U.S. stocks saw their losses deepen Thursday with the Nasdaq Composite sliding further into correction territory following another batch of disappointing megacap company earnings.

Meanwhile, a blockbuster report on summertime economic growth had only limited market impact as investors expect the economy will likely slow after a summer bump.

How U.S. stocks are trading

- The S&P 500 fell 30 points, or 0.7%, to 4,156.

- The Nasdaq Composite declined by 144 points, or 1.1%, to 12,675.

- The Dow Jones Industrial Average fell 122 points, or 0.4%, to 32,917.

On Wednesday, the Nasdaq closed 10.7% lower from its 2023 closing high of 14,358.02, reached July 19. The tech-heavy index fell 2.4%, its largest percentage-point decline since Feb. 21, according to Dow Jones Market Data. The S&P 500, meanwhile, logged its lowest close since May 31, having officially erased all of its summer gains.

What’s driving markets

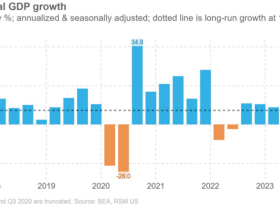

A preliminary reading on third-quarter U.S. GDP came in even hotter than expected on Thursday, with data from the Commerce Department showing the economy grew at an annualized pace of 4.9%, surpassing the 4.7% pace that Wall Street had expected.

See: GDP jumps 4.9% as the U.S. economy speeds up

Callie Cox, a U.S. equity strategist at eToro, said the latest data should help assuage concerns about an imminent recession in the U.S., although an economic downturn remains a possibility.

“The US economy was incredibly resilient last quarter. Growth was spectacular, mainly due to how much money Americans spent,” Cox said.

“Consumer spending had its biggest contribution to economic growth since the end of 2021, and inventories grew as retailers scrambled to meet demand. It’s hard to say we’re in — or even near — a recession with this kind of GDP print.”

Buried in the GDP data was a quarterly reading on the personal consumption price index, the Fed’s preferred inflation gauge. The core gauge, which strips out volatile energy and food prices, retreated to 2.4% from 3.7% during the second quarter.

The decline was larger than Wall Street had expected, and it likely bodes well for the September PCE data that’s set to be released early Friday.

Strong economic growth and signs of slowing inflation mean Thursday’s GDP report was “as good as it gets” for the U.S. economy, Moya said. However, corporations’ warnings about a weakening U.S. consumer and signs of deterioration abroad mean the U.S. economy likely peaked in the third quarter, as more difficult times lie ahead, he said.

Small-cap stocks, which have underperformed all year, were one of the few bright spots in U.S. equity trading Thursday, as the Russell 2000

RUT,

gained 18 points, or 1.1%, to 1,669. The small-cap gauge logged a new 52-week closing low on Wednesday when it finished at 1,651, having fallen during five of the previous six trading days, according to Dow Jones data.

Poorly received earnings reports from some of the biggest publicly traded U.S. companies continued to weigh on the market Thursday.

This time, Facebook parent Meta Platforms Inc.

META,

was the latest “Magnificent Seven” company to release disappointing results, following poorly received numbers from Alphabet Inc.

GOOG,

and Tesla Inc.

TSLA,

Alphabet’s Class A shares fell 9.5% on Tuesday, their worst daily drop since March 16, 2020, when the arrival of the COVID-19 pandemic plunged global markets into turmoil.

See: The Nasdaq just fell into a correction. Now what?

Shares of Meta Platforms Inc.

META,

shed 5.2% immediately after the open, helping to make the Nasdaq the worst-performing index once again this week. Meanwhile, the Dow outperformed, thanks to a rally in shares of IBM.

Next up on the big-tech earnings docket is Amazon.com

AMZN,

which will report after Thursday’s close.

In addition to Amazon, Chipotle

CMG,

Intel

INTC,

and Ford Motor

F,

are set to report after the close.

Treasury yields were again slipping on Thursday, with the 10-year Treasury yield

BX:TMUBMUSD10Y

down 3.2 basis points at 4.907%. The yield on the benchmark bond briefly topped 5% for the first time since 2007 earlier this week. However, market analysts surmised that Treasury yields would have to fall further to help boost stocks.

In other news, the United Auto Workers said it reached an agreement to end the strike at Ford.

Investors also digested data on weekly jobless claims, which rose by 10,000 to 210,000, but remained relatively low, a sign that companies continue to hang on to workers.

Companies in focus

-

Meta Platforms Inc.

META,

-4.42%

shares fell after the firm’s CFO warned of slower advertising revenues in the fourth quarter, following the publication of analyst beating results in the third quarter that showed rising digital-advertising revenue. -

Mattel Inc.‘s stock

MAT,

-7.88%

fell 10% even as the toy maker beat analysts expectations in the third quarter after warning of slower demand during the holiday season. -

IBM stock

IBM,

+4.52%

rose 1% as the technology giant’s results came in ahead of forecast. -

Ford Motor Co. stock

F,

-1.39%

rose 1% as the United Auto Workers said it reached a pay deal with the automaker, which also reports results after the closing bell. -

United Parcel Service Inc.

UPS,

-5.46%

were nearing a more than three-year low Thursday, after the package delivery giant extended its quarterly streak of revenue misses and cut its full-year outlook. -

Mastercard Inc.

MA,

-5.31%

shares fell after the company beat earnings expectations, but warned about a slowdown in spending growth in the U.S. and internationally.

Read the full article here

Leave a Reply