The Fed funds rate, the target interest rate at which commercial banks borrow and lend their extra reserves overnight, is expected to decrease by the end of 2024, but not by much and likely not until later in the year.

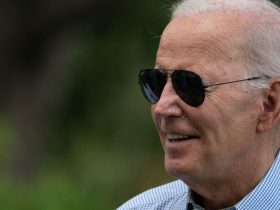

As a debt-free millionaire and personal finance educator, I shifted some of my own riskier and volatile investments to cash so that I could take advantage of high interest rates that will continue into the new year. You can do the same.

Here are four short-term vehicles that can help you grow your money without the ups and downs of the stock market causing you stress.

Lend Your Money For A Few Months Or Even Days To The U.S. Government

Treasury bills are often overlooked by newer investors because they don’t look like other interest-bearing accounts when you buy them, and they have shorter terms.

They are sold at a discount and the difference between the price you pay and value you receive at redemption represents the accrued interest.

T-bills are only subject to federal taxes, not state and local, which keeps more of the return on investment in your own pocket.

As a beginner, I first confused them with Treasury bonds or Treasury notes, so be clear on which you are buying.

TreasuryDirect, the government’s website for purchasing its securities, looked so old-fashioned I thought I was at the wrong website. So, I opted to buy T-bills in my individual retirement accounts and brokerage accounts instead. This helps me see them alongside my other investments instead of logging into the tedious Treasury site.

Government Money Market Funds Keep Your Cash Accessible

As we head into 2024, pay closer attention to government money market funds. You may already even have your cash in one if you’ve opened a brokerage account, but haven’t yet invested the money.

These funds invest 99.5% or more of their total assets into vehicles such as: cash, government securities, and/or repurchase agreements backed with government securities.

Money market funds are also easier to access than other investments with similar returns, such as CDs. You can withdraw cash or buy other investments quickly.

Money market funds are more diversified. They can invest in securities with interest payments that aren’t subject to federal — and sometimes state — taxes, which saves investors money.

I personally am storing cash in a government money market fund while I do research into other long-term investments.

Certificates Of Deposit Can Help You Stop Overanalyzing

When you cash in your CD after a defined period of time, you receive the money originally invested plus earn passive income through interest paid by the bank.

I have locked in APYs as high as 6% in 2023. CDs are competing with my other investment choices such as dividend stocks that have similar returns with more risk, while maintaining flexibility to retrieve my funds between 10 and 12 months after I deposit the funds.

If you are the type of investor who overanalyzes where to put your money, CDs can help you stash some cash without overthinking things until they mature later on.

If the 2023 U.S. bank collapses worry you, CDs are insured up to $250,000 if the bank is covered by the Federal Deposit Insurance Corporation.

FDIC insurance covers all accounts under your name at the same bank in total, and it does not cover $250,000 for each CD or account you have at the bank.

Do Your Research And Don’t Rule Out The High-Yield Savings Account

A high-yield savings account is the one option every person should use, especially if you’re waiting for paychecks to cover bills and want to start building an emergency fund that will also grow on its own.

With interest rates expected to remain relatively high in 2024, replacing your traditional savings accounts with a high-yield option offers a no-stress way to start growing your savings. The only real downside might be not having a physical bank to visit.

Any strategies you learn should not be undertaken without assessing whether the ideas shared fit your own personal money goals, current needs and risk tolerance.

Aside from returns, be sure to assess any financial institution’s insurance coverage and its customer service before trusting it with your hard-earned money. Also make sure you know how to access your funds when you need to.

High interest rates into 2024 are not great news if you have debt to pay off. But they are helpful if you have some extra cash that you won’t need in the immediate future and you’d like to grow with relatively low risk.

Read the full article here

Leave a Reply