Key News

Asian equities had a strong day as Japan, South Korea, and Hong Kong outperformed, while India and Thailand were rare underperformers.

We have previously stated that the Shanghai Composite’s level of 3,100 and the Shenzhen Composite level of 1,900 were lines in the sand for Chinese policymakers. Jawboning of the market higher, stimulus measures were announced in August when these levels were breached, with repeated measures having been rolled out since then. Today, we saw Central Huijin Investment Ltd., an arm of China’s sovereign wealth fund, a member of the proverbial “National Team”, increase its stakes in four Mainland listed Chinese banks: the Bank of China, which gained +3.18%, the Agricultural Bank of China, which gained +0.55%, ICBC, which gained +2.54%, and China Construction Bank, which gained +2.68%. As we’ve stated before, the Chinese government is telling you to buy stocks. Today, they put their money where their mouth is. Yes, it was only $68 million, though they stated their positions would be increased over the next six months. Central Huijin last publicly bought stocks in August 2015 after the Mainland’s margin debt-driven bubble burst. Their entry point was a short-term low, though it took time for all those margin positions to be unwound. Still, their entry point was profitable.

The banks are big weights in Mainland indices and thus have an outsized role in the index levels. Central Huijin has stakes in more than one hundred publicly traded stocks, including Kweichow Moutai, Wuliangye, and Midea. Central Huijin bought Kweichow Moutai in August 2015 at RMB 180 compared to today’s price of 1,786, according to a Mainland media source. Foreign investors piled into Mainland stocks via Northbound Stock Connect with $906 million worth of net buying. Hong Kong ripped higher on high volumes, as advancers outpaced decliners including today’s most heavily traded stocks by value, which were China Construction Bank, which gained +5.63%, Tencent, which gained +1.8%, and Meituan, which gained +1.63%. We did see the large buying of Hong Kong-listed ETFs from earlier this week reversed via selling. We still don’t understand the big swings in Hong Kong-listed ETFs via Southbound Connect.

There were further signs of US-China diplomatic relations improving overnight as China extended and the US accepted an invitation to an Asian military forum being held in Beijing. Last week, I failed to mention that China appears to have helped release the US soldier who defected to North Korea (he was supposed to return to the US to face charges against him).

CNY and the Asia dollar index gained versus the US dollar overnight, which also helped markets.

Japanese retailer Fast Retailing, which is known for its Uniqlo brand, reported that Greater China fiscal year revenue increased +15.2% year over year to 620.2 billion yen and operating profit +25% YoY to 104.3 billion yen. The company stated: “While sales in the region struggled in the first half due to COVID-19, performance recovered to a greater degree than expected in the second half, which resulted in a record full-year performance.” The company had a great year, with Japan, Europe, the US, and other regions reporting strong results.

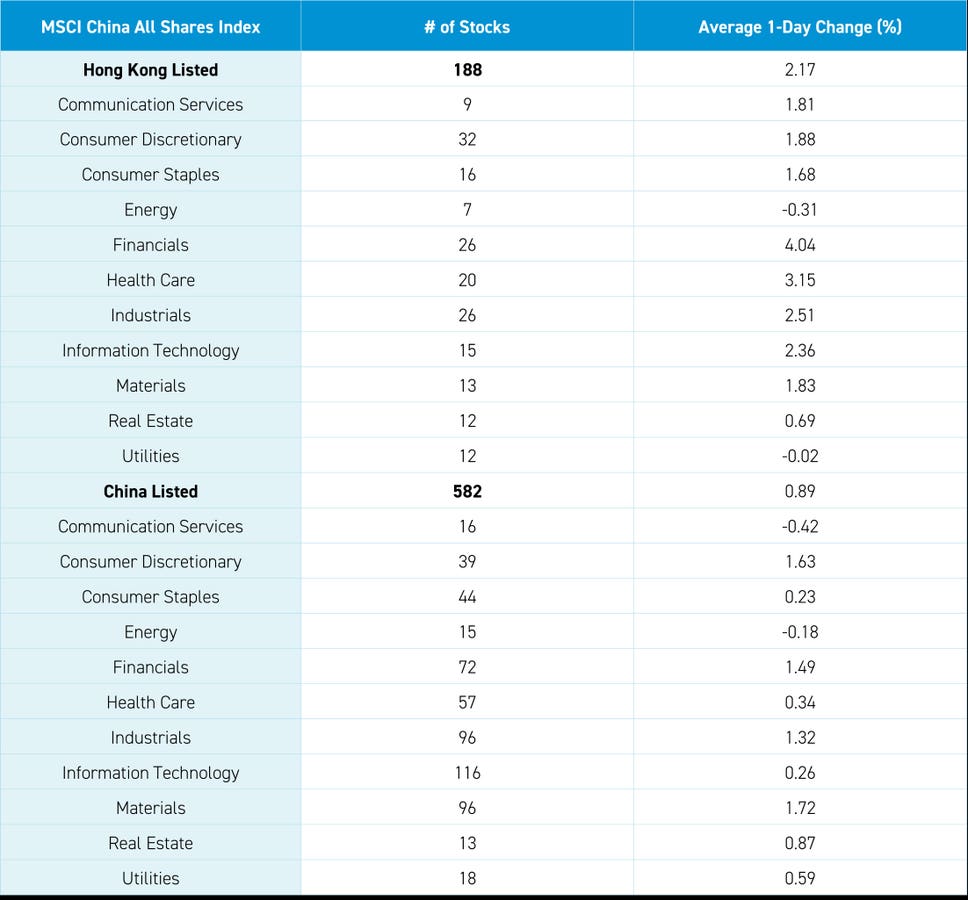

The Hang Seng and Hang Seng Tech indexes gained +1.93% and +1.68%, respectively, on volume that increased +13.88% from yesterday, which is 89% of the 1-year average. 371 stocks advanced, while 116 declined. Main Board short turnover increased +23.35% from yesterday, 92% of the 1-year average, as 17% of volume was short turnover (remember Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). Growth and value factors were mixed as large caps outperformed small caps. The top sectors were financials +4.04%, healthcare +3.15%, and industrials +2.51%, while utilities -0.31% and real estate -0.02%. The top sub-sectors were security monitoring, anti-terrorism, and medical cosmetology, while property management, power companies, and film/television were the worst. Southbound Stock Connect volumes were moderate/high as Wuxi Bio and Hong Kong Exchanges were small net buys, while the Hong Kong Tracker ETF saw a large net outflow, and ICBC and Hang Seng H Share ETF were moderate/high net sells.

Shanghai, Shenzhen, and the STAR Board gained +0.94%, +0.72%, and +0.73%, respectively, on volume that decreased -0.86% from yesterday, which is 95% of the 1-year average. 3,123 stocks advanced, while 1,287 stocks declined. Value outperformed growth, while small caps outpaced large caps. The top sectors were materials +1.72%, discretionary +1.63%, and financials +1.48%, while communication -0.42% and energy -0.18%. Top sub-sectors included lithium mine, battery, and EV, while optical module, photolithography machine, and gold were the worst. Northbound Stock Connect volumes were moderate/high as foreign investors bought +$906mm of Mainland stocks BYD, a moderate/large net buy, China Merchants Bank, Gangfeng Lithium, and Kweichow Moutai small net buy, while Sokon, Changan Auto, and CTG Duty Free were small net sells.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.30 versus 7.30 yesterday

- CNY per EUR 7.74 versus 7.74 yesterday

- Yield on 10-Year Government Bond 2.69% versus 2.69% yesterday

- Yield on 10-Year China Development Bank Bond 2.76% versus 2.76% yesterday

- Copper Price +0.11%

Read the full article here

Leave a Reply