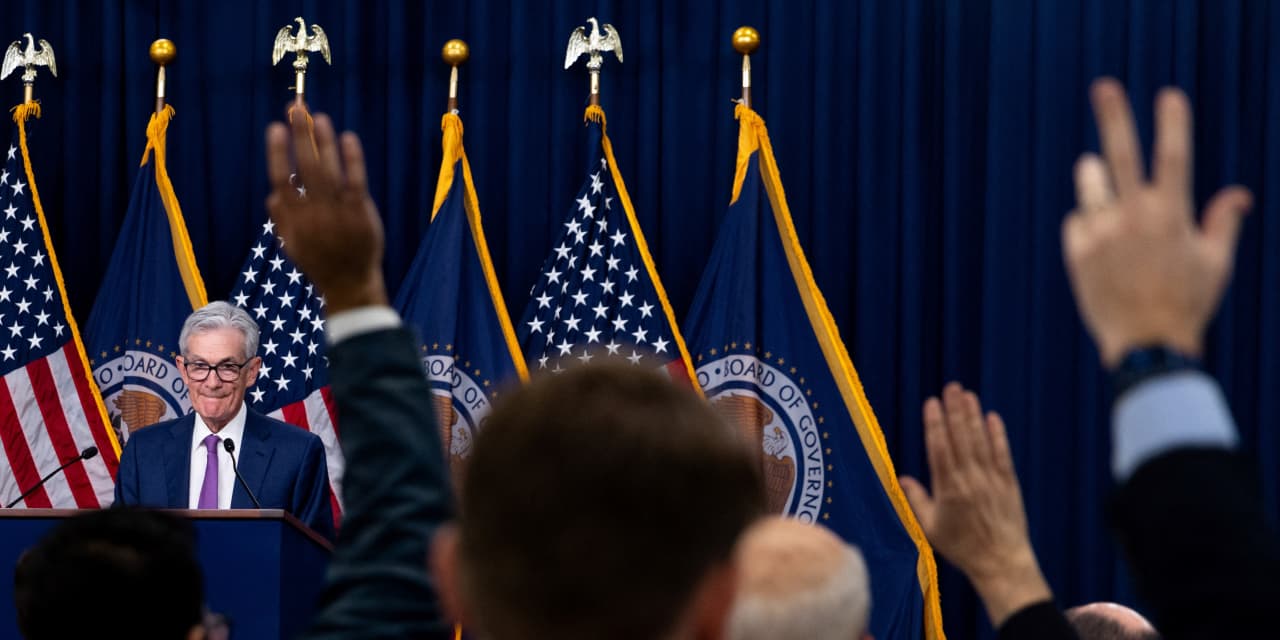

Another batch of strong U.S. economic data coupled with weekend remarks from Federal Reserve Chairman Jerome Powell shook financial markets on Monday, sending long-term Treasurys to their biggest two-day losses since at least 2022.

Investors and traders aggressively sold off 2-year notes

BX:TMUBMUSD02Y

through 30-year bonds

BX:TMUBMUSD30Y,

pushing their corresponding yields higher by 10 basis points or more each on the day. The policy-sensitive 2-year rate finished at an almost two-month high. Meanwhile, the benchmark 10-year rate

BX:TMUBMUSD10Y

and its 30-year counterpart ended at their highest levels since Jan. 24-26, and have jumped by the most in the past two trading sessions since June 2022 and March 2020, respectively.

Monday’s bond-market selloff, which also sent the iShares 20+ Year Treasury Bond ETF

TLT

into its worst two-day stretch since September 2022, was triggered by a return of the “higher-for-longer” theme in interest rates and expectations for fewer-than-expected rate cuts this year. Stocks got hit hard, with the Dow Jones Industrial Average

DJIA

falling by as much as 434 points before paring its decline to 274.30 points at the end of trading.

Amid the dual selloff in equities and U.S. government debt, fed funds futures traders clung to a 55% likelihood of at least five quarter-point interest-rate cuts from the Fed by year-end. In other words, traders aren’t entirely abandoning the idea of 2024 rate cuts, just bracing for fewer of them than they previously thought.

“How long is the path of higher for longer? That’s what the market is trying to put its finger on,” said Rob Daly, who oversees about $4.5 billion in fixed-income assets for Glenmede Investment Management in Philadelphia. Traders are trying to find “a happy equilibrium” between the “higher-for-longer” theme and expectations for fewer rate cuts than the six quarter-point reductions they had expected.

As recently as a week ago, fed-funds futures were trading at levels that implied a 53% likelihood of at least six rate cuts by December, according to the CME FedWatch Tool. Now, traders are taking one of those cuts out of the picture.

Monday’s data from the Institute for Supply Management and S&P Global showed business conditions did better than expected and economic activity continued to expand during January. This follows Friday’s surprising nonfarm payroll gain of 353,000 for last month and Powell’s weekend interview on “60 Minutes,” in which he said policymakers can be careful about deciding when to cut rates from their current level of between 5.25%-5.5%.

Read: Powell tells ’60 Minutes’ the economy’s strength allows Fed to be careful about rate cuts

Via phone on Monday, Daly said he now expects the first Fed rate cut to arrive in June, and that he’s preparing for two or three cuts this year versus his previous guess of three or four moves. Meanwhile, Fed policymakers have penciled in three quarter-point reductions for this year.

“All’s well, for now,” said Subadra Rajappa, head of U.S. rates strategy for Société Générale. “With relatively strong data and the disinflationary trend intact, the Fed has the luxury of not rushing into cuts.”

Read the full article here

Leave a Reply