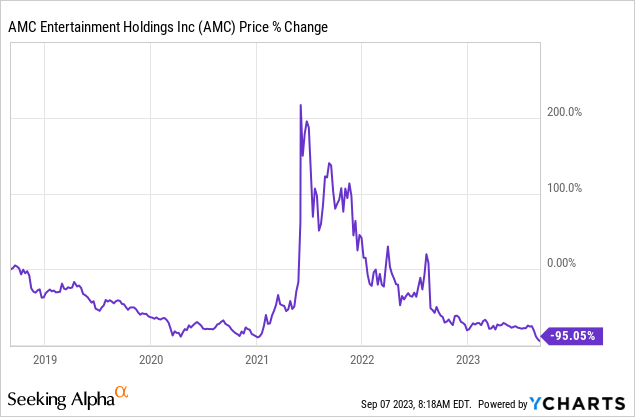

Shares of AMC Entertainment (NYSE:AMC) plunged close to 37% on Wednesday, the largest drop since 2021, after the movie theater company disclosed that it seeks to sell another 40M more of its shares. AMC Entertainment’s fundamentals, even after the COVID-19 pandemic ended and the company reported a rebound in attendance numbers, continue to look weak, especially regarding free cash flow. The company only recently conducted a reverse 1-for-10 stock split, and the short interest ratio remains exceptionally high, indicating that the market expects high cash burn trends to persist. The latest equity offering is a serious warning sign for investors that AMC Entertainment may go out of business, and I believe the risk profile remains highly skewed to the downside.

Previous rating

I covered AMC Entertainment during the pandemic and mentioned the risk that came with investing in meme stocks that attracted a large amount of attention: AMC Entertainment: Don’t Touch It. AMC Entertainment has so far managed to stay afloat, but the company’s latest equity offering will further dilute shareholders and may be the final nail in AMC’s coffin.

AMC Entertainment’s high cash burn, new stock offering

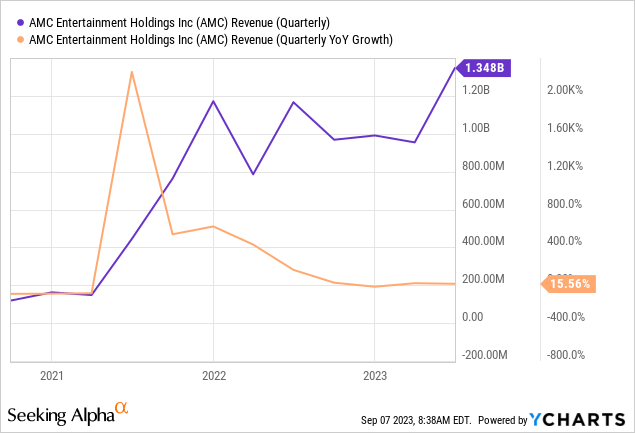

Although AMC Entertainment benefited from a recovery in attendance numbers after COVID-19 restrictions were lifted in FY 2021, the company continues to be in a dire position, from a financial perspective.

In the second quarter, AMC Entertainment reported a 12.2% increase in attendance numbers (to 66.4M) for its movie theaters compared to the year-earlier period and a 15.6% increase in the company’s top line. While AMC’s top line recovery is solid, the firm continues to face serious challenges regarding free cash flow and profitability. And so far, AMC Entertainment has not found a recipe to improve its situation fundamentally.

In the first six months of FY 2023, AMC Entertainment lost $299.3M in free cash flow and reported a cumulative adjusted net loss of $186.3M. This means that, for every dollar in revenues, AMC Entertainment lost $0.13 in free cash flow. Considering this high level of cash burn, it was only a question of time until AMC Entertainment was forced to raise new capital from investors.

According to a material (8-K) disclosure dated September 6, 2023, AMC Entertainment entered into an equity distribution agreement with a number of investment banks in order to sell 40,000,000 shares of Class A common stock to investors. Shares dropped almost 37% on the announcement, as investors are not only worried about the financial/cash burn situation of AMC Entertainment but also about the impact of dilution.

Assuming 40M shares are being sold at a current price of $8.62, AMC Entertainment could potentially raise $345M in proceeds (also assuming that AMC’s share price won’t drop further). The size of the equity offering represents about 25% of AMC Entertainment’s current market cap of $1.35B, resulting in massive dilution for shareholders.

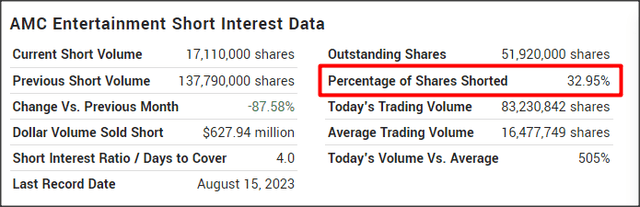

AMC Entertainment’s equity offer may further fuel short interest ratio

What I am especially concerned about is that AMC Entertainment continues to have a very high short interest ratio, which may increase further as the sharks start circling. As of August 15, 2023, AMC Entertainment had a short interest ratio of 33% which is extremely high, and the latest equity raise may further fuel short selling activity.

marketbeat.com

AMC Entertainment’s valuation

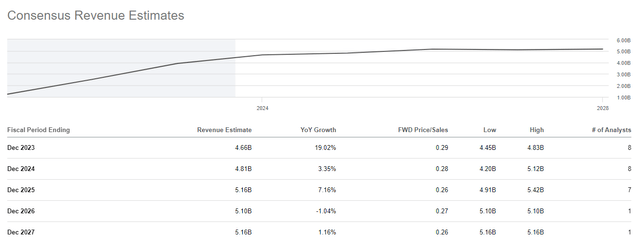

Although AMC Entertainment is seeing a revenue recovery following the end of COVID-19 restrictions and is expected to grow its top line by 19% this year, the company has not yet proven to the market that it can operate its movie theaters at scale and at a profit. For investors, this raises serious questions about a potential bankruptcy, concerns that were only highlighted yesterday when AMC Entertainment announced its 40M share offering.

Currently, AMC Entertainment is valued at a price-to-revenue ratio of 0.3X, and the company has lost all meme stock gains: Shares are now trading at its lowest price ever. Given the extremely uncertain financial condition of AMC Entertainment and the fact that the short interest remains excessive (and could rise), there is a very real possibility that investors will incur a total capital loss on AMC.

Seeking Alpha

Risks with AMC Entertainment

The obvious risk for AMC Entertainment is that the company will run out of cash and ultimately be forced to declare bankruptcy. On the other hand, given how highly shorted the company is, a fundamental improvement in operating metrics, especially free cash flow, could result in a short squeeze and a huge bounce in the shares. This, however, would likely be driven by speculative behavior on the part of traders. At this point, I consider the odds of a rescue for AMC Entertainment to be very small.

Final thoughts

The meme stock rally is officially over, as AMC Entertainment now lost all meme stock gains and trades at its lowest share price ever. The 40M Class A common stock offering is a negative for investors from a dilution perspective and shares cratered 37% as a result, with more pain likely to come: I expect further selling pressure in the near term.

AMC Entertainment may see a top line and attendance recovery in its business, but the company continues to burn through cash at a high rate and has significant free cash flow losses. The market has turned very bearish on AMC Entertainment, and the firm’s equity offering is, in my opinion, the final nail in the coffin for AMC Entertainment. With massive dilution ahead, a huge short interest ratio, and an unclear strategy about how the company could run its theaters profitably, the risk profile remains highly skewed to the downside!

Read the full article here

Leave a Reply