The oft forecasted Recession hasn’t yet appeared. Has it been avoided (i.e., “soft-landing”)? A look at the growing evidence leads us to conclude that the Recession is coming; we suspect that when the NBER gets around to dating it, this quarter (Q4) will mark its beginning.

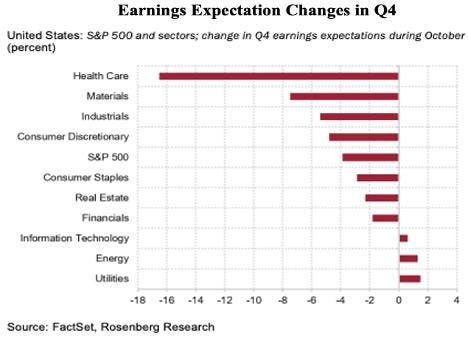

The first evidence of this showed up in the recent employment data. And consumers (2/3rds of GDP) are just starting to adjust after a spending spree with the “free money” doled out by Uncle Sam in 2021 and 2022. Credit card balances are now at record levels (and at interest rates in the mid-20% range). Delinquencies are now rising. Earnings expectations for the Retail industry are being cut as major retailers reduce guidance. And stock analysts have been cutting their earnings forecasts (see chart). Banks have cut back on staff and have restricted lending both to consumers and businesses while upping their loan loss reserves. Housing affordability is at a 35-year low because of high prices, but equally to blame are mortgage rates, now at 8%. As for inflation, that’s about the only good news; it looks like it is melting.

Employment

October was the first month in a while to show employment weakness. As noted in our last blog, when the revisions (-101K) and Birth/Death model add-on (+127K) are accounted for, the payrolls were actually negative in the Establishment Survey. The Household Survey, which wasn’t mentioned anywhere in the media, registered -348K net jobs. And if it weren’t for the fall in the Labor Force Participation Rate (discouraged applicants), the U3 Unemployment Rate would have risen more than the +0.1 percentage point that brought it to 3.9% (the low was 3.4% last December). Be that as it may, in the post-WWII era, a rise of 0.5 percentage points in U3 has signaled a Recession 100% of the time. So, those that believe in the “soft-landing” scenario must also believe that “this time is different.” (As Warren Buffet famously said: “What we learn from history is that people don’t learn from history.”)

According to Rosenberg Research, over the past three months, the Household Survey has shown a -40K decline in job holders and +665K more unemployed people. To show the stress on household budgets, over those three months, the number of multiple job holders has risen by +243K to a near record 8.4 million.

In the latest Challenger survey, layoffs were up 8% from a year ago in October, and hiring announcements were down -85%. Retail’s seasonal hiring is the lowest since 2008; that says something about what retailers think of upcoming holiday sales. In addition, the U6 unemployment rate, a more comprehensive view of the employment picture, also rose, but by 0.2 percentage points to 7.2% (this was at a low of 6.5% last December). We also note that the number of companies announcing large layoffs is rising with several new announcements each week.

While the employment picture has moved toward “balance” from where it was in 2022 and early 2023, we expect that it will move passed “balanced” and deteriorate. The nature of the cycle is that it always goes through “neutral” or “balanced,” both when it rises AND when it falls. October may be the first of many such weak employment reports.

Another indicator of job weakness is employment in the head-hunting business. It has contracted, down -115K since February. When the head-hunting business is struggling, it is a sign of a weak job market.

Consumers

One of the reasons that the U.S. economy has remained in growth mode is the “resilient” consumer. Unfortunately, that appears to be changing. As noted above, the “free money” from Uncle Sam kept the consumer buoyant, at least through Q3. Now there is reason to believe that the “free money” has been spent.

The chart shows the savings rate since the turn of the century. Note that savings have fallen nearly to their 2008 level and that most of that “free money” has been spent. There appears to be no reservoir or reserve.

Note also that credit card balances are at record levels, $1.1 trillion, up 16% year over year. The chart shows that credit card debt now totals $3,800 per capita, up $1,000 per person since October 2021.

Most American households pay for day-to-day items (groceries, gasoline) with a credit card. So, as prices have risen, so have card balances. Delinquencies have risen too, now at 5.8% (up 0.7 percentage points in Q3). Auto delinquencies have risen in tandem with credit cards, now at 7.4% of outstanding balances in Q3. And 2.5% are over 90 days past due, keeping the repo man busy!

Nowhere is the inflation bite more evident than in the interest rate on those credit cards. All of them are 20%+ and some approach 30%. For the low- and middle-income families, it has become increasingly hard to keep up. Many have maxed their credit card limits. Unfortunately, the banks have been denying requests for increased limits (and requests for new cards) at near-record or record levels. More cardholders are being charged late fees, are falling behind on minimum payments, and are facing higher costs on a growing debt burden. About 10% of card users were in “persistent debt,” a term used when cardholders pay more in interest and fees each year than what they pay toward the principal.

Now that the “free money” has been spent and there is little room left on the credit card line, there is nothing left to do but cut back. The reality is that even modest cutbacks, if widespread, have significant economic consequences, including Recession.

We note that auto sales fell in October (-1.2% from September). They are now down in three of the last four months. And the latest Fed Senior Loan Officer Opinion Survey (SLOOS) indicates that banks have continued to tighten lending standards in Q4, and that includes for autos.

The Business Sector

The economy can’t be very good when earnings expectations in seven out of 10 sectors are falling. The chart shows that health care costs lead the way with a -16%+ reduction in Q4 earnings. For the S&P 500 as a whole, expectations are for a -4% in earnings growth. The equity market is quite sensitive to these earnings’ expectation changes.

In addition, we see that Johnson Redbook reported a -1.5% fall in same store sales in October and the big box stores like Target

TGT

WMT

We have noted in past blogs that Manufacturing is already in Recession. The ISM Manufacturing PMI at 46.7 for October has been in contraction (below 50) for 11 months in a row.

And the ISM Services PMI was 51.8 in October, down from 53.6 in September and disappointed the consensus forecast of 53.0. It, too, appears to be headed for contraction, and soon.

Banking

Because credit is the lifeblood of the economy, when the banking sector contracts, the economy fades. And banks are contracting. Since the March Regional Bank blow-up, banks have:

- Lost deposits;

- Reduced lending in every loan type, and are denying applications for an increase in credit card lines at the highest rate in history. In addition, they have also tightened mortgage lending standards;

- Have rising delinquencies in consumer, auto, and commercial loan sectors;

- Are all raising their loan loss reserves;

- New consumer loans, auto loans, and credit card loans are at or near historic lows;

- In the Regional Banking space, Commercial Real Estate (CRE) loan issues are rising. 15 of 18 Regional Banks reported increasing charge-offs and those non-performing loans had risen 80% from Q3 ’22.

Housing

The Housing Industry continues to slide as mortgage rates approach 8%. Affordability is at its lowest level since the 1980s.

DR Horton, a major U.S. builder, reported slowing sales in Q3 and sees very slow sales growth ahead (2.8% in 2024). We think even this is optimistic. Horton is now offering smaller homes at lower prices.

We’ve seen sales collapse in the existing home space (pending sales down -13% year over year), and mortgage applications are now at three-decade lows. With homeownership out of reach for most, one would think that landlords would be able to raise rents. Not so! There has been a glut of new product, and there is weak demand as most of the population that wanted to move during the pandemic have done so by now. According to FNMA, vacancy rates have reached 6.5%; the 15-year average is 5.8%. And the downward pressure on rents looks like it will continue as the record number of apartment units under construction are completed.

Inflation

The current inflation has fallen at the fastest pace in the post-WWII era. Even the Manheim used vehicle price index, the poster child for this particular inflation pandemic, has now turned negative on a year over year basis (-4.0%).

Wage growth has not turned into the much-feared wage-price spiral the Fed was so worried about. According to Rosenberg Research, the three-month annualized rate of wage growth of +3.2% is more than consistent with a 2% or lower rate of inflation, as productivity showed up as +4.7% in Q3 and +2.2% Y/Y. Quoting Chairman Powell (his November 1 press conference):

The wage increases have really come down significantly over the course of the last 18 months to a level where they’re substantially closer to that level that would be consistent with 2% inflation over time.

The NY Fed’s Global Supply Chain Pressure Index (The “Bottleneck Index”) was -1.74 standard deviations below its average in October. This is the lowest reading on record.

We also have world food prices off -10.9% from a year ago and down -25% from its peak.

The Baltic Dry Index is now down -74% from its October 2021 peak. And the world’s biggest container shipper, Moller-Maersk, just announced a -10,000 person layoff! It wasn’t that long ago, when the cost of shipping a container, if they could even be found, was $20,000+.

As discussed in past blogs, China is already in Recession. Their Producer Price Index has been falling for several months as have the prices of their exports. As pointed out by Economist David Rosenberg, that means that China is exporting deflation.

To cap off the discussion of inflation, the growth of the Money Supply (M2) is now, for the first time in history, negative. For monetarists, that means deflation is just around the corner!

The Fed’s own internal views are that inflation is rapidly falling. The NY Feds inflation gauge is at a 30-month low and on a steep decline, while the San Francisco Fed predicts that inflation will be nil by the end of 2024.

Final Thoughts

- The underlying employment data are signaling weakness. Our view is that the unemployment rate will be rising for the next several quarters.

- We also believe that the NBER will mark the start of the Recession in this quarter, Q4.

- The risk of deflation is real. A mild Recession will pull inflation down toward 0%; but if the Recession isn’t so mild, we could have a bout of deflation.

(Joshua Barone and Eugene Hoover contributed to this blog)

Read the full article here

Leave a Reply