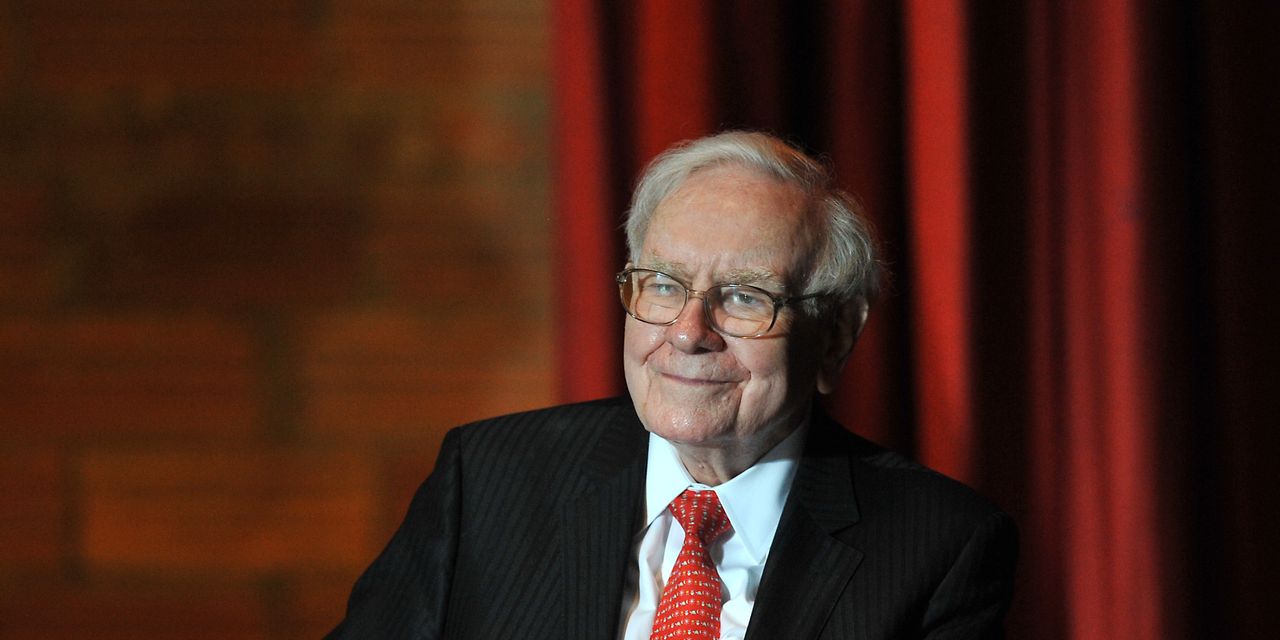

Warren Buffett, the CEO of Berkshire Hathaway, is world famous and a closely watched market force. Berkshire is a big shareholder of Apple, one of the seven big tech companies that currently dominate the U.S. stock market. It also recently made big bets on Japanese trading companies, just as the Japanese stock market roared back to life, and Occidental Petroleum, helping to popularize a new financial model for U.S. shale producers.

But Buffett is also exceptionally candid when communicating with investors. Nobody has done more to explain how the nuts and bolts of various large businesses work, or don’t work. Buffett’s management style has been an outstanding success for decades and yet he doesn’t shy away from talking about his less successful business ventures and the mistakes he has made.

Buffett lands on The MarketWatch 50 list of the most influential people in markets. The list is composed of people whose actions move the prices of stocks and bonds, but also includes people who influence the behavior and strategies of market participants. Buffett does both. And at age 93, Buffett’s biggest legacy may be how he has schooled others about investing.

Every year, of course, Buffett leads Berkshire Hathaway’s annual meeting in Omaha, Neb., typically on the first Saturday in May. The meetings are widely covered in the media. His company’s annual report and Buffett’s letter to shareholders are other examples of how Buffett shares information with investors and teaches them important concepts that can be widely applied.

Berkshire Hathaway is a conglomerate, with insurance and reinsurance operations at its core, but it also owns a railroad, utilities and other subsidiaries, along with a portfolio of investments in other companies. It has been an incredible platform for Buffett to educate investors.

Stock performance

Since 2001, Buffett has started his letters with comparisons of annual total returns for Berkshire Hathaway’s stock and the S&P 500

SPX,

with dividends reinvested.

But any one year is an arbitrary period. If we look at longer returns, the numbers are also interesting.

For example, Berkshire Hathaway’s Class B shares

BRK.B,

returned 83% for five years through 2021. Not bad, but during the same period, the S&P 500 returned 133%, as the giant technology stocks that make up a large portion of the index soared. Toward the end of that run, it was not unusual to find opinion pieces in the financial news indicating that maybe Buffett’s value-oriented investment style was past its time, or that recent mistakes had taken too much of a toll.

But if you took another five-year lookback at the end of 2022, you would have seen a different type of result:

Yes, Berkshire underperformed the benchmark index slightly, but it was a smoother ride. When the S&P 500 dropped 18.1% in 2022, as big tech led a downward move for stocks as interest rates shot up, Berkshire’s stock returned 4%.

That sort of performance makes it easier for an investor to resist the temptation to sell into a declining market. Trying to time the market by moving to the sideline typically ends with the investor coming back too late and missing out on a major part of the stock market recovery. A market-timing effort is likely to lower total returns over time.

Before looking at stock performance further, we need to point out that Berkshire Hathaway has two common share classes. The Class A shares

BRK.A,

closed at $533,815 on Nov. 3. These shares have never been split, which is something companies do if a share price gets high enough that many investors won’t be able to invest in them. High share prices can also keep stocks from being included in some stock indexes. For this reason and to keep voting rights concentrated among Class A shareholders, Berkshire Hathaway created its Class B shares in 1996, and the Class B shares were split 50-to-1 in January 2010. The Class B shares closed at $351.81 on Nov. 3. Each class B share has rights to dividends and other distributions to the amount of one fifteen-hundredth of a Class A share, and voting rights equal to one ten thousandth of that of a Class A share.

Here is a comparison of total returns for various periods through Nov. 3 for Berkshire and the S&P 500:

| 3 Years | 5 Years | 10 Years | 15 Years | 20 Years | 25 Years | 30 Years | |

| Berkshire Hathaway Inc. Class A | 72% | 73% | 208% | 354% | 576% | 696% | 2972% |

| Berkshire Hathaway Inc. Class B | 70% | 70% | 205% | 356% | 569% | 687% | N/A |

| S&P 500 | 36% | 74% | 199% | 509% | 511% | 511% | 511% |

| Source: FactSet | |||||||

And here is a look at average annual returns for the same periods:

| 3 Years | 5 Years | 10 Years | 15 Years | 20 Years | 25 Years | 30 Years | |

| Berkshire Hathaway Inc. Class A | 19.8% | 11.6% | 11.9% | 10.6% | 10.0% | 8.6% | 12.1% |

| Berkshire Hathaway Inc. Class B | 19.4% | 11.2% | 11.8% | 10.6% | 10.0% | 8.6% | N/A |

| S&P 500 | 10.7% | 11.8% | 11.6% | 12.8% | 9.5% | 7.6% | 9.9% |

| Source: FactSet | |||||||

Berkshire’s outperformance for three years reflects how well it held up during the broad market decline in 2022. As we look at longer periods, Berkshire shines. And if you look at the total return figures for Berkshire and the S&P 500 in the 2022 shareholder letter, you will see an average annual return from 1965 through 2022 of 19.8% for Berkshire’s Class A stock, against a 9.9% average for the S&P 500.

And that brings us to our first example of Buffett’s honesty combined with a desire to treat investors with respect through an effort to educate them.

What investors should expect

In his annual letter to shareholders for 2016, Buffett wrote that he and his longtime partner, Charlie Munger, expected Berkshire’s “normalized earnings power per share to increase every year.” (All italics in this article are Buffett’s.) The company can suffer losses from catastrophes in its insurance or reinsurance business in any year, and earnings can decline for other reasons, such as an economic slowdown.

In the same letter, Buffett wrote, “Our expectation is that investment gains will continue to be substantial – though totally random as to timing…”

That is an important lesson. When you buy companies outright or become a shareholder in other companies (Berkshire does both), you cannot expect the investments to gain value in a steady, orderly fashion.

Diversification, index funds and the importance of minimizing management fees

In the 1993 letter, Buffett had this to say about the importance of having a diversified portfolio of investments. An investor “who does not understand the economics of specific businesses [but] nevertheless believes it in his interest to be a long-term owner of American industry… should both own a large number of equities and space out his purchases.”

Then he added this fascinating comment: “By periodically investing in an index fund, for example, the know-nothing investor can actually out-perform most investment professionals. Paradoxically, when ‘dumb’ money acknowledges its limitations, it ceases to be dumb.” This lesson serves investors without necessarily doing anything to encourage them to buy shares of Berkshire Hathaway.

In the 2017 letter, Buffett described the result of a bet he made in 2007, that a group of five “funds of funds” selected by Ted Seides, who was a co-manager of Protégé Partners, an investment advisory firm, wouldn’t be able to beat the performance of the S&P 500 over a 10-year period. It may not surprise you that the low-cost index fund performed much better than any of the five funds-of-funds that were chosen. Buffett explained how highly motivated those fund managers were, especially when it came to fees.

“Even if the funds lost money for their investors during the decade, their managers could grow very rich. That would occur because fixed fees averaging a staggering 2 1⁄2% of assets or so were paid every year by the fund-of-funds’ investors,” he wrote.

And in the same letter: “Performance comes, performance goes. Fees never falter.”

Going back to the 2016 letter, Buffett wrote: “Human behavior won’t change. Wealthy individuals, pension funds, endowments and the like will continue to feel they deserve something ‘extra’ in investment advice. Those advisors who cleverly play to this expectation will get very rich. This year the magic potion may be hedge funds, next year something else. The likely result from this parade of promises is predicted in an adage: ‘When a person with money meets a person with experience, the one with experience ends up with the money and the one with money leaves with experience.’”

“Charlie and I are not stock-pickers; we are business-pickers.”

Buffett wrote the above in the 2022 letter, adding that his job and Munger’s was to manage the savings of their shareholders by purchasing entire companies and shares of other companies to become passive co-owners of other businesses. They want both types of businesses to have “long-lasting favorable economic characteristics and trustworthy managers.”

They take concentrated bets, which runs counter to the diversification of an index fund. Going back to the 1993 letter, after pointing out the advantages of index funds to non-professional investors, Buffett wrote: “On the other hand, if you are a know-something investor, able to understand business economics and to find five to ten sensibly-priced companies that possess important long-term competitive advantages, conventional diversification makes no sense for you.” He went on to suggest that rather than diversifying further, such an investor might be best served by investing more in the “top choices,” or companies that are most easily understood and “present the least risk, along with the greatest profit potential.”

Buffett “has expounded over the years on the value not of diversifying but of concentration,” said Adam J. Mead, author of the book “The Complete Financial History of Berkshire Hathaway,” which details the full history of how Buffett transformed a textile manufacture into an insurance company and then a conglomerate. “You can look at Berkshire Hathaway’s history from Buffett’s tenure, 1965 through the present day, as a series of very large bets.”

For the wholly-owned businesses, Buffett tends to leave the management teams in place, trusting those experts to continue operating the units properly, and only stepping in if he needs to. This style also reduces expenses on the conglomerate level.

Insurance float

An insurance company collects premiums and invests them with the aim of covering any needed claim payouts and earning additional profit. Insurance underwriting is both a science and an art, as companies set premium rates at appropriate levels, when taking risk expectations and investment needs into account, while also considering what competitors are doing.

The premiums that an insurer can invest are called “float” by Berkshire’s management team. Buffett explained in his most recent letter that Berkshire’s float increased to $164 billion at the end of 2022 from $147 billion a year earlier, in part because of the acquisition of Allegheny Corp. Float isn’t reflected on the company’s balance sheet, because “it will eventually go to others,” as Buffett explained on page A-2 of Berkshire’s annual report for 2022.

Mead described the $164 billion in float as “better-than-free money that Berkshire gets to invest on its behalf” Even though the money isn’t Berkshire’s, “because of its revolving nature, it functions like equity capital,” he said.

In the annual report Buffett described an advantage to Berkshire over other insurers. Because Berkshire has so much cash of its own on hand, the company has “far more investment flexibility than is generally available to other companies in the industry,” he wrote.

And Mead made another interesting point about Berkshire’s insurance underwriting – the company doesn’t push too hard to compete on price.

According to Buffett (in the annual report), “Disciplined risk evaluation is the daily focus of our insurance managers, who know that the rewards of float can be drowned by poor underwriting results. All insurers give that message lip service. At Berkshire it is a religion, Old Testament style.”

As a very large property and casualty insurer, Berkshire will take “very big” losses when catastrophe strikes, Buffet warned in the 2022 annual report. But he added that “handling the loss will not come close to straining our resources, and we will be eager to add to our business the next day.”

Corporate game-playing with accounting language

Companies with poor earnings performance may focus in their financial press releases on items that don’t conform to generally accepted accounting principles (GAAP). Here is Buffett’s opinion of this ever-growing practice from his 2001 letter: “Bad terminology is the enemy of good thinking. When companies or investment professionals use terms such as ‘EBITDA’ and ‘pro forma,’ they want you to unthinkingly accept concepts that are dangerously flawed. (In golf, my score is frequently below par on a pro forma basis: I have firm plans to ‘restructure’ my putting stroke and therefore only count the swings I take before reaching the green.)”

Investment-banking leeches

Berkshire Hathaway’s website is another example of Buffett’s direct and unvarnished communication to investors. There is no wasted space, graphics or fluff – only links to important items, including regulatory filings, company press releases, websites of subsidiaries, annual reports and Buffett’s letters.

You can also read the letters in book form, in various electronic and printed formats.

On the main Berkshire Hathaway website, there is a link on the left, called “Special Letters from Warren & Charlie RE: Past, Present and Future.”

Buffett’s letter includes gems you might think about as you read the financial media’s coverage of mergers, acquisitions and spin-offs. He has argued that investment bankers like to push acquiring companies to pay big premiums over market prices for publicly-traded businesses by talking about how the premium is justified for the “control value” and the amazing things that will occur once the acquiring CEO takes over. But Buffett points out the bankers are in the business of ginning up deal fees.

“A few years later, bankers – bearing straight faces – again appear and just as earnestly urge spinning off the earlier acquisition in order to ‘unlock shareholder value.’ Spin-offs, of course, strip the owning company of its purported ‘control value’ without any compensating payment. The bankers explain that the spun-off company will flourish because its management will be more entrepreneurial, having been freed from the smothering bureaucracy of the parent company.”

Going back to 1982, Buffett had this advice to potential acquirers communicating with investment bankers: “Don’t ask the barber whether you need a haircut.”

Cash dividends

Buffett has emphasized the importance of dividends received from Berkshire’s stock investments over the years. For example, in the 2022 letter, he wrote that the company had “essentially” completed its purchase of shares of American Express Co.

AXP,

in 1995, and that annual dividends from this holding had increased to $302 million from $41 million.

Berkshire reports its stock holdings every quarter. Here are its largest 10 stocks held as of June 30, with estimated annual dividends:

| Company | Ticker | June 30 value | Shares held as of June 30 | Annual dividend rate | Estimated annual dividends |

| Apple Inc. |

AAPL, |

$177,591,247,296 | 915,560,382 | $0.96 | $878,937,967 |

| Bank of America Corp. |

BAC, |

$29,632,524,052 | 1,032,852,006 | $0.96 | $991,537,926 |

| American Express Co. |

AXP, |

$26,410,583,940 | 151,610,700 | $2.40 | $363,865,680 |

| Coca-Cola Co. |

KO, |

$24,088,000,000 | 400,000,000 | $1.84 | $736,000,000 |

| Chevron Corp. |

CVX, |

$19,372,950,883 | 123,120,120 | $6.04 | $743,645,525 |

| Occidental Petroleum Corp. |

OXY, |

$13,178,796,490 | 224,129,192 | $0.72 | $161,373,018 |

| Kraft Heinz Co. |

KHC, |

$11,560,036,039 | 325,634,818 | $1.60 | $521,015,709 |

| Moody’s Corp. |

MCO, |

$8,578,175,206 | 24,669,778 | $3.08 | $75,982,916 |

| HP Inc. |

HPQ, |

$3,714,461,041 | 120,952,818 | $1.05 | $127,000,459 |

| DaVita Inc. |

DVA, |

$3,626,521,918 | 36,095,570 | $0.00 | $0 |

| Source: Berkshire Hathaway filings | |||||

Buybacks

When a company repurchases its shares, it lowers the share count, which raises earnings per share. Buying back shares can also mitigate the dilution caused by the handing out of newly created shares to executives. The rising earnings per share from buybacks can also support a rising share price over time. But Buffett believes these reasons alone aren’t sufficient reasons to repurchase. He explains that shares should only be repurchased if they are trading “well below intrinsic value, conservatively calculated,” and explained the good and bad of buybacks in great detail in his 1999 letter.

No, he wasn’t too late with Apple and he can still move the needle with deals

Macrae Sykes manages the Gabelli Financial Services Opportunities ETF

GABF,

which had 7.4% of its portfolio invested in Berkshire as of June 30. He attends the Berkshire annual meeting each year and participated in this panel discussion with Mead in May:

During an interview, Sykes said, “By Buffett’s own admission, when you are talking about a $350 billion equity portfolio, to invest that is much more challenging than running a small pool of capital, which Berkshire was in earlier days.”

Then again, one might have said this about Berkshire years ago. Berkshire began to accumulate shares of Apple Inc. in 2016. And at that point, one might have thought the move to be a bit “late,” since Apple’s

AAPL,

shares had a tenfold return for 10 years through 2015, while the S&P 500 had a 102% return.

Now Apple is Berkshire’s largest stock holding, by far, and generates nearly $879 million in annual dividends for the conglomerate.

Berkshire began loading up on shares of Occidental Petroleum Corp.

OXY,

in the third quarter of 2019. Now Berkshire has a 25.13% ownership position in the oil producer, according to FactSet.

Mead said that Buffett doesn’t rush to jump on the bandwagon, but “will sit, watch and learn. With a stock that has a business that can compound exponentially, you can be late to the game and do extremely well.”

Mistakes

All investors make mistakes and can benefit from trying hard to take emotion out of their investment decisions. For example, if you buy a stock which declines significantly in value, should you wait for it to recover, or have you identified something better that may rise more quickly than the first stock might recover?

Buffett writes about mistakes he has made in every letter. He also emphasizes the importance of avoiding “major mistakes.”

If he later thinks he overpaid for an acquisition, he admits it and shares the lesson learned. In his 2014 letter, for example, Buffett wrote that among Berkshire’s portfolio of subsidiary companies there were some poor performers. This was “the result of some serious mistakes I made in my job of capital allocation. I was not misled: I simply was wrong in my evaluation of the economic dynamics of the company or the industry in which it operates,” he wrote.

Nobody, not even Buffett, is perfect.

Read the full article here

Leave a Reply