Co-authored with Treading Softly

I have found in life that while I am not beholden to having to buy things on the cheap or at a discount, there are plenty of times that getting things at a discounted price makes a lot of financial sense. I am willing to be patient and to strike when the time is right, and although patience is a virtue that must be learned, it can be a virtue that pays you massive dividends in the long run. On the other side of the coin, you can be so patient that you don’t move at all, leading to other failures.

When it comes to the market, I am always drawn to finding holdings that are trading at a discount that can provide you with a double-sided return – one through strong income and another through capital gains – especially when it comes to fixed-income investments or buying closed-end funds that are trading at wide discounts. The reason is that the yield they’re providing me is a lot more attainable if the assets they’re holding are valued much higher.

Today I want to look at a closed-end fund and a fixed-income investment that are both trading at attractive discounts but also offering highly attractive yields.

Let’s dive in!

Pick #1: BCX – Yield 6.7%

BlackRock Resources & Commodities Strategy Trust (BCX) is a Closed-End Fund (‘CEF’) that invests in commodity companies. This includes three main categories: Energy, Mining, and Agriculture.

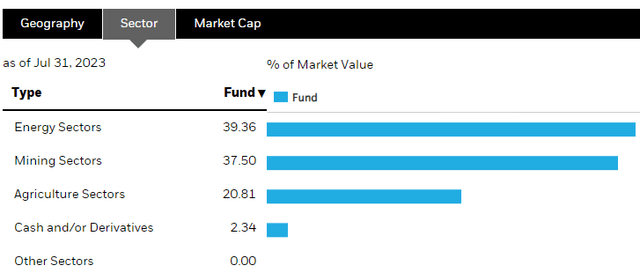

Last year, BCX was split roughly even between the three sectors. However, this year, we’ve seen it overweight towards energy and mining. Source

BlackRock Website

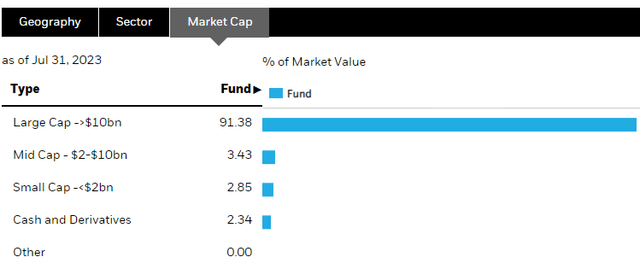

One appeal BCX has for HDO is that it has holdings that are very different from most of our portfolio. In recent weeks, we’ve discussed in our Market Outlooks how the HDO portfolio is heavily weighted towards small-cap companies. We believe that companies with small market capitalizations present the best opportunities today. However, it is important to keep a balanced portfolio diversified.

Over 90% of BCX’s holdings are in companies with a market cap in excess of $10 billion.

BlackRock Website

Among BCX’s holdings, you will find well-known names like Shell plc (SHEL), Exxon Mobil (XOM), and Glencore plc (OTCPK:GLNCY).

This is one of the reasons I love to incorporate CEFs into my investment strategy. I want exposure to energy and mining, but the companies in these sectors typically don’t offer a yield that is consistent with my goals.

A CEF like BCX will pay out a dividend that will reflect the total returns of its portfolio – converting total return into a dividend return. I don’t have to settle for the 3% yields we see from the oil majors; BCX will convert it into a higher-yielding dividend for me.

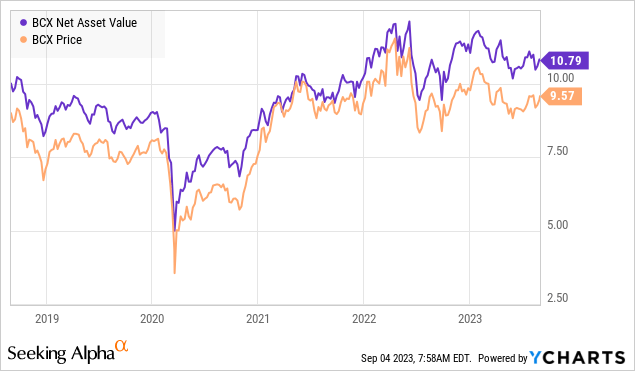

BCX has fully recovered from the COVID crash, yet the price continues to trade at a significant discount to NAV.

The inflation rate has slowed down, but the absolute price of materials remains above pre-COVID levels. This is why we continue to see strong performance in the energy and mining sectors. We expect that commodity prices will remain elevated. This is the “new normal”, and that is a benefit for the companies that struggled with the relatively low prices of oil and other commodities in the late 2010s.

BCX is a great option to get a good yield from energy and mining.

Pick #2: GLP Bond – Yield 7.2%, YTM 8%

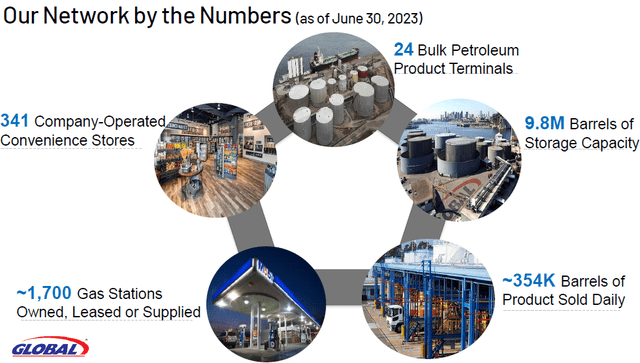

Global Partners LP (GLP) is a midstream company that focuses on fuel distribution, moving fuel from refineries to consumers via gas stations. Source

GLP Q2 Investor Presentation

GLP operates in three major segments, the first being their retail fuel segment, which is the bulk of their operations consisting of gas stations in which they either lease to 3rd parties or distribute fuel to, as well as company-owned and operated gas stations. The second segment is their wholesale segment, which involves the bulk purchasing, storing, and movement of refined petroleum products. The third segment is commercial, which involves the wholesale selling of oil to commercial companies, either storing it for them and moving it onto their vessels or just selling the product outright as a middleman.

75% of GLP’s revenue comes from its core segment focused on retail fuel operations. As such, GLP is subject to shifting gasoline prices. Previously HDO was long GLP’s common units but sold in 2022 when we recognized year-over-year earnings would be down. But 2022 was an unusually strong year for GLP and its peers.

GLP has not stopped earning its common distribution or stopped growing even in this challenging interest rate environment; however, its common yield of just over 8% was less attractive on a risk-adjusted basis than other options in the capital stack.

Currently, we find its bond trading at a discount most attractive, offering a 7.2% current yield and 8.0% yield to maturity. This is their Global Partners LP 2029 Notes 6.875% (CUSIP 37954FAJ3).

GLP has an interest coverage ratio of 4.15x using their earnings before interest, taxes, depreciation and amortization, EBITDA. Their year-over-year interest was up slightly but not concerningly so as their total liabilities trended downward.

While GLP is excellently run, we’d rather avoid the K-1, enjoy a greater degree of safety, and take 7% current yield and 8% YTM over more risk with little additional reward. GLP’s bond is well worth holding for income, and we’re happily buying more.

Conclusion

Today we’ve just looked at two outstanding investment opportunities that are both trading at attractive discounts. This means that they can provide us great income now and have a strong likelihood of capital gains in the future. As a professional income investor, it’s these types of investment opportunities that I am always on the hunt for. I love reaping great income from the market, but I also like it when the market doesn’t realize that holding is undervalued, and when it correctly values, it provides me with excellent returns on top of my excellent income. In those moments, I feel like I’m eating my cake and holding it too.

When it comes to retirement, I want you to have enough income pouring in from your portfolio that you don’t feel the need to buy things on sale, that you don’t feel like you need to go to Goodwill, or that you don’t feel like you need to go to a discount store. I’m not saying that doing any of those things is wrong and that you should feel guilty if you do, but what I am saying is that I don’t want you to feel like you have to do that as if you have no other choice.

The beautiful thing about having financial freedom is that you can choose to do those things if you want to, or you can choose not to. There’s no right or wrong answer. Getting excellent income from the market by being an income investor provides you with that financial freedom.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here

Leave a Reply