Co-authored by Treading Softly

Have you ever competed with somebody whose sole goal was not just simply to win but to utterly crush you at whatever game you’re playing with them? At times, those who have such motivations can be enjoyable competitors but also can be absolutely miserable to compete against.

When it comes to the markets, investors’ goals are to succeed in making a return. But many investors feel that they must crush you in their path to climb to the top, almost as if making returns in the market is literally climbing over a pile of other humans pushing them down to propel yourself upwards. They see it as a competition where they have to “beat” everyone else. I wholeheartedly disagree with that viewpoint. I believe that we can all succeed at achieving our goals in the market without having to denigrate, belittle, or insult others. It’s one reason that I absolutely love the Seeking Alpha community, its editors, and moderators because they strive to create a positive environment for all investors from every walk of life and all levels of experience to learn and grow together.

As a professional income investor, I want to help those who seek to earn outstanding income for the market discover those opportunities so that their retirement can be as safe, enjoyable, and filled with as much splendor as they want it to be. We aren’t here to compete with each other, we’re here to invest in the economy and enjoy the economic benefits of owning companies.

I can’t make your retirement amazing, but I can help point you to opportunities that, if you take advantage of them, you can have that amazing retirement.

Today, I have two outstanding opportunities to do just that.

Let’s dive in!

Pick #1: EICB – Yield 7.8%

Eagle Point Income Company (EIC) is a smaller, closed-end fund that specializes in buying very specific types of bonds. This fund purchases bonds that are issued by collateralized loan obligations or CLOs. What they’re purchasing is the junior debt tranches of the CLOs, which typically have a floating rate and offer highly attractive yields. Unlike its big sister, Eagle Point Credit Company (ECC), which purchases the equity tranche of the CLO, which is the highest-risk position, EIC focuses on purchasing the lower-risk but still highly attractive debt tranches. Because they do this, they are actually more of a niche, specialized bond fund than what could be considered a strict CLO fund. As such, they actually benefit from less volatility in their book value.

EIC has been able to generate strong, recurrent income for its shareholders ever since it was formed, and has a history of raising its dividends because of its out-earning ability.

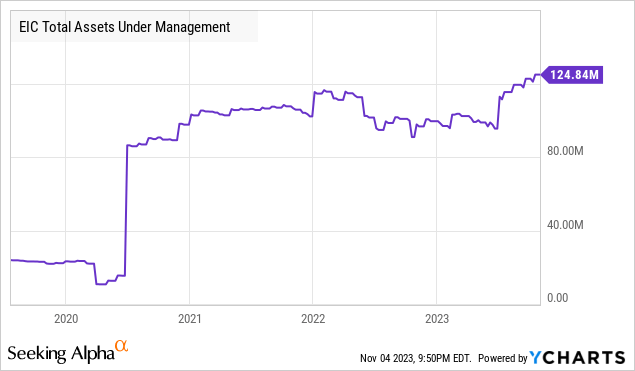

EIC is a rapidly growing fund, and it routinely issues new common shares to help generate additional growth for the fund. But with any closed-end fund, another way that management teams can help grow the fund and expand the reach of their assets is by issuing preferred securities. EIC has two outstanding sets of preferred securities and just like its peer ECC their preferred securities are term-preferred, essentially being like a baby bond, having a set call date, but also a set maturity date. However, unlike most other preferred securities or baby bonds, these preferred securities pay their dividends monthly to their shareholders, just like common shareholders receive monthly dividends.

- Eagle Point Income Company Inc 5.0% Series A Term-Preferred Stock due 10/31/2026 (EICA) – yield 5.5%

- Eagle Point Income Company Inc 7.75% Series B Term-Preferred Stock due 7/31/2028 (EICB) – yield 7.8%

EIC has consistently outearned its common dividend after factoring all of its expenses and preferred dividends, making both of these attractive for their high yields, as well as the fact that there’s a set maturity in the future. You can lock in a +7% yield today on EICB and not have to worry about replacing that 7% yield until 2028. EICA offers a nearer maturity and lower yield, but a capital gains reward at maturity due to trading at a larger discount.

When it comes to buying attractive income, there are countless options within the preferred security space that we find investors can own. However, every opportunity must be reviewed with careful diligence, as trading volumes can be limited. A limit order is always a must, as well as a lot of patience. Don’t buy a preferred security that you don’t plan to hold until maturity. With EICB and EICA, you will have low trading volumes that you will want to buy and know that you want to hold for the long term.

I’m happy to buy here.

Pick #2 ARCC – Yield 9.7%

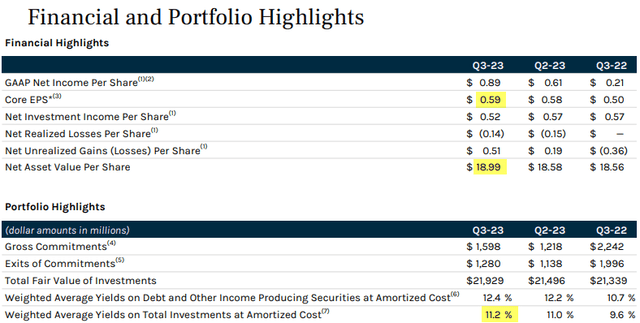

Ares Capital (ARCC) reported earnings that can be described as solid. Core EPS of $0.59 easily covers the $0.48 regular dividend. ARCC has consistently outearned its dividend throughout the year, which increases the probability of seeing the supplemental dividend return in 2024.

In addition to high earnings, ARCC saw its NAV rise to $18.99. Source

ARCC Q3 2023 Presentation

If there is any weakness in the earnings report, it is the average yield on the portfolio. Note that at 11.2%, it is higher than last quarter, but the pace of growth has declined significantly. This is a result of short-term interest rates being relatively flat. BDCs lend at floating rates, typically using 1-month or 3-month reference rates. So as those short-term rates stop rising, we can expect that earnings growth will slow.

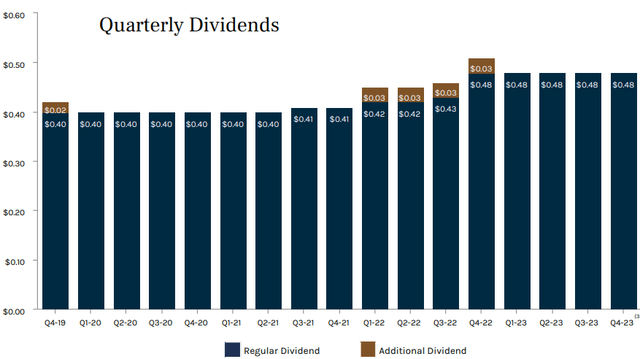

Over the past several years, we’ve enjoyed several raises to ARCC’s quarterly dividend. During the rate hiking cycle, ARCC’s regular dividend increased 20%, from $0.40 to $0.48.

ARCC Q3 2023 Presentation

With short-term rates likely peaking, we do not expect additional increases in the regular dividend anytime soon. However, as noted above, a temporary supplemental dividend is likely. On the other hand, the portfolio building that ARCC has been able to achieve over the past few years means that the regular dividend is likely sustainable even if we see a return of 0% interest rate policy.

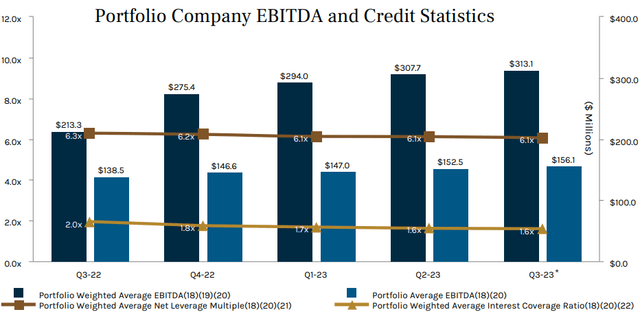

The Fed’s pause has been beneficial for ARCC’s customers. Portfolio companies with ARCC have seen EBITDA interest coverage stabilize at 1.6x. Higher interest rates naturally reduce coverage. Collecting high interest is great, but only if the borrower can actually afford it!

ARCC Q3 2023 Presentation

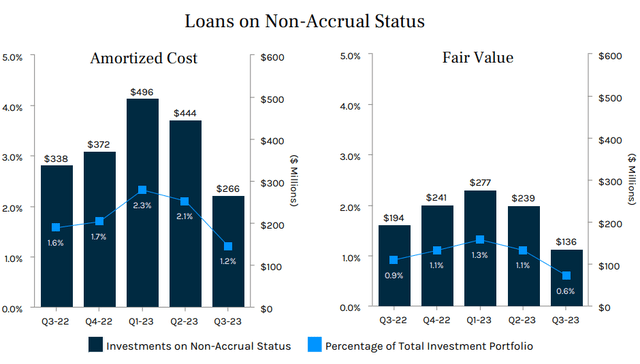

One area where ARCC has historically stood out is in credit quality. ARCC has demonstrated an ability to experience small credit losses relative to peers and banks. Whenever you are in the business of lending money, some folks won’t pay you back. ARCC has a proven history of minimizing these credit losses. Earlier this year, we saw a spike in non-accruals. In Q3, this came down significantly as ARCC exited over $160 million in non-accrual and non-paying investments.

ARCC Q3 2023 Presentation

It is a great sign when a BDC can exit investments that didn’t go according to plan, and still see an increase in quarterly NAV.

ARCC is a blue-chip BDC, that we are very happy to continue holding. It has been part of the HDO Model Portfolio for over 6 years now, and it continues to prove the consistency and durability we want to see in a long-term holding.

Conclusion

With ARCC and EICB, we can lock in great income for decades to come. I personally held ARCC for over six years. I can expect to continue to do so for many years to come. With EICB, you can buy a great yield here today and lock in an income stream until 2028. That’s five years of peace of mind with over 7% yield.

In retirement, the last thing you want to do is worry about where your income is coming from. You can’t have a sense of safety if you do not have plans in place to ensure that that safety is persistent and consistent. When it comes to your finances, the safest place to be is in a place where your income exceeds your expenses, and you have a large reserve of extra cash when needed to tap into. Yet a retirement that is strictly focused on having a safe cash flow and nothing to enjoy wouldn’t be one that’s filled with splendor. I want you to have a retirement that is marked by abundance – abundance of safety and abundance of enjoyment within your hobbies and time with loved ones. Whether that means taking a cruise and seeing all the different sites or simply sitting in your backyard enjoying the crackling of a fire in your fire pit. Whatever splendor is to you, I want you to have that. I don’t think anyone else in the market needs to be hurt for you to achieve it.

That’s the beauty of my income method. That’s the beauty of income investing.

Read the full article here

Leave a Reply