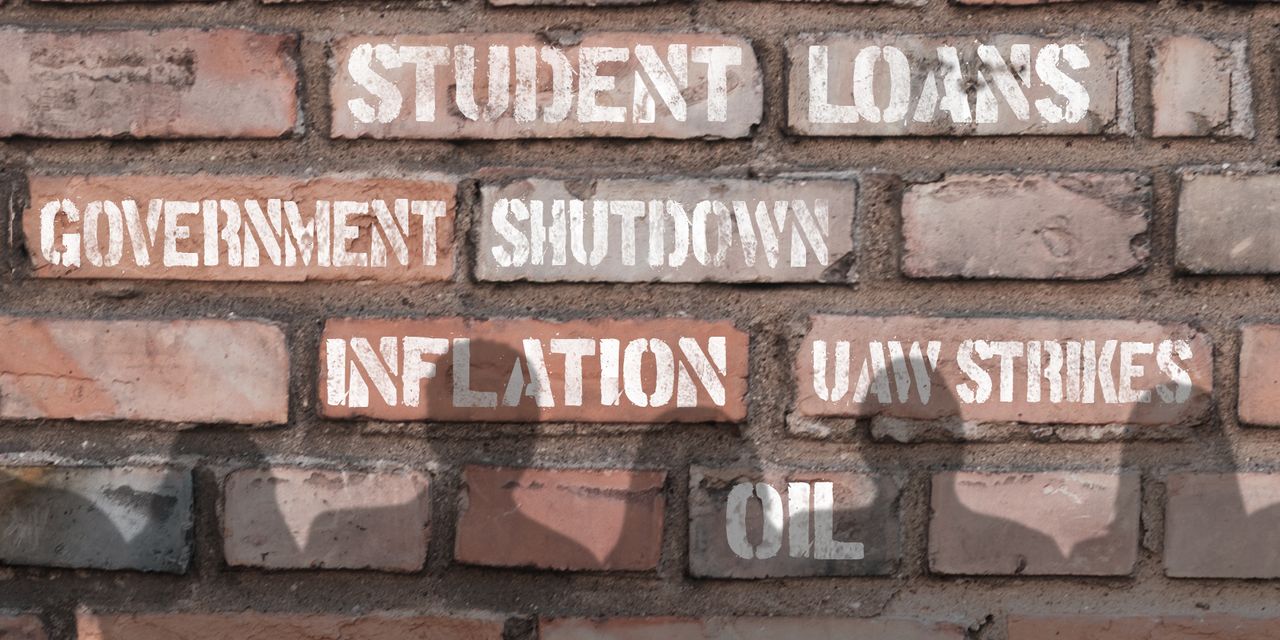

Investors face a growing list of risks heading into the fourth quarter that just keeps getting bigger — from rising interest rates to a possible revival of inflation and gridlock in Washington that may become headwinds for economic growth.The Federal Reserve remains in rate-hiking mode and is unlikely to cut borrowing costs next year by as much as previously thought. The prospect of $100-a-barrel oil at a time of expanded strikes by the United Auto Workers union is reigniting inflation concerns. Meanwhile, mitigating factors that could slow economic growth — such as the possibility of a government shutdown and the resumption…

Read the full article here

Leave a Reply