General Motors idled its Fairfax assembly plant in Kansas as the effects of the United Auto Workers strike widened.

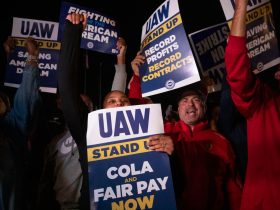

The UAW struck just three assembly plants on Sept. 15—one each at GM,

Ford Motor,

and

Stellantis

—but the Fairfax shutdown underscores how complex and interconnected auto makers are.

GM laid off nearly all of the estimated 2,000 people working in Fairfax, saying that they are “not expected to return until the situation has been resolved,” and are “not eligible for company-provided SUB-pay” usually offered during production-related stoppages.

GM called the shutdown a “negative ripple effect” of the UAW’s decision to call a strike at the Wentzville Assembly Plant in Missouri on Friday. It said in a statement that “there is no work available” because of “a shortage of critical stampings supplied by Wentzville’s stamping operations to Fairfax.”

“We have said repeatedly that nobody wins in a strike, and that effects go well beyond our employees on the plant floor and negatively impact our customers, suppliers and the communities where we do business, such as in greater Kansas City,” GM said in an email to Barron’s. “We will continue to bargain in good faith with the union to reach an agreement as quickly as possible.”

UAW President Fain has disputed GM’s account, blaming the shutdowns on the companies. “Let’s be clear: If the Big Three decide to lay people off who aren’t on strike, that’s them trying to put the squeeze on our members to settle for less,” he said on social media. Laid-off workers could receive $500 a week in strike pay.

Stellantis on Wednesday announced that because of the UAW strike at the Toledo Assembly Complex, it will “immediately temporarily lay off 68 employees at the Toledo Machining Plant in Perrysburg, Ohio, due to storage constraints,” but that all other production at that facility will continue.

Stellantis said it anticipates “similar actions at Kokomo Transmission and Kokomo Casting in Kokomo, Ind., affecting an estimated 300 employees at these two facilities,” as it monitors the impact of the UAW strike on its manufacturing operations.

Fain has threatened to expand the strike to more plants if Ford (ticker: F), GM (GM), and

Stellantis

(STLA) fail to make “serious progress” by noon ET on Friday. He said he would update members at a

Facebook

live event at 10 a.m. ET ahead of that deadline.

Stellantis confirmed it had made its fifth offer to the union on Wednesday afternoon, and a union source close to discussions said the UAW was evaluating it. Union leadership recently rejected Stellantis’ proposal that included a 19.5% increase in wages over five years, or 21% when compounded, excluding additional adjustments for inflation.

Stellantis stock gained 1.7% on Wednesday, while the S&P 500 was down about 0.9%, and the Dow Jones Industrial Average was off about 0.2%.

At $19.67 a share, Stellantis stock is about 4% above pre-strike levels and up about 12% since the start of July, when investors started to think more about labor issues.

GM and Ford shares are down about 14% and 17%, respectively, since the start of July.

Wedbush analyst Dan Ives said the dispute was reaching a “fork in the road” and feared the strikes could be “long and nasty” for the Detroit auto makers. But he said

Tesla

(TSLA) is a clear winner, although the Champagne is on ice for now.

The analyst said the company sits in a nonunion position, and its biggest potential Detroit EV competitors “now face mounting costs and complexities in the years ahead.”

“This is a growing nightmare situation for GM and Ford as both 313 [Detroit’s area code] stalwarts are in the early stages of a massive EV transformation path for the next decade that will define future success.

If the UAW’s demands for around 40% wage increases are met, it will be a major cost headwind for GM and Ford, and one that could be passed down to consumers through EV prices, they added.

“The costs of EV vehicles out of Detroit is a major advantage going after mass adoption with any $3k, $5k, $7k, etc added to the slew of vehicles coming out would result in demand churn in our opinion.

Tesla

shares are about 5% down since the UAW made its strike official, although that was largely due to Monday’s 3.3% drop after

Goldman Sachs

lowered third-quarter earnings estimates. Shares are flat since early July.

Write to Callum Keown at callum.keown@barrons.com

Read the full article here

Leave a Reply