Thesis Summary

Petrobras (NYSE:PBR) is a controversial company, but investors can’t deny that this stock has performed very well since my last report on it.

Since then, the company has recorded a strong Q2, and Brazil’s political and economic situation continues to be strong. All while oil prices show strength on the back of more OPEC cuts.

I think that PBR is a fantastic long-term hold, but I will say that, from a technical perspective, we could get a pull-back in the coming month.

In this article, I’d like to touch on the Q2 results, recent developments in Brazil’s economic and political situation and the oil market. These are essentially the key driving factors of PBR’s price, which is why we must stay on top of them.

Overall, I think the last few months have given us yet more evidence that oil and Brazil could do very well in the coming years, which is why I am re-iterating my buy rating.

I maintain my buy rating due to the long-term potential and the juicy dividend.

Why I Really Like PBR

PBR is a part government-owned oil company in Brazil, and though many American investors have doubts, the performance speaks for itself.

In my last two articles, I have talked about why I liked PBR so much, so let’s review this really quickly and look at what has happened since my last report.

Firstly, from a purely fundamental perspective, PBR is much cheaper than its competitors. Despite a very solid YTD performance, PBR trades at a PE of 3.2.

This is well below what US oil and gas companies trade at. Of course, this discount can be attributed to the fact that this is a Brazilian company, and this is a country which has been struggling with low growth and inflation.

But where others see risk, I see an opportunity. As I mentioned in my first PBR article from April, the Brazilian economy has been improving, and many of the risks associated with Lula may be overstated.

Lastly, I defended that PBR would do well as oil prices increased in June, and this is what we have seen.

Q2 Update

PBR is up nearly 35% in the last six months, and though you might think that the company is crushing it, Q2 was, as you’d expect, given the oil price at the time, not that impressive.

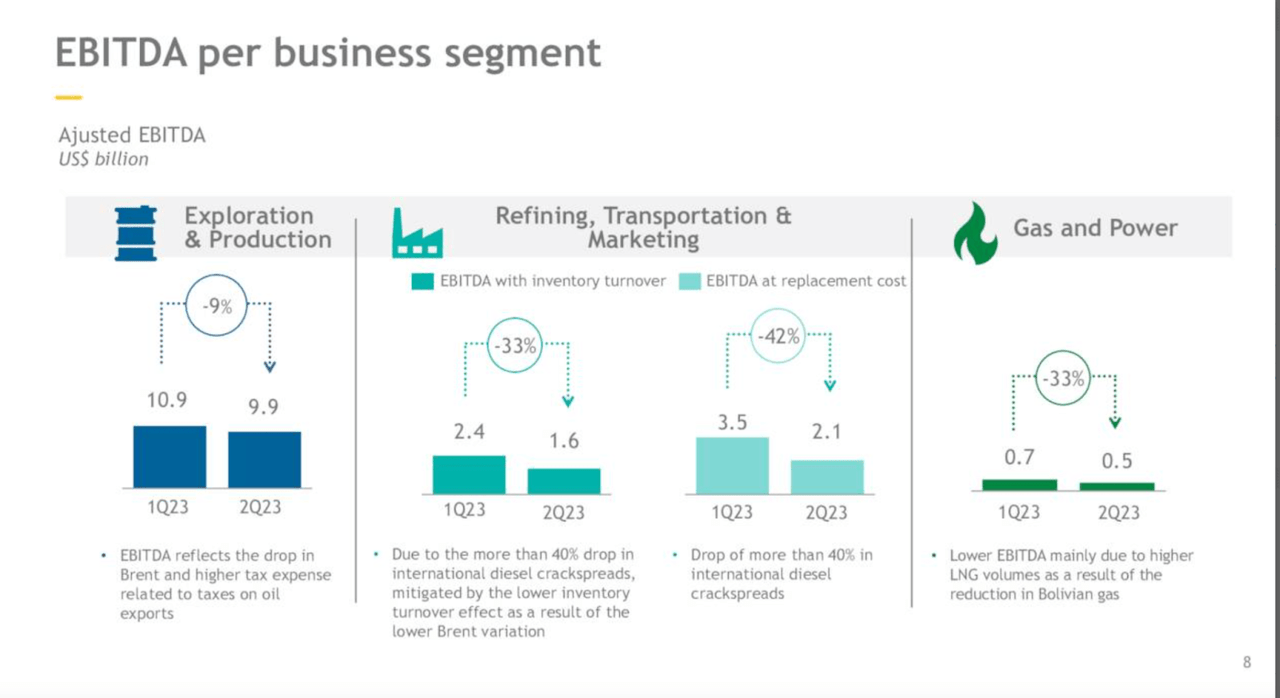

The company reported $11.7 billion in required adjusted EBITDA, down almost 15% from the prior quarter. We can see the segment breakdown below.

Segment EBITDA (Q2 presentation)

The biggest fall in revenue was in the Refining, Transportation and Marketing due to the 40% drop in international diesel crack spreads.

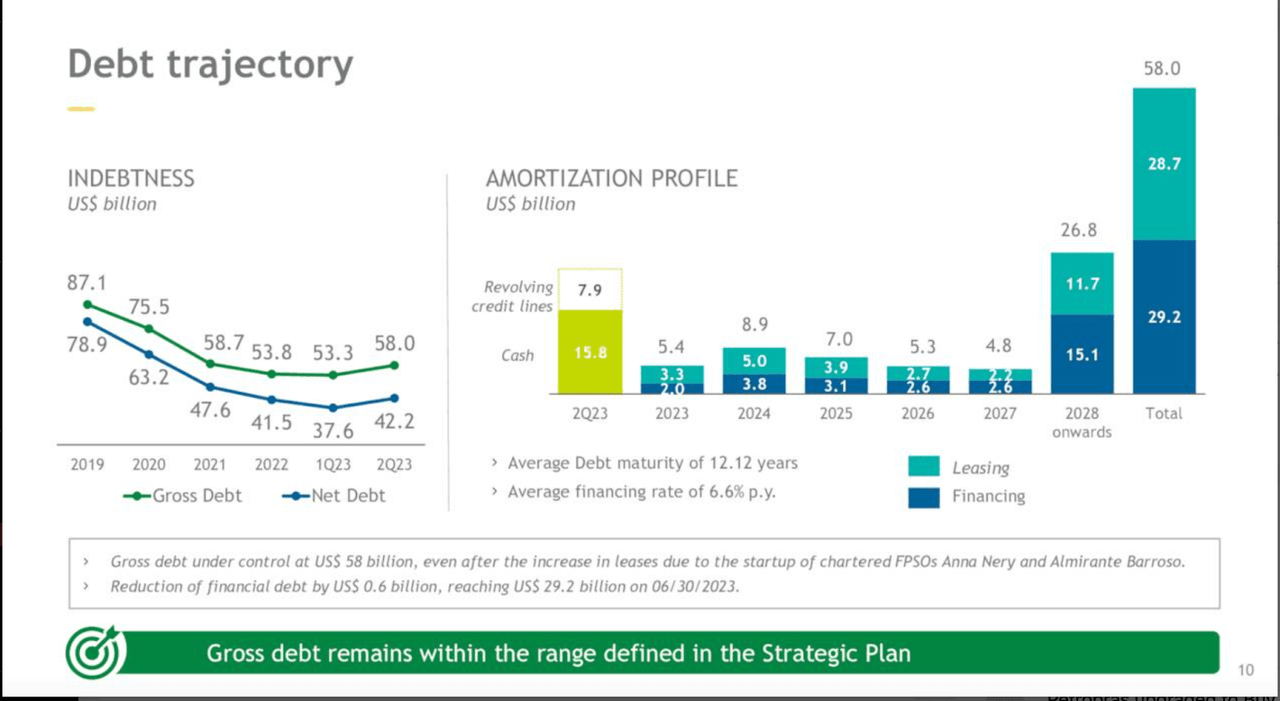

Debt Trajectory (Q2 presentation)

Meanwhile, net debt climbed for the quarter, but as we can see from the panel on the right, the company has a very manageable load over the next five years.

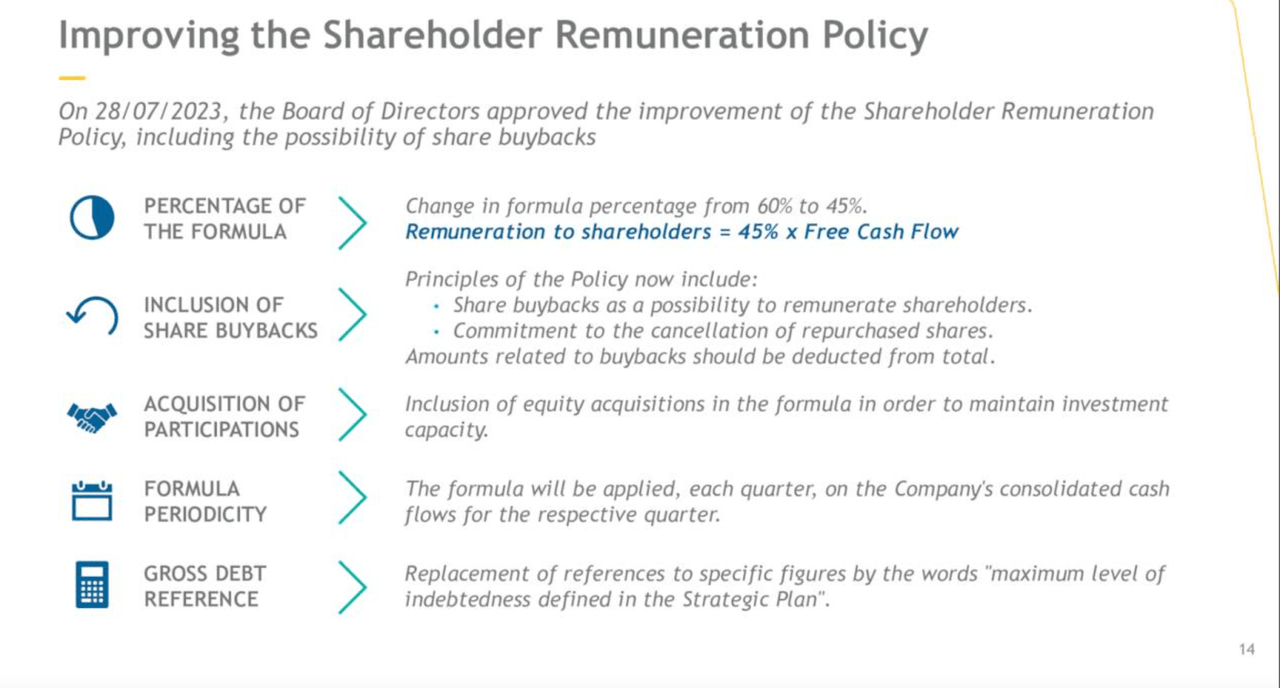

Shareholder remuneration policy (Q2 Presentation)

Key to my fellow income-loving investors is the new Shareholder Remuneration Policy, which was approved at the end of July.

The company expects to pay out 45% of FCF, will include equity acquisitions in the formula, and may even carry out buybacks to increase shareholder return.

On the surface, it looks like a decrease in the payout, but it doesn’t necessarily have to be once we include share buybacks. This gives the company some more flexibility while also committing a high amount of their FCF.

Politics and Brazil

Investors in Petrobras have to also keep a close eye on the company’s economy and politics. This is partly a partly government-owned monopoly, which does create a potential risk.

With that said, since Lula’s appointment, the company has done well, and despite a lot of speculation on the matter, the president has not derailed this company’s trajectory. If anything, we have seen the opposite.

In the last few months, we have seen a string of bullish news for the company. Just a couple of weeks ago, Brazil’s attorney general opened up the possibility of exploring the Amazon area.

Some might find this unexpected coming from Lula’s government, and the President did address this apparent “contradiction” in an interview.

There is no contradiction. You indicate where you want to get and then you’ll need resources for that,” Costa said. “We are going to build a sustainable, renewable energy matrix, but it’s obvious that we need to fund that transition process.

Source: Brazilenergyinsight

This actually makes sense, dare I say? Brazil’s economy has been lagging for some time, and the president doesn’t want to cripple it, especially now that it is doing relatively well.

Brazil has been surpassing expectations, growing GDP 3.4% YoY and with unemployment falling below 8%, which is good for the country.

And to top things off, following a very aggressive hiking cycle, the Brazilian Central Bank has now begun to cut, aggressively, starting with a 50 bps cut last month

Oil Outlook

Of course, the fate of PBR will depend on the oil outlook, and in my opinion, it looks quite good.

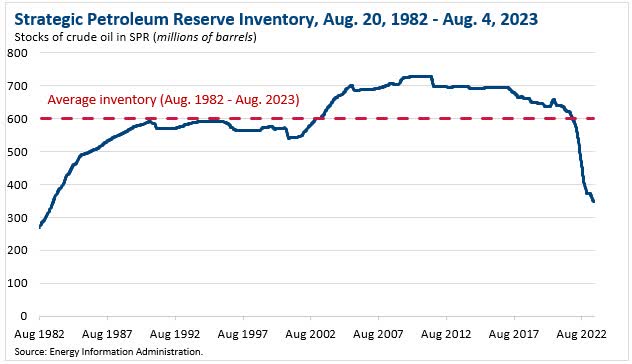

From a fundamental perspective, we have the continuation of OPEC cuts, at a time when the US’s Strategic Petroleum Reserves are at levels not seen since the 80s.

SPR (EIA)

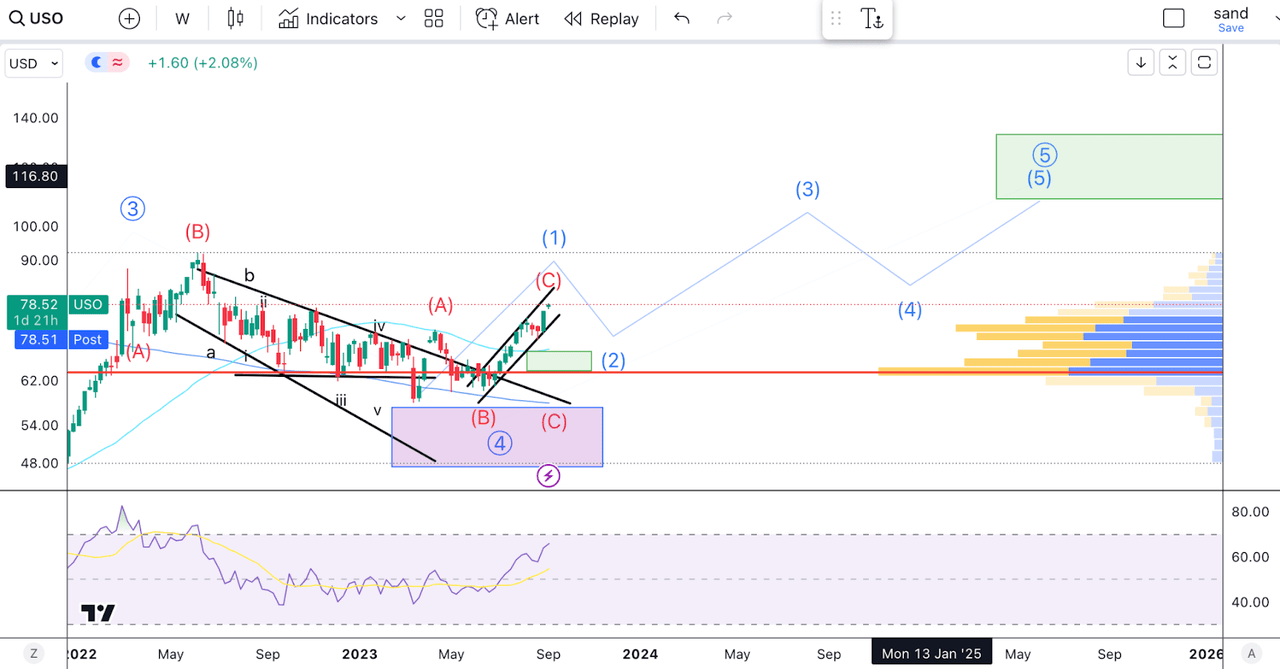

From a technical perspective, I think the recent move off the lows is just the first impulse to take us back north of $100 barrel.

USO chart (Author’s work)

I think we are just beginning a final impulse in a large-degree wave 5, which should end near the green target box.

In the more immediate term, we could see a pull-back in prices, especially if the RSi enters overbought on the weekly.

PBR Technical Analysis

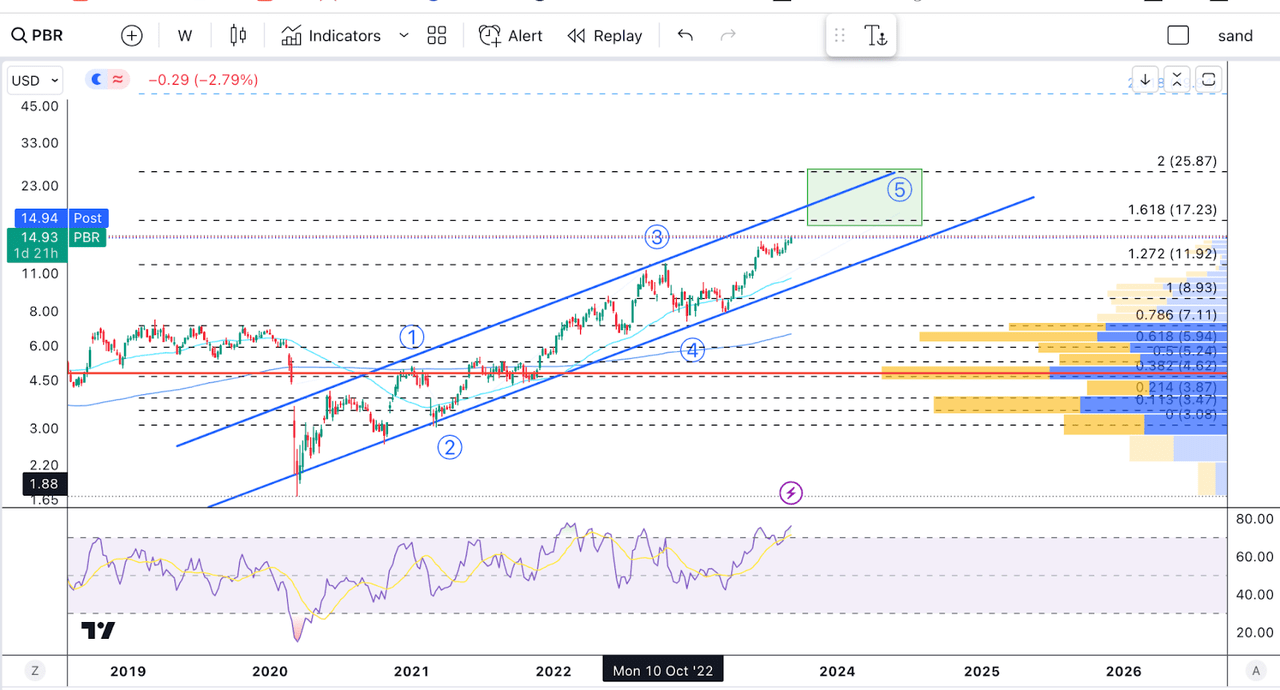

A slight sell-off from here in oil would also coincide with my current view of the PBR chart:

PBR (Technical Analysis)

We have a very clean diagonal forming since the 2020 lows in PBR, but we might be near the top of our wave five target.

If we measure the length of wave 1 from the bottom of 2, we can see that wave 3 topped at the 1.272 ext at $11.92. This makes me think that the next leg up could end somewhere between the 1.618-2 ext, which is the green box.

Again, I must reiterate that I like PBR a lot, and I am not looking to sell. If we did get to +$20 in the coming months, I might consider shaving off some of my position.

Risks

While I am very bullish on PBR, let’s look at what could go wrong.

Politically, there is always a chance that the government will step in and curtail PBR’s profit-earning capabilities. Yes, this is always a risk, and that is why PBR will likely never trade at the ratios of American oil companies. But so far, we have little evidence to suggest this will happen.

On another note, PBR will, of course, suffer if oil prices take a hit. So far, dynamics in the energy market seem to suggest higher prices are likely, but this would change if we witnessed some form of global economic slowdown.

China is facing some issues, no doubt, and so is Japan, and Europe is also showing some signs of weakness. A slowdown can’t be ruled out, but I would still view this as a short-term headwind.

Final Thoughts

All in all, I continue to see PBR as one of the best, if not the best, way to gain from the coming oil bull market. The stock is cheaply valued and positioned to benefit both from increasing oil prices and improvements in the Brazilian economy.

Read the full article here

Leave a Reply