You can dominate a market without being a law-breaking monopolist. While it’s illegal to use your market dominance to make consumers and competitors worse off; if consumers freely choose your product over the alternatives, you have earned your market leadership legitimately.

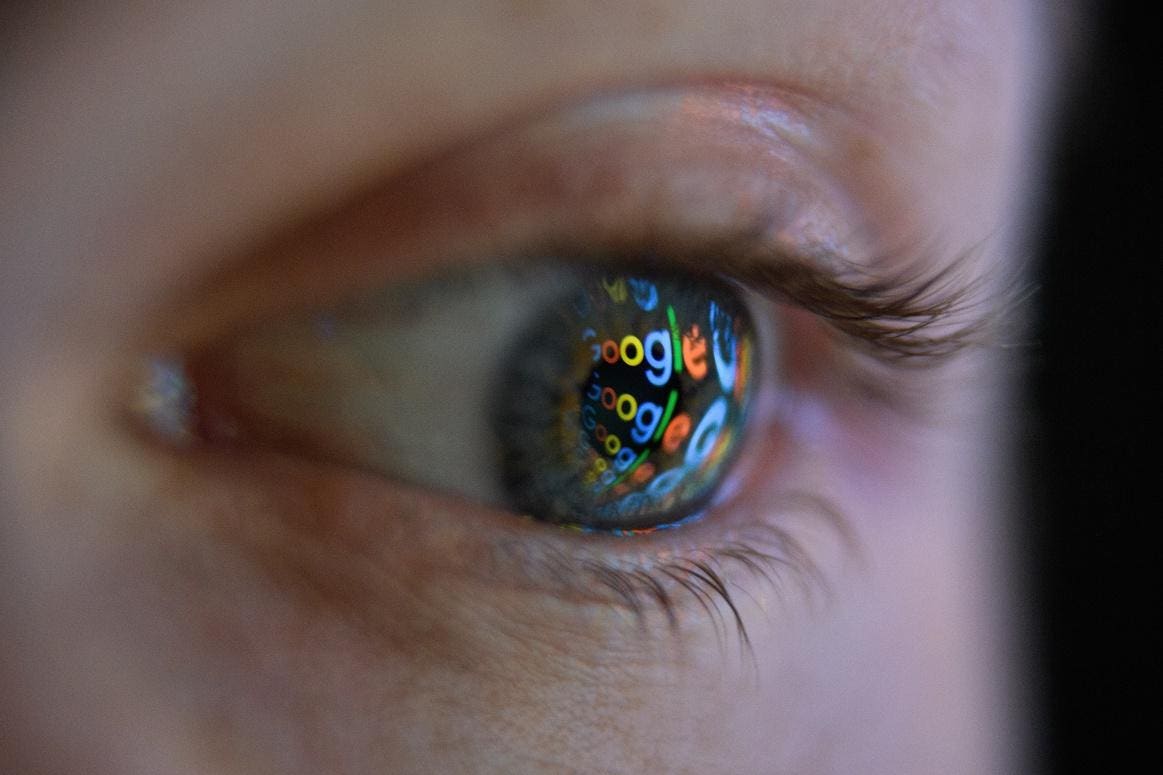

There is no question Google dominates the market for search queries. As the Wall Street Journal reported, the company handles “about 90%” of such queries — supporting $160 billion in advertising revenue for Google making up most of parent company, Alphabet’s annual revenue.

If the search giant can prove its market dominance flows from making customers better off by providing a service they prefer over the alternatives, Google has a shot at emerging victorious in this lawsuit.

But who are the customers of Google’s search service? There are many:

- Smartphone and device makers who choose whether to make Google the default search engine on their products.

- Consumers who want the best results from their web searches.

- Advertisers who hope to tap into searches to expose consumers to their marketing messages to boost sales.

If Google wins by satisfying the specific purchase criteria of these different customers better than rival services do, then the judge should conclude the search leader is not a power-abusing monopoly.

This trial makes holding Alphabet stock a bit of a gamble. If the court — presided ove by U.S. District Judge Amit Mehta — rules against Google, he would oversee a separate trial to decide how to fix the illegal conduct.

In such a trial, Mehta would seek to repair the harm Google has caused — without requiring him to monitor Google’s conduct.

Two options — changing Google’s distribution contracts or spinning off Chrome — do not appear likely to change Google’s market share in search.

A more effective remedy would be for Microsoft or other rivals — possibly powered by Generative AI — to produce a search engine that works much better than Google’s.

Therefore, I do not see this antitrust case having a negative impact on Google’s stock.

I have requested comment from Google and will update this post if I receive a reply.

Google’s Antitrust Trial

On September 12, a bench trial pitting the Justice Department against Google began. The DOJ and group of 38 states and territories allege the search giant monopolized the search engine market — harming rivals, consumers, and innovation, according to the Journal.

The trial could last until the middle of November. Mehta alone will decide whether to order a breakup or make changes to the way Google operates, noted the Journal.

The plaintiffs allege Google’s multi-billion dollar contracts with Apple, Samsung, and others to make its search engine the default option on web browsers and mobile phones “illegally helped” the search giant maintain a monopoly in that market. Google argued it competes fairly for these contracts, and “users can easily switch away from defaults,” the Journal wrote.

In an opening salvo, the DOJ alleged this case would determine “the future of the internet and whether Google will ever face meaningful competition,” Justice Department lawyer Kenneth Dintzer said during his opening statement.

Google countered by noting defaults do not lock in consumers. Indeed, Google’s lead trial attorney, John Schmidtlein, claimed consumers who use Microsoft’s Edge browser — which sets Microsoft’s Bing as the default search engine — overwhelmingly preferred Google, noted the Journal.

A Brief History Of The Google Antitrust Lawsuit

The DOJ first filed the lawsuit — which hinges on Google’s contracts with device makers — in 2020. According to Forbes, the most significant of these contracts is the one Google signed with Apple worth “undisclosed billions” of dollars. The Boston Globe reported the U.S. has alleged Google’s payments for such contracts exceed $10 billion.

The DOJ’s original lawsuit claimed Google CEO Sundar Pichai and Apple CEO Tim Cook met in 2018 to discuss how they could grow faster together. In 2018, the DOJ alleged Apple devices generated about half of Google’s revenue — making the possible loss of the Apple contract a “Code Red” event for Google, Forbes reported.

On September 8 the DOJ argued Google’s default distribution agreements raised the costs to device makers and other distributors of switching to a search rival’s service — thereby “diminishing rivals’ ability to compete,” Forbes wrote.

Google views the distribution agreements as giving consumers easier access to the products they want. Kent Walker, Google’s legal chief, wrote September 8, “We plan to demonstrate at trial that our Search distribution agreements reflect choices by browsers and device makers based on the quality of our services and the preferences of consumers.”

Why Consumers Choose Google

Why do consumers choose Google for search?

Google argues consumers choose its product because it returns higher quality results than do competing search engines. Chris Barton, a former Google employee hired to pitch telecom and smartphone executives to contract with the search giant, testified on September 13, when he pitched other companies, he tended to focus on Google’s “superior product” and “superior monetization,” according to the New York Times

NYT

The government employed an expert witness who argued defaults drive user choice. Antonio Rangel, a behavioral economist and professor at Caltech, testified “defaults have a powerful influence on consumer decisions,” noted the Times. Having a default search engine on a device such as a smartphone or PC would bias users to choosing that search engine in a “sizable and robust” way, Rangel testified.

Why Device-Makers Choose Google

Did device-makers and others — such as web developers and wireless carriers — choose Google as its default search provider because the search giant engaged in illegal conduct?

The plaintiffs alleged Google’s contracts with these third parties illegally preserved the search giant’s market leadership.

Barton said the company paid mobile companies a percentage of Google’s advertising revenue “primarily” so they would choose Google as their exclusive default search engine, according to the Times.

Barton testified the aim of these contracts was to “maximize the opportunity” for users to discover and regularly use Google. He said a “key thing” determining whether Google paid such distributors a share of its revenue was whether the distributors would make Google its exclusive default search engine, the Times wrote.

Google argued its success in online search resulted from having a better product, not the default agreements. In opening statements September 12, Google’s lawyer said “it was easy for people to switch their search engine and that smartphone and browser makers promoted other search engines as well,” the Times reported.

Why Advertisers Choose Google

Without advertisers, Google’s search engine market leadership would not generate significant revenue. Did Google abuse its market leadership to earn that $160 billion in ad revenue? The DOJ has filed a second lawsuit against Google, arguing it abused a monopoly over advertising technology, the Times reported.

Implications For Investors

What would happen to Google if Mehta rules in favor of the plaintiffs? What should investors do about each possible outcome?

If Mehta finds Google guilty, he could seek a remedy that does the following:

- It repairs the specific damage he finds Google’s conduct has caused

- It does not require ongoing monitoring of Google’s compliance or otherwise require the court to micromanage Google, the Globe reported.

If he rules against Google, Mehta might choose one of the following remedies.

Restrict Or Alter Distribution Deal Terms

Mehta could require Google to give all users a choice of multiple search providers when they set up a new phone or to offer them defaults to rivals — such as DuckDuckGo or Microsoft’s Bing.

This probably would not work. As the Globe reported, these remedies have been ineffective against Google in the past. For example, after 2019 — when the EU required Google to give all users a choice — the search giant’s market share remained at 97%. What’s more, such remedies would require ongoing court monitoring.

Breakup Google By Spinning Off Chrome

Another option would be to force Chrome — which has a dominant share of web browsing on computers and Android mobile phones — to become an independent company. Were Chrome an independent company, it “might add a different search service as its default or make changing the default option simpler,” the Globe noted.

This is a more likely option; however, it might not require Chrome to add different search services as a default. University of Tennessee law professor Maurice Stucke said, “The remedy has to fit with the theory of how the market was harmed and be commensurate.” He said a permanent split-up could “better fit with current Supreme Court precedents” than ongoing business restrictions, the Globe reported.

Since Google did not lose market share after the EU required it to offer other defaults on Android, were Mehta to require Google to change distribution contracts to highlight other defaults, the result would neither cost it search market share nor harm Google investors.

Since consumers seem to prefer Google to the other possible default search engines, spinning off Chrome might not hurt Google stock either.

Of course, Mehta might conclude Google gained its market dominance in search legally — which might result in a temporary relief rally in its stock.

From there, the biggest fear for Google investors would be the outcome of the DOJ lawsuit alleging monopolistic abuse of its power in the advertising technology market.

In the long term, the search giant’s future depends on whether — in a world transformed by Generative AI — Google can deliver consumers a much more powerful search engine than ones from Microsoft and other rivals.

Read the full article here

Leave a Reply