Income stocks don’t have to be exciting as far as share price appreciation is concerned, especially if they already throw off yields that are at or above the long-term return of the overall market.

This brings me to New Mountain Finance (NASDAQ:NMFC), which I last covered here back in September of last year with a ‘Buy’ rating, noting its NAV/share stability and healthy portfolio.

The stock hasn’t done much of anything from a share price appreciation standpoint, with the current price being up by just 0.4% since my last piece, but its total return, including dividends, of 11.4% surpassed the 10% rise in the S&P 500 (SPY) over the same timeframe. In this piece, I revisit the company and determine whether if it remains a Buy at present, so let’s get started!

Why NMFC?

New Mountain Finance Corp. is a relatively underfollowed externally-managed BDC that’s managed to produce strong returns for shareholders in recent years. It’s been around for 14 years, and currently has a $3.2 billion investment portfolio spread across noncyclical sectors.

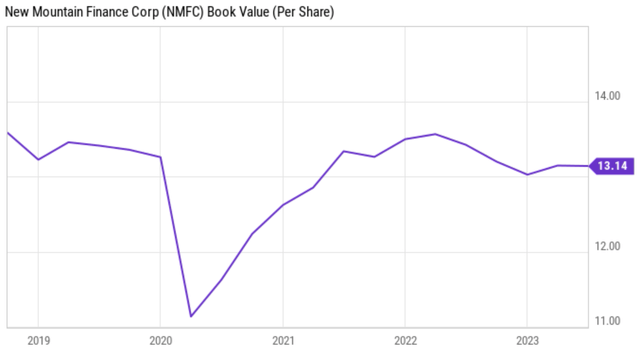

This includes Business Software, IT Services, Human Capital Management, and Logistics, which comprise its top 4 sectors which comprise 25% of portfolio value. As shown below, NMFC has maintained a steady book value per share (also known as NAV/share) over the past 5 years.

YCharts

While NMFC’s NAV/share has slightly fallen from where it was in early 2022, this has to do with a mark to market lower valuation (unrealized loss) to account for higher macroeconomic risk amidst higher interest rates rather than realized losses. NMFC’s management has had a fairly good track record of managing risk, as it’s achieved $10 million in cumulative net realized gains over the past 14 years ($222M in realized gains against $211M in realized losses), while churning out income over this timeframe.

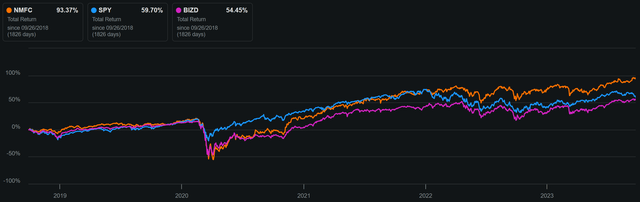

Thanks to conservative management and a high dividend yield, NMFC has outperformed both the S&P 500 and the VanEck BDC Income ETF (BIZD) over the past 5 years on a total return basis, which importantly, includes the 2020 pandemic timeframe. As shown below, NMFC’s 93% total return since 2018 far surpasses that of SPY and BIZD.

NMFC Total Return (Seeking Alpha)

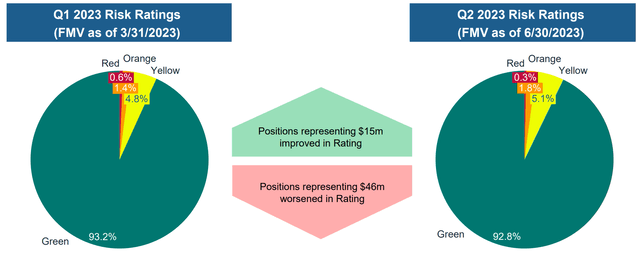

At present, NMFC’s portfolio is overall healthy, with 93% of its portfolio being at the desired green risk rating, with 2.1% of investments being at the lower Orange and Red tiers, as shown below. This represents just a slight change on a sequential basis.

Investor Presentation

Plus, investments on non-accrual represent just 1.5% of portfolio fair value, and this includes an older investment, Unitech, which has since been recapitalized. This has resulted in a warrant on NMFC’s books today, which a $47 million valuation more than offsets the previous write down on preferred tranches that are baked into the non-accrual.

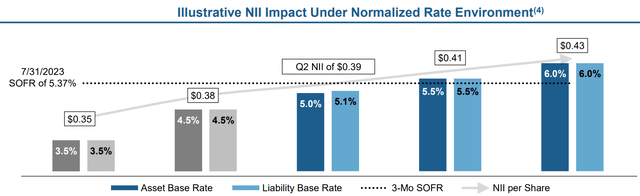

At the same time, NMFC, like its peers, is benefitting from higher interest rates, as 89% of its debt investment portfolio is carried at floating rates. This compares favorably to just 44% of NMFC’s own debt being carried at a floating rate (56% of debt is held at fixed rates), enabling NMFC to take advantage of a healthy investment spread.

Recent comments by the Fed Reserve Chairman this month suggested that rates will remain higher for longer and that there will be one more rate hike before the end of the year. This is a positive for NMFC as one can imagine, and as shown below, it’s expected to see a $0.02 bump in quarterly NII/share with every 50 bps rate increase.

Investor Presentation

Importantly, NMFC carries a reasonably strong balance sheet with a Baa3 investment grade credit rating from Moody’s, and has a 122% statutory debt to equity ratio, sitting below the 200% regulatory limit.

NMFC is also out-earning its dividend with NII/share of $0.39 during the second quarter, which comfortably covers its $0.32 regular quarterly dividend. Management also aims to distribute half of its NII-to-dividend overage, enabling the $0.04 per share supplemental dividend that was paid out in mid-September. I believe investors can see another potential supplemental dividend during Q4 with steady Q3 results in the current high rate environment.

At the current price of $12.71, NMFC currently trades at a 3.3% discount to its NAV/share of $13.14. As shown below, this sits at around where NMFC has traded at over the past 5 years outside of the 2020 timeframe.

NMFC Price-to-Book (Seeking Alpha)

While NMFC isn’t cheap on a historical basis, I continue to view the shares as being a ‘Buy’ considering NMFC’s strong track record of delivering 10% annual returns since IPO through dividends, and its positioning to benefit in a higher for longer interest rate environment. Plus, the discount to NAV also provides a slight edge as investors are getting the full portfolio for less than what it’s worth.

Risks to the thesis include potential for a recession should higher rates drive down consumer spending and confidence. Also, higher rates may impact borrowers’ ability to make interest payments. This, however, can be negotiated with borrowers should they run into trouble, and the 43% average loan-to-value ratio of NMFC’s loans provide a buffer. Lastly, investors should consider that NMFC won’t be able to raise equity capital in an accretive manner to grow the portfolio should its share price continue to trade at a discount to NAV for an extended period of time.

Investor Takeaway

I continue to view NMFC stock as a solid investment opportunity for investors seeking high income. The company’s conservative management and strong track record of delivering returns make it an attractive option for those looking to diversify their portfolios. Additionally, its current discount to NAV and high and well-covered yield provides a slight edge investors looking to limit downside risk. In a higher for longer interest rate environment, NMFC appears to be a good choice for investors seeking to weather the storm.

Read the full article here

Leave a Reply