Investors are in the fog-of-war period in the United Worker Auto battle with the Detroit-Three auto makers:

Ford Motor,

General Motors,

and Chrysler parent

Stellantis.

A lot of big numbers and claims are being thrown, painting a picture of greedy corporations and insatiable workers. The truth, as usual, likely lies somewhere in the middle.

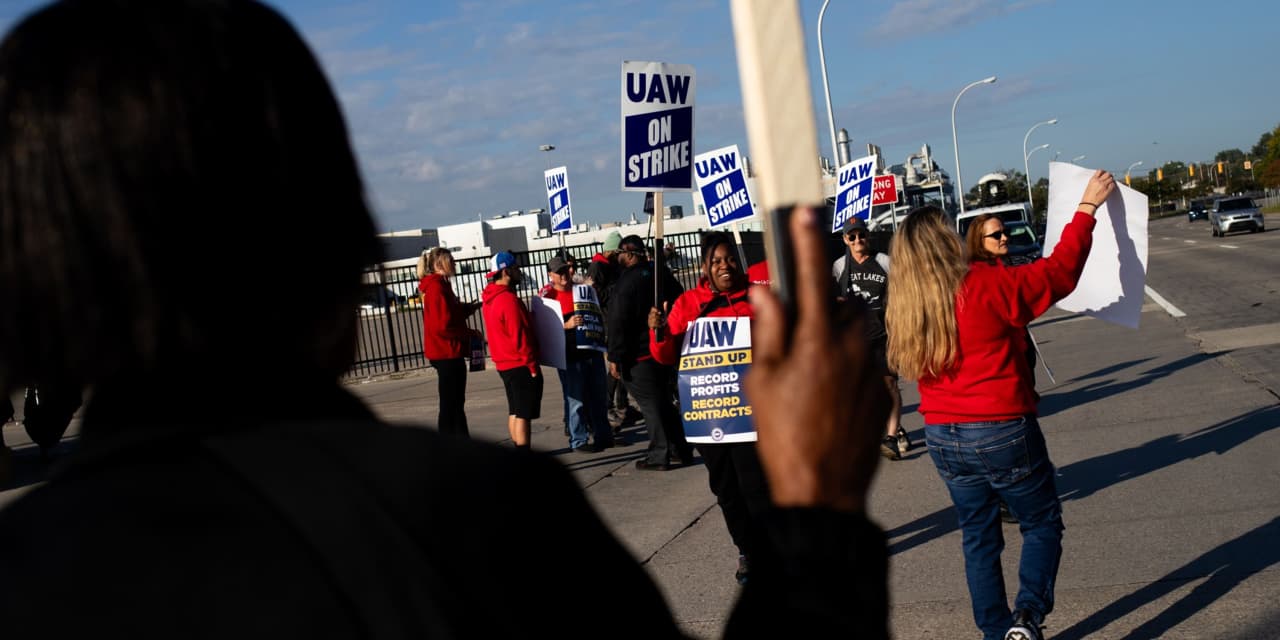

Friday, the UAW expanded its strike against the auto makers, the second expansion after walking out at three facilities, one at each auto maker, on Sept. 15. “The UAW strike debacle continues in 313,” wrote Wedbush analyst Dan Ives, referencing the area code for Detroit. It’s “like watching a slow moving car crash.”

He estimates that the union’s demand can add $3,000 to $5,000 to the price of an electric vehicle manufactured by Ford (ticker: F), GM (GM), or

Stellantis

(STLA). That is an alarmingly high number. And it’s one that is likely too high.

Ford CEO Jim Farley didn’t completely discount the number when asked to comment on a Friday media call, pointing out that worst-case scenarios were based on the union’s initial demands, which include wage increases in the range of 40%, better retirement benefits, and a 32-hour work week (while still getting paid for 40 hours).

Farley also called the UAW strike expansion “grossly irresponsible,” Friday which drew a retort from UAW President Shawn Fain claiming Farley was being dishonest about the state of negotiations.

The cost increase at $5,000 per car sold by the Detroit-Three auto makers is roughly $35 billion. The trio sold about seven million vehicles in North America in 2022. There are about 145,000 UAW members at the big three so that amounts to about 243,000 per UAW member. The entire compensation bill for the UAW, including wages and benefits, is roughly $20 billion, according to Federal Reserve numbers. That’s just shy of $140,000 a year.

The increase implies 175% increase over the life of the contract. That’s too much.

Ives tells Barron’s he is looking at only EVs and assuming the companies need to make them profitably. So the $3,000 to $5,000 range is partly an allocation issue. It’s as if all increases need to be borne by EV divisions, which isn’t likely to happen.

Wells Fargo analyst Colin Langan estimated that the difference between initial offers from the UAW and the auto makers amounted to about $1.9 billion a year, or about $300 per vehicle sold in North America. The total increase, relative to the prior contract, might be $500 a car, or about 1% of the average transaction price for a new car in the U.S.

Ford, however, doesn’t have any incentive at this point in the negotiation process to endorse small changes on new car prices from a new contract. Auto executives have also pointed out to Barron’s that rising wages have resulted in sedans being made overseas.

Ford and GM don’t make many sedans in North America anymore, but they aren’t exactly made overseas.

Toyota Motor

(TM) and

Honda Motor

(HMC) make Corollas, Civics, and Accords in North America, but not at plants represented by the UAW.

Toyota didn’t respond to a request for comment about compensation costs for hourly workers, but one investor suggested to Barron’s the amount is about $10 to $15 less per hour than what the Detroit-Three pay UAW employees.

That can be all it takes to make some product lines unprofitable. It’s why GM, Ford, and Stellantis have moved into bigger, more expensive vehicles over time, says Benchmark analyst Mike Ward. There is less labor per vehicle in a higher priced truck, such as a Ford F-150, than there is a lower priced Toyota Corolla.

The impact on an F-150 Lighting’s price from a new labor deal might not be $5,000, but the companies are right to be worried about competitiveness. The Detroit-Three have lost some 30 percentage points of market share to foreign auto makers over the past 30 years.

The U.S. auto makers can’t keep going upmarket, selling bigger vehicles forever. And they need to produce low cost EVs to compete with

Tesla

(TSLA) and

Rivian Automotive

(RIVN).

Striking a balance while EV investment is rising and while inflation has average roughly 4% a year over the duration of the last contract while wages, excluding profit-sharing, have risen closer to 1% a year is why this negotiation is so difficult.

When a deal nears, some of the numbers about wage increases and total compensation will be clearer. Investors will be able to evaluate the impact on stocks at that point.

Ford and GM shares are down about 17% and 14%, respectively, since the start of July when labor issues came to the fore. The

S&P 500

is down about 4% over the same span.

Stellantis stock is up 9%, partly because the company is more global, with headquarters in Europe. It is also a cheaper stock, trading for less than 4 times estimated 2024 earnings. GM and Ford shares trade for less than 5 times and 7 times, respectively.

Write to Al Root at allen.root@dowjones.com

Read the full article here

Leave a Reply