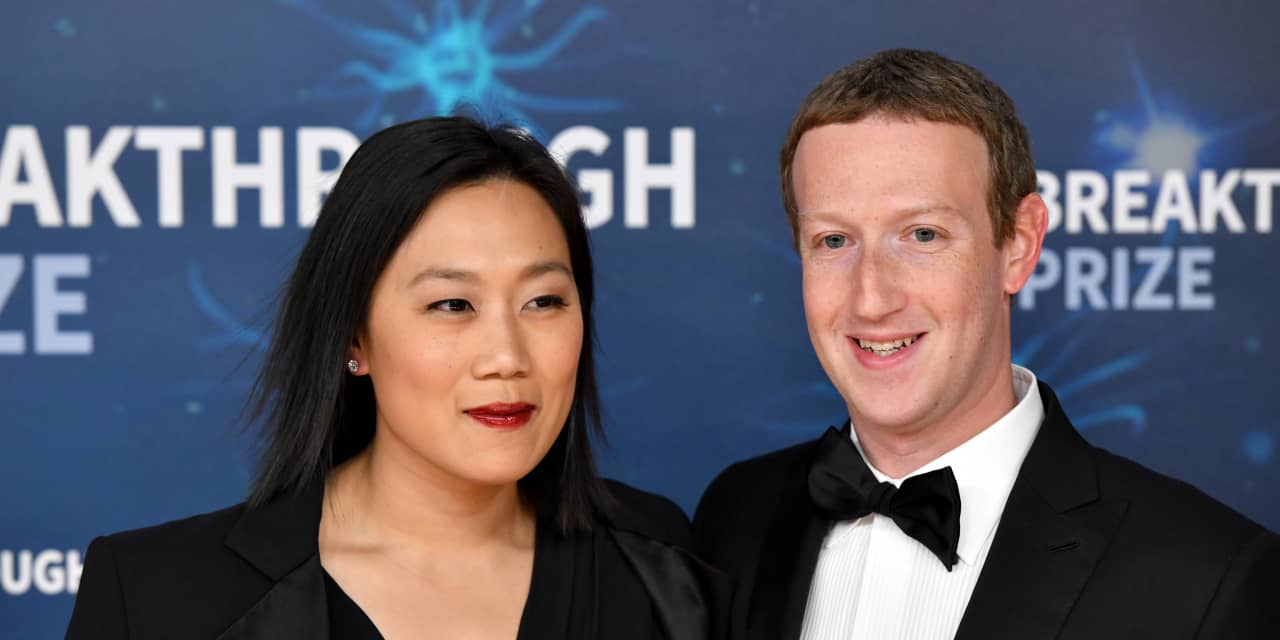

The foundation established by

Meta Platforms

CEO

Mark Zuckerberg

and his wife,

Priscilla Chan,

has made some major changes in its U.S.-traded investments.

The Chan Zuckerberg Initiative sold shares in

DoorDash

(ticker: DASH) and

iShares Core MSCI Emerging Markets

exchange-traded fund (IEMG), and increased its investment in

Vanguard FTSE Europe ETF

(VGK) by nearly fivefold in the third quarter.

The foundation disclosed the changes in a form it filed with the Securities and Exchange Commission. The Chan Zuckerberg Initiative didn’t respond to a request for comment.

Zuckerberg and Chan are giving away 99% of their Meta stock (META) through the foundation, which from December 2015 through October 2022 has made 4,470 grants totaling $4.84 billion.

In the third quarter, the foundation sold all of the 52,859 DoorDash shares it had owned at the end of June. The stock surged 63% in the first nine months of this year after a 67% plunge in 2022. So far in the fourth quarter, shares of the food-delivery firm have gained 12%.

The

S&P 500 index

rose 12% from January through September, after a 19% drop in 2022. So far in the fourth quarter, the index has gained 1.8%.

DoorDash earnings have been strong this year. The company has warned app users that food orders without tips could result in longer waits. A judge ruled that higher minimum-pay rates for New York City food-delivery workers could take effect in July while considers challenges brought by app-based companies, including DoorDash.

Shares of the iShares Core MSCI Emerging Markets ETF managed a 1.9% gain in 2023’s first nine months, after a 22% slump last year. So far in the fourth quarter, shares are up 2.1%.

As of Nov. 3, the ETF’s top five holdings in order of value were

Taiwan Semiconductor Manufacturing

(TSM),

Tencent Holdings

(TCEHY),

Samsung Electronics,

Alibaba Group Holding

(BABA), and

Reliance Industries.

The ETF is benchmarked against the MSCI Emerging Markets Investable Market Index.

The Chan Zuckerberg Initiative owned 746,880 shares of the iShares Core MSCI Emerging Markets ETF as of June 30, but sold them by the end of September.

The foundation bought 1.62 million more shares of the Vanguard FTSE Europe ETF to lift its investment to 1.97 million shares as of Sept. 30.

The ETF is benchmarked against the FTSE Developed Europe All Cap Index. Its five biggest equity holdings as of Sept. 30 were

Nestlé

(NSRGY),

Novo Nordisk

(NVO),

ASML Holding

(ASML),

Novartis

(NVS), and

AstraZeneca

(AZN).

Vanguard FTSE Europe ETF sported a 4.5% gain for the first nine months of this year, after a 19% slump in 2022. So far in the fourth quarter, shares of the ETF are flat.

Inside Scoop is a regular Barron’s feature covering stock transactions by corporate executives and board members—so-called insiders—as well as large shareholders, politicians, and other prominent figures. Due to their insider status, these investors are required to disclose stock trades with the Securities and Exchange Commission or other regulatory groups.

Write to Ed Lin at edward.lin@barrons.com and follow @BarronsEdLin.

Read the full article here

Leave a Reply