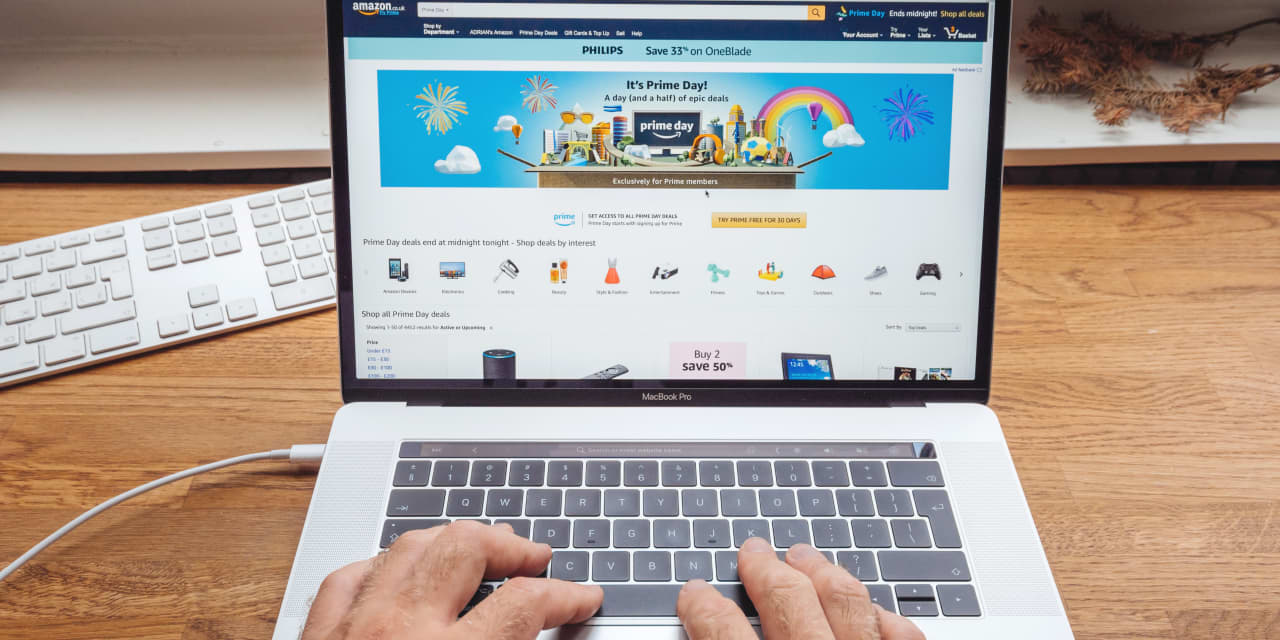

Amazon.com

has been accused by the Federal Trade Commission of using a secret price-raising algorithm and destroying internal messages. It’s the latest development in the FTC’s crucial antitrust lawsuit against the retail giant.

Amazon

(ticker: AMZN) is fighting a monopoly lawsuit brought against it by the FTC under its chair Lina Khan and 17 states. The details of the case come from parts of the FTC’s original complaint filed in September, that were unredacted on Thursday.

The FTC alleges that Amazon’s “anticompetitive conduct” includes anti-discounting measures that punish sellers and deter other online retailers from offering prices lower than its own. The company has said the accusations are inaccurate.

The unredacted details give more insight into the allegations, including that Amazon generated more than $1 billion in extra profit from an algorithm known as ‘Project Nessie’ which was designed to test what price raises it could get competitors to follow and was used from 2014 to 2019.

The FTC alleged that the”sole purpose” of the algorithm was to manipulate prices in the wider market and that Amazon paused its use when it feared public scrutiny.

Amazon spokesman Tim Doyle said the FTC’s complaint “grossly mischaractizes” the use of the algorithm.

“Nessie was used to try to stop our price matching from resulting in unusual outcomes where prices became so low that they were unsustainable. The project ran for a few years on a subset of products, but didn’t work as intended, so we scrapped it several years ago,” Doyle said in an emailed statement to Barron’s.

The lawsuit against Amazon is a crucial test for the FTC under the leadership of Khan, who first rose to prominence after writing a law-review article while a student at Yale Law School that argued antitrust law had failed to restrain Amazon.

Analysts have examined the prospect of a breakup of Amazon but stockholders seem unconcerned for now. Amazon shares were broadly flat in premarket trading on Friday at $138.13 and the stock is slightly up from where it traded when the FTC lawsuit was first filed.

Any prospective separation of Amazon could revolve around splitting its own retail operation and its third-party retail or marketplace platform. The FTC’s lawsuit cited internal documents showing that Amazon executives acknowledged there was a “punitive aspect” to its requirements on third-party sellers.

The face-off between the FTC and Amazon has placed third-party sellers on the fence, according to Yoni Mazor, chief growth officer of GETIDA, which provides services for sellers on Amazon.

“On one hand, [third-party sellers] are inclined to embrace any potential cost reductions Amazon may undertake, which could bolster their operating margins. On the flip side, they are wary of the prospect of Amazon’s fragmentation, as it could erode the e-commerce giant’s mass appeal among consumers,” said Mazor.

The FTC also alleged that Amazon attempted to thwart its investigation into the company’s business practices by using messaging app Signal, which can automatically delete messages, to destroy more than two years’ worth of communications despite being instructed not to do so.

“Amazon voluntarily disclosed employee Signal use to the FTC, painstakingly collected Signal conversations from its employees’ phones, and allowed agency staff to inspect those conversations even when they had nothing to do with the FTC’s investigation,” Amazon’s Doyle said.

Write to Adam Clark at adam.clark@barrons.com

Read the full article here

Leave a Reply