Introduction

Over the past few months, I’ve noticed that there are two areas of real estate that people really dislike (to put it mildly). These areas are deep-blue cities like San Francisco and New York and office real estate.

Boston Properties (NYSE:BXP) combines both of these things!

In this article, I’ll dive into this company, assessing the risk/reward in light of macroeconomic challenges.

The Bigger Picture

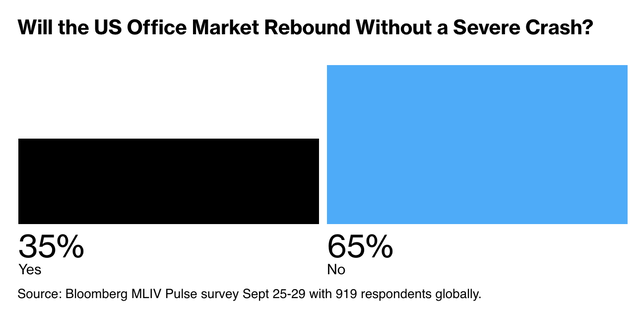

According to the recent Bloomberg Markets Live Pulse survey, there’s a looming crash expected in office prices in the U.S., and the commercial real estate market is anticipated to face continued declines for at least nine more months.

A majority of the respondents, approximately two-thirds out of 919 surveyed individuals, believe that the U.S. office market will only start to recover after a significant collapse.

Bloomberg

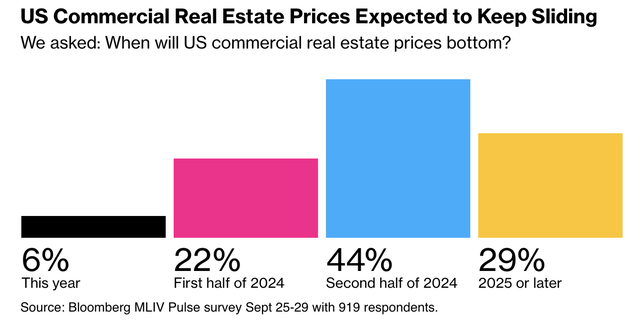

Moreover, a significant majority predict that U.S. commercial real estate prices will not reach their lowest point until the second half of 2024 or beyond.

Bloomberg

This situation poses a significant challenge for the $1.5 trillion worth of commercial real estate debt due by the end of 2025. Refinancing this debt, especially for around 25% of commercial property in the form of office buildings, will be particularly difficult.

According to Bloomberg, the Green Street index, measuring commercial property prices, has already experienced a 16% decline from its peak in March 2022.

Furthermore, Wells Fargo data shows that office vacancy rates keep rising while rent growth is declining. The net absorption rate remains negative. These are very poor developments.

Wells Fargo

As we all know, the Federal Reserve’s aggressive tightening campaign, leading to increased financing costs, is hitting commercial property values hard.

This is amplifying the decline in the market. Unfortunately, finding willing buyers at this stage is proving to be a challenge, as confidence in the market’s proximity to its bottom is lacking.

As a result, many property holders are reluctant to sell their properties at a significant loss, leading to delayed sales. Regional banks, holding a substantial portion of office building debt, are facing stress. Approximately 30% of office building debt is held by these regional banks.

In general, CRE transaction volumes are very low.

Wells Fargo

Next year’s maturities may trigger a major repricing trend in various CRE segments. That’s my fear, at least.

Having said all of this, let’s take a closer look at Boston Properties.

What To Make Of Boston Properties?

The company behind the BXP ticker is America’s largest publicly traded developer, owner, and manager of offices. It owns properties like the Salesforce Tower in San Francisco, which is one of my favorite buildings.

Boston Properties

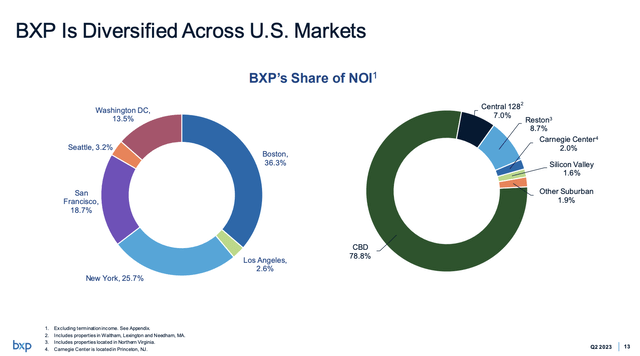

As of 2Q23, the company owns 222 premier buildings. Most of these are located in Boston, San Francisco, and New York.

Close to 80% of these assets are in central business districts.

Boston Properties

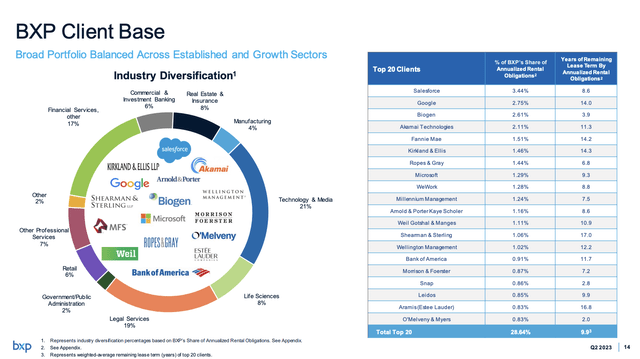

What’s interesting is that the company leases its buildings to some of the biggest companies in America. This includes technology, healthcare, and financial giants like Salesforce (CRM), Alphabet (GOOGL), and Biogen (BIIB). It also has significant exposure to legal services. These people tend to be highly dependent on offices.

Its top 20 tenants account for 29% of its annual rent. The average remaining lease is 9.9 years, which could be a lot worse.

Boston Properties

However, it needs to be said that big tech isn’t what it used to be. During last month’s Barclays Global Financial Services Conference, the company noted that traditional financial institutions and private capital were driving the demand for office space in San Francisco, whereas large tech companies like Salesforce, Amazon (AMZN), Microsoft (MSFT), and Google were no longer the dominant force in the market, leading to sublet space becoming available.

Based on this context, despite its size, the company is holding up quite well.

In the second quarter, BXP reported above-expected operating performance.

FFO (funds from operations) per share exceeded market consensus and the midpoint of the company’s forecast.

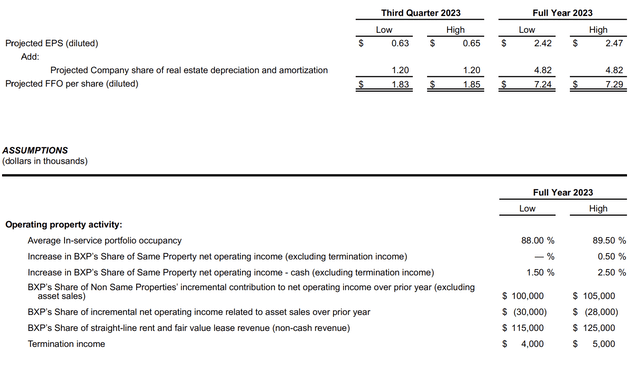

The company raised its full-year 2023 FFO guidance to a range of $7.24 to $7.29 per share. They anticipated that most benefits from lower maintenance expenses would be deferred to later in the year.

Moreover, the company revised assumptions for same-property NOI growth and cash NOI growth, foreseeing improvements in net interest expenses, primarily through interest rate swaps and advantageous bond issuances.

Occupancy is expected to stay above 88.0%, with at least 1.5% year-on-year growth in NOI.

Boston Properties

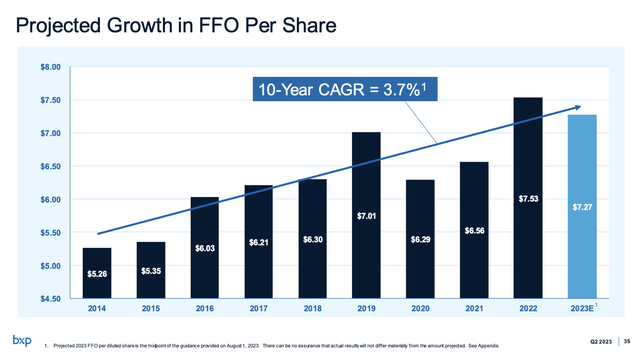

Looking at FFO per share guidance, 2023 is expected to be slightly worse than 2022 but stronger than all pre-pandemic years (except for 2019).

Boston Properties

Also, despite challenging leasing market conditions, BXP completed 938,000 square feet of leasing with an 8-year average lease term.

It’s also interesting that during its earnings call, the company noted that there are two competing theories about the U.S. economic outlook.

- One suggests controlled inflation and a healthy economy with strong labor markets and GDP growth.

- The other predicts an overly aggressive Federal Reserve, potentially leading to a recession later in the year.

In anticipation of potential risks, BXP maintains a strong liquidity position of $3.1 billion, pursues capital-raising opportunities, and manages capital expenditures cautiously.

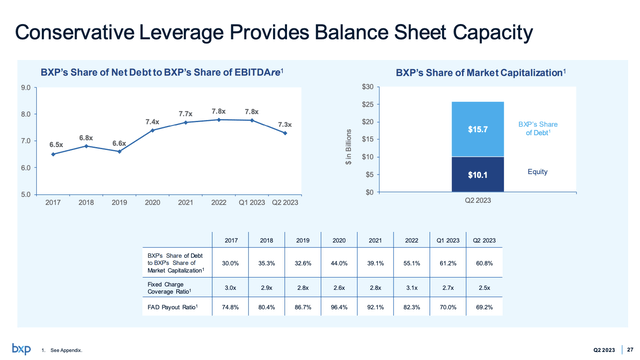

Roughly half of its liquidity consists of cash. Furthermore, the net leverage ratio has declined to 7.3x EBITDAre, which is still elevated compared to other REITs. Nonetheless, the company enjoys a BBB+ credit rating, which is one step below the A-range.

Boston Properties

The problem is that even if the balance sheet is healthy, the company might be forced to refinance debt yielding 3.8% debt at 6.5%, which is an example the company gave during its earnings call. This goes for all REITs, as we’re now in a highly unfavorable financing environment.

Furthermore, despite the prevailing negative sentiment, BXP remains optimistic about the office market, as evidenced by steady leasing activity and encouraging trends (according to the company).

While this may be the case in BXP’s portfolio, the general market is not seeing improvements, as we discussed in the first part of this article.

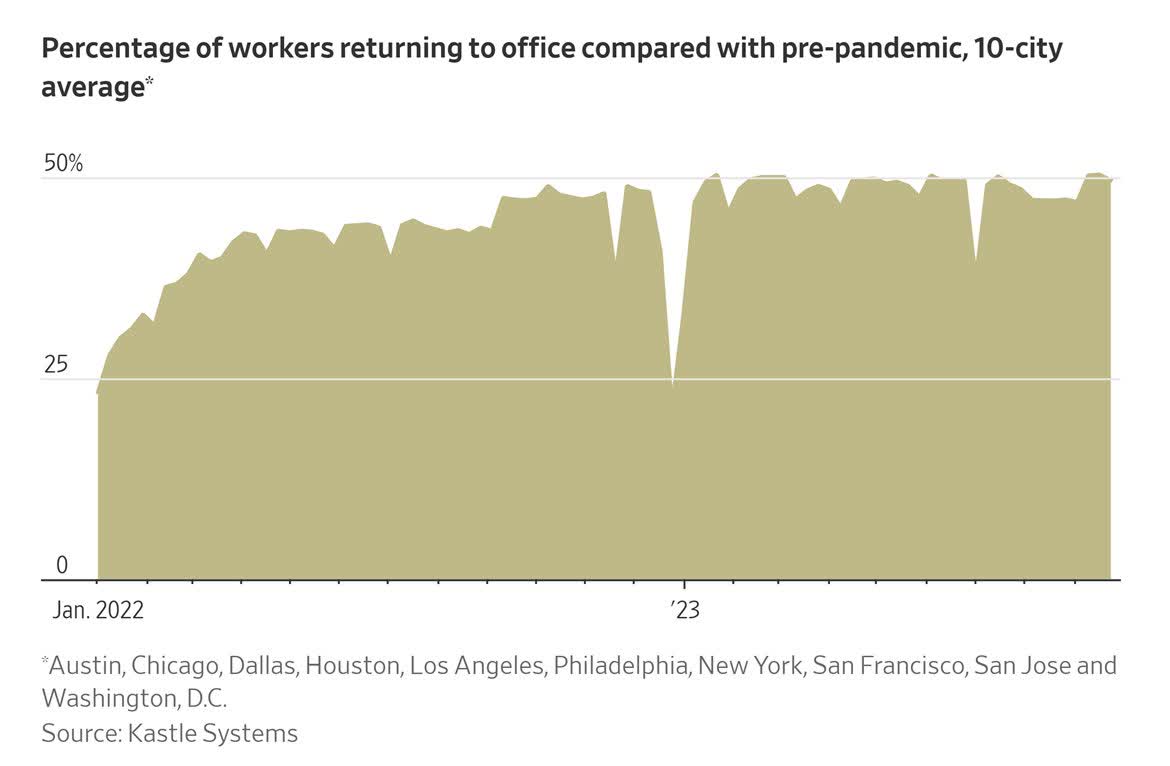

Also, looking at data from major cities, we see that the return to the office has stalled completely.

Wall Street Journal

BXP is seeing that some tenants have given up on trying to return to pre-pandemic conditions, as most offices allow for flexible work between home and the office. I expect that this will keep a lid on absorption.

However, in light of the challenges, it helps that CRM has top-tier assets. The worst performers are companies with old buildings. In this market, employees have high demands for good offices, which causes a shift toward higher-quality offices, benefiting Boston Properties.

While this isn’t a massive game-changer, it’s one of the reasons why BXP is still holding up quite well, given the circumstances.

Dividend & Valuation

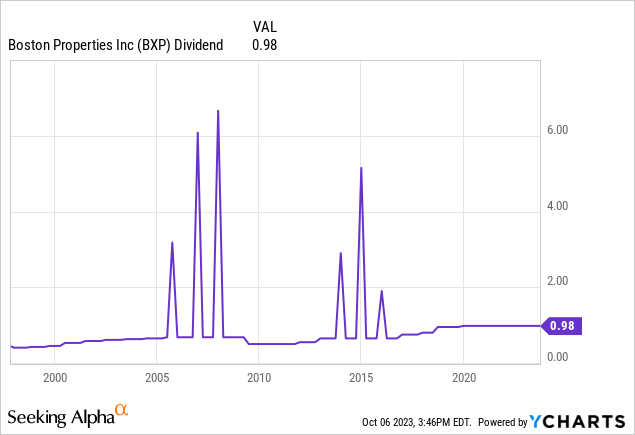

BXP currently pays a $0.98 per share per quarter dividend. This translates to a yield of 7.3%.

As the chart below shows, the dividend hasn’t been raised since the pandemic. The chart also shows the BXP has a history of issuing special dividends, which makes the payout even sweeter.

However, in this environment, special dividends are off the table.

Now, it’s all about dividend safety.

During last month’s Bank of America 2023 Global Real Estate Conference, the company was asked about dividend safety. I added emphasis where needed.

Unknown Analyst

And maybe 1 final question before Rapidfire. Mike, could we get your thoughts on dividend, how you’re thinking about that? You’ve seen a lot of your peers cut. So what could make you change your assessment there.

Michael LaBelle

Well, I think that we have — we cover our dividend quite well, very consistently. So we’re very comfortable with the cash flows of the organization. I think the outlook for the dividend would change if the restrictions — the ability of ourselves to raise capital through the debt or equity markets, either private equity or debt markets change significantly so that we’re very uncomfortable that we could raise capital in the future. We don’t feel that way right now.

We actually are feeling better about that right now because we’ve been quite successful. Our dividend, we do have — I mentioned on a call a couple of quarters ago, there is room in our dividend because the taxable income from our operations are lower than our dividend. But we’ve been able to fill that with asset sales very consistently every year such that we’re paying out the full amount or even more.

So I feel very confident. We’ve maintained our dividend. I think it differentiates us significantly from many of our peers. It’s one of the many things that differentiate our company from our peers, not only our dividend, but the quality of our assets and the stability of our income stream and the diversity of our income stream. So I think that right now, our view is we will maintain our dividend as we have.

The company’s statements are backed by its balance sheet, high expected occupancy rate, and strong guidance.

Using the company’s FFO guidance ($ 7.27 midpoint), the company has a dividend payout ratio of 54%, which gives it one of the healthiest payout ratios in the entire REIT space. So, that’s definitely a reason to like BXP – especially in light of its elevated yield of 7.3%!

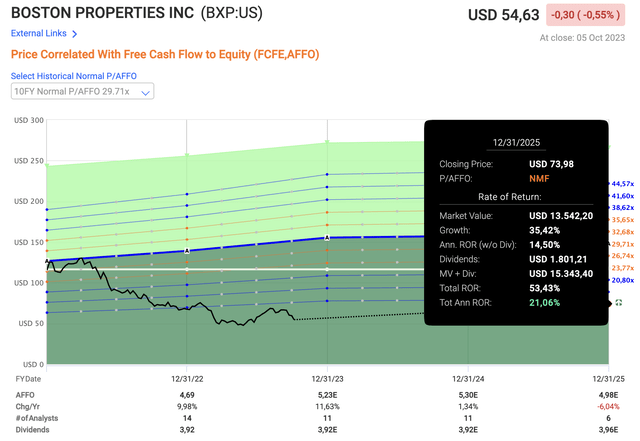

Valuation-wise, we’re dealing with an interesting development. Over the past ten years, the company has traded close to 30x adjusted FFO. Now, the company trades at 10.7x AFFO. Even a return to 14.9x AFFO would indicate an annual compounding return of 21% through 2025. Also note that analysts expect the company to grow AFFO by 11.6% this year, followed by a 1.3% increase in 2024.

FAST Graphs

Please note that I am NOT making the case that BXP will return 21% per year.

What we’re seeing here is that the market is not believing that things will go as planned. A valuation this cheap shows that the market expects the Fed to do much more damage than we’re expecting right now.

My point of view is that this might be correct.

So, while I highly respect the company’s ability to navigate this environment, its healthy dividend payout ratio, and its solid balance sheet, I cannot make the case that BXP is a buy.

I believe that we’re still faced with too much economic risk, which could lead to much lower office real estate prices. When adding the risks of prolonged elevated rates, rising interest expenses are likely to keep a lid on earnings.

Hence, my rating remains a Hold.

Takeaway

Despite the prevailing headwinds in the commercial real estate market, BXP remains resilient. With top-tier assets and a diverse tenant portfolio, it’s holding up well.

The company’s solid balance sheet and strong dividend payout ratio make it appealing with a 7.3% yield, but market skepticism keeps its valuation low.

While BXP’s stability and fundamentals are commendable, the broader economic risks and the potential for lower office real estate prices lead me to maintain a Hold rating.

The market’s cautious outlook suggests that we may still face significant challenges ahead, and I agree with that.

Read the full article here

Leave a Reply