Guru reveals 2nd-quarter portfolio

Summary

- The guru established five new positions, including in Elevance Health and DT Midstream.

- He curbed his holdings of Alphabet

GOOGL

Omega Advisors leader Leon Cooperman (Trades, Portfolio) disclosed his portfolio for the second quarter earlier this month.

At the end of 2018, the guru converted his New York-based hedge fund into a family office structure. In a letter to clients, Cooperman, who is in his 80s, said he decided to make the change because he did not want to spend the rest of his life “chasing the S&P 500 and focused on generating returns on investor capital.” His investment strategy combines a macro view with fundamental valuations.

During the three months ended June 30, 13F filings show Cooperman entered five new positions, sold out of four stocks and added to or reduced a number of other existing investments. His most notable trades included new holdings in Elevance Health Inc. (ELV, Financial) and DT Midstream Inc. (DTM, Financial) as well as reduced bets on Alphabet Inc. (GOOGL, Financial), Chimera Investment Corp. (CIM, Financial) and Apollo Global Management

APO

Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

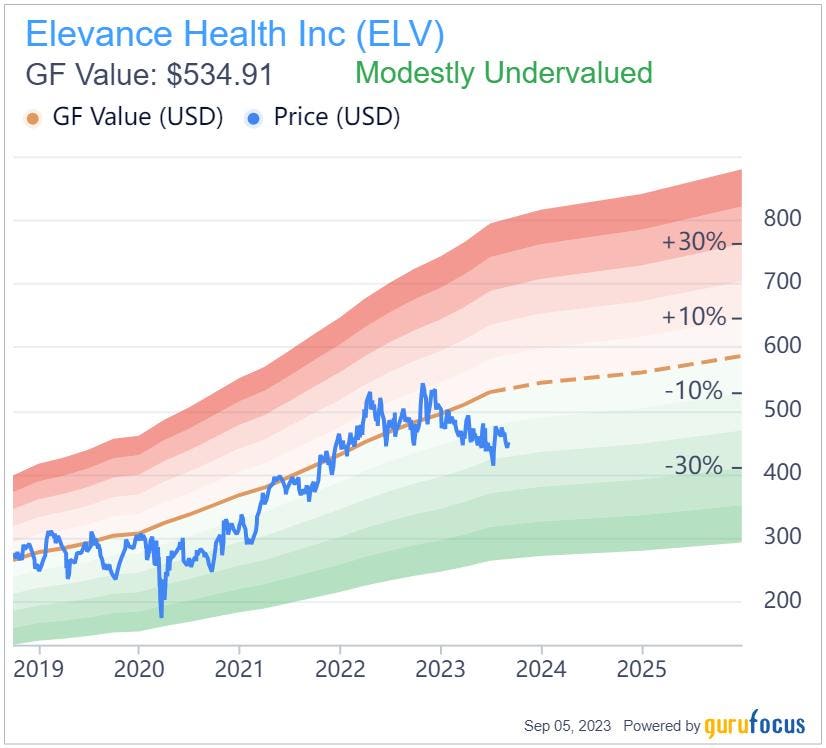

Elevance Health

The guru invested in 60,000 shares of Elevance Health (ELV, Financial), allocating 1.45% of the equity portfolio to the position. The stock traded for an average price of $461.29 per share during the quarter.

Previously known as Anthem, the Indianapolis-based health insurance company has a $106.24 billion market cap; its shares were trading around $450.84 on Tuesday with a price-earnings ratio of 16.89, a price-book ratio of 2.78 and a price-sales ratio of 0.64.

The GF Value Line

VALU

At 93 out of 100, the GF Score indicates the company has high outperformance potential. While it received high ratings for profitability, growth, value and momentum, the financial strength rank is more moderate.

Of the gurus invested in Elevance, Baillie Gifford (Trades, Portfolio) has the largest stake with 1.33% of its outstanding shares. The Vanguard Health Care Fund (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Hotchkis & Wiley and several other gurus also have notable holdings.

DT Midstream

Cooperman picked up 300,000 shares of DT Midstream (DTM, Financial), dedicating 0.81% of the equity portfolio to the holding. Shares traded for an average price of $47.87 each during the quarter.

The midstream energy company, which is headquartered in Detroit, has a market cap of $5.07 billion; its shares were trading around $52.27 on Tuesday with a price-earnings ratio of 13.76, a price-book ratio of 1.25 and a price-sales ratio of 5.51.

According to the price chart, the stock has gained nearly 25% since being spun off of DTE Energy

DTE

The GF Score of 26 also warns the company has poor performance potential. However, since it only received ratings for profitability and financial strength, its full prospects are not reflected.

With 0.31% of its outstanding shares, Cooperman is DT Midstream’s largest guru shareholder. Other top guru investors include Paul Tudor Jones (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Jefferies Group (Trades, Portfolio) and John Hussman (Trades, Portfolio).

Alphabet

The investor curbed his investment in Alphabet’s (GOOGL, Financial) Class A stock by 23.53%, selling 200,000 shares. The transaction had an impact of -1.25% on the equity portfolio. During the quarter, the stock traded for an average per-share price of $114.92.

Cooperman now holds 650,000 shares in total, which make up 4.22% of the equity portfolio. GuruFocus estimates he has gained 46.72% on the investment, which is currently his 10th-largest holding.

The communications services company based in Mountain View, California, which owns the Google

GOOG

Based on the GF Value Line, the stock appears to be fairly valued currently.

With high ratings for four of the criteria and a more moderate value rank, the GF Score of 98 means the company has high outperformance potential.

Ken Fisher (Trades, Portfolio) is Alphabet’s largest guru shareholder with a 0.34% stake. The stock is also being held by PRIMECAP Management (Trades, Portfolio), Dodge & Cox, the Harbor Capital Appreciation Fund (Trades, Portfolio), Philippe Laffont (Trades, Portfolio), Bill Nygren (Trades, Portfolio) and several other gurus.

Chimera Investment

The guru slashed his position in Chimera Investment (CIM, Financial) by 98.79%, dumping 2.51 million shares. The transaction impacted the equity portfolio by -0.88%. The stock traded for an average price of $5.31 per share during the quarter.

He now holds 30,834 shares, which occupy 0.03% of the equity portfolio. GuruFocus data shows Cooperman has lost 10.40% on the long-held investment.

The American real estate investment trust, which is invested in a diversified portfolio of mortgage assets, has a market cap of $1.34 billion; its shares traded around $5.90 on Tuesday with a price-book ratio of 0.52 and a price-sales ratio of 14.35.

While there is not enough data for a GF Value Line, the stock has gained 0.51% year to date.

The GF Score of 48 implies the company has weak performance potential on the back of a high momentum rank and low ratings for profitability, financial strength and value.

Caxton Associates (Trades, Portfolio) is now the REIT’s largest guru shareholder with 0.06% of its outstanding shares. Cooperman holds 0.01%.

Apollo Global Management

Cooperman trimmed the Apollo Global Management (APO, Financial) stake by 11.61%, shedding 213,400 shares. The transaction had an impact of -0.81% on the equity portfolio. During the quarter, shares traded for an average price of $66.81 each.

He now holds 1.63 million shares, making up 6.77% of the equity portfolio as the fourth-largest position. GuruFocus found he has gained 30.75% on the investment to date.

The private equity firm headquartered in New York has a $50.32 billion market cap; its shares were trading around $88.77 on Tuesday with a price-earnings ratio of 41.87, a price-book ratio of 6.56 and a price-sales ratio of 1.92.

According to the GF Value Line, the stock is modestly undervalued currently.

Driven by moderate to high ratings for all five criteria, the GF Score of 84 suggests the company has good outperformance potential.

Holding a 2.18% stake, Chase Coleman (Trades, Portfolio) is Apollo Global’s largest guru shareholder. Glenn Greenberg (Trades, Portfolio) and Tom Gayner (Trades, Portfolio) also have notable holdings.

Additional trades and portfolio composition

During the quarter, Cooperman also sold out of Aspen Group Inc. (ASPU, Financial) and boosted his holdings of Citigroup

C

Omega’s $1.84 billion equity portfolio, which is composed of 54 stocks, is most heavily invested in the energy, financial services and industrials sectors.

Disclosures

I/we have no positions in any stocks mentioned, and have no plans to buy any new positions in the stocks mentioned within the next 72 hours.

Read the full article here

Leave a Reply