Samsung

Electronics has reported another plunge in quarterly earnings. However, the drop was less steep than in recent quarters, which could be a positive sign for U.S. peers

Micron Technology

and Intel.

Samsung

(ticker: 005930.Korea) said Wednesday that its September quarter operating profit came to 2.4 trillion won ($1.79 billion), down 78% from the same period a year earlier.

The Korean technology giant is still struggling with a slowdown in its semiconductor business but the results were better than the previous quarter when it suffered a 95% profit drop. Samsung shares climbed 2.7% in local trading.

“Samsung’s preliminary results came in better than expected adding weight to the possibility that the inventory correction is coming to an end which will allow revenue on consumer electronics to stabilize,” wrote independent analyst Richard Windsor, who publishes Radio Free Mobile.

If Samsung is on the upswing, that means

Micron

(MU) and

Intel

(INTC) can take heart.

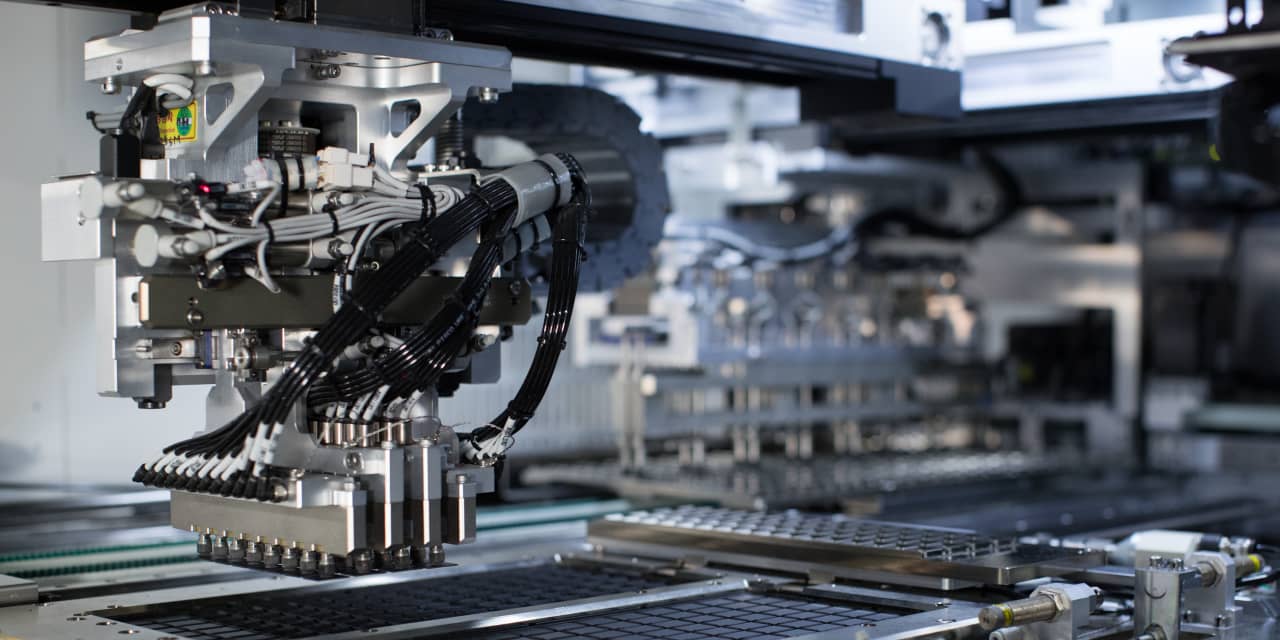

For Micron, it’s all about memory chips. Samsung is the biggest player in the market and hopes of a turnaround are largely pinned to better pricing for those chips as an inventory glut caused by the slowdown in PC and smartphone sales eases. Samsung’s figures suggest that recovery is under way after the Korean company cut its production.

Analysts at Stifel wrote in a recent research note that Micron was set to benefit from Samsung’s price increases on NAND memory chips and took a short-term Overweight position on the stock. Micron executives told Barron’s last month that pricing had bottomed in the memory-chip market.

Micron shares were up 0.9% in premarket trading on Wednesday.

Intel will be hoping the results suggest a more broad-based recovery in demand for chips in PCs and smartphones, as well as positives for the contract chipmaking business where the U.S. company aims to challenge Samsung and

Taiwan Semiconductor Manufacturing

(TSM). Taiwan Semi’s own sales report last week was better than analysts had expected.

Intel shares were up 0.1% in premarket trading.

Write to Adam Clark at adam.clark@barrons.com

Read the full article here

Leave a Reply