Ford Motor Co.’s and General Motors Co.’s stocks were higher Friday as workers kicked off a strike, but their bonds have been under selling pressure for some time.

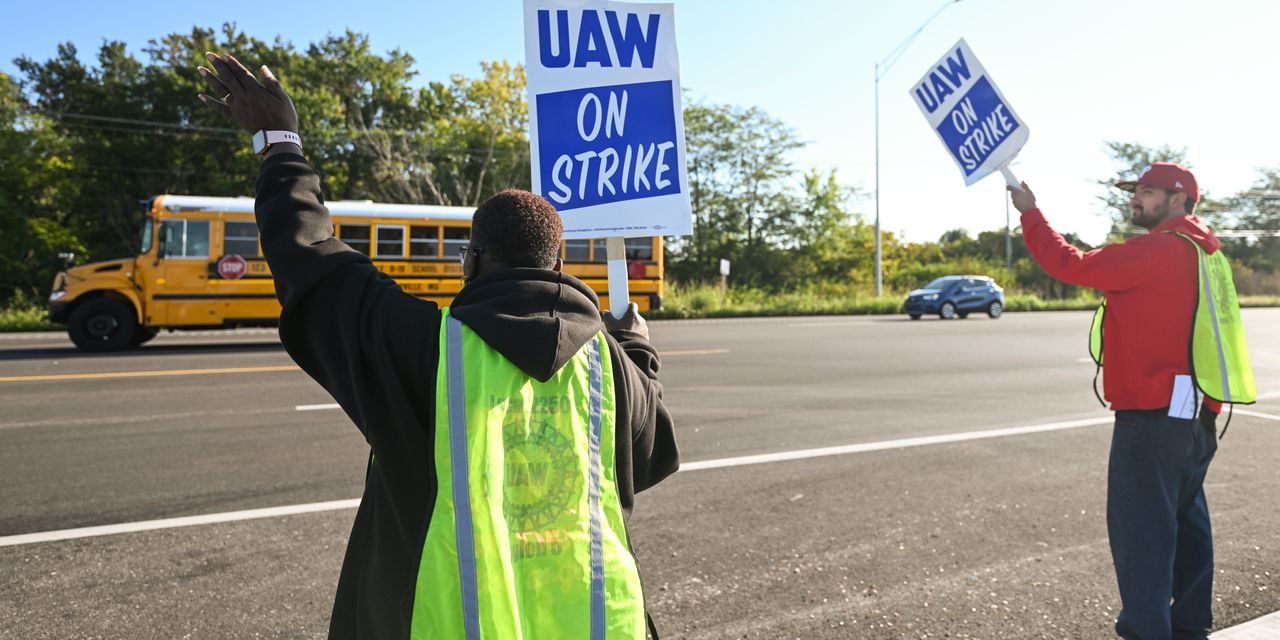

Nearly 13,000 U.S. auto workers went on strike early Friday after the three automakers and the UAW failed to reach an agreement before their national contract expired just before midnight.

The union has opted for targeted strikes, so workers at a Ford

F,

plant in Michigan and a GM

GM,

plant in Missouri were first to down tools, along with workers at a Stellantis N.V.

STLA,

plant in Ohio.

UAW President Shawn Fain has said others could join later and asked all 150,000 members to be ready if and when they’re called to strike.

The strike at all three U.S. carmakers is a break with tradition, as the union for many years has elected to center strike efforts at one company to protect its strike fund and picket-line firepower.

For more, read: UAW strike: 12,700 Ford, GM and Stellantis auto workers walk off the job

Ford’s stock was last up 0.5%, while GM was up 1.4%.

But as the following charts from data solutions company BondCliQ Media Services shows, the bonds have seen far more selling than buying over the last 10 days. Bondholders are often viewed as “smarter” than shareholders, because they tend to be laser-focused on a company’s financials and cash flows, to ensure they will be repaid their principal when bonds mature.

The next chart shows that Ford has seen more selling than GM.

Stellantis, meanwhile, was seeing strong buying of its U.S. dollar-denominated bonds. The company, the former Fiat Chrysler, has far less debt than Ford and GM.

Stellantis has about $26.5 billion of total debt, according to FactSet data, about $19.7 billion of which is in bonds.

Ford has $143 billion of debt and $124 billion of bonds. GM has $118 billion of debt, with about $107 billion in bonds, according to FactSet.

Fitch Ratings said earlier Friday the strike will have a limited financial impact on the auto makers, at least for now with just three plants striking.

“It seems likely the UAW will try to ratchet up pressure on the automakers over time by shifting the strike to more impactful plants and adding more plants to the strike,” Stephen Brown, a senior director at Fitch, said in emailed comments. “The impact on the automakers of striking individual plants could be similar to the semiconductor-induced disruptions that we saw over the past few years.”

See also: Big Three need to step up for the automotive workers who keep them profitable

Fitch had already incorporated the potential impact of strikes in its recent decision to upgrade its ratings of Ford and GM, he said. The agency moved Ford to BBB- from BB+, moving it back into investment trade from speculative, or “junk,” status.

“Ford, GM and Stellantis all have robust liquidity positions that will help them to withstand a potentially drawn-out period of production disruption. Based on June 30 figures, we estimate Ford has over $50 billion of cash and credit facility capacity, while GM has nearly $40 billion,” said Brown.

Stellantis stock was up 2.2% Friday and has gained 36% in the year to date, outperforming GM’s 1.2% gain and Ford’s 9.0% gain. The S&P 500

SPX

has gained 17% in the same time frame.

For live coverage of the UAW strikes, click here.

Read the full article here

Leave a Reply