Chrysler-parent Stellantis reached a deal with the United Auto Workers to end a six-week strike just days after Ford Motor came to a tentative agreement with the union, according to multiple media reports.

General Motors

(ticker: GM) doesn’t have a deal and negotiations are continuing, according to those familiar with talks. A deal is expected soon now that both

Ford

(F) and

Stellantis

(STLA) have reached tentative agreements.

Details of the Stellantis deal were not immediately known.

The Ford contract, announced Wednesday night, includes a wage increase of 25% over the course of four-plus years, with a lot of that, about 11%, coming in year one, a cost-of-living adjustment, and the right to strike over plant closures. The UAW will provide additional details Sunday and members will vote on the deal at a later date. If workers vote the deal down, leadership will go back to the negotiating table.

Ford’s agreement serves as a template for the separate contracts with Stellantis and GM. Each company has their own contract with the UAW, which means the same negotiation and voting process will happen with each auto maker.

What the deal means for the auto makers is still being determined.

Ford CFO John Lawler said on a call with media that the deal adds hundreds of dollars to the cost of a car. Hundreds of dollars per vehicle is significant. Ford, in its gasoline-powered car business called Ford Blue, made roughly $2,000 per unit in the third quarter. But pricing, productivity, and the economy all impact profitability.

Deutsche Bank analyst Emmanuel Rosner estimates that the new contract will raise costs by roughly $1 billion for each auto maker in year one. Over the course of the entire contract, it adds roughly $20 billion in costs, or $6.7 billion per year for all three, or about $1.7 billion per year per auto maker.

The Detroit-Three auto makers reported 2022 North American operating profit of roughly $30 billion in 2022. The $6.7 billion figure is more than 20% of that amount. It will be up to management to offset that cost headwind.

Rosner’s math is only an estimate based on limited details. Much of the impact will be learned once the companies brief Wall Street.

For that reason, it’s too early to say that auto makers were losers in negotiations. Wages are rising at auto makers across the country, and the increase was expected.

UAW, however, appears to be a clear winner. The double-digit wage increase is substantial, even if it was short of the 40% initially requested.

Members gave up billions in annual wages and benefits starting in 2007 when the Detroit-Three auto makers were in crisis. Ford and GM lost a cumulative $100 billion between 2005 and 2009. (Stellantis is excluded because mergers and corporate restructuring make comparability nearly impossible.)

Barron’s estimates, using Federal Reserve data, that the wages ceded by the union saved the Detroit Three about $2 billion a year on average since 2007. The givebacks and restructuring by management have put the three auto makers on much better financial footing.

Over the past decade, GM and Ford, combined, have generated roughly $10.5 billion in operating profit a year, with a profit margin of 4%. In the 10 years leading into the 2008-2009 financial crisis, those numbers were about $3 billion a year, with a margin of 1%.

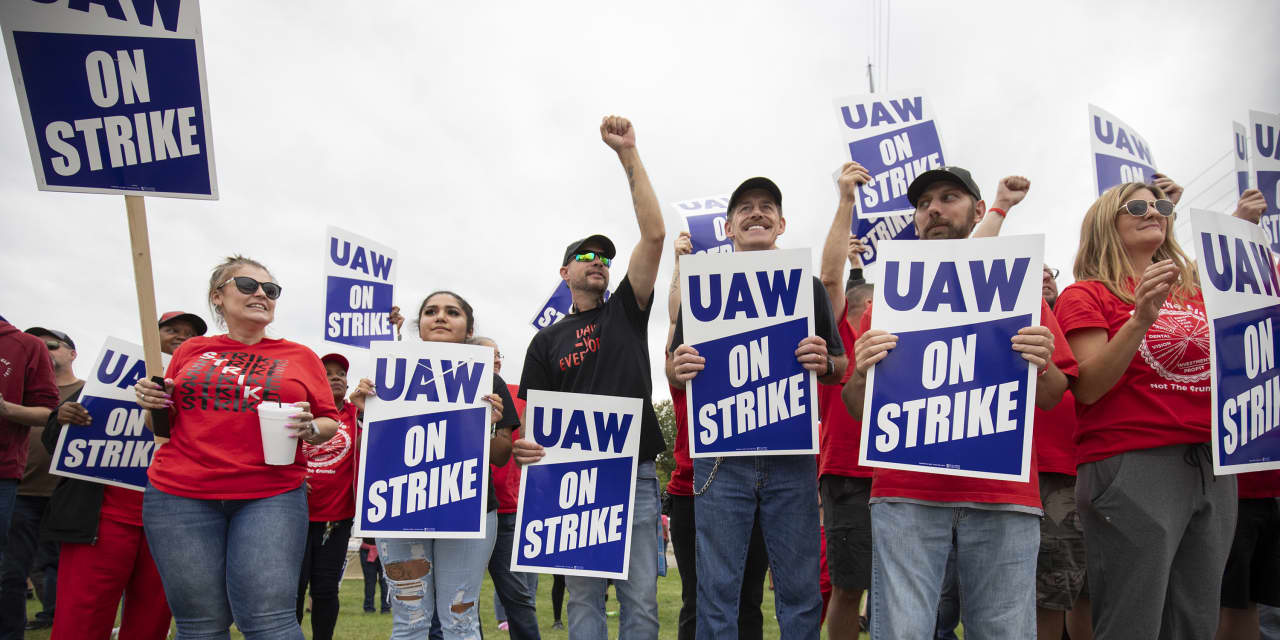

The strike at the Detroit-Three auto makers began on Sept. 15. This week, it surpassed the length of the 2019 walkout. That strike targeted GM; the UAW targeted all three auto makers at once in this negotiation.

The labor unrest has weighed on investor sentiment. Through the end of Friday’s trading, Ford and GM shares were down about 34% and 29%, respectively, since the start of July when contract issues came to the forefront. The

S&P 500

is down about 7% over the same span.

Shares of Stellantis, a more global company, are up about 3% over that time.

The drop in share price can’t be blamed entirely on the strike, either. Ford stock dropped 12% on Friday after reporting disappointing third-quarter earnings.

Shares of non-union car maker

Tesla

(TSLA) are down 21% over the same span. The EV maker could be seen as a winner from these negotiations due to its relatively lower labor costs. But Tesla has other issues to deal with. On Oct. 18, Tesla reported disappointing earnings and CEO Elon Musk lamented the impact of higher interest rates on vehicle affordability.

Write to Al Root at allen.root@dowjones.com

Read the full article here

Leave a Reply