As Hong Kong’s shriveling stock market continues to shed billions in liquidity and trading volumes fall, even the bears are wondering if things have hit bottom.

Until recently, the city’s exchange had been one of the premiere stock markets in the world. In seven of the last 14 years, it was the top destination globally for initial public offerings. This year, listings have hit a 20-year low, with only 42 newly public firms raising $3.13 billion in the first nine months so far.

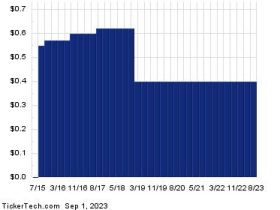

The reluctance among companies is due in part to the anemic secondary market, analysts said, with the benchmark

Hang Seng

Index nearly hitting a one-year low earlier this month, and trading volume surpassing a one-year low.

Hong Hao, chief economist for Shanghai-based hedge fund Grow Investment, told Barron’s this was normally a sign that things should be bottoming out. But he is anxious about mainland China’s property industry, whose firms are mostly listed on the Hong Kong Exchange. It could take a decade to fix the sector, he said, for the simple reason that China built far too many homes needed to house its population.

“Despite the government’s efforts to roll out support measures for the property sector, a sustainable recovery has yet to be seen,” Hang Seng Bank wrote in a recent research note.

China’s property crisis is just one example of pain in the country’s economy that is spilling over into Hong Kong’s market. China’s overall economy continues to defy rebound predictions, and its tensions with the U.S. and unpredictable regulatory rules have made foreign investors and firms nervous.

Foreign fund managers have to contend with the possibility of being forced to sell as the Biden administration’s investment restrictions intensify in the lucrative tech space or even into other sectors.

Despite little to show in actual policy, Beijing has shown signs it feels the pinch of weakened foreign sentiment and political tensions.

“China is studying the ease of foreign stake limits in Chinese firms,” Ministry of Commerce spokesman He Yadong said last week. “China is looking forward to working with the United States to create a fair and stable business environment for bilateral business cooperation.”

Regardless, the economy seems to be haunting Hong Kong.

“In the last 20 years, Hong Kong has really become sort of a proxy market for foreigners who want to trade in China stocks. So, you know the fact that China is struggling so much right now is making Hong Kong’s already not great situation even worse in terms of trading,” said Doug Young, director of Hong Kong-based Bamboo Works, which provides analysis on Chinese companies listed in the city.

With control of China’s unwieldy economy far out of Hong Kong’s hands, city authorities have turned to doing what they can at the local level. A much-talked-about task force was formed last month to review liquidity and other market problems and offer policy prescriptions.

One step investors are hoping the group will advocate is reducing the so-called stamp duty on stock trades, which was hiked two years ago to 0.13% from 0.1%, making trades on the bourse higher than most of its peer markets globally.

“If total exemption is not in the cards yet, maybe they can consider halving it or only charging one trading party instead of both,” said Dickie Wong, executive director of research at Kingston Securities, according to a report by Bamboo Works. “The Hong Kong stock market is bleeding, so the top priority should be stopping the bleeding. As long as trading costs stay high, high-frequency traders will sit on the sidelines.”

Some advocates are pushing for change in the exchange’s rules that don’t allow the purchases of low quantities of shares—even as low as one share, as the U.S. allows. With many firms’ shares trading in the $100 or more range, requiring bulk buys can be prohibitive for smaller investors, which the exchange has said it wants to attract. But there again, barriers are high.

“Hong Kong is fairly closed to smaller Western investors. It’s very accessible for the Morgan Stanleys and JPMorgans because they all have offices there, you have to open a registered company, and have a locally registered bank account. It’s possible they’ll make it easier for smaller brokerages to set up accounts,” Young said.

That inaccessibility seems to extend even to mom-and-pop investors in the mainland, where the share of retail trading is much higher than it is in Hong Kong. The Stock Connect system was established years ago to allow mainlanders to buy Hong Kong-listed shares, but the rules are prohibitive to most unprofessional Chinese day traders, with capital requirements and extensive paperwork.

Beijing hair stylist Wu Ming, 34, said he uses an app on his phone to buy stocks in Shanghai and Shenzhen. “But I have no idea how I would buy anything from the Hong Kong market,” he told Barron’s.

Write to editors@barrons.com

Read the full article here

Leave a Reply