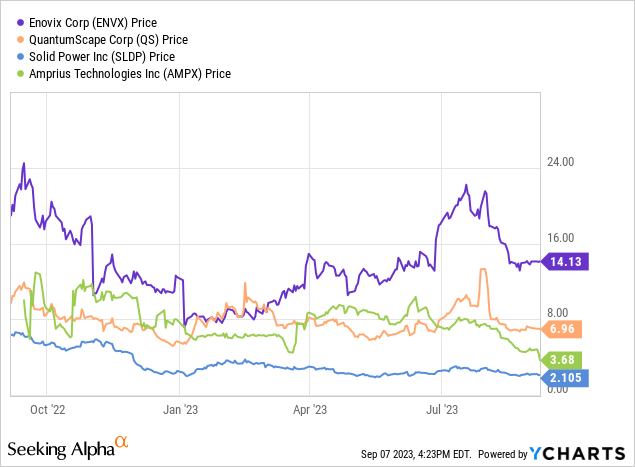

The promise of Enovix (NASDAQ:ENVX) was never going to be a straight line, but the volatility of its common shares has been intense, they’re down 30% over the last 1 year but have surged 115% from all-time lows set in 2023. I owned a small speculative position in the company but closed this out in early summer. Do the commons still form a healthy speculative buy? It depends. Short interest in the company is high at 27.5% with bears betting that the pre-revenue higher energy density battery upstart, currently trading hands at a $2.25 billion market cap, will run into headwinds to the commercialization of its 3D silicon lithium-ion batteries. A range of speculative battery plays went public on the pandemic era SPAC boom from Solid Power (SLDP), QuantumScape (QS), Amprius Technologies (AMPX), and Enovix is the only ticker trading above its $10 SPAC reference price.

Bulls flag that this divergence is justified on the back of several factors. Firstly, its executive chairman is T.J. Rodgers, the founder and former CEO of Cypress Semiconductor, and his heavy involvement in solar darling Enphase Energy (ENPH). Enphase has had one of the most dramatic ascents of any of the green energy tickers and shareholders are betting that the involvement of Rodgers with Enovix should provide an apt mirror of Enphase’s performance. Mr Rodgers has invested in and worked with Enovix since 2012. Hence, you can describe this difference from its peers as the Rodgers premium. The other factor is pegged to its battery tech offering dramatic improvements to lithium-ion density without being many years away from commercialization. To be clear, Solid Power and QuantumScape are still working through some technological constraints and technical bottlenecks to bring their solid-state batteries to market.

Enovix Chases The Lithium-Ion Battery Dream

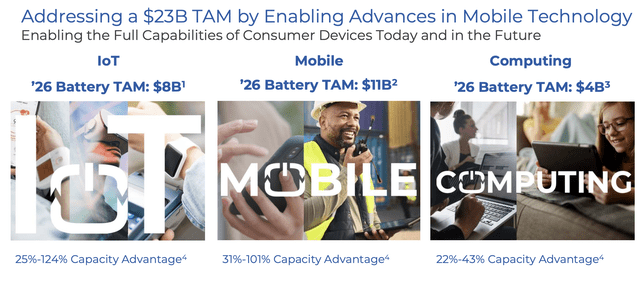

Developing better lithium-ion batteries has attracted billions of dollars in investment since the pandemic with almost $10 billion raised by battery firms in the first half of 2021 alone. The bullish thesis is underpinned by enthusiasm and euphoria for a post-pandemic zeitgeist increasingly defined by the continued embrace of green technologies. Enovix diverges from other battery tickers in that it’s actually also targeting non-electric vehicle applications for its batteries from smartphones, wearables, and laptops. The company’s first high-energy density battery products are being developed for consumer gadgets. Indeed, the company’s new CEO, Raj Talluri, managed Micron Technology’s (MU) $6 billion dollar mobile division and has strong connections to the sectors and customers that are set to purchase Enovix’s 100% active silicon anode batteries.

Enovix Corporation July Presentation

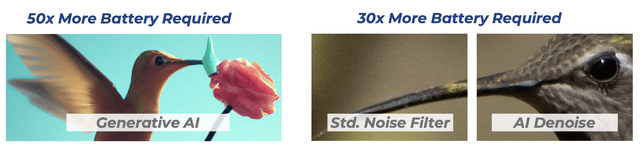

The company highlighted its 111 engineers and scientists, 43 of whom have PhDs, in a July letter as a factor driving what’s been 141 patents filed for a technology Enovix has been working on since 2007. Enovix flagged that only one other company, Amprius Technologies, has been able to sell batteries with 100% active silicon anodes. Hence, it’s a leading candidate to win the silicon anode race to upgrade the original lithium-ion battery first commercialized in 1991 by Sony (SONY). There are further reasons to be bullish on the ticker with emerging AI applications requiring substantially more battery from respective consumer devices. When Enovix ran Stable Diffusion, a text-to-image application used to generate images, its test laptop ran out after only 68 minutes. The company anticipates that it’s chasing multiple multi-billion dollar TAMs with a total combined value of $24 billion.

Enovix Corporation July Presentation

Liquidity And Manufacturing Ramp

Liquidity is key against this backdrop and the company last reported cash and equivalents of $409.2 million as of the end of its fiscal 2023 second quarter, up sequentially from $293.8 million in the prior first quarter. This came on the back of the April issuance of $172.5 million in convertible senior notes that will bear interest at a rate of 3% per year, maturing on May 1, 2028, unless earlier converted. Net proceeds from the issuance came in at around $167 million and will be used to build out Fab 2 in Malaysia. Critically, the convertible senior notes can be converted at a conversion price of $15.61 per share at 64.0800 shares per $1,000 principal amount of the convertible senior notes. Hence, Enovix has been able to tap debt at a lower coupon than the US Fed funds rate and with a less than 10% dilution if these are converted before maturity.

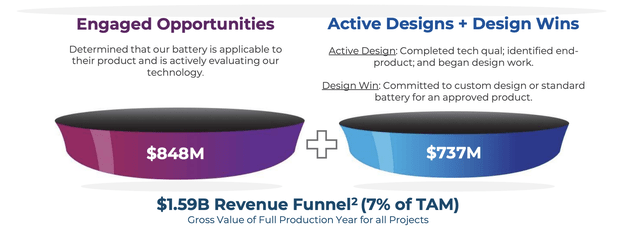

Enovix Corporation July Presentation

Further, with the company’s trailing 12-month free cash outflow as of the end of its second quarter coming in at $129.1 million, the current cash and equivalents position provides a multi-year cash runway that will only be boosted by the partial and gradual realization of its $1.59 billion revenue funnel. It’s important to note that this funnel is still somewhat broad and engaged opportunities might not translate into active designs or design wins. The plan is now to ramp up its first high-volume production line in Malaysia. Shares are a hold against this positive backdrop but the volatility will continue.

Read the full article here

Leave a Reply