The Questions Every Investor Should Answer

As people age, many aspects of their lives change. When it comes to money, this includes cashflow and investment issues that affect their lifestyles today as well as the quality of their future.

Just like yearly physical health check-ups, it’s important to annually evaluate your current economic situation and maintain a sound financial plan that meets your current needs and long-term monetary goals.

As a money manager with 30 years of experience, I believe an important key to a successful advisor/client relationship depends on understanding the client’s knowledge & temperament regarding money.

When I meet with prospective clients, these are the basic questions I typically ask –

1. How often do you review your personal finances?

This includes more than investment management but also tax planning, insurance coverage, employment benefits, household budgets.

I have prospective clients score themselves on:

a. Evaluating investments (individual, retirement plans, annuity funds, cash holdings, etc.)

b. Setting and adhering to household budgets.

c. Planning for purchasing expensive items (cars, houses, vacations, etc.) – savings versus credit use.

d. Disciplined approach to save money (both retirement plans & taxable accounts)

e. Review estate, gifting & charity efforts

f. Evaluating employment benefits

g. Planning for taxes over next 24 months

h. Reviewing insurance coverage (life, health, disability, property, etc.)

i. Annual meetings with family members to discuss finances.

2. How does your wealth breakdown in percentage terms?

a. Equity in a home

b. Investment real estate

c. Private business ownership

d. Retirement plans & pensions

e. Insurance (life insurance, annuities, etc.)

f. Equity investments (stocks, commodities, etf, & mutual funds)

g. Income investments (bonds, preferreds, etf & mutual funds)

h. Cash & short-term investments (CD, T bills, etc.)

i. Other (inheritance, gold, artwork, collectibles, etc.)

3. Who do you seek advice from regarding finances? Besides investment managers & wealth advisors, many people also seek financial advice from accountants, attorneys, bank & insurance representatives, family & friends.

Even in today’s digital world, most people still find their financial advisers “by word of mouth” versus searching the web.

After getting a clear picture of a prospective client’s financial landscape, it’s time to look at their investment portfolio.

4. How do you define investment success? (short & long term)

5. How did you go about determining this goal? (Long term investment statistics & considering tax implications on profits.)

6. Which investment types you are most & least comfortable with? (stocks, bonds, preferred stocks, real estate, commodities, CDs)

Last and probably most important question I need an honest answer to

7. What is your greatest fear in investing: Losing Money or Not Reaching Investment Goals?

Keep in mind there is no right answer to the questions listed above.

We are all different, and there isn’t a “money cookbook” that fits all financial situations. It’s about having a realistic assessment of your finances and communicating it to your advisors.

From my many years of experience of managing client investments in good and bad times, I have learned that people, regardless of age, education, background and personality, have different tolerances for financial risk.

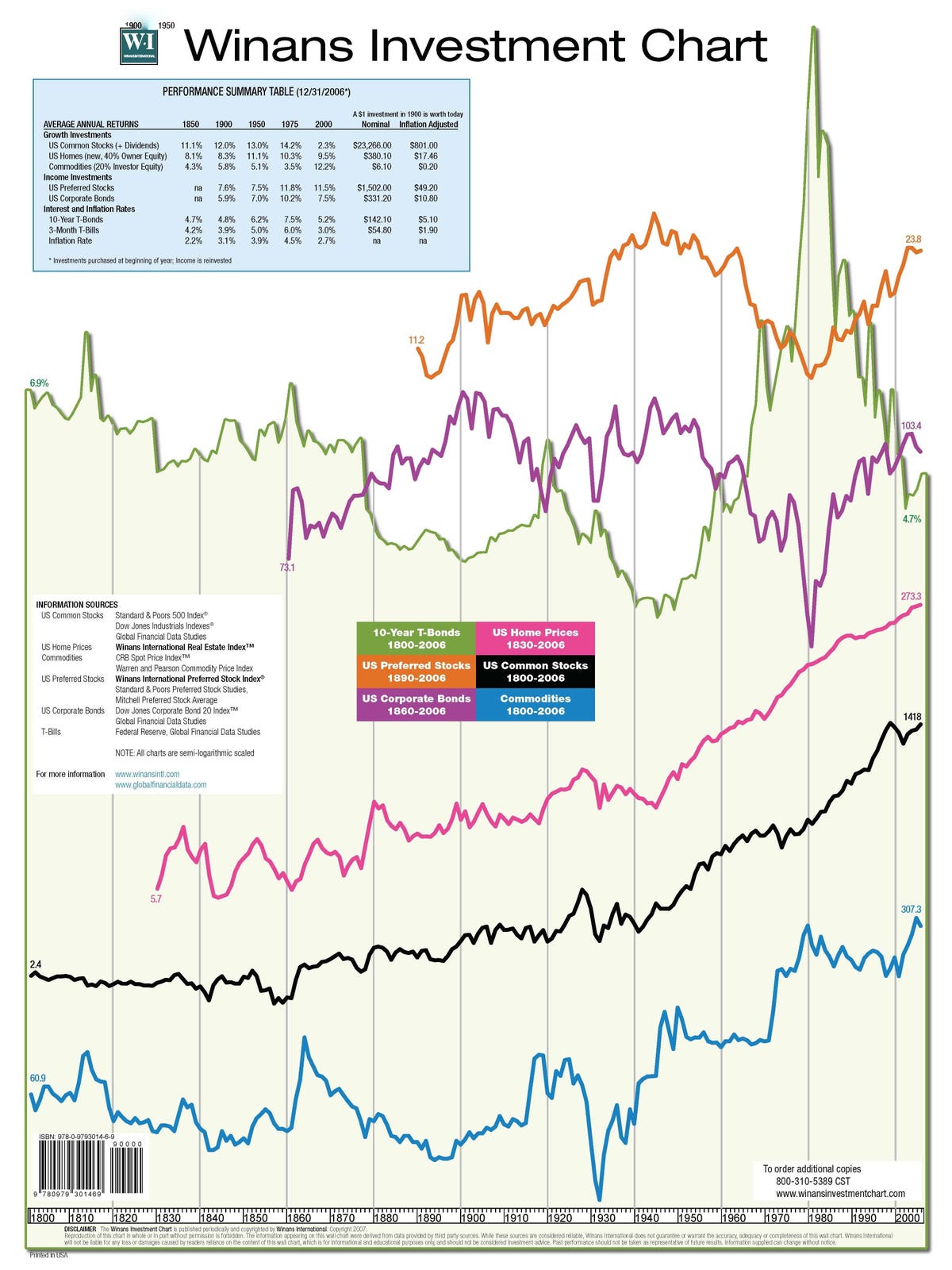

Also, there is no such thing as a “best investment” that works for everyone. What’s important to understand is that investments essentially fall into one of two categories — owning for price appreciation or loaning for investment income. Common stocks, real estate investment trusts, commodities, bonds and preferred stocks all have strengths and weaknesses.

Simply put, investors need to have a basic understanding of how these investments perform in various economic conditions. An investment portfolio must match an investor’s temperament for long-term investment success to be achieved.

The post COVID world has shifted many aspects of our lives for years to come. It’s time for your money checkup!

Read the full article here

Leave a Reply