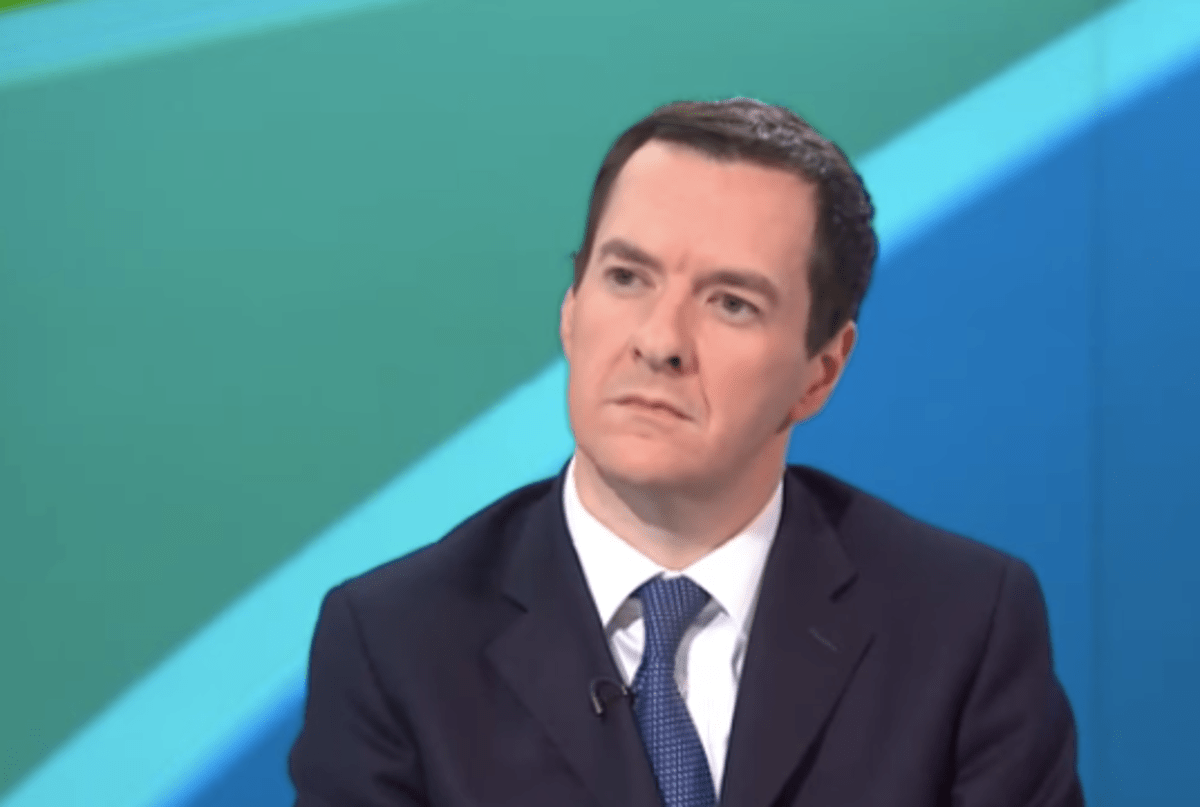

The world’s second-largest crypto exchange, Coinbase, announced on January 31 the addition of former UK Chancellor of the Exchequer George Osborne as an advisor to its council.

Coinbase’s Chief Policy Officer (CPO), Faryar Shirzad, disclosed this in an official announcement on X (formerly Twitter).

Shirzad revealed that Osborne would bring his years of experience overseeing the UK’s financial affairs to Coinbase as it expands globally.

We are very pleased to have @George_Osborne join @coinbase‘s Global Advisory Council. George is one of the most experienced and thoughtful leaders in government and business, and we are grateful to have his advice and counsel as we expand Coinbase around the world.…

— Faryar Shirzad

(@faryarshirzad) January 31, 2024

Advisors Transitioning from TradFi to Crypto

The latest development makes Osborne the latest former UK Chancellor to transition from the traditional regulated financial into a blockchain-backed financial firm.

His immediate successor, Phillip Hammond, joined crypto custody firm Copper in 2021 as an advisor before becoming chairman of the board of directors.

Before he was appointed an advisor with Coinbase, Osborne served as a Chancellor between 2010 and 2016.

Coinbase’s new advisor is set to join a distinguished nine-man panel that includes heavyweights like John Anzalone, Dr. Mark T. Esper, Chris Lehane, and seven others. This move will make him the latest and tenth advisory council member as the crypto exchange seeks to align with global regulators.

Coinbase has been a leading force in developing digital assets and blockchain technology in its home soil. Founded in 2012 and headed by Brian Armstrong, Coinbase’s user-friendly interface has driven many crypto newbies into the Web3 landscape.

The platform went public through a Nasdaq listing in 2021. Coinbase has then expanded into France, Spain, Singapore, and Bermuda in a bid to increase digital asset adoption worldwide.

It has faced major obstacles in its home country, the US, as regulators criticize the exchange for offering access to unregistered crypto-backed securities, however.

One such legal issue is an ongoing discourse with the US Securities and Exchange Commission (SEC). Headed by Gary Gensler, the SEC is charging the crypto exchange with offering unregistered assets.

The security agency states that crypto assets offered on Coinbase fall under the ‘Howey Test’ due to the perceived sense of profit generation from user investments.

Coinbase has since discredited these views and stated that the government agency is not considering unique cases surrounding cryptocurrencies.

US Lack of Clarity Driving Crypto Adoption Abroad

US regulators have ramped up efforts to checkmate bad action in the crypto ecosystem in the last two years. Hence, many crypto-backed enterprises have come into the crosshairs of several government agencies.

Large trading platforms like the Binance exchange have been fined billions of dollars for violations in their business practices.

Binance’s Market Share Nears 50% Recovery

In the early hours of November 22, 2023, the US Department of Justice imposed a fine of $4.3 billion on #Binance, leading to the resignation of CEO #CZ. While this might have seemed like an endpoint, it instead marked the beginning of a… pic.twitter.com/Ak4N8PaJ1Z

— Creat-IO (@Creat_io) January 31, 2024

Coinbase is also in a legal tussle with the SEC as it seeks to provide clarity on crypto asset regulations.

Amidst all this, numerous crypto businesses are urging US agencies for clearer regulatory guidelines to ensure compliance. For now, a dynamic compromise has yet to be achieved, forcing many crypto exchanges to seek pasture elsewhere.

The Coinbase exchange has established its EU operations in Ireland largely due to compliance with the MiCA (Markets in Crypto Asset) regulation.

The Coinbase international expansion continues

Ireland has been chosen for our EU MiCA hub.

Here’s why

https://t.co/mpc2t2u5EI

— Coinbase

(@coinbase) October 19, 2023

MiCA, which seeks to bring regulatory clarity to the crypto space, is the European Union’s (EU) effort to make it safe for investors. The MiCA team recently published two consultation papers where ‘reverse solicitation’ was introduced.

EU begins sorting MiFID-regulated securities out of crypto assets

MiCA passed in 2022, but aspects of it are still being worked out. Defining a financial instrument is a big outstanding question.

On Jan. 29, the European Securities and Markets Authority (ESMA)…

— Harley Lawrence (@HarleyLawr58926) January 30, 2024

Reverse solicitation allows third-country crypto firms to serve EU clients if the client initiates the contact. The papers are due for comments on April 24, 2024.

Read the full article here

Leave a Reply