About the author: Desmond Lachman is a senior fellow at the American Enterprise Institute. He was previously a deputy director in the International Monetary Fund’s Policy Development and Review Department and the chief emerging market economic strategist at Salomon Smith Barney.

Much attention has been focused on the economic woes of China, the world’s second-largest economy. By comparison, little notice has been paid to the deep economic troubles of Germany, the world’s fourth-largest economy. This could be a serious omission in terms of gauging the world economic outlook, especially when the Chinese economic miracle seems to have come to an abrupt end.

In much the same way as China has been the main economic-growth engine for its Asian trade partners, Germany has been the principal driver of economic growth for the euro zone. A sputtering of the German economic growth engine has the potential to tip the rest of the euro zone economy into recession, and set the stage for another round of debt crises. This is particularly the case given high levels of public debt in the euro zone economic periphery.

Germany has now registered three consecutive quarters of negative economic growth. It will be the only G-7 economy to experience a recession this year, according to the International Monetary Fund.

A whole variety of past economic policy mistakes cast a dark cloud over Germany’s longer-run economic prospects. Among the more glaring of these was Germany allowing itself to become overly dependent on Russia for its energy supply. As a result of this dependence, and in light of the country’s large, energy-intensive heavy industry sector, Germany was the country hardest hit by the cessation of Russian natural gas exports and the spike of natural gas prices following Russia’s Ukraine invasion.

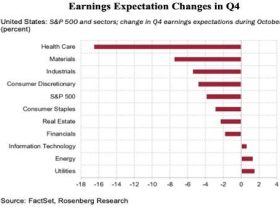

Germany’s dependence on the Chinese export market is now looking like another one of these policy errors. China’s economy is on the cusp of a Japanese-style lost economic decade in the wake of the bursting of its property and credit market bubble. According to the OECD, among the advanced economies, the German economy has the highest exposure to the Chinese economy. German exports of goods and services to China amount to around 3% of Germany’s gross domestic product, while revenue from Germany’s Chinese subsidiaries account for over 6% of Germany’s GDP.

Yet another reason to be pessimistic about Germany’s long-run economic outlook is its failure to have invested adequately in the high-tech sectors that might have reduced the German economy’s dependence on its heavy industry sector. It is estimated that the country’s investment in information technology as a share of GDP is less than half that in the U.S. or France.

As if this were not sufficient reason for pessimism, Germany is suffering from poor demographics, fractious politics, and a hawkish European Central Bank resorting to high interest rates to regain inflation control. A rapidly aging population will put a heavy burden on the country’s public finances while its fractious coalition politics makes it unlikely that the government will adopt the much-needed economic reforms to revitalize the economy and to restore investor confidence in the country’s economic management.

It would never be a good time for the euro zone to have its German economic growth engine fail. However, it is a particularly bad time for this to happen when high inflation is forcing the ECB to slam on the monetary policy brakes and when the euro zone’s economic periphery in general, and Italy in particular, is more indebted today than it was at the time of the 2010 Eurozone sovereign debt crisis.

All of this has to raise questions as to whether the Federal Reserve is doing us a service by not paying sufficient attention to the deteriorating external economic environment. It was striking that in his recent Jackson Hole speech, Fed Chair Jerome Powell did not as much mention the deepening Chinese economic crisis. Hewing to an aggressive monetary policy stance at a time of world economic weakness could exacerbate economic problems abroad that may negatively impact U.S. financial markets and our economy.

Guest commentaries like this one are written by authors outside the Barron’s and MarketWatch newsroom. They reflect the perspective and opinions of the authors. Submit commentary proposals and other feedback to ideas@barrons.com.

Read the full article here

Leave a Reply