Introduction

Hercules is the Roman equivalent of the Greek divine hero Heracles, son of Jupiter and the mortal Alcmena. In classical mythology, Hercules is famous for his strength and for his numerous far-ranging adventures. – Wikipedia

While I don’t really like quoting Wikipedia, it does make sense here, as we’re discussing a business development company (“BDC”) with the name Hercules Capital (NYSE:HTGC), a company I have never discussed before.

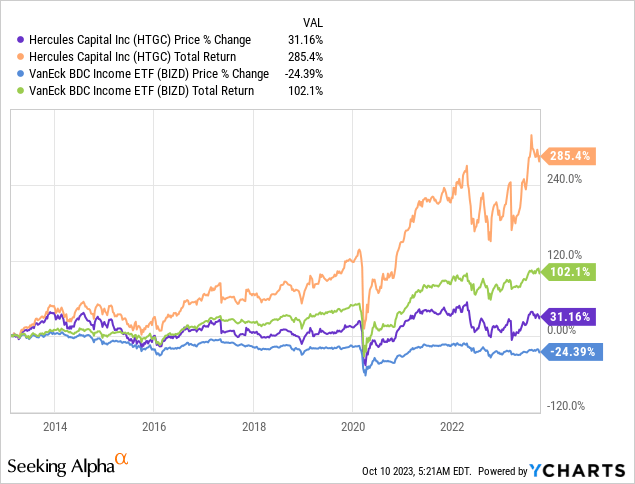

The company doesn’t just have a cool name, but it also has a history of outperformance. This 10% yielding BDC that went public in 2005 has survived every recession it encountered. It has also outperformed its BDC peers by a wide margin.

Since 2013, the inception year of the BDC ETF (BIZD), HTGC has returned close to 290%. Even excluding dividends, the performance was 31%.

In this article, I’ll do two things.

- Explain why HTGC is such a great pick for investors seeking income from the BDC Industry.

- Cover economic developments using the company’s financial numbers. After all, the economy is in an increasingly tricky spot due to rising rates, sticky inflation, and declining economic growth. This also impacts the risk/reward of the HTGC investment.

So, let’s get to it!

A Specialized BDC With A Fat Yield

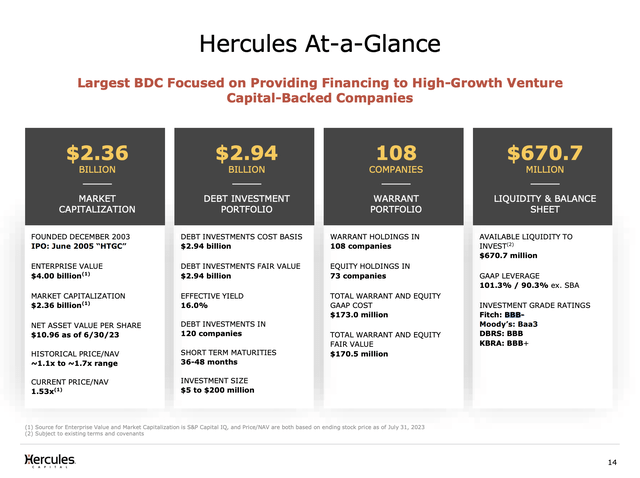

Hercules Capital is a BDC/asset manager with a $2.4 billion market cap.

Its largest shareholder is the Kingdom Holding Company, which owns more than 6% of the company. This company is a Saudi holding company owned by billionaire entrepreneur Al Waleed bin Talal Al Saud.

Essentially, Hercules Capital is a distinguished finance company specializing in providing tailored financing solutions to high-growth companies within the technology, life sciences, and sustainable technology sectors.

Hercules Capital

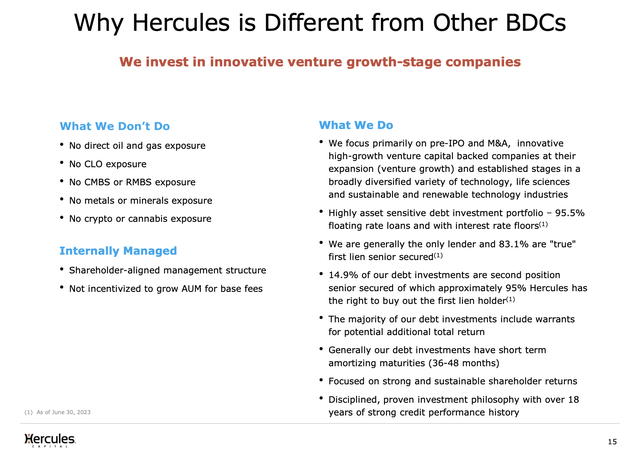

Their core focus lies in assisting venture capital and institutionally backed companies by offering financing that is structured with an equity component, such as warrants or options to purchase or convert into common or preferred stock.

In other words, it’s not just debt but an approach to add even more value to Hercules and its investors if it bets on the right horses. This approach also comes with more safety – on top of the fact that it invests in companies with a competitive edge in fast-growing industries.

It also does not own collateral loan obligations, commercial mortgage-backed securities, or residential mortgage-backed securities.

Hercules Capital

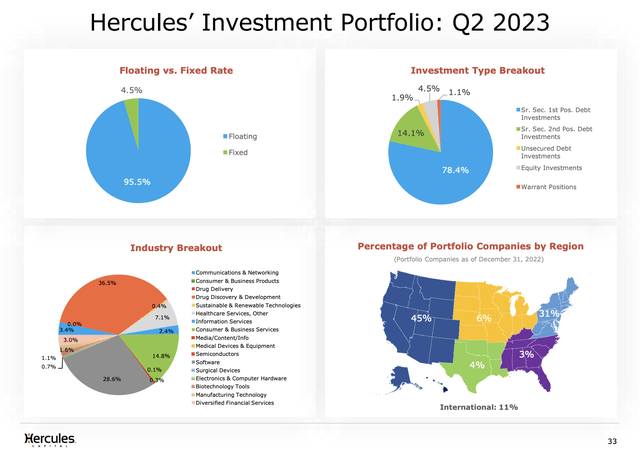

Looking at the overview below, we see the industry breakdown of its holdings and the fact that Hercules Capital’s investment portfolio predominantly consists of debt securities, with a significant emphasis on structured debt.

This includes term debt investments with attached warrants, providing the company with an opportunity for potential capital appreciation. They also invest in equity securities, primarily in the form of warrants or equity interests, which are often obtained in conjunction with structured debt investments.

Hercules Capital

Due to the variable nature of its debt, HTGC loves an economic environment of elevated rates and economic stability. While economic trends are unfavorable, the economy is still strong enough to deal with high rates.

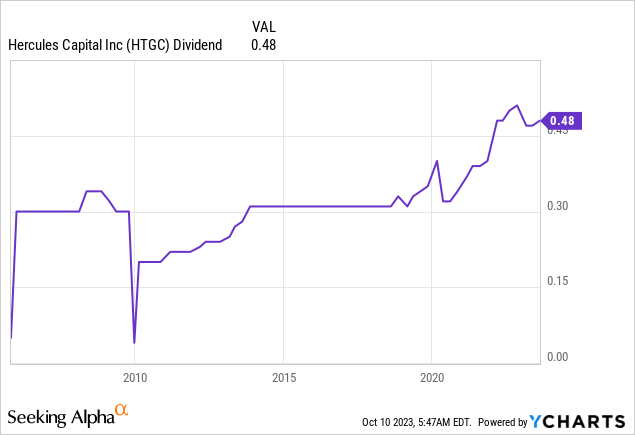

Prior to the surge in rates, the company paid a quarterly dividend of $0.32 per share. This would translate to a yield of 7.9% using the current stock price.

Currently, the company pays a $0.40 base dividend per quarter. This translates to a base yield of 10%. In August, it also announced a $0.08 special dividend, bringing the total annualized yield to 12%.

With that said, let’s take a closer look under the hood. After all, we’re living in one of the most volatile economic environments of the past few years.

A Closer Look At Hercules Capital

Thanks to the mix of elevated rates and economic stability (ignoring the trend), the company is doing very well.

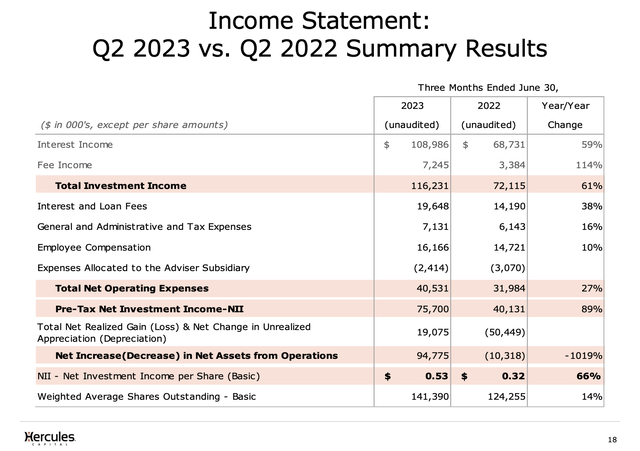

For example, 2Q23 witnessed significant financial growth, with record total investment income of $116.2 million and net investment income of $75.7 million, marking a 61% and 89% year-over-year increase, respectively.

Hercules Capital

Also, the return on equity exceeded 20% for the first time.

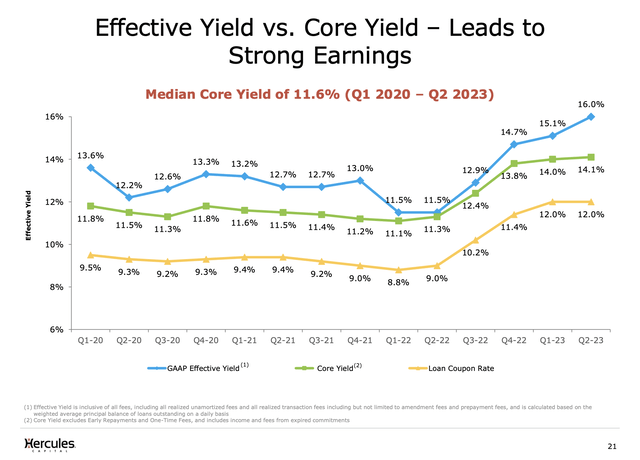

The company’s portfolio saw a GAAP effective yield of 16%, which reflects recent rate increases.

Hercules Capital

During its earnings call, the company mentioned an increasing strategic emphasis on diversification and later-stage opportunities. Loan repayments increased, validating portfolio quality, while credit quality remained stable.

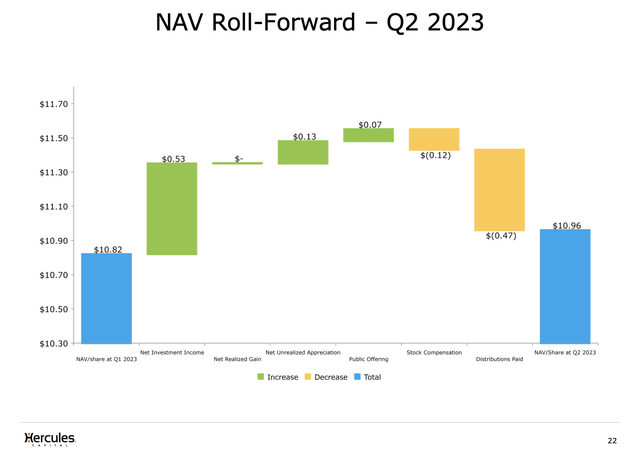

Furthermore, with regard to dividend safety, the company ended Q2 with increased undistributed earnings spillover, supporting base distribution increases to shareholders.

This means that it had cash left after paying dividends, leading to a stronger balance sheet and room for future special dividends. With an effective yield of 16%, that’s no major surprise.

Hercules Capital

As a result, the company increased its net asset value to $10.96 per share.

Thanks to a consistent earnings spillover, the company remains in great financial shape. Liquidity exceeded $670 million, positioning Hercules to capitalize on market opportunities down the road.

Adding to that, both GAAP and regulatory leverage decreased compared to the prior quarter, with GAAP leverage at 101.3% and regulatory leverage at 90.3%.

Net GAAP and regulatory leverage, factoring in cash on the balance sheet, decreased to 97.4% and 86.4%, respectively.

The company maintains a Baa3/BBB- credit rating, which is in the investment-grade category.

It also helps that roughly half of its funding is equity. While the company has diluted its investors to achieve lower leverage, it did not keep the company from outperforming its peers, as it invests debt and equity proceeds in highly profitable companies and derivatives.

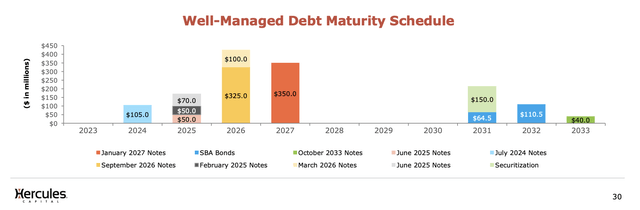

The company has no maturities in 2023 and just $105 million in maturities in 2024.

Hercules Capital

We also need to keep in mind that higher rates have a limited impact on Hercules. While it may make future funding more expensive, it does come with higher income as well. After all, almost all of its investments have floating interest rates.

An unfavorable situation would be elevated rates and economic contraction. That would mean higher portfolio risks on top of more expensive funding.

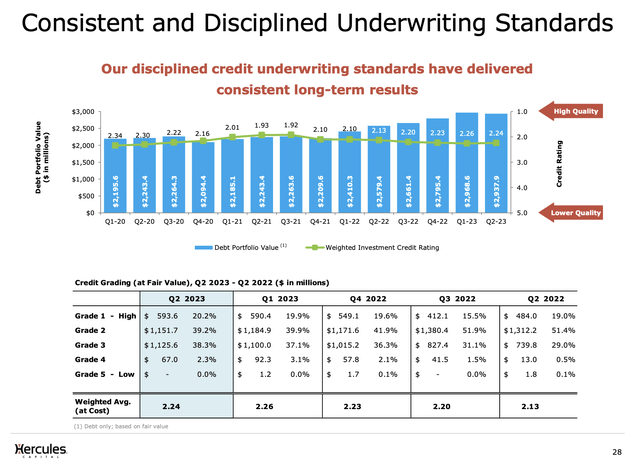

Having said that, the health of its portfolio is as important as its own financial health. During its 2Q23 earnings call, the company emphasized the strong health and stability of its debt investment portfolio.

The weighted average internal credit rating improved slightly, staying within historical norms. Grades 1 and 2 credits remained consistent, demonstrating portfolio strength, while higher-grade credits showed a minor increase.

Notably, there was only one debt investment on non-accrual, accounting for a small percentage (0.4%) of the overall investment portfolio.

Hercules Capital

Looking ahead to the remainder of 2023, Hercules Capital anticipates a core yield range of 13.8% to 14.2%, with the majority of their debt portfolio being floating rate with a floor.

Unsurprisingly, recent interest rate hikes and potential future increases in 2023 are expected to positively impact their core yield.

Its strong balance sheet ensures the ability to support existing portfolio companies and capitalize on strategic investment opportunities.

Valuation

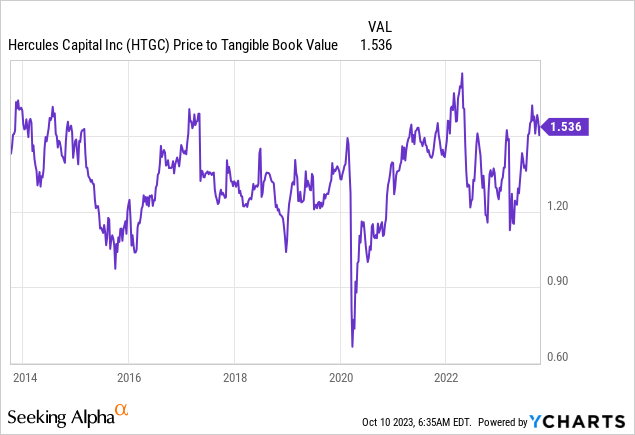

HTGC trades at 1.5x its tangible book value. Unlike some weaker BDCs, this company trades well above its book value, as investors reward the company’s prudent management, healthy portfolio, and ability to benefit from more than just debt investments.

That said, while I would make the case that HTGC is a top 3 BDC company, I do not like its valuation so much. 1.54x tangible book is far from attractive.

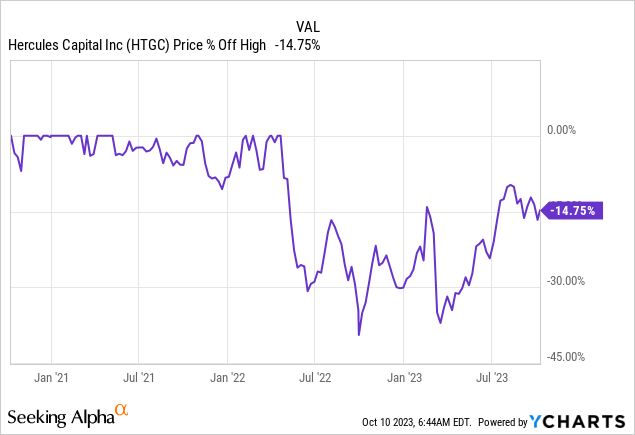

Also, with new market risks, I wouldn’t rule out another correction. Bear in mind that since 2020, the company has been through a number of corrections – despite having strong financials.

This is also where I say that despite everything I’ve said so far, I am giving the stock a Hold rating. That is purely based on its valuation.

If I were a bit older and focused on income, I would be looking to buy HTGC for sure. If the market provides us with another correction, I will likely turn bullish close to $12-$13.

Having said that, market timing is tricky, and I’m not trying to keep anyone from buying HTGC because of my view on the economy.

The main takeaway is that I believe that HTGC is a top-tier BDC company. If I were looking for income, I would be on the hunt for an entry for sure!

Takeaway

Hercules Capital stands out as a top-tier business development company with a remarkable track record and a fat yield.

This specialized finance firm focuses on high-growth companies in technology, life sciences, and sustainable technology sectors, offering tailored financing solutions that include equity components, adding value and safety to its investments.

Despite the volatile economic environment, HTGC continues to excel, boasting record financial growth and a strong portfolio. Its ability to maintain a healthy balance sheet, pay substantial dividends, and adapt to changing market conditions underscores its resilience.

However, the stock’s valuation at 1.5x tangible book value gives me pause, and I’m cautiously giving it a Hold rating.

But for income-seeking investors, HTGC remains an attractive prospect, especially during market corrections.

In essence, HTGC shines as a top-notch BDC worth considering, particularly for those on the lookout for income opportunities.

Read the full article here

Leave a Reply