Blue Owl Capital Corporation (NYSE:OBDC) is a well-managed business development company for which I see considerable dividend upside, particularly with respect to its regular dividend rate.

Blue Owl Capital saw a huge improvement in its dividend coverage ratio in the second quarter, driven by an ongoing increase in the BDC’s net interest margin, and the BDC posted a QoQ increase in its net asset value despite paying a supplemental dividend. Unfortunately, Blue Owl Capital suffered an increase in non-accruals.

Though I think that Blue Owl Capital could raise its dividend as well as its supplemental dividend to distribute excess portfolio income, the deterioration in credit quality leads me to lower my stock classification to hold.

My Rating History

As a primary investor in BDCs and REITs, I have mentioned Blue Owl Capital, formerly known as Owl Rock Capital Corporation, due to the BDC’s large discount to net asset value and solid dividend coverage. Taking into account the 2Q-23 rise in non-accruals, I lower my classification one notch to hold but still think that the BDC could raise its dividend given the improved dividend coverage.

A Focus On Senior Secured, Floating-Rate Debt

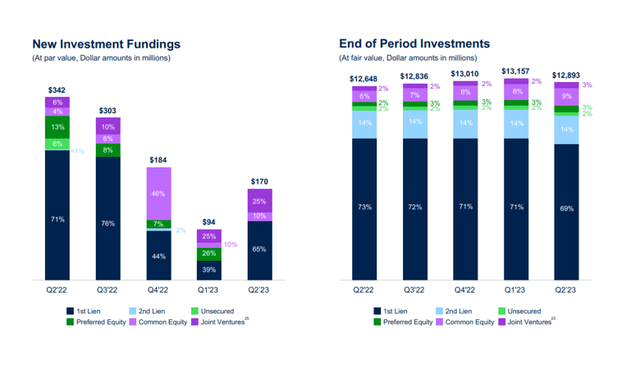

A slowdown in new loan originations as well as an acceleration of debt repayments have resulted in a drop in Blue Owl Capital’s portfolio value in 2Q-23.

At the end of the second quarter, the company had investments totaling $12.9 billion in its portfolio, of which 69% related exclusively to first lien debt. Another 14% was invested in second lien debt which brings the total amount of capital invested in senior secured debt to 83%. Common and preferred equity accounted for 12% of all investments at the end of the second quarter.

Blue Owl Capital made a number of new equity investments recently (including preferred debt) and joint ventures which are meant to increase the company’s total return potential. In the second quarter, 65% of new investments were made in the first lien category, with the other 35% going to equity and joint ventures.

New Investments (Blue Owl Capital Corp)

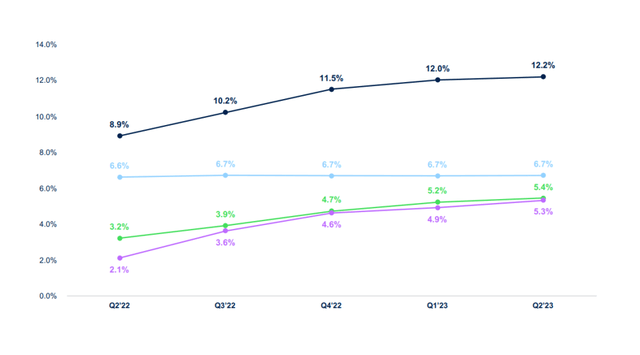

While the origination business has slowed down a bit (which is not Blue Owl Capital’s fault), the BDC has profited enormously from its floating-rate positioning in its investment portfolio.

Almost all of Blue Owl Capital’s debt investments were floating-rate (98%) at the end of 2Q-23 and the BDC has seen a sharp uplift in its net interest margin in the last four quarters: The net interest margin reached 12.2% in the second quarter and is the reason why Blue Owl Capital is profiting from increased dividend coverage.

Net Interest Margin (Blue Owl Capital Corp)

Decline In Portfolio Quality

Unfortunately, Blue Owl Capital has experienced a notable deterioration in portfolio credit quality in the second quarter. The BDC reported a 2Q-23 non-accrual ratio of 0.9%, based on fair value, representing a 3x increase over 1Q-23, which is when the BDC had a non-accrual ratio of 0.3% (also based on fair value). At the end of 2Q-23, Blue Owl Capital had three portfolio investments on non-accrual after adding one more portfolio company to its non-accrual roster.

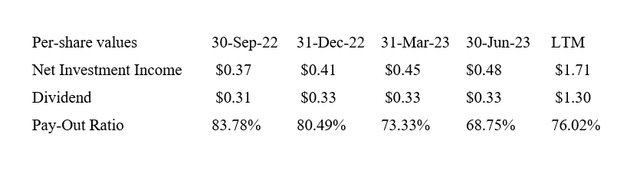

Investors Could See An Increase In the Regular Distribution

Blue Owl Capital is a solidly managed BDC with good dividend coverage, despite the increase in non-accruals. The dividend payout ratio in the second quarter dropped below 70%. The BDC earned $0.48 per share in net investment income while paying out $0.33 per share in dividends (not including supplemental dividends).

In total, Blue Owl Capital used 76% of its net investment income to pay its regular distributions in the last year, and the BDC had a better dividend payout ratio than Oaktree Specialty Lending Corporation (OCSL), which I consider to be the gold standard in the BDC sector due to excellent credit and risk management. Oaktree Specialty Lending paid out 90% of its net investment income in the last year.

Dividend (Author Created Table Using BDC Information)

Huge Income And Dividend Growth Potential, Still Trading At A Discount To NAV

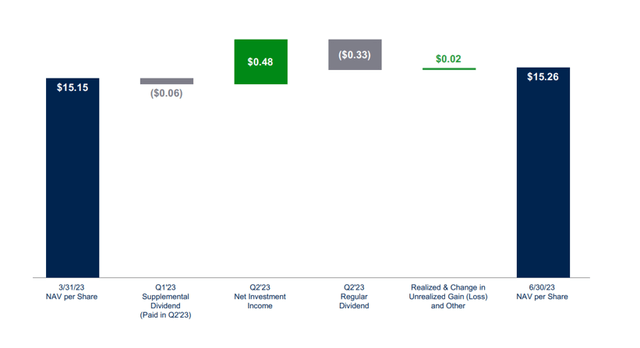

Despite the payment of a $0.06 per share supplemental dividend in the second quarter as well as the regular dividend payment of $0.33 per share, Blue Owl Capital reported an increase of 1% in its net asset value.

Since 2Q-22, Blue Owl Capital’s net asset value has risen 5.4%, and that’s despite a 6.4% raise in the regular dividend and a total payment of supplemental distributions of $0.20 per share.

Net Asset Value (Blue Owl Capital Corp)

OBDC is selling at a 10% discount to net asset value, which is not much different from when I last dug into the BDC. With that being said, I no longer consider the net asset value discount as a reason to buy the BDC’s stock after the company reported a decline in credit quality in 2Q-23.

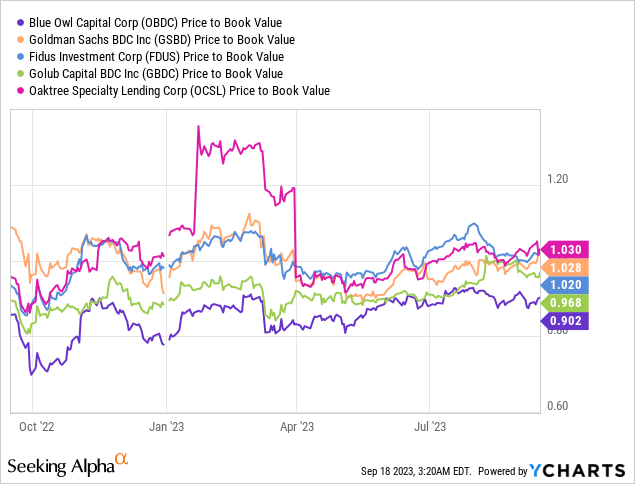

With regards to other BDCs, I think OBDC is probably fairly valued, as peer group BDCs tend to trade at or around net asset value.

Why Blue Owl Capital Might See A Lower Or Higher NAV Multiple

Passive income investors should pay some attention to Blue Owl Capital’s non-accrual ratio moving forward, as the direction is concerning.

The BDC’s dividend coverage still looks good, but a further deterioration in credit quality (particularly if the non-accrual ratio rises above 1.5%) could result in softer dividend coverage and less dividend safety.

My Conclusion

Given that the dividend coverage ratio improved in the second quarter, Blue Owl Capital has the potential to raise its dividend as well as keep distributing a considerable amount of cash to pay its supplemental dividends.

I think, however, that a downgrade to hold appears in order considering that Blue Owl Capital has experienced a decline in portfolio quality in the second quarter.

Though the BDC is seeing a growing net asset value, a soaring net interest margin, and improved dividend coverage, weaker credit quality is an issue that passive income investors should take seriously. Hold.

Read the full article here

Leave a Reply