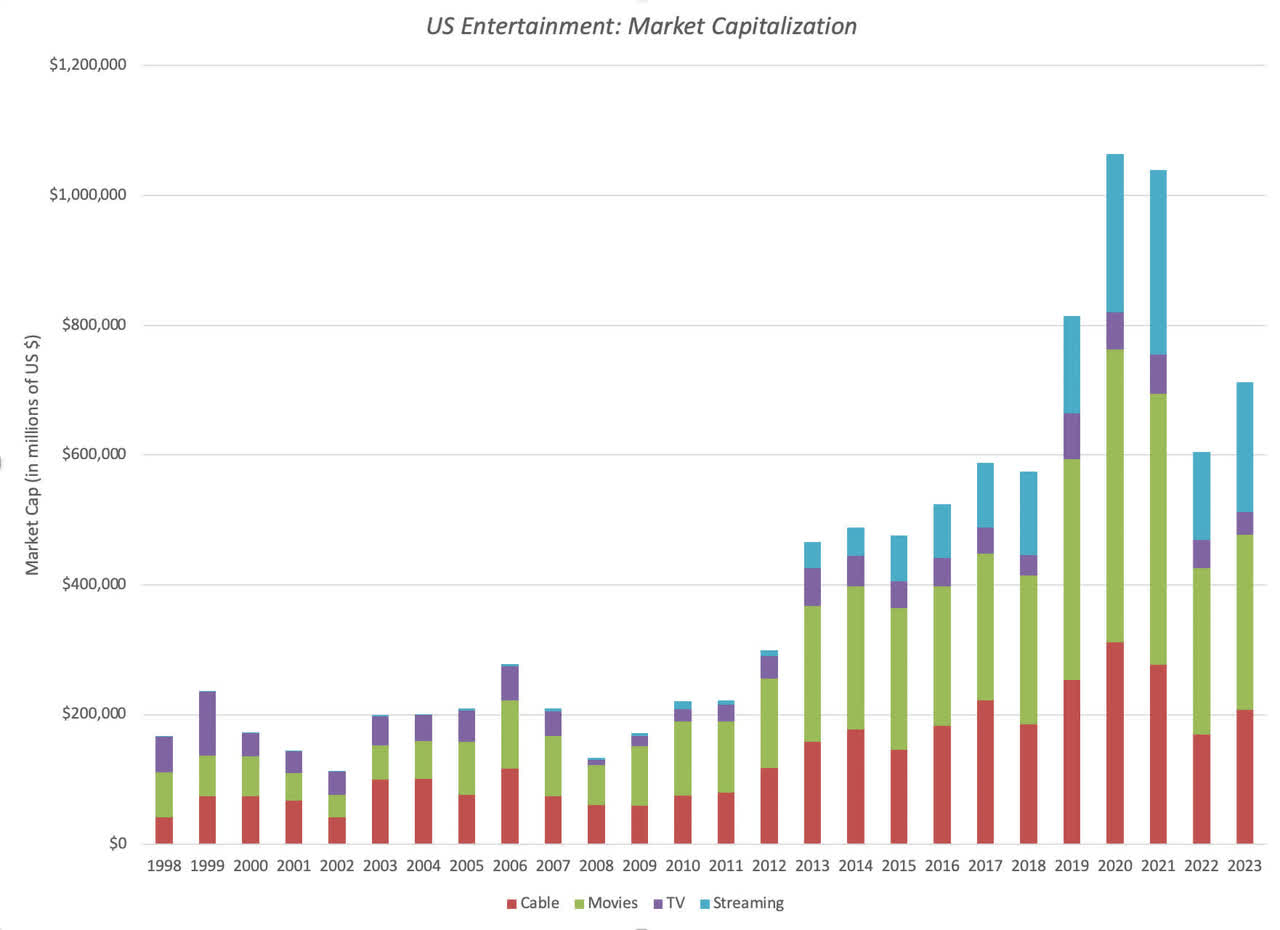

As streaming has changed the movie and broadcasting businesses, financial markets have struggled to get a handle on how these changes affect the values of companies in these businesses. Looking at the cumulative market capitalization of all entertainment companies, there are two shifts that we can observe over time, one in the decade leading into COVID and one in the years after:

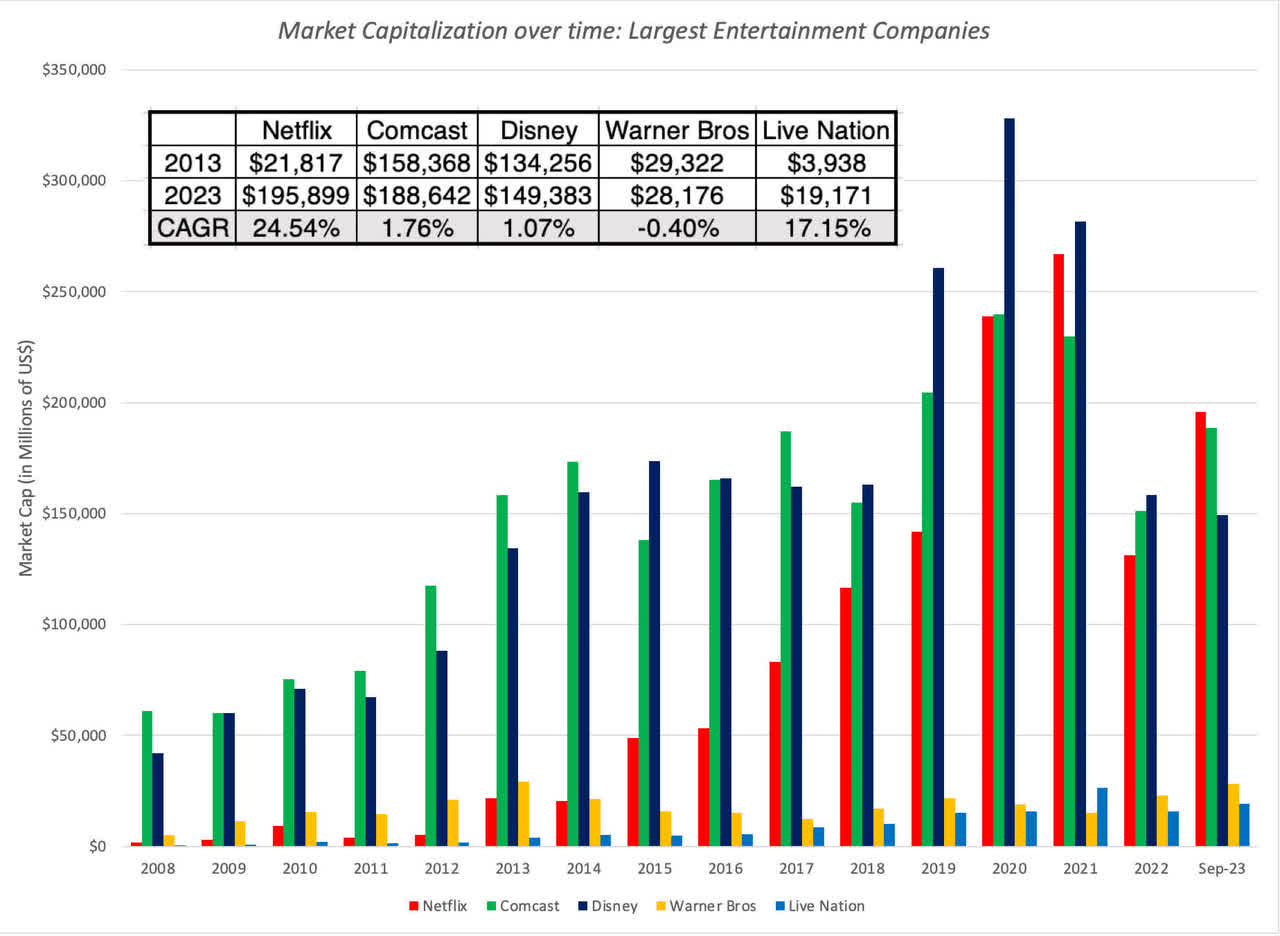

Note the surge in aggregate market capitalization between 2019 and 2021, with Netflix leading the way, and with other entertainment companies partaking, and the drop in value in the last two years. The trends in cumulative market capitalization of all entertainment companies also masks shifts in value across companies within the group, as can be seen in the graph below, where I look at the diverging fortunes across the last decade of the five largest entertainment firms (in terms of market capitalization) in September 2023:

Between 2013 and September 2023, Netflix gained $174 billion in market capitalization, posting an annual return of 24.5% a year. During the same period, Comcast, Disney, and Warner saw their market capitalizations stagnate, in a period when the market was up strongly, effectively translating into a lost decade of returns to shareholders. Live Nation, the fifth-largest company in the group in September 2023, barely registered in the rankings in 2013, but has risen 17.19% a year to reach its current standing.

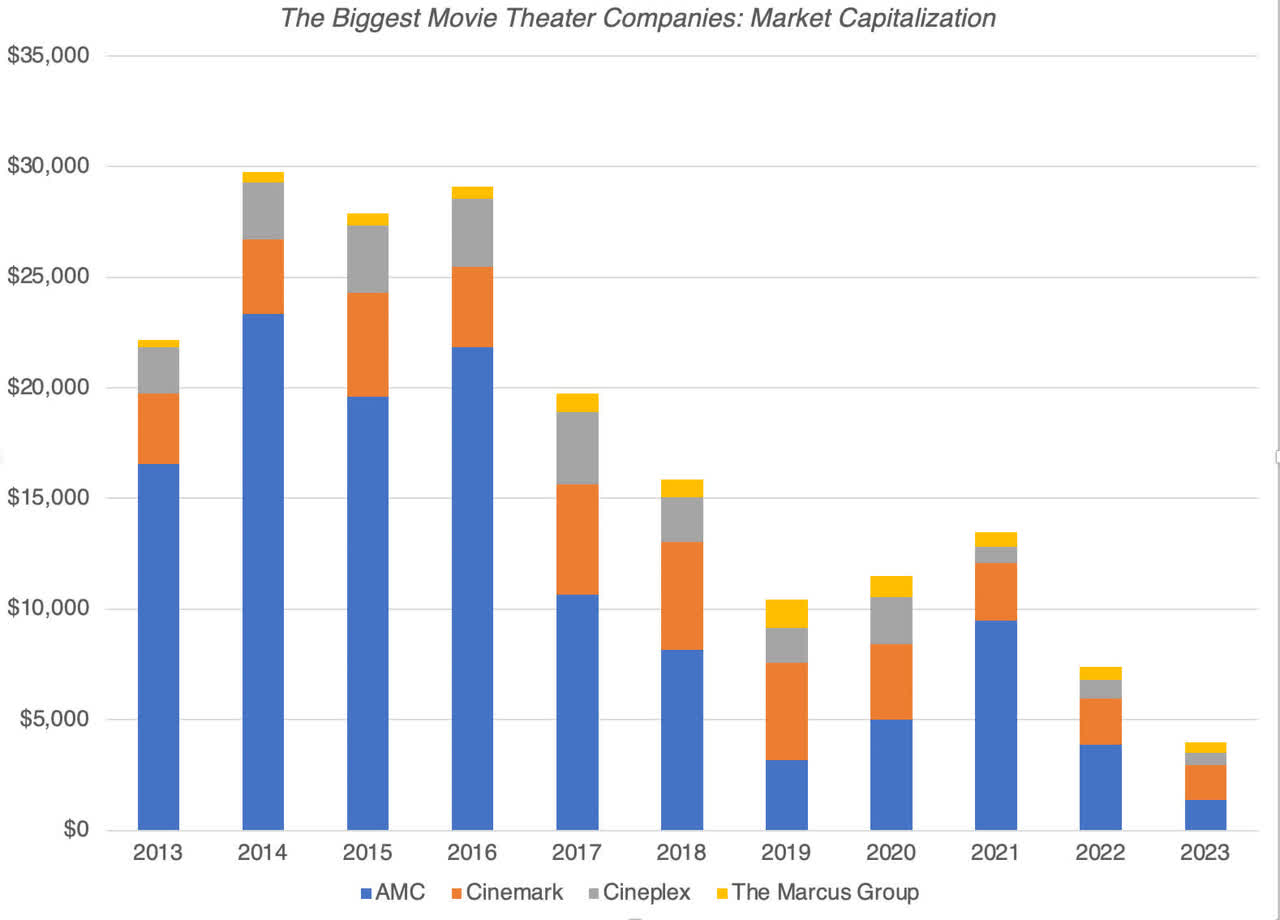

While the shifts in value from the status quo players to Netflix and Live Nation is buffering the impact of streaming on the cumulative market capitalization of this industry group, the market has become decidedly more negative on one segment of this group – movie theater companies. In the last graph, I look at the cumulative market cap of the four largest movie theater companies in North America – AMC (AMC), Cineplex (CGX:CA), Cinemark (CNK), and the Marcus Group.

While the COVID shutdown clearly impacted the 2020 numbers, note that the market decline in these companies started in 2017, and has picked up steam since.

Corporate Governance

Corporate governance at companies rarely draws attention during the good times, when managerial mistakes are overlooked, and rising revenues and earnings can hide corporate flaws. However, in challenging times, disruption clearly has created challenges for entertainment companies, so it is not surprising that we are seeing more investor angst at these companies.

- CEO Turnover: There has been drama in the top ranks of Disney in the last few years, as Bob Iger first turned over the reins in the company to Bob Chapek in 2020, and then reclaimed it two years later. Some of that blowback can be traced to an expensive bet made by the latter on streaming, reorganizing the company around Disney+, and investing billions into streaming content, trying to attract new customers. While there are factors specific to Disney that can shed light on that company’s CEO wars, I expect CEO turnover and turmoil to increase at entertainment companies, as investors look to replace management at companies that are struggling, in a sometimes futile effort to change their fortunes.

- Activist Presence: It is no surprise that activist investors are drawn to industries in turmoil, pushing companies to spend less on reinventing themselves and returning more cash to shareholders. Here again, the Disney experience is instructive, where Nelson Peltz’s opposition to Chapek’s plans clearly played a role in the CEO change this year. While Iger has been given some breathing room to fix problems after his return, the clock is ticking before activist investors return to the company. In fact, I expect the companies in the entertainment group to be prime targets for activist investors in the next few years.

- Spin-offs, Divestitures, and Break-ups: In response to streaming challenges, entertainment companies have started exploring whether splitting up or spinning off businesses will improve their chances of survival and success in the streaming age. Warner Bros. was spun off by AT&T (T) and merged with Discovery in 2022, precisely for this reason, and the push for Disney to spin off or divest ESPN is similarly motivated.

- Bankruptcy: For the companies whose financials have imploded as a result of streaming, and all have debt, you should expect to see dire news stories not just about layoffs and shrinkage, but about potential bankruptcy. In the theater business, this has become a reality as Cineworld (owner of Regal, the second-largest theater chain in North America) issued a bankruptcy warning in early 2023, and AMC (owner of both the largest theater chain and a streaming service) had to do a reverse stock split to keep itself from careening towards penny stock status.

There are three final notes that I would like to add to this (LONG) post. First, I know that this post has been US-centric in its examination of the streaming effects on entertainment, but I do believe that much of it applies to the rest of the world, with a caveat. The status quo may be better protected in other parts of the world, either because of explicit limits or implicit barriers to entry. Thus, streaming may be less of an immediate threat to Bollywood, India’s immense homegrown movie-making business than it is to Hollywood, but change is coming nevertheless. Second, as I noted before, the line between content made by professionals (movie makers, broadcasting studios) and individuals (on platforms like YouTube and TikTok) is getting fuzzier, and they are all competing for limited viewer minutes. Third, for those in this business who are naive enough to think that artificial intelligence will rescue their companies from oblivion, I would offer the same caution that I did to the active money management business, a few months ago. If everyone has it, no one does, and with AI, content makers may very well find themselves competing with computer power and technology companies, and that is not a fight where they have the upper hand.

What the future holds…

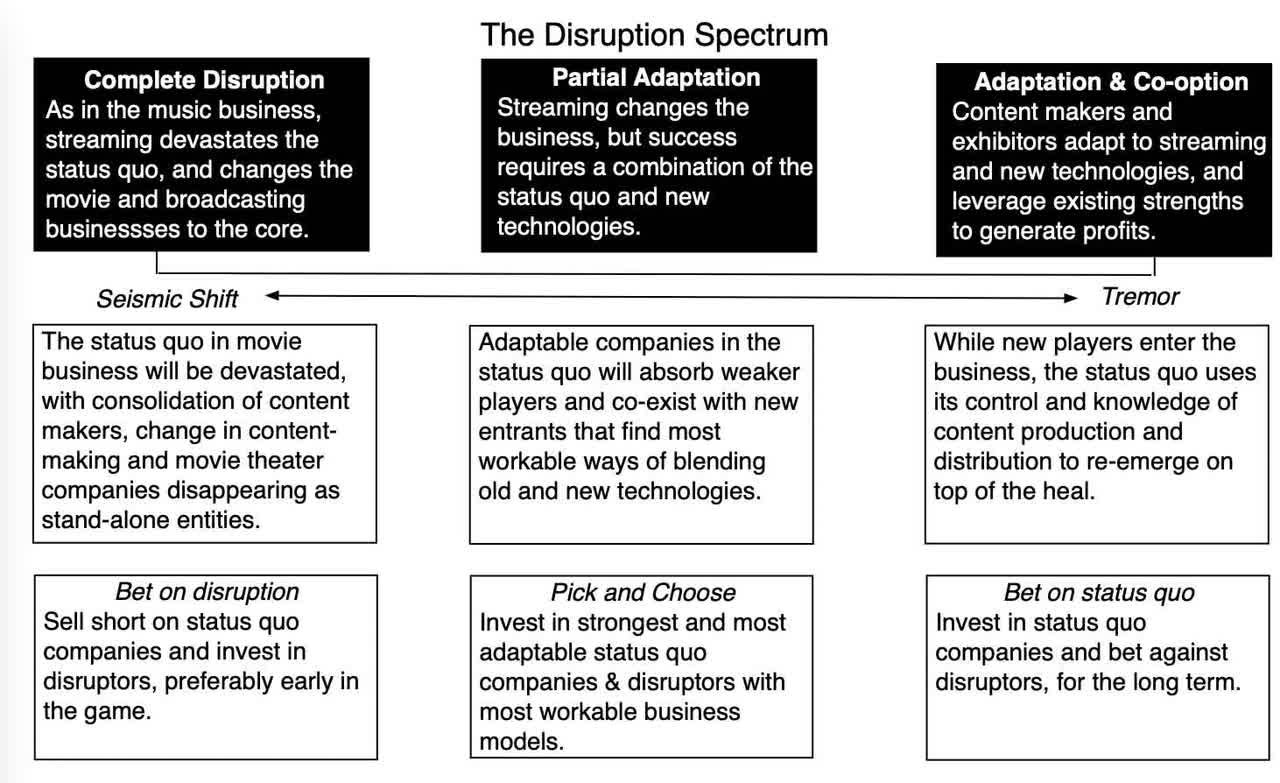

The consequential and unresolved question is what the movie and broadcasting business will look like a decade from now since the answer will determine how stakeholders in the business will be affected. To frame the answer, I start by looking at the most malignant and benign ways in which this could play out:

- At one extreme, you may see the movie and broadcasting business follow the music business and see a collapse of revenues, a destruction of the status quo and a resetting of the competitive landscape. If this happens, some of the biggest names in movies and broadcasting will disappear as independent entities, either absorbed as pieces of much larger companies or cease to exist. The disruptors, including Netflix and Live Nation, will face different challenges, as they now become the status quo, and they will have to figure out how to make their business models profitable and sustainable, even as they themselves will become targets of new disruptors.

- At the other exhibit, you will see entertainment continue to grow as a business, but with status quo players (content makers and exhibitors) bringing their strengths into play to outflank the disruptors. In this scenario, the big names in the movie and broadcasting business will modify how they make and exhibit content, and come back, bigger, stronger and more profitable than they were in the pre-streaming era.

- There is a middle-ground, where success will require that you draw on the strengths of both the status quo and new technologies. The players in the status quo who are adaptable and willing to change will absorb those players who are not, and there will be a similar shake up among disruptors, with those disruptors who combine entertainment business wisdom with technological knowhow will win at the expense of disruptors who do not.

As investors in this industry group, your task is simple, if you believe in either extreme. If you believe that disruption will be absolute and upend the movie and broadcasting businesses, you should, at the minimum, avoid the status quo entertainment companies, and if you are more of a risk taker, sell short on these companies. If you believe that after all is said and done, disruption will expand entertainment business revenues, but will leave the status quo on top, you should buy Disney, Warner and perhaps even AMC, and sell short on the highest-flying newcomers in the business.

If, like me, you go for the middle ground, your success will depend on how good you are at assessing adaptability in entertainment companies, buying status quo companies with speedy learning curves on streaming and new technologies and disruptors that acquire content-making skills to pair with technological prowess. That would make both Disney and Netflix works-in-progress, with the former still wrestling with the challenge of making its streaming platform a money-maker and the latter working on a content model that is more disciplined and less costly. I took a run at valuing both companies, assuming that they each find their way to a healthy balance (between growth and profits), with Disney’s margins settling in below where the 18-20% levels the company delivered in pre-COVID days, and Netflix reducing its content spending (with content costs growing much slower than subscriber growth), going forward:

| Disney | Netflix | |

|---|---|---|

| Revenues (LTM) | $87,807 | $32,465 |

| Operating Income | $7,725 | $5,624 |

| Revenue Growth (last year) | 8.30% | 0.29% |

| Operating Margin (LTM) | 8.80% | 17.32% |

| Expected Revenue Growth (Years 1-5) | 10.00% | 15.00% |

| Expected Operating Margin | 16.00% | 20.00% |

| Sales to Capital | 1.46 | 3.00 |

| Value per share | $87.52 | $238.08 |

| Price per share | $80.00 | $443.10 |

| Spreadsheet | Download | Download |

Put simply, the market seems to be pricing in the presumption that Netflix will continue to get content costs under control, while still delivering growth similar to what it has delivered in the past, while it is pricing Disney for low growth and margins that will fall short of their historic norms. I agree that Disney is a mess, right now, but I do believe that at current pricing, the odds favor me more with Disney than Netflix, but that is just me!

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply