Thesis

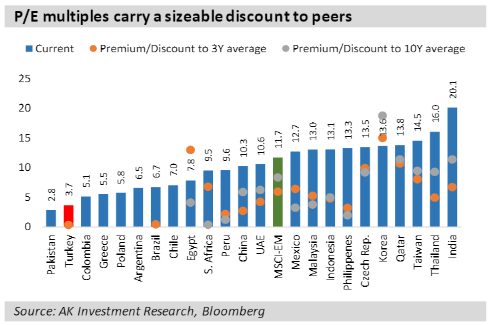

Chile is the most mature and developed economy in LATAM. However, its equity market is among the cheapest in the world, measured with PE multiple. The chart below compares the EM equity market by P/E.

AK investment research

Chile, together with Argentina and Brazil, holds P/E 6.5-7. Only Colombian equities are cheaper with P/E 5.1.

Today, I will turn your attention to Chile and its banking sector. One of the major players is Banco Santander-Chile (NYSE:BSAC). The bank has robust balance sheets with a well-diversified loan portfolio. On the other hand, BSAC uses all available tools to fund its operation: client deposit, interbank borrowing, and bond issuance. Given Chile`s excellent sovereign debt rating, I consider that a wise move. Apart from that, BSAC is leading the digital transformation in Chile’s banking industry, with a 90% growth in digital clients since 2019.

However, the last quarter results were disappointing. Despite a growing deposit base, the net interest margin declined and non-performing loans soared. On top of that, BSAC is generously valued by Mr. Market and measured against its Chilean peers. That said, BSAC gets a hold rating.

Company Overview

Banco Santander Chile is a subsidiary of The Santander Group, a Spanish international banking conglomerate. It is the biggest bank in Chile in terms of loans and deposits. It is also the largest private branch network in the nation, serving more than four million retail, small business, and corporate clients through a network of 504 branches spread around the region, including 70 WorkCafe and 1480 ATMs.

Banco Santander Chile provides commercial and retail banking services to its clients, including credit lines, loans in Chilean pesos, and foreign. In addition to standard banking services, the bank offers leasing, financial advice, mutual fund management, securities brokerage, insurance brokerage, investment management, mobile and online banking, private banking, foreign exchange, money transfers, and more.

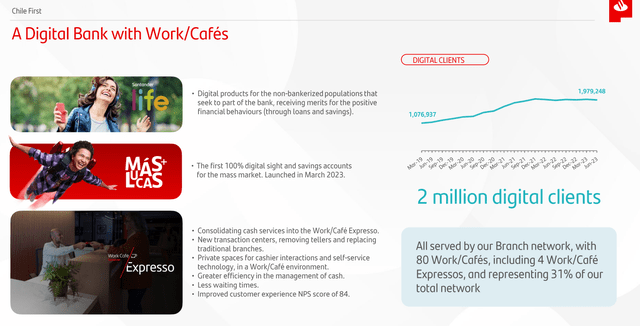

The major challenge for any traditional bank is to adopt and implement digital banking services. The Brazilian NU bank is the largest neo-bank in Latin America. However, a few more players claim their slice of the pie. Grupo Galicia’s Naranja X payment app and Mercado Libre’s Pago are Argentina’s most used banking apps. Banco Santander is among the best-performing traditional banks in digital services in Chile. The table below from the last company presentation shows BSAC’s digital growth.

BSAC presentation

The figures are impressive. Since 2019, the digital clients have grown by 90%. Chile’s banking industry has the deepest penetration in South America. Only 13% of the population is unbanked, compared to Peru with 43% and Argentina with 28%. That said, Chilean banks now have to push further the digital transformation, i.e., to transform their existing customers into digital ones. BSAC is leading the pack.

Company Financials

BSAC’s balance sheet is not typical for a traditional bank. Its deposit ratio exceeds 100 %. The table below details the balance sheet composition—the data is from the last company financial report.

|

Asset ratios: assets structure |

|

|

Cash/Total Assets |

3.3 % |

|

Loans (total)/Total Assets |

57 % |

|

Consumer Loans/Total Assets |

7.3 % |

|

Mortgage Loans /Total Assets |

23 % |

|

Commercial Loans/ Total Assets |

24 % |

|

Bonds/Total Assets |

33 % |

|

Liability ratios: capital structure |

|

|

Deposits/ Total Liabilities |

43 % |

|

Interbank borrowings/ Total Liabilities |

13 % |

|

Company bonds/ Total Liabilities |

10 % |

|

Other financial instruments/Total Liabilities |

3.5 % |

|

Equity/ Total Liabilities + Equity |

5.7 % |

|

Solvency ratios: |

|

|

Loans /Deposits |

135 % |

|

Cash/Deposits |

11.2 % |

|

Borrowings (inc. bonds)/ Total Assets |

23 % |

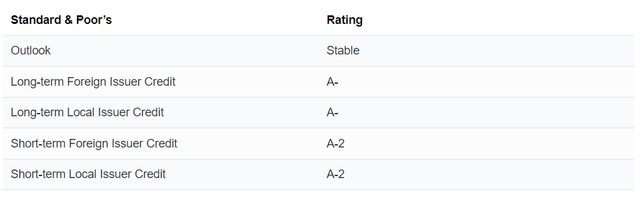

At first glance, the loan-to-deposit ratio is high. However, the bank also funds its operations with bond issuance and interbank borrowings. The company’s bonds are investment grade as per significant rating agencies. The screenshot below shows the BSAC rating by S&P.

BSAC presentation

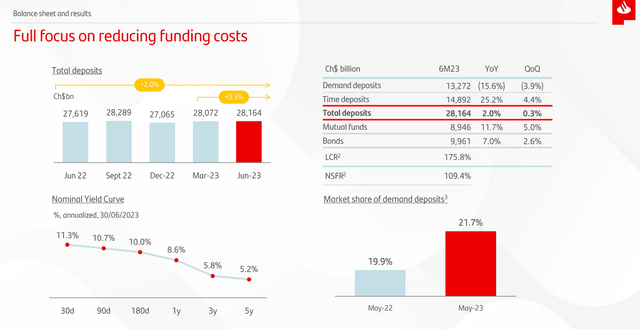

The deposit composition is adequate without overweight to interest-bearing or non-interest-bearing deposits (NIB). The former is 56% of total deposits, while the latter is 44%. This is a simplistic but efficient diversification between the cost of funds and liquidity. Demand deposits are NIB and the most liquid; however, time deposits are more expensive for the banks but are relatively illiquid.

The image below shows the current liabilities composition.

BSAC presentation

The deposit base has risen gradually for the last 12 months. BSAC’s market share of demand deposits has grown, too, up to 21.7%.

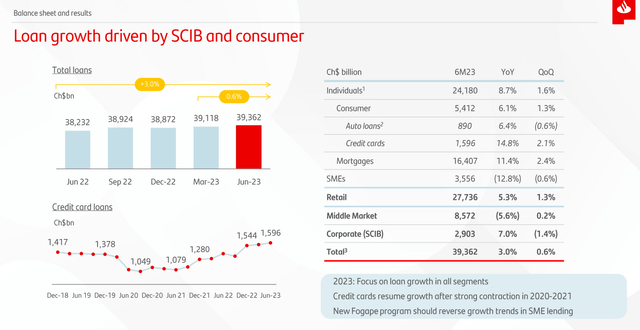

The image below shows the BSAC loan structure.

BSAC presentation

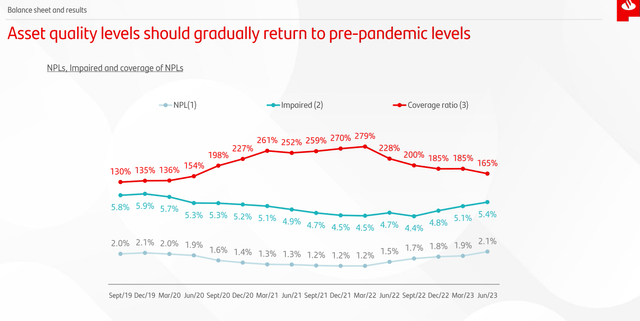

The loan portfolio is well diversified between three groups of borrowers: individuals, small and medium enterprises (SMEs), and middle market. The retail, however, carries more than 70% of total weight. Retail loans are distributed primarily between mortgages and consumer loans and, to a lesser degree, auto loans. The nonperforming loans (NPL) have been slowly rising and have reached Chile’s average value of 2.1%.

BSAC presentation

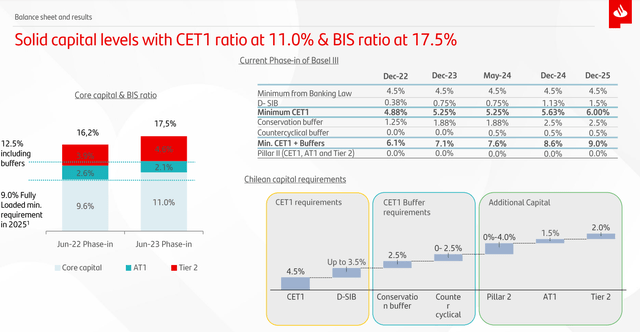

BSAC has a solid capital structure measured with Basel III metrics. The table below shows the bank’s solvency and liquidity figures. The data is from the last financial report.

|

Capital (in billions of US dollars): |

|

|

Regulatory Capital |

6.4 |

|

Tier 1 capital |

4.9 |

|

Common equity tier 1 (CET1) |

4.0 |

|

Risk-Weighted Assets |

38.3 |

|

Basel III Ratios: |

|

|

Regulatory capital ratio (Capital adequacy ratio) |

16.9 % |

|

Tier 1 ratio |

12.9 % |

|

CET1 ratio |

10.5 % |

|

LCR |

182 % |

|

NSFR |

113 % |

The liquidity figures are crucial for BSAC, considering its funding sources. LCR and NFSR are adequate, thus affirming banks’ ability to weather a liquidity issue in a banking system downturn.

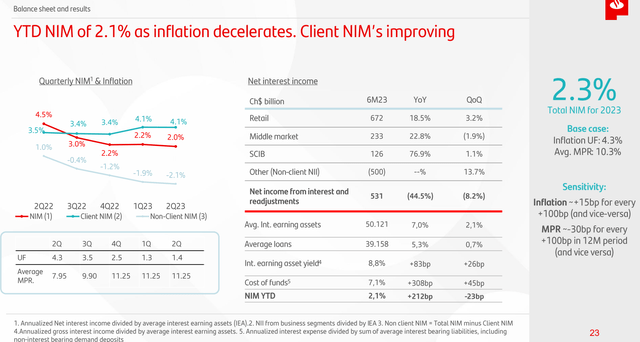

Regardless of the growing deposit base, BSAC’s profitability is stalled. Net Interest Margin (NIM) has dropped, thus affecting the bank’s efficiency ratio. The latter is still acceptable at 44%. The graph below shows BSAC`s profitability metrics for the last quarter.

BSAC presentation

Declining NIM translates into a lower return on equity. BSAC’s current ROE and ROA are much lower than the bank’s five-year average. The table below shows the recent figures.

|

ROE |

13.7 % |

|

RoTE |

13.8 % |

|

RoCET 1 |

16.9 % |

|

ROA |

0.78 % |

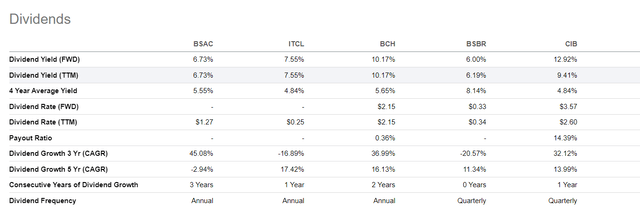

However, BSAC pays dividends with a respectable yield, lower than its Chilean competitors.

Seeking Alpha

Company Valuation

To calculate BSAC value with the Dividend Discount Model, I have to measure the price of the company’s equity and levered beta.

To obtain those numbers, I use the following steps and assumptions:

- Risk-free rate equals the 5Y average of USA long-term Government bond Rate, 2.2%.

- Growth rate, g, equals the 5Y average of the USA long-term Government bond Rate, 2.2%.

- Chile’s equity risk premium is 6.28%.

- BSAC’s dividend pre-share $ 1.27

- BSAC’s unlevered Beta 0.42

- BSAC’s Debt/Equity ratio 450%.

- BSAC’s effective tax rate 5Y average of 27.0%.

-

- Calculate Levered Beta with the formula below:

Levered Beta = Unlevered Beta * (1+D*(1-T)/E).

2. Calculate the discount rate (discount rate as the cost of equity) using the resulting value for leveraged beta. The formula I use is:

Cost of Equity = Risk-Free Rate + (Levered Beta * Equity Risk Premium).

3. Calculate the Terminal Value of dividends considering the Cost of Equity and Expected dividend growth:

Terminal Value = Dividend per share * (1 + expected dividend growth) / (Cost of Equity – Expected Dividend Growth)

4. Calculate the Present Value of Terminal Value assuming a constant discount rate for ten years.

For BSAC, I get the following results:

Intrinsic value per share = $ 12.88

Current Market price = $ 18.85 on Sept 19, 2023

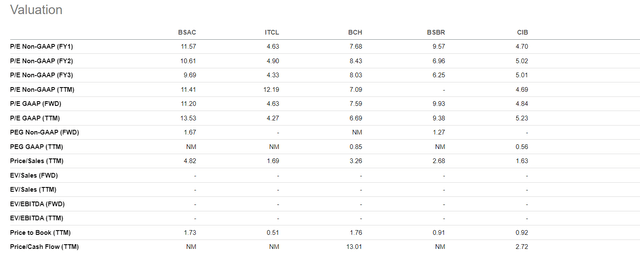

To estimate BSAC`s relative value, I choose the following South American banks:

- Banco Itau Chile (ITCL)

- Banco de Chile (BCH)

- Banco Santander Brazil (BSBR)

- Bancolombia (CIB)

Seeking Alpha

I use price to book and price to sales for relative valuation. BSAC is significantly overvalued compared to its peers. Adding the lower dividend yield, BSAC is generously valued by Mr Market.

Risks

BSAC carries the usual risks: liquidity, credit, market, and operational risk. Banks` balance sheet provides adequate liquidity to cover its debt obligations. BSAC bonds are investment grade, thus giving confidence in the bank’s ability to pay their debts. The deposit composition is equally divided between interest-bearing and BIB deposits, thus mitigating even more of the bank’s liquidity risk.

BSAC is a strong performer measured in Basel III ratios. The image below shows BSAC’s progress.

BSAC presentation

The bank has improved all components of its capital, not just CET1. The trade-off between CET1 and AT1 is a positive sign; thus, the former represents core banks’ equity while the latter is a buffer capital. AT1 consists of convertible and hybrid bonds. In case of bank turmoil, they could be converted into equity.

Among LATAM countries, Chile and Uruguay are the most politically and economically stable. That said, runaway inflation, decaying economic growth, and populist measures are exceptions, not a rule. The lack of turbulence so typical for LATAM significantly improves business conditions. Given that, BSAC political and economic risks still exist but are not overweight, as with Argentina.

Conclusion

Banco Santander-Chile is one of the best banks in Chile. The bank’s balance sheet is well-structured to weather any liquidity storm. Basel III metrics are excellent, too.

However, last quarter’s performance was disappointing: rising NPL and declining NIM. In other words, it is dropping profitability and soaring credit risk. That does not mean BSAC is a low-quality bank. The opposite is true, but I prefer to wait for improved profitability and lower stock prices. Considering all the above, I give BSAC a hold rating.

Read the full article here

Leave a Reply