The Federal Reserve might not need to raise interest rates again this year, thanks to the recent rapid rise in U.S. bond yields, the president of the Federal Reserve Bank of San Francisco said Thursday.

The yield on the 10-year Treasury shot up to a 52-week high of 4.801% earlier this week on Tuesday. Through Wednesday’s close, the 10-year yield has climbed 0.909 percentage points so far in 2023.

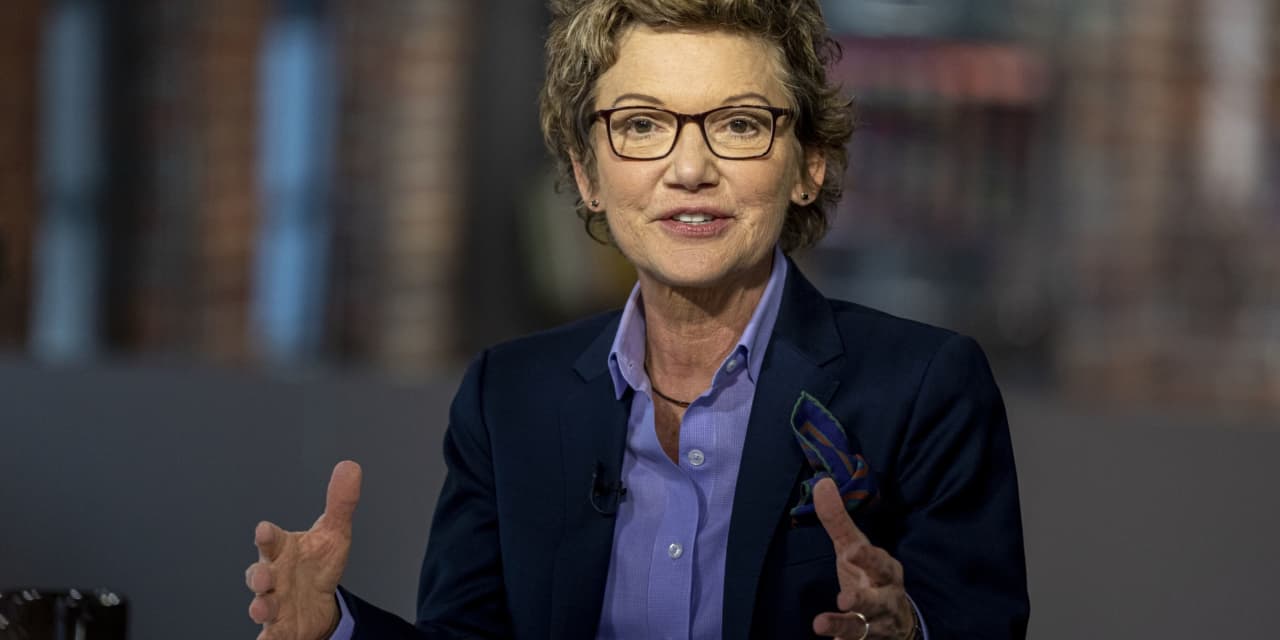

If the current economic conditions remain on track, the Fed could potentially avoid lifting interest rates further, as the climb in rates on long-term Treasuries is largely doing the central bank’s job for it, Mary Daly, the San Francisco Fed president, said Thursday in an appearance at the Economic Club of New York. The Fed’s aggressive battle to tame inflation since last year has brought its benchmark interest rate to the current 5.25% to 5.5% level.

“If we continue to see a cooling labor market and inflation heading back to our target, we can hold interest rates steady and let the effects of policy continue to work,” said Daly, who is currently a nonvoting member of the Federal Open Market Committee, but will be a voting member next year.

In August, the headline consumer price index rose 3.7% from a year earlier, accelerating slightly from July’s 3.2% pace, but down significantly from the June 2022 peak above 9%. The central bank maintains a target inflation rate of 2%.

Financial conditions, in particular, have tightened considerably in the past 90 days, Daly noted.

“If they should remain tight, well then the need for us to take further action is diminished because financial markets are already moving in that direction and they’ve done the work—we don’t need to do it more,” she said.

When asked if that means, if all things being equal, the Fed won’t need to hike again if bond yields stay where they are, Daly said that’s exactly how she thinks about it.

The bond market has tightened “quite considerably,” Daly explained, noting that the 10-year Treasury’s yield has risen more than 36 basis points since the Federal Open Market Committee met in September. “That is equivalent to about a rate hike,” she said.

“We’ve done a lot in a short time and the economy is in a better place,” Daly said. But she cautioned “I would argue that we’re now entering into the hardest phases of policy-making.”

The FOMC is committed to keeping rates “higher for longer” in an effort to bring inflation fully back down to 2%, Daly said. She sees the tightening financial conditions as a positive outcome, because then Fed officials can really get the job done and put inflation in line with the bank’s goal. Daly added that she believes that monetary policy is “well into” restrictive territory at this point, echoing a sentiment that Michael Barr, the Fed’s vice chair for supervision, expressed earlier this week.

“I think it is likely that we are at, or very near to, the level that is sufficiently restrictive to bring inflation back to 2%,” Barr said Monday. “The most important question now is not so much whether we need to make an additional hike at the next meeting or the meeting after—the most important question is what is the extent of restrictiveness that is required over what time period.”

But there are still risks—particularly that the Fed’s progress reining in inflation could plateau, Daly said.

“The economy still has considerable momentum, and we’re a long way from 2% on inflation and a long way from a sustainable pace on job growth,” Daly warned. “So, those things both are saying that we still have a ways to go, and they could stall out, because we have so much momentum.”

While there has been some cooling in the labor market in recent months, Daly noted that job growth remains well above what is needed to keep pace with overall labor force growth. Over the past three months, gains in payrolls averaged 150,000 jobs a month.

There are, however, “long and variable lags” in regards to Fed rate hikes affecting the economy, and Daly said the U.S. is still seeing the effects of that.

Inflation is also still almost 2 percentage points higher than the Fed’s target on a 12-month basis. While it’s possible that the slowing pace of price growth will translate into a steady march toward the Fed’s goal, the last mile of that process could prove challenging, Daly acknowledged.

“Many components of inflation are coming down just as we would expect,” Daly said. But inflation in non-housing core services, often called “supercore” inflation, has been relatively sticky and remains far above its prepandemic level, Daly noted. “This type of inflation, this supercore, often lags recovery in the other sectors—so there’s not a reason to worry yet. But we will need to see some progress in this category to be fully confident that we are on the path back to price stability.”

Speaking to the Fed’s slightly more hawkish tone of late, Daly said when you don’t know exactly what will be needed, “it’s not actually a terrific idea to telegraph one thing over the other” in forward guidance. “That’s why this tolerance of uncertainty is so important. The forward guidance doesn’t go away, but it gets less precise on a meeting by meeting basis,” she said.

Progress isn’t victory, Daly warned, and said both the Fed and the public must remain resolute to finish the job. “A gradual return to 2% is in our sights, but it is not yet in our grasp. And that is the final mile.”

Write to Megan Leonhardt at megan.leonhardt@barrons.com

Read the full article here

Leave a Reply