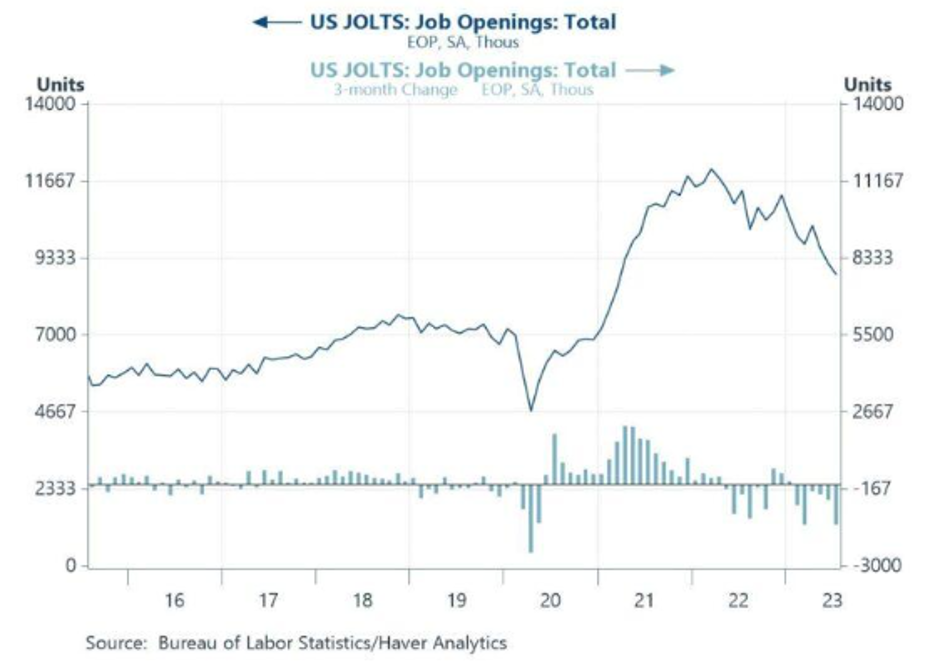

It began with the JOLTS (Job Openings and Labor Turnover Survey) on Tuesday (August 29). That survey showed job openings shrinking to 8.83 million in July. While that still appears to be a large number, it is the change here that is important. In June, that number was 9.17 million, and that number was revised down from the 9.58 level originally reported. The 8.83 report is nearly an 8% fall from the originally reported number – all in one month! Additionally, over the three-month period, openings were off -1.5 million and are down more than -3.2 million from their peak in early 2022. New hires also fell -167k in July after being off -291k in June. In addition, the “voluntary” quit rate also plummeted, indicating that jobs at higher pay aren’t as easy to find as earlier in the year.

The next day, the ADP report also underwhelmed at +177k (the consensus estimate was for +195k). Key in this report was a continuation in the fall of the year over year change in wages for both job stayers and job changers. This should assuage the Fed’s concern over the chances of a 1970s style “wage-price” spiral.

Then on Friday (September 1), the Bureau of Labor Statistics (BLS) revealed the official Non-Farm Payroll Report (+187k). As has happened in every month so far in 2023, there were revisions to prior months totaling -110k, making us skeptical of the quality of the initial reports. Theoretically, then, the net gain was +77K. But let’s not forget the automatic add-on from the Birth/Death model, +82k in this case, an automatic add based on long-term trends because BLS does not survey small businesses. As a result, the net change that was actually counted was more like -5K!

But wait! That’s not the extent of it. As pointed out by Economist David Rosenberg in several of his latest missives, both July and August saw a decline in the number of full-time jobs and a sharp rise in part-time. Because BLS counts full-time and part-time jobs as equal, the total reported can be quite deceiving. In August, the Household Survey reported that full-time positions fell by -85k. This means that part-time jobs rose +190k. [187k – 82k (Birth/Death) = 105k. If full-time are -85k, then part-time are +190k.] Using logic here by counting a part-time job as half of a full-time one, the +190k part-time becomes the equivalent of +85k full-time. Since the Household Survey tells us that full-time positions fell by -85K, the real full-time equivalent job count for August was a big fat 0! Tack on to this the continued fall in hours worked per week (see chart), the rapid rise in multiple job holders, and rapidly rising layoffs. (Challenger, Gray and Christmas show a 267% rise in layoffs from year earlier levels.) And, let’s not forget the unusually large +0.3 percentage point leap in the U3 unemployment rate (to 3.8%) and the similarly unusually large +0.4 percentage point leap in the U6 version (to 7.1%). Given how fast August’s employment data has deteriorated, it appears that an economic “soft-landing” has moved further to the sidelines.

Excess Savings

We commented last week on the weakness in Q2 sales and expected future sales by the country’s leading retailers, pointing out that weakening consumption will drag down economic growth. That weakness indicates that incomes are not keeping up with inflation. Several market commentators have pointed out that weakening retail sales are a function of the populace running out of “excess savings,” a nice term for the free money handed out during the pandemic. Those “excess savings” allowed the populace to consume at a higher rate than their incomes would have normally allowed. Those “excess savings” have been spent, as evidenced by the Q2 major retailer reports. And of high importance, we just saw a drop off of -0.2% in July’s Disposable Personal Income data. In our view, this means a sluggish economy for the next few quarters.

Forecasts

There is conflict among forecasters as to whether or not there will actually be a Recession, implying a difference in view about how strong/weak the economy is. The biggest conflict in this domain is within the Federal Reserve itself. The Atlanta Fed has a GDP forecasting model (called GDPNow). The St. Louis Fed has a similar model. Atlanta says Q3 GDP will show a +5.6% growth, while St. Louis says it’s a mere +0.47%. (The Commerce Department’s first pass at Q3 GDP will be revealed on October 26th.) Given the sluggishness in retail sales (exhaustion of “excess savings”), and the recent employment reports, the 5.6% number, a growth rate not seen in the U.S. in several decades, seems overly optimistic (an understatement). The St. Louis model, we think, is closer to reality.

One must also be mindful of the economic bias coming from Wall Street economists and the politicians. It is in their best interests that the economy perform well, and, if it isn’t, then the appearance that it is. So, one must look at the economic interests of the forecasters before accepting their forecasts as unbiased.

Surprise!

Citigroup

C

Other Data

U.S. housing continues to struggle. Pending Home Sales (new contracts signed on existing homes) were off -14% from year earlier levels, and, as discussed in past blogs, low inventory of existing homes (most homeowners have a mortgage rate in the 3% area) continues to be an issue.

Economies in the rest of the world are also weakening. Perhaps this is why U.S. exports are off by -9% vs. a year ago. As we noted last week, China’s data says that the Recession there has already begun. The latest data show its Manufacturing PMI (Purchasing Managers’ Index) has printed a second month in contraction. We also note that Germany’s July employment report showed a contraction of -18k jobs, nearly twice that of the consensus estimate (-10k). Swiss retail sales showed up as -2.2% in July vs. a year earlier, and Japan’s Industrial Production was off by -2.0% vs. June.

Inflation

The good news is that inflation continues on its downward path. Even the moribund bond market rallied last week (i.e., prices rose, yields fell), as markets have now become convinced that the Fed won’t hike rates at its September meeting. In addition, they’ve assigned a low probability that they will hike in November, a probability that is fading with each incoming inflation report.

The latest inflationary gauge, the PCE (Personal Consumption Expenditure) Price Deflator, one that this Fed watches closely, showed but a +0.2% rise in both its headline and core indexes in July. The three-month trend in the all-important (to the Fed) core rate was +2.2% (annual rate).

As noted at the top of this blog, employment is weakening as is the rate of growth in wages. The Fed’s dreaded wage-price spiral never occurred, so one of the Fed’s major objectives in its rate raising regime has been accomplished. While the Fed’s mantra, “higher for longer” is still in play, we expect that we have seen the highs in interest rates, and that the first-rate cut will occur earlier than today’s Fed would have us believe.

Final Thoughts

- The bond market rally this past week is the first sign that market players are convinced that inflation is on its last legs and that the Fed will refrain from further tightening. A continuation of the rally would imply that the bondies see a Recession brewing.

- The employment reports, from JOLTS to ADP to Non-Farm Payrolls all show weakness. The loss of full-time positions for the last two months bodes ill, as does a declining workweek.

- The weakness in retail indicates that the cash gifts (“excess savings”) are now exhausted. We think that the fall in personal income in July is not a fluke and that we will continue to see such weakness.

- The worldwide prognosis is the same as for the U.S. The Baltic Dry Index (a price index) is off -80% from its high. The Cass Freight Index (shipments) is down -9% from year ago levels. In the U.S., Railway Carloadings are down -5.5% (vs. a year ago).

- We still don’t see a “soft-landing”.

(Joshua Barone and Eugene Hoover contributed to this blog)

Read the full article here

Leave a Reply