What Is A Nest Egg?

A nest egg refers to the financial reserve or savings that one accumulates to use in the future, especially during retirement.

Building a nest egg ensures you can maintain your desired retirement lifestyle without the anxiety of outliving your savings. A substantial nest egg provides peace of mind, financial security, and the freedom to enjoy retirement.

Determining Your Retirement Needs

Assess Your Current Financial Situation

Start by taking a detailed look at your current finances. This includes understanding your monthly expenses, ongoing debts, and income sources. Knowing where you stand financially is the foundation of planning for future needs.

Estimate Your Retirement Expenses

While some costs, such as commuting expenses, may decrease in retirement, others could rise. Consider hobbies, healthcare expenses, and potential inflation when estimating retirement costs.

Set Retirement Goals

Determine what age you want to retire, the lifestyle you hope to lead, and any significant expenses you anticipate, e.g., traveling or buying a new home. Setting clear goals will guide your savings and investment strategies.

Strategies For Building Your Nest Egg

Start Early

One of the most powerful tools in building a robust nest egg is time, and this is where the principle of compounding comes into play.

Compound interest refers to earning interest not only on the initial amount saved but also on the accumulated interest from previous periods.

When you start saving early, even if the amounts are modest, the interest compounds over a longer duration, multiplying your savings in ways that can be genuinely transformative.

For instance, someone who starts saving in their 20s will typically accumulate more wealth by retirement than someone who starts in their 30s or 40s, even if the latter contributes more significant sums.

Maximize Contributions To Retirement Accounts

Tax-advantaged retirement accounts like IRAs and 401(k)s are among the most effective vehicles for long-term savings. The tax benefits they offer can significantly enhance net returns over time.

By consistently contributing the maximum allowable amount to these accounts each year, you not only boost your savings but also take full advantage of the tax incentives provided by the government.

Leverage Employer-Match

Many employers offer retirement plans that match a portion of the contributions made by employees. This employer match is essentially “free money” and plays a crucial role in accelerating the growth of your nest egg.

Participating fully in these employer-sponsored plans, especially contributing enough to capture any available match, can substantially increase your retirement savings. It is an opportunity that is too valuable to overlook.

Diversify Your Investments

Avoid putting all your eggs in one basket. Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can shield your nest egg from market volatility.

For instance, real estate has historically been a source of passive income and capital appreciation, while mutual funds offer diversification for those who might not have the expertise or resources to pick individual stocks.

By holding a diversified portfolio, you reduce the risk of significant losses and create opportunities for growth from various market sectors.

Protecting And Growing Your Nest Egg

Regularly Review And Adjust Your Portfolio

An active engagement with your investment portfolio is indispensable. A regular review will aid in identifying any discrepancies, unrealized potentials, or unnecessary exposures to risks.

As you journey through different life stages, your financial goals and risk tolerance naturally evolve. A younger individual might lean towards aggressive investments, while someone nearing retirement might prioritize capital preservation. Tailor your portfolio to mirror these shifts.

Minimize Investment Fees

High fees can erode your returns. Consider investment vehicles like index funds or ETFs known for cost-effectiveness and lower fees. These options can offer broad market exposure and diversification at a fraction of the cost of actively managed funds.

Moreover, do not hesitate to negotiate fees with your brokers or financial advisors. Every penny saved contributes to the growth of your nest egg.

Stay Informed

The more informed you are, the better equipped you will be to make decisions that can protect and grow your nest egg. Rely on credible sources of information to stay abreast of economic and market developments.

Consider subscribing to reputable financial journals, following trusted financial analysts, and utilizing technology to streamline the flow of information. You may also enroll in workshops and seminars.

These platforms offer insights into emerging trends, investment opportunities, and risk management strategies. They also provide an avenue for networking with other investors and financial experts.

Managing Your Nest Egg In Retirement

Transitioning From Saving To Withdrawing

During your earning years, the primary focus is consistent savings and asset growth. However, the need to structure a reliable and regular income stream from these assets becomes paramount upon retirement.

The key to this transition lies in understanding how best to tap into various income sources. For instance, some might begin with withdrawals from taxable accounts to take advantage of lower tax brackets in the early years of retirement.

Others may choose to delay Social Security benefits to maximize their monthly payouts. Making informed decisions during this transition can ensure that you optimize the longevity and utility of your nest egg.

Creating A Sustainable Withdrawal Strategy

Several factors can influence the optimal withdrawal rate, such as the overall size of the retirement portfolio, expected market returns, and the retiree’s lifespan.

A widely referenced guideline is the 4% Rule, suggesting that if retirees withdraw 4% of their portfolio in the first year and adjust it for inflation thereafter, their savings should last 30 years.

However, this is just a starting point. Given market volatility and individual circumstances, it may be prudent to reassess this percentage, perhaps considering more conservative withdrawal rates, especially in market downturns.

Consider Tax Implications And Potential Tax-Efficient Strategies

Taxes do not disappear in retirement. Withdrawals from retirement accounts, pension distributions, and even Social Security benefits could be subject to taxation, depending on one’s overall income. Hence, understanding the tax implications of various withdrawals is vital.

For example, strategically drawing down taxable accounts first can provide more time for tax-advantaged accounts to grow. Roth IRA withdrawals, being tax-free, offer flexibility in managing taxable income.

Furthermore, considering strategies like Roth conversions during low-income years can spread out tax liabilities and potentially reduce overall taxes in retirement.

Continually Monitor And Adjust Your Retirement Income Plan

Retirement is not static. Health considerations, changes in living situations, or significant global economic events can dramatically impact your financial needs and the performance of your investments.

As such, it is essential not to view retirement planning as a one-time event. Instead, retirees should commit to an ongoing process of review and adjustment. This might involve rebalancing investment portfolios, recalibrating withdrawal rates, or seeking alternative income sources to ensure a consistent income.

Regularly revisiting and adjusting your retirement income plan can help navigate the dynamic landscape of retirement and ensure financial security throughout.

Final Thoughts

Building a substantial nest egg for retirement necessitates foresight, discipline, and adaptability.

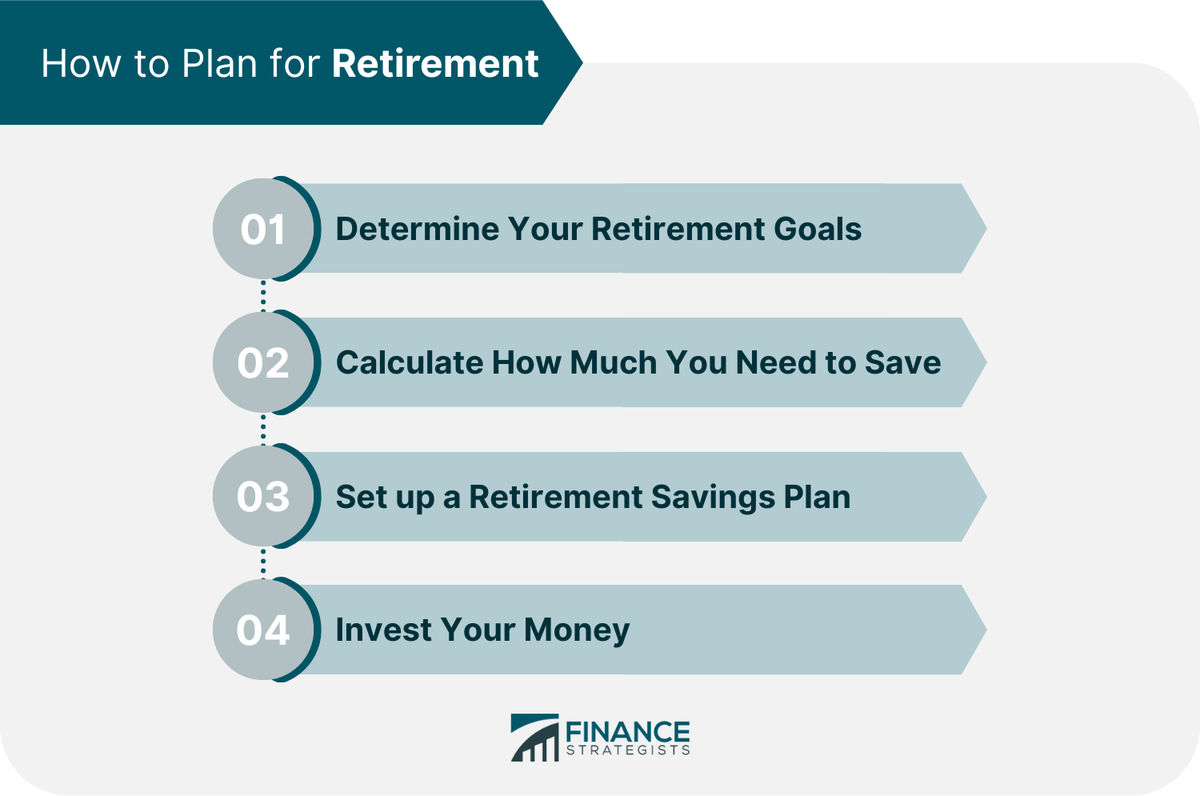

This financial cushion begins with assessing your current situation, setting retirement goals, and adopting effective strategies, such as starting early, maximizing tax-advantaged contributions, and diversifying investments.

As you near retirement, the focus shifts from saving to devising a sustainable withdrawal strategy, considering tax implications and changing financial needs.

Given the intricate nature of retirement planning, including transitions, market volatility, and individual needs, consider seeking guidance from a trusted financial advisor. Their expertise can aid you in navigating these complexities, ensuring you enjoy your retirement years with financial security and peace of mind.

FAQs

1. How can I start building my nest egg?

Begin by analyzing your current situation, setting clear financial goals, creating a budget, and saving a portion of your income regularly. Consider investing in assets like stocks, bonds, or mutual funds to grow your savings.

2. Can I rely solely on Social Security or pension for my retirement nest egg?

While Social Security or pensions can provide a base for retirement income, they may not be sufficient to cover all your expenses, especially with the rising healthcare costs and inflation. It is advisable to have a diversified retirement strategy, which includes personal savings and investments.

3. Can I withdraw from my nest egg before retirement?

While it is possible to withdraw from your nest egg before retirement, doing so may incur penalties and taxes or set back your long-term financial goals. It is essential to understand the rules and implications before making early withdrawals.

4. How can I ensure my nest egg lasts through retirement?

Develop a realistic withdrawal strategy, diversify your investments, consider longevity (how long you might live), and adjust your spending habits as needed. Regularly reviewing and adjusting your financial plan can also ensure you are on track.

5. Are there professionals who can help me with my nest egg?

Yes, financial planners, advisors, or retirement specialists can offer guidance tailored to your specific situation and goals. It is crucial to choose someone with appropriate qualifications and whom you trust.

Read the full article here

Leave a Reply