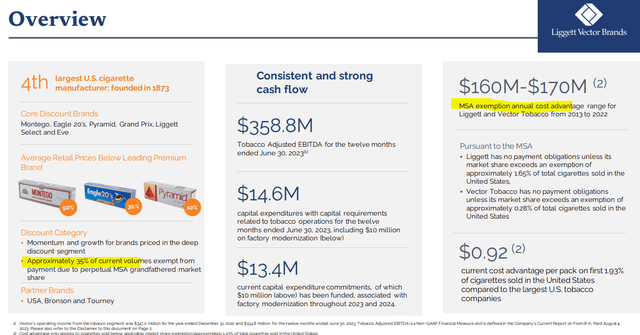

Vector Group Ltd. (NYSE:VGR) is the 4th largest cigarette manufacturer in the U.S. with a portfolio of discount brands like “Montego”, “Eagle 20’s”, and “Liggett”. Recognizing challenges facing the tobacco products market, the reality here is that VGR’s business is highly profitable, with the stock standing out by offering a compelling 7.7% dividend yield.

We last covered the name more than two years ago with a bullish article that focused more on the company’s real estate segment, emerging from the pandemic at the time. The stock is up in the period since, but a lot has changed, considering the “Douglas Elliman” group was spun off in a transaction that closed in late 2021. It’s time for an update.

The attraction of Vector Group is its pure-play profile as a leader specifically in the discount segment of cigarettes, which has gained importance in recent years. Indeed, while the industry has been pressured by declining smoking rates and the rise of e-cigarettes, data shows that deep-discount brands have been one area of growth.

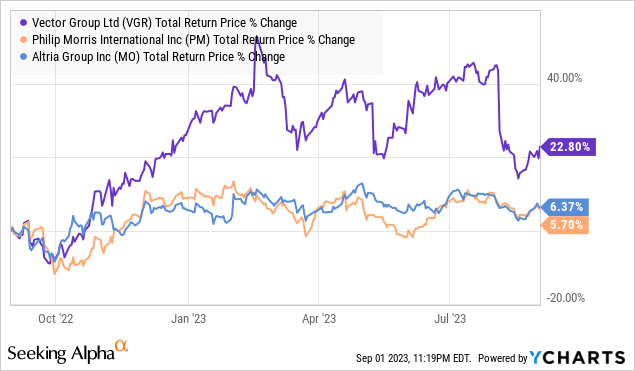

Vector Group has gained market share against larger players like Philip Morris International Inc. (PM) and Altria Group, Inc. (MO) by taking advantage of its unique cost advantages. Shares have been volatile more recently, but we see good value in VGR at the current level ahead of the next leg higher.

VGR Financials Recap

VGR last reported Q2 GAAP EPS of $0.24, compared to $0.25 in the period last year. Revenue of $366 million, declined by 5.6% y/y, although this headline figure considers some quarterly variability with zero recorded revenue in the quarter from the company’s smaller real estate segment. Separately, an $18.1 litigation settlement hit the operating income. Excluding that charge, a non-GAAP EPS of $0.32, up from $0.25 in the period last year paints a more favorable picture.

Focusing on the tobacco segment, Q2 revenue was down by 2.3% y/y, which reflects an ongoing strategy shift with the company’s Montego brand from a volume-based approach to an income-based approach. In this case, the company has used strategic price hikes in certain products to support higher margins at the expense of some top-line sales.

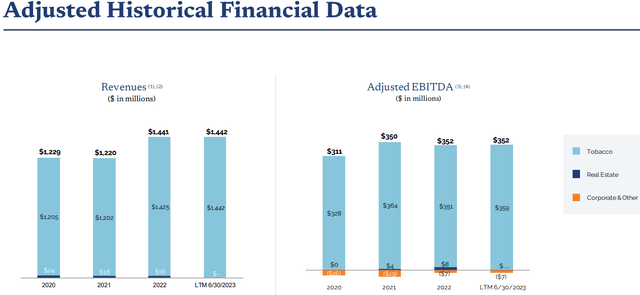

The effort appears to be working. Q2 tobacco segment adjusted EBITDA at $94.7 million, climbed by 5.3% y/y, which we view as a key performance metric for the company. Firm-wide adjusted EBITDA at $352 million has been steady from levels in 2022, with that figure now representing a higher overall margin.

source: company IR

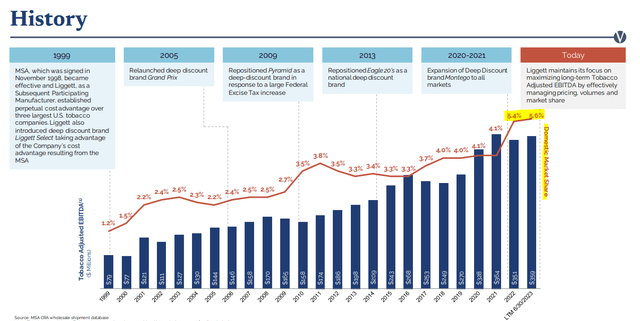

As mentioned, the strong point here is the continued market share gains for the brand portfolio, reaching 5.6% of the U.S. market, up from 5.4% at the end of 2022. That measure is further broken down with gains on the wholesale and retail side as well.

source: company IR

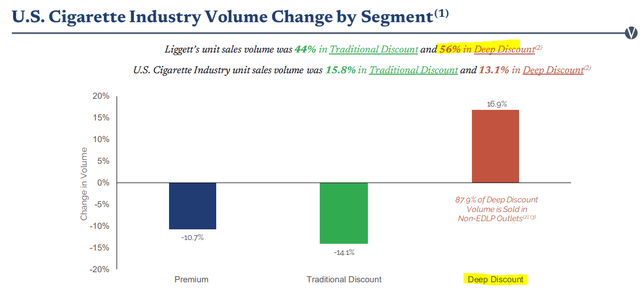

According to Vector Group, the segment of “deep discount” cigarettes has seen a 16.9% increase in volumes sold at non-everyday-low-price outlets “non-EDLP” as a tracking retail channel. This is a sharp contrast compared to the -10.7% decline for the premium side of the industry and the -14.1% drop in “traditional discount”.

The setup is favorable for the company as 56% of the unit sales fall into that deep discount category, which itself comprises about 13.1% of the overall market. In the macro environment of consumer spending being squeezed by inflation and high interest rates, smokers potentially substituting for the deep-discount segment could be a tailwind for the company.

source: company IR

The takeaway here for us is that amid the several moving parts to the U.S. Cigarette Industry, Vector Group has been a net winner through a solid strategy.

On the balance sheet, the company ended the quarter with $446 million in cash, equivalents, and securities investments against $1.4 billion in long-term debt. Considering $359 million in adjusted EBITDA over the past year, we view the net leverage ratio under 3x.

The stock’s $0.20 per share quarterly dividend represents an annualized distribution of around $120 million and a payout ratio of 75% on earnings over the past year, which we believe is supported by underlying cash flows. Keep in mind, the company maintains a separate $45 million in long-term investments along with its real estate ventures carried on the balance sheet valued at $121 million could represent a separate source of liquidity if necessary.

source: company IR

What’s Next For VGR?

The biggest question mark when looking at tobacco stocks is the risk of potentially new regulatory pressures, further limiting demand and sales. Recent rulings by the U.S. Food and Drug Administration have centered on efforts to prohibit flavoring like menthol along with reducing nicotine levels. There is also some thought that e-cigarettes could be targeted for tighter regulations.

At the same time, it’s understood an outright ban in the United States is not under any consideration, as it would face significant opposition and legal challenges up to the Supreme Court. There are an estimated 28 million smokers in the U.S. representing around 12% of the adult population.

The good news here, as it relates to VGR, is that the company’s relatively smaller profile relative to peers like MO and PM ends up working to its advantage. The company never had a significant exposure to menthol cigarettes, and it never made a major push to invest in electronic alternatives, keeping the operation more streamlined.

The other important consideration here is that based on regulatory provisions established back in 1998 in the Master Settlement Agreement (MSA), Vector Group through Liggett received grandfathered exemptions related to annual settlement payments. This is possible given the market share of underlying brands in the portfolio remains below key thresholds.

The result is that the company captures an effective cost advantage estimated between $160 million and $170 million or nearly $0.92 per pack on the first 1.93% in market share volume compared to larger players, like PM and MO. This allows the company to be competitive in the deep discount segment while supporting its profitability.

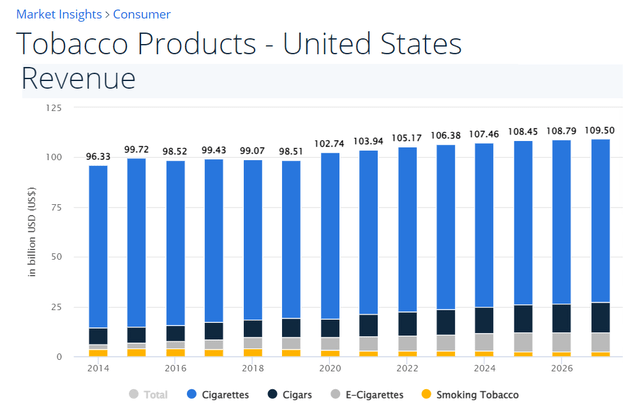

Data suggest, that the overall tobacco products market remains stable, with even some marginal growth in overall revenue. This is achieved by gradual price increases from all brands that have balanced manufacturing costs and taxes.

We believe company revenues and earnings can follow these trends. VGR’s strategy has been to manage each brand’s volume and pricing to capture these cost efficiencies, and ultimately maximize shareholder value.

source: Statista

VGR Stock Price Forecast

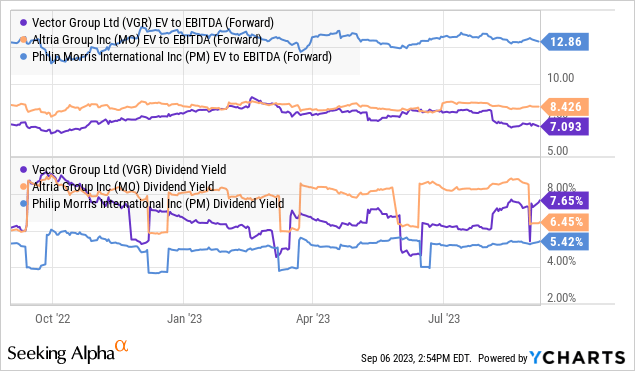

We like VGR as a dividend play and our favorite “tobacco stock”. Notably, shares trade at a discount to PM and MO across metrics like the EV to EBITDA and P/E ratio. VGR also has a modest yield spread above the group. It’s not perfect, but shares deserve a closer look by income investors and a spot on more traders’ radars.

We rate shares of VGR as a buy with a price target for the year ahead at $13.00 representing 8x EV to EBITDA multiple. The share price upside here along with the dividend return offers a potential 30% return, as a compelling risk-adjusted opportunity.

In terms of risks, the regulatory headlines are capable of adding volatility to the stock. Weaker than expected results over the next several quarters would undermine the outlook with a selloff in shares below ~$9.50, signaling a more concerning deterioration of the outlook. Monitoring points include free cash flow trends and market share dynamics over the next several quarters.

Seeking Alpha

Read the full article here

Leave a Reply