““The Fed has corrected and they’re basically on course, but the plane is still well above a landing spot. It’s still going very fast and whether it’s going to overshoot is very much unclear.””

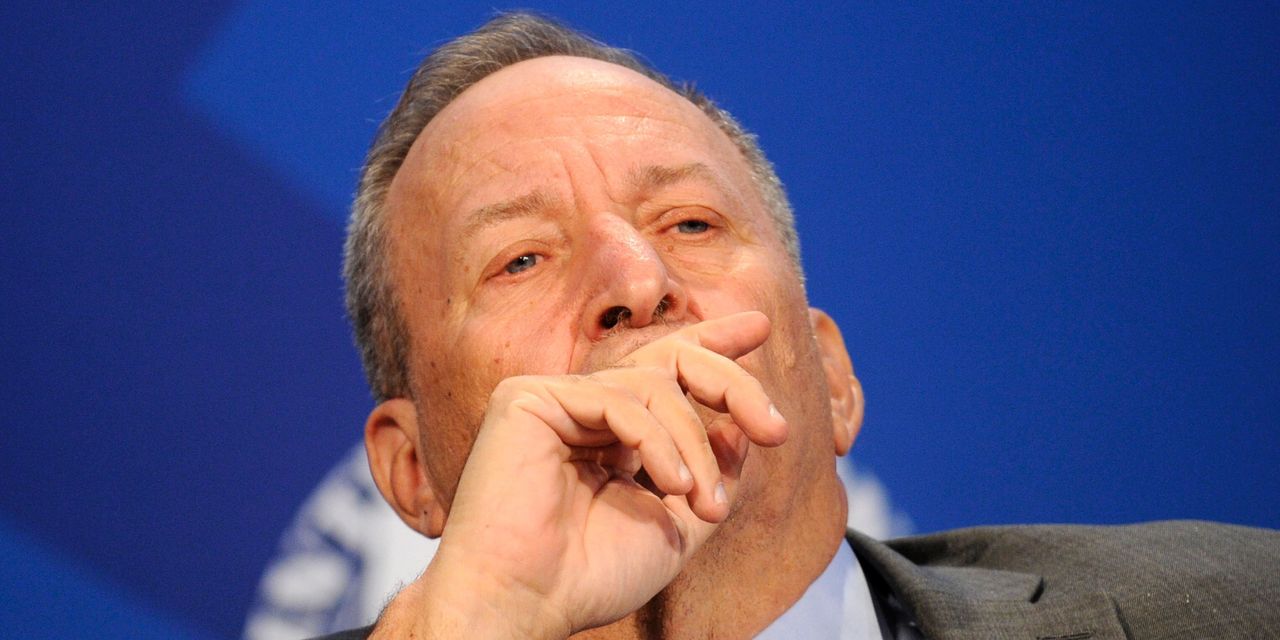

The U.S. economy remains a “difficult situation to manage,” and investors need to take extreme care. That’s according to former U.S. Treasury Secretary Larry Summers, who spoke to Bloomberg TV on Wednesday, following data that showed underlying inflation coming in slightly hotter than expected, and 3.7% on a headline annual basis.

Read: For stocks this was ‘the worst part’ of inflation report, says First Trust

“There is no sign, in any of this, that we have a 2% inflation economy now, or in prospect,” said Summers, who held economic advisory roles for both Clinton and Obama administrations.

He said the U.S. has three possibilities: the much hoped for soft landing, with inflation brought under control without tipping into recession; no landing where inflation never really gets below 3% and potentially starting to rise again; or a harder landing “as the monetary policy lags work through.”

“I think it’s a very narrow window to achieve that soft landing, I’d put it about 1 of 3 on each of those possibilities. We’re all hoping for the best, but there’s no assurance that that can be achieved,” said Summers, who added the Fed is correct in its stance of being data dependent.

Thursday will bring a fresh batch of data, with August retail sales and producer prices expected at 8:30 a.m. Eastern.

“My best guess is that inflation is going to be a little strong and they [the Federal Reserve] will need to move again in this cycle,” said Summers, who added that the central bank may need to increase interest rates more than once and the market is “over-discounting that possibility.”

“It’s a very difficult situation and people need to be very careful about declaring victory…and need to be very careful about some assets, particularly in the stock market, that may be priced a bit for perfection at this point with more room for negative surprises than positive surprises,” he said.

The S&P 500 index

SPX

has gained about 16% so far this year, despite a slight pullback this summer. Tech stocks, driven by a clamor for artificial intelligence names like Nvidia

NVDA,

have surged 31%, also dipping this summer, but regaining some momentum on hopes that the Fed may be done hiking interest rates.

Summers warned in 2021 about the then-growing risks of elevated inflation, which turned out to be true, and has been vocal this year about the Fed’s 2% inflation target being unattainable. But he also warned in 2021 about stagflation risks in coming years, something that has not yet materialized.

Read the full article here

Leave a Reply