This article was coproduced with Leo Nelissen.

Over the past few weeks, we’ve spent time discussing the increasingly tricky situation in the real estate market. The Fed is forced to keep rates elevated, inflation is sticky, and economic fundamentals continue to deteriorate.

We’re currently seeing what this does to the real estate market, as even the best players on the market are suffering.

Having said that, I think we can all agree that this investment environment isn’t fun. As a long-only investor, I can say that my net worth has seen better days.

However, environments like the one we’re in are the reason why we are able to build long-term wealth: by buying great companies at great prices. During most bull markets, that’s simply not possible.

So, while we’re discussing quite a bit of bad news, none of it is to create panic. No, we’re looking for buying opportunities to create portfolios that will allow us to retire early.

In this article, we’ll dive into the multi-family residential real estate industry, an industry that is seeing increasing headwinds – all related to the fact that it was such a great place to be since the pandemic.

We’re seeing cracks caused by oversupply and elevated rates.

The good news is that we also see buying opportunities in two residential REITs with juicy yields, rock-solid balance sheets, and consistent dividend growth.

So, let’s get to it!

Is Multifamily Real Estate In Trouble?

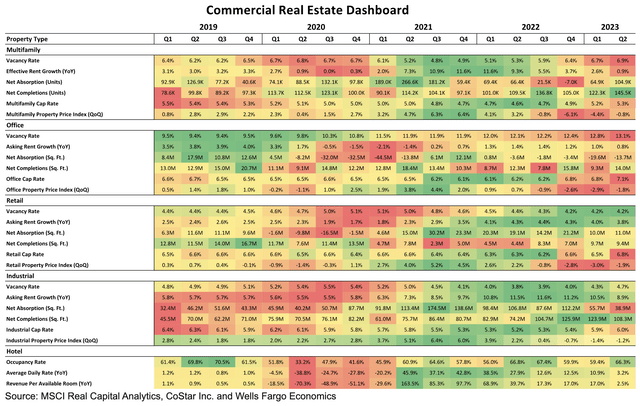

Multifamily has been one of the best places to be for a very long time. Especially after the pandemic, this segment saw a significant boost in rent. Looking at the table below, effective rent growth remained in double-digit territory for three consecutive quarters. It also enjoyed a very low vacancy rate of roughly 5% throughout most of 2021 and 2022.

Now, this is changing. As of 2Q23, the vacancy rate has hit a multi-year high at 6.9%, which is up from 5.1% in 1Q22 (a multi-year low).

Moreover, effective rent growth is now below 1%.

Wells Fargo

According to Wells Fargo, in 2Q23, the multifamily housing sector saw a notable increase in demand, with a net absorption of 105,000 units, the highest since 3Q21. Despite this improvement, demand remained below pre-pandemic levels observed in 2Q19, which stood at 127,000 units.

Essentially, multifamily supply continued to surpass demand for the seventh consecutive quarter, resulting in the addition of 145,000 new units, marking the highest quarterly increase since 2000, which is why the aforementioned vacancy rate has increased.

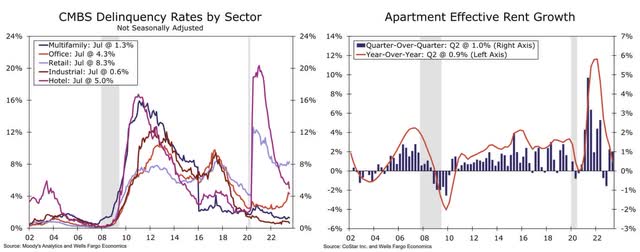

The good news is that delinquency rates are showing no increase yet. In the overview below, we also see that quarter-on-quarter rents remain strong.

Wells Fargo

With this in mind, Newmark’s 2023 U.S. Multifamily Capital Markets Report confirms our expectations that pressure from the Fed is starting to pressure what still looks like a good environment to make money.

According to the report, a surge of capital inflows during the pandemic led to increased transaction activity and altered pricing for debt and equity. However, as these loans mature in a more stringent financial environment, borrowers face tough choices such as paying down the debt, refinancing, or seeking loan modifications.

Rising multifamily financing rates are expected to decrease returns, presenting a complex situation for borrowers.

Newmark’s data reveals a significant amount of multifamily loans originated during the pandemic liquidity bubble are set to mature in 2023, 2024, and 2025.

In total, the report found that $436 billion of multifamily debt is potentially troubled, while total CRE debt in the same condition totals $1.2 trillion!

To make things worse, banks are particularly exposed to the multifamily market, with a significant percentage of loans set to mature by 2025. The report indicates that 52% of such loans are held by banks, emphasizing their vulnerability to the dynamics of the multifamily sector.

So far, the gloom and doom part.

The good news is that this comes with opportunities.

Another Newmark report showed that despite the challenging market conditions, opportunities are emerging for savvy investors.

For example, closed-end funds have seen an 11% increase in dry powder since the beginning of the year. This surge is attributed to the growth in value-added funds and a sharp rise in dry powder for opportunistic vehicles. This marks the end of a multiyear decline.

The total dry powder amassed for equity investments, excluding debt strategies, amounts to a substantial $219 billion. Considering a 55% loan-to-value ratio, this equates to an impressive leveraged purchasing power of $488 billion.

This brings us to the picks of this article. Two top-tier residential real estate plays.

Mid-America Apartment Communities (MAA) – 4.1% Yield

With a market cap of $16 billion, the company behind the MAA ticker is one of America’s largest multifamily operators.

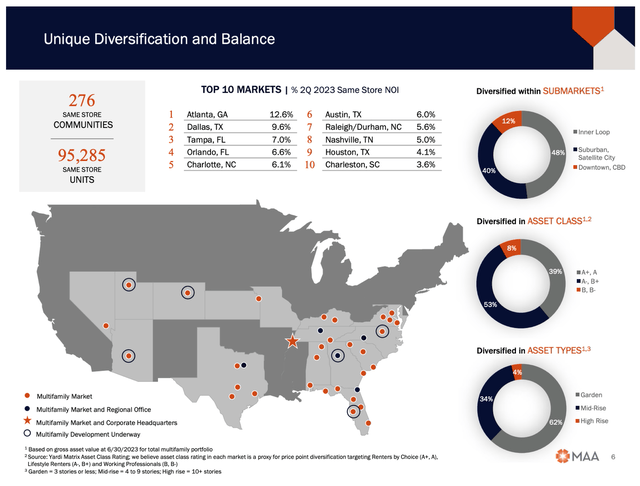

The company owns more than 276 communities, covering 95 thousand apartments. All of these apartments are in the Sunbelt. None of the apartments are located in California, a market a lot of readers want to avoid.

Its largest markets are Atlanta, Dallas, and Tampa, with more than 60% of its apartments having a garden. Only 4% of its apartments are high-rise apartments.

MAA – IR

As a result of its locations, the company has seen strong migration trends, with 13% of total move-ins from non-MAA states. Half of these people came from states like California, New York, Illinois, New Jersey, Massachusetts, and Washington.

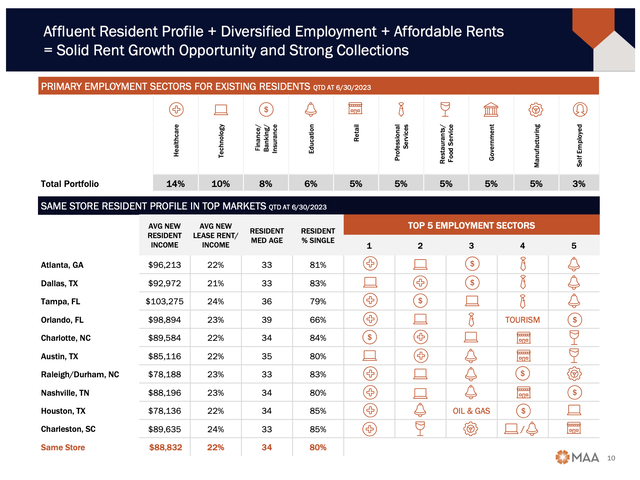

The company also benefits from a diverse tenant base. On average, its tenants bring home $88,800 per year. The average age of its tenants is 34. The average rent/income ratio is 22%. 80% of its tenants are single.

The average rent/income ratio in the United States is 30%, which gives MAA a significant margin of safety.

MAA – IR

The company has a physical occupancy rate of 95.6%. In 2Q23, the company benefited from 9.3% average effective rent growth per unit, 8.1% higher same-store revenue growth, 7.2% higher expenses, and 8.6% growth in net operating income.

In other words, the company did very well in an environment of weakening fundamentals and sticky inflation.

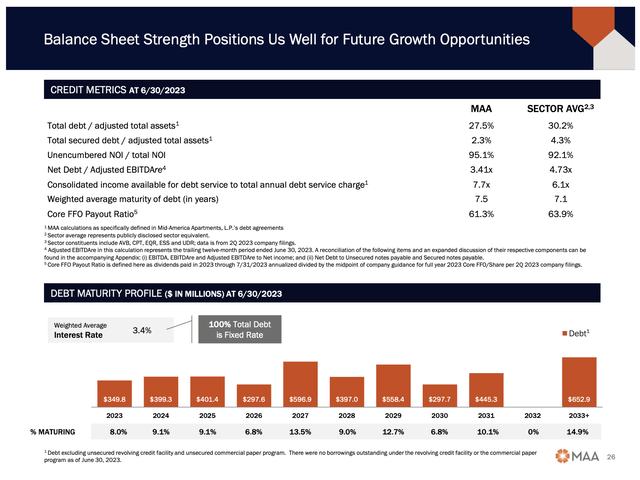

The company also has one of the healthiest balance sheets in the industry. It has an A- rating from both S&P and Fitch, a net leverage ratio of just 3.4x (EBITDAre), and 7.5 years weighted average maturity of its debt.

100% of its debt has a fixed rate with a weighted average rate of just 3.4%.

MAA – IR

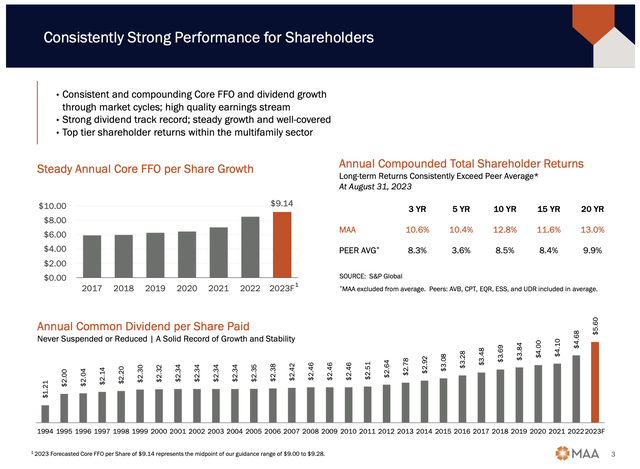

With regard to its dividend, the company currently pays $1.40 per share per quarter. This translates to a yield of 4.2%. Over the past five years, the dividend has been hiked by 8.4% per year.

On December 13, 2022, the company hiked by 12%.

The company has not cut its dividend during the Great Financial Crisis and delivered 13.0% annual compounding returns over the past 20 years, outperforming its peers by a wide margin.

MAA – IR

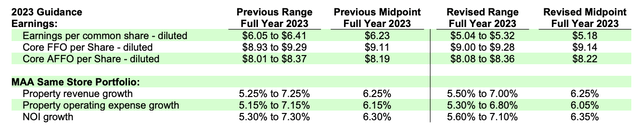

This dividend is also backed by strong guidance.

In the second quarter earnings call, the company discussed revisions to its guidance for the remainder of the year based on the aforementioned earnings performance.

They highlighted a 25 basis points increase in the midpoint of effective rent growth guidance, now at 7.4%.

However, this was balanced by a 30 basis points decrease in the physical occupancy guidance, averaging 95.5% for the year.

Despite these adjustments, the total revenue growth guidance for the year remained steady at the midpoint of 6.25%. The core FFO projection for the full year was increased to a midpoint of $9.14 per share, reflecting a $0.03 per share increase.

MAA – IR

Based on the core AFFO midpoint of $8.22, the company has a 68% payout ratio.

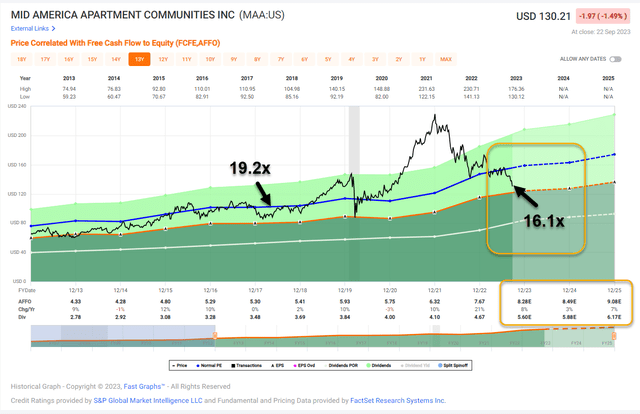

Also, using that same number, the company is trading at 16.0x 2023E core AFFO.

The consensus price target is $165, which is 25% above the current price.

We have a Buy rating on the stock.

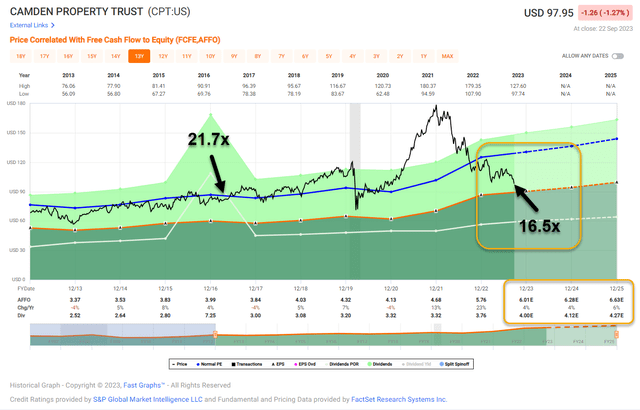

FAST Graphs

I do believe that MAA is undervalued. It has strong and significant NOI and AFFO growth, outperforming rent growth, and a strong tenant portfolio capable of withstanding severe recessions. The same goes for its portfolio.

The problem is that Mr. Market is dealing with severe economic headwinds, like the ones we discussed in the first part of this article.

So, investors need to be careful.

Gradual buying on weakness is the way to go. This is how I currently deal with all of my new investments. I also hold a bit more cash than usual, as bigger sell-offs are not unlikely – unless the economic environment improves significantly.

Hence, stock number two is a fortress REIT as well.

Camden Property Trust (CPT) – 4.0% Yield

Camden Property Trust went public in 1993. It’s an S&P 500 member and, like MAA, one of America’s largest multifamily landlords.

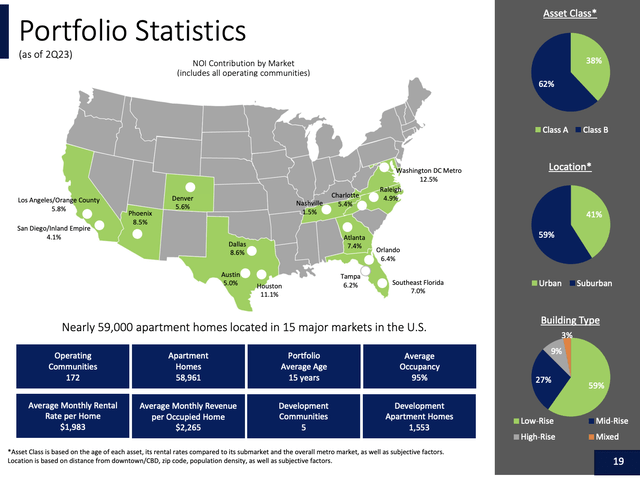

The company operates 172 communities, covering close to 59 thousand apartments. It has an average occupancy rate of 95%. The average age of its apartments is just 15 years.

60% of its assets are low-rise apartments. Roughly 60% of them are in suburban areas.

The company has mainly Sunbelt exposure, with roughly 10% California exposure.

CPT – IR

Its tenant characteristics are similar to those of MAA. The median tenant age is 31. The average annual household income of new move-ins was $120 thousand, bringing the average rent/income ratio to 20%. That’s 10 points below the nationwide average.

On average, it has 1.7 tenants per apartment.

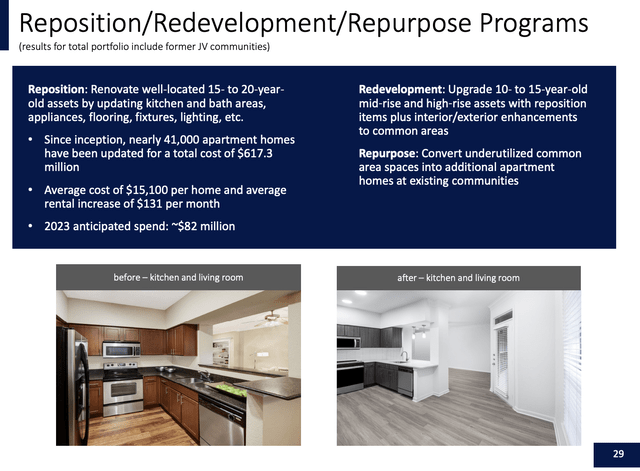

One of the strengths of CPT is turning its assets into high-performing assets. Since 2011, the company has spent $2.7 billion on new acquisitions. The average age of these buildings was four years. It got $3.5 billion from dispositions. The average age of disposed buildings was 23 years.

On top of that, $4.2 billion was spent on asset developments.

This way, the company can efficiently squeeze more money from each building and offer better value than landlords with lower-quality assets.

CPT – IR

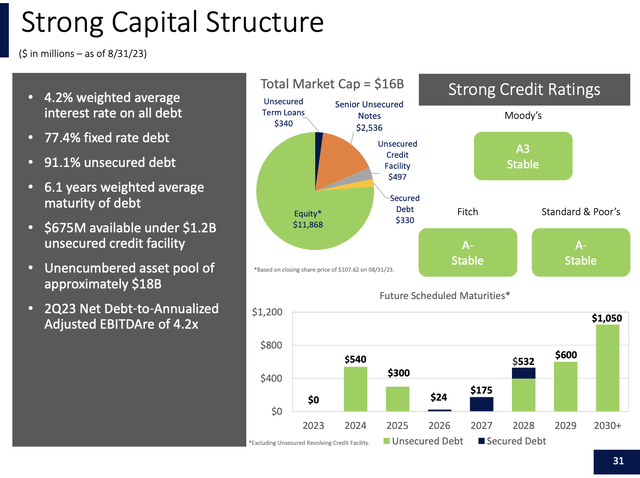

Like MAA, the company is maintaining an ultra-healthy balance sheet. The company has a 4.2% weighted average interest rate on its debt. 77% of its debt is fixed. 91.1% of its debt is unsecured. The weighted average maturity of its debt is 6.1 years.

Its net debt leverage ratio is 4.2x (EBITDAre). It has no debt maturities in 2023. The company enjoys an A- credit rating from all major rating agencies.

CPT – IR

With regard to its dividend, the company pays $1.00 per share per quarter. This translates to a yield of 4.0%.

On average, over the past ten years, this dividend has been hiked by 5.0% per year. Over the past five years, that number is 5.0% as well.

On February 2, 2023, the company hiked by 6.4%.

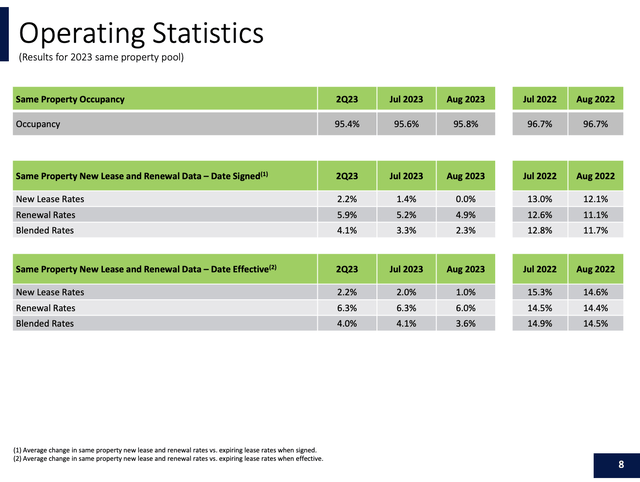

Dividend hikes are supported by strong fundamentals. In the second quarter, signed leases grew by a blended rate of 4.1%, with new leases up 2.2% and renewals up 5.9%.

However, the company saw moderating growth rates beyond the second quarter. In July, the blended rate was in the mid-3% range.

That number dropped to 2.3% in August. In other words, we’re seeing the impact of higher supply unfold. It won’t kill CPT, but it’s a trend that might keep a lid on these stocks for the time being.

CPT – IR

Having said that, on a full-year basis, the company did hike its guidance. It now sees a full-year core FFO of $6.88 per share (midpoint). That’s 0.02 higher than initially expected.

This translates to a dividend coverage ratio of 58%, which is very healthy, and a valuation of 14.4x full-year FFO.

We have a Buy rating on the stock.

FAST Graphs

The current consensus price target is $125, which is 26% above the current price.

Like MAA, CPT is among the best REITs money can buy. It is executing well in a challenging market. However, its stock price is suffering. Over the past 12 months, CPT is down 19% (excluding dividends).

As bullish as I am on a long-term basis, it needs to be said that deteriorating fundamentals will likely keep a lid on CPT and MAA’s share prices for a while.

This may be annoying for investors looking to make a quick buck. However, as a long-term investor, I believe buying top-tier assets at great prices is the way to go. At some point, we’ll see a massive surge of institutional money pouring into residential real estate. At that point, both MAA and CPT are poised to take off.

Until that happens, the way to go is to gradually add on weakness and build a top-tier portfolio of stocks capable of delivering both income and growth.

Takeaway

In the face of a challenging real estate landscape riddled with uncertainty, it’s crucial to remain calm and focused on the long game. The multifamily housing sector, once a beacon of stability, is showing signs of stress with rising vacancy rates and slowing rent growth.

However, this storm also brings opportunities for savvy investors, particularly in robust REITs like Mid-America Apartment Communities and Camden Property Trust.

MAA, with its strong balance sheet and consistent dividend growth, presents a compelling investment option. Meanwhile, CPT, boasting a history of smart asset management, is another solid choice.

Both REITs offer attractive yields and have the potential to shine when the economic tides turn.

While current market conditions may test your patience, adopting a gradual buying strategy and building a top-tier portfolio could prove to be a winning formula.

So, keep your eyes on the horizon, and remember that in tumultuous times, opportunities for long-term wealth creation often emerge from the storm.

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here

Leave a Reply