As student loan payments resume following the formal end of the Covid-era payment pause, the Biden administration has launched what it is calling the most affordable student loan repayment plan ever. Millions of borrowers have signed up, and the Education Department is ramping up a massive outreach campaign to get more borrowers to enroll. Meanwhile, the administration is also implementing student loan forgiveness through multiple programs.

But amidst the unprecedented return to repayment, the federal student loan system appears to be buckling, with borrowers and advocacy groups reporting widespread problems.

Here’s the latest.

Student Loan Forgiveness Continues Under Biden Initiatives

The Biden administration is continuing to enact what it bills as “targeted” student loan forgiveness through a variety of initiatives, even after the Supreme Court struck down Biden’s mass student debt relief plan earlier this summer.

“The Biden-Harris Administration has already approved more than $117 billion in targeted relief for 3.4 million student loan borrowers,” said the Education Department in a statement last week. This includes $39 billion in loan forgiveness for borrowers under the IDR Account Adjustment, which is ongoing, as well as over $10 billion in loan discharges for disabled borrowers. The department has approved billions in additional student loan forgiveness for borrowers working in public service careers, and those defrauded by their schools.

The administration is also moving forward to establish a new student loan forgiveness plan to replaced the one struck down by the Supreme Court in June. Earlier this month, the Education Department announced new details on the process and timeline to develop this new program.

Student Loan Payments Resume With New Repayment Plan

Meanwhile, the Biden administration has launched a massive outreach campaign to get borrowers to enroll in the new SAVE plan, which officials are billing as “the most affordable student loan repayment plan in history.” SAVE will result in $0 payments for borrowers making under 225% of the federal poverty limit for their family size, and cut student loan payments in half for some borrowers. SAVE also has an interest subsidy that will eliminate interest accrual that exceeds a borrower’s monthly payment.

The Education Department is coordinating with over 100 organizations to spread the word about the new SAVE plan and encourage borrowers to sign up.

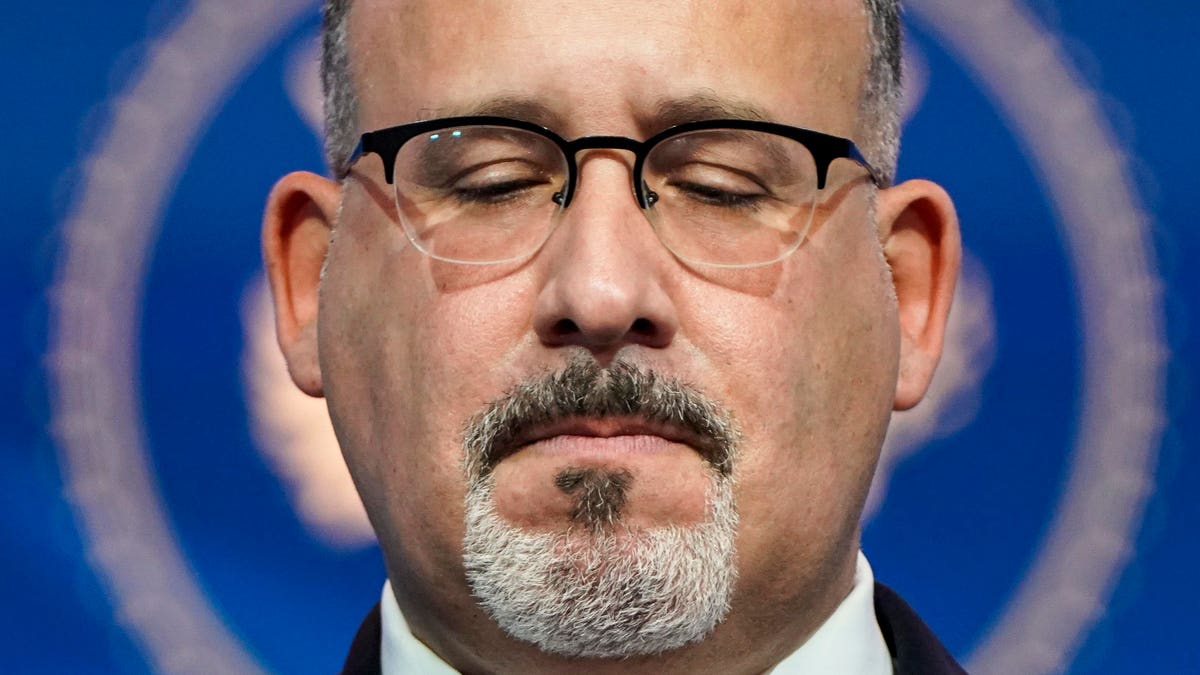

“More than 4 million borrowers are already benefitting from more affordable student loan payments under the SAVE plan, but we know there are so many more individuals and working families who stand to gain,” said U.S. Secretary of Education Miguel Cardona in a statement last week. “Our partners in the SAVE on Student Debt campaign will amplify Federal Student Aid’s outreach and communications to borrowers by working in communities across the country to encourage enrollment in the SAVE plan, which not only offers lower monthly student loan payments, but also protects borrowers from runaway interest and ever-growing balances.”

Borrowers Reporting Major Problems With Student Loan Servicing

But while the Biden administration touts its student loan forgiveness and repayment initiatives, borrowers are reporting widespread problems trying to access these programs.

The federal Consumer Financial Protection Bureau is receiving numerous reports that borrowers are experiencing extremely long call hold times when trying to reach their student loan servicers, according to a recent NPR report. A federal funding freeze has resulted in the Education Department and its contracted student loan servicers being unable to adequately staff up, even as millions of borrowers resume repayment and try to access new Biden administration student debt relief initiatives.

Last week, a coalition of student loan borrower advocacy groups launched a campaign to bring attention to the ongoing loan servicing problems, encouraging borrowers to call their loan servicers and report any problems to the CFPB.

President Biden “gave student loan borrowers’ new rights to lower payments. Student loan companies are dropping the ball,” said the Student Borrower Protection Center. In a series of tweets, the SBPC highlighted anecdotal reports of borrowers waiting on hold for an hour or longer, with some borrowers never being able to reach their loan servicers.

Other borrowers and advocates are reporting additional student loan servicing problems including miscalculated student loan payments, misleading communications, and failure to properly process paperwork and applications. So far, the problems show no sign of improvement.

Further Student Loan Forgiveness Reading

$10 Billion In Student Loan Forgiveness Approved Under Overhaul For Borrowers With Medical Issues

6 Student Loan Forgiveness And Repayment Updates As Interest Starts Accruing

Education Department Suggests More Student Loan Forgiveness Approvals This Month

Student Loan Forgiveness Update: What The Latest Court Victory Means For Borrowers

Read the full article here

Leave a Reply