“You have to accept the fact that sometimes you are the pigeon, and sometimes you are the statue.” -Claude Chabrol

To My Partners and Friends:

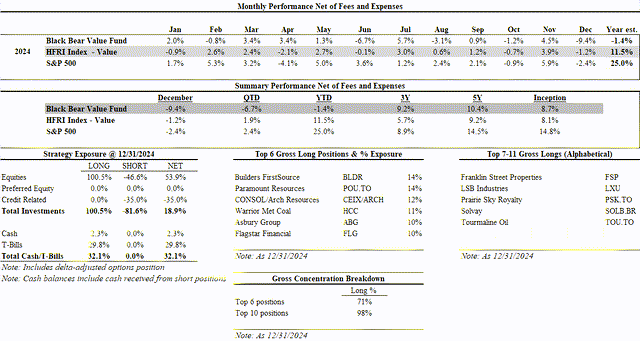

Black Bear Value Fund, LP (the “Fund”) returned -9.4% in December and -1.4% in 2024. The S&P 500 (SP500, SPX) returned -2.4% in December and +25.0% in 2024. The HFRI Index returned -1.2% December and +11.5% in 2024. We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

Note: Additional historical performance can be found on our tear-sheet.

While the natural reaction to our December and 2024 returns would be disappointment, I am entering 2025 with a much different perspective. In December our top positions dropped by 15-20+%. There are varying reasons why the stocks sold off but can be summarized as a negative sentiment shift. And sentiment is temporary. The long-term theses remain intact, and we used December as an opportunity to meaningfully add and further concentrate in our businesses. We have multiple names in the portfolio where a permanent capital impairment is remote and a path to being up 50-100% is reasonable. In addition, we are finding several short prospects that are going to have a “valuation meets reality” moment in the coming 12-24 months. Despite a year of treading water, we are still outperforming the broader indices over the last 3 years while taking 30-40% of the risk. This is an example of the power of protecting capital during tumultuous times (2022).

I can only act on what is in front of us now and our investments are as compelling as at any time since I started the Fund. It’s often most uncomfortable adding or starting an investment when things look bad but if you agree with the thesis, it’s typically the best time to make the investment. I would encourage you to consider the merits of what I lay out below. This is my “pound the table” moment to say you’d be adding/joining at a compelling time.

A common theme in a few of our investments (HCC/POU.TO/FLG) is that they are in the midst of a capital- investment cycle. The current market does not seem hospitable to these kinds of ideas. The valuations for these companies are extremely attractive and while we are not getting the near-term sugar high of market acceptance, I anticipate a major re-rating when the capital-investment cycles end in the next 12-24 months. We are getting paid an extremely high IRR to be patient and wait.

The broader themes of the portfolio are largely the same as we entered 2024.

- Foreign stocks – we are finding a lot of opportunity outside of the U.S. markets with 37% of our portfolio in foreign-domiciled companies.

- Housing – Structurally underbuilt housing with a rising need as millennials form households. With rising mortgage rates, existing home supply should remain low and benefit the new homebuilders and by extension their suppliers and distributors.

- Metallurgical coal (coal for steel) – Significant underinvestment in a needed input for worldwide steel consumption particularly in Asia and India where high-grade met coal resources are limited.

- Energy/Natural resources/Commodities – Significant underinvestment in natural gas, oil and thermal coal which are necessary for the worlds economies to function and grow. While renewables will play an increasing role the change will occur over decades, and not years.

- New: Regional bank/REIT turnarounds – We have 2 investments with managements/Boards that are ahead of the game in turning their businesses around. Both know the issues they are managing and have been proactive and sensible in protecting shareholders’ interests. Both have valuable assets with balance sheets that are healthy (FLG) and/or actively de-risking (FSP). At the same time, we are short similar companies with management teams that are obfuscating/ignoring the issues and have unhealthy balance sheets (some rhyme with our shorts of Silicon Valley Bank/First Republic).

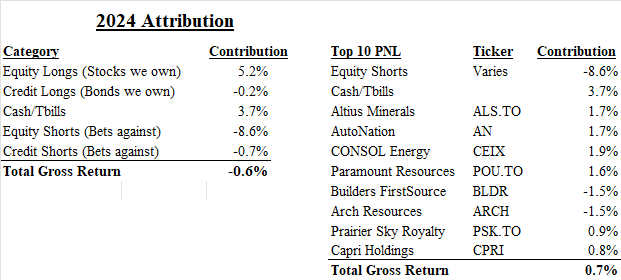

Breakdown of PNL Components

Our short positions offset the gains we made in our equity longs (businesses we own) and earnings on cash/T- bills. Our portfolio and positioning are discussed at length in this letter so will refrain from repeating myself here.

Credit Shorts/Equity Shorts

We entered the year with a meaningful equity short position (~46%) and credit short position (~35%). While I do not name shorts specifically, there are some consistent themes represented. Some examples:

- Banks/private credit lenders/real estate bridge lenders – We are short a bank that rhymes with our Silicon Valley/First Republic short in the sense that I think the bank is technically insolvent. They have assets overmarked on their balance sheet and are playing games recognizing impending losses. The same can be said about the private credit/bridge lenders we are short. Their tenants/borrowers are catching colds and through aggressive accounting they are pushing off the loss recognition. In time the dividends will be further cut, and the cash simply won’t be there.

- Legacy data centers – These businesses consume capital and produce mediocre levered returns on capital (single digits). The accounting is squishy, and the economics are dreadful. They are massively levered and the general AI- “mania” has been a rising tide lifting all ships. Like real estate, not all data centers are created equal. A corollary would be the bifurcation between Class A office which is doing better (newer build data centers) and struggling Class B office (legacy data centers).

We remain short longer duration credit instruments. The spread for corporate bonds is near all-time lows with very little in the way of defaults/economic risks priced in. While long-term interest rates have risen, they are in a normal range if one assumes 2-2.5% inflation. Presume 2.5% inflation + 0.50% for a short-term interest rate of 3%. Add 1.50% for a normal yield curve and you get to a 10Y of 4.5%. If inflation is higher and /or we need to borrow significantly (i.e. lack of governmental fiscal discipline) the 10Y and risk spreads could rise.

Top 6 Businesses We Own

I am including our top 6 ideas as I consider Flagstar Financial (FLG) a core position given its weight in the portfolio.

Builders FirstSource (BLDR) – 14% of AUM

BLDR declined 23% in the month of December after housing fears returned to the market. This mirrored the selloff experienced during COVID as short-term mortgage rate fears returned. I viewed this as a prime buying opportunity and added a meaningful amount of stock.

BLDR is a manufacturer and supplier of building materials with a focus on residential construction. Historically this business was cyclical with minimal pricing power as the primary products sold were lumber and other non-value-add housing materials. Since the GFC, BLDR has focused on growing their value-add business that is now 40%+ of the topline. The company has modest leverage and has been using their abundant free-cash-flow to buy in over 40% of the stock in the last 33 months.

Our long-term thesis remains intact as there is a structural shortage of housing in the USA. Higher mortgage rates reduce the supply of existing home supply as homeowners are locked into low-rate mortgages. As we have seen in recent history, the overall pie of housing activity may shrink, with new homebuilders capturing an increasing share of home sales. Homebuilders can buy-down the mortgage to a lower rate and accept a lower,yet still healthy margin on the home sale.

Past letters have commented that the coming 6-12 months could be rocky and BLDR (the stock) has not disappointed. The business continues to perform well, and I am optimistic that management took advantage.

The company has sustained higher gross margins as they have gained scale. I estimate normalized free-cash- flow per share to be $12-$17 per year implying a free-cash-flow yield of 8-12% with no growth priced in.

Paramount Resources (POU:CA) – 14% of AUM

Paramount is an ENP (exploration and production) in the energy space. In the 4th quarter the Company sold the bulk of their mature assets and will be making a large cash distribution of $15 CAD (~47% of the stock price at year-end) in Q1. I expect additional disclosure in the coming months after the sale goes through. The remaining Company will have liquid cash/investments to fund additional exploration for development.

My rough breakdown for this investment is as follows and looks out 2-3 years once their investment cycle is more mature.

- $14 of tax-adjusted dividend in Q1 or Q2

- Plus: $7 of cash/marketable securities on the balance sheet

- Less: $4-$5 of development costs over the coming 2 years

- Plus: $1-$2 of privately owned assets

The total of the asset value is ~$18 per-share vs. a year-end stock price of $32, implying a $14 value for the future expected free cashflows. I roughly estimate, based on the current disclosure, that they will generate $2-$3 of annual free cash flow in a benign oil environment (or an unlevered 14-21% return). Our thoughts could change to the up or down as we get further disclosure. It is important to note management owns almost 50% of the Company and is fully aligned with us and has been excellent operators.

CONSOL (CEIX) /Arch Resources (ARCH) – 12% of AUM combined

Both ARCH and CEIX were down ~18% during the month of December as fears of retaliatory tariffs (these have a large export component to their businesses), economic slowing and likely tax-loss selling drove the stocks lower. Like our discussion on BLDR, the long-term story remains intact, and we used this as an opportunity to further concentrate our investment. Due to their impending merger neither Company can buy back their stock. Once the merger is complete in Q1 there should be abundant cash to buy back stock. I am generally constructive on the merger as the Companies should be able to realize some modest synergies. My sense is more mergers will be coming to this sector given the depressed prices of the securities.

ARCH is one of the leading U.S. producers of high-quality metallurgical coal (“met coal”). This is the kind of coal used for steelmaking. ARCH also has a thermal coal business that contributes ~20% of their earnings.

CONSOL is a leading producer of thermal coal.

Met coal demand is projected to climb for the next 25 years, driven by the economic development and urbanization in India and the rest of Southeast Asia. ~60% of the world’s population lives in Asia, where met coal demand is centered and where local sources are limited. Over the coming years demand will likely outstrip supply, leading to higher prices. There has been a severe lack of investment in met coal due to ESG concerns with investment peaking in 2014.

Rough math on the combined companies looking out 2 years from now (vs. a $5.7BB combined market cap):

- Accumulated FCF (net of liabilities) of $300MM-$1.5BB

- The existing combined business generating between $500MM-$1BB per year

- Let’s presume non-heroic FCF yield of 15% which comes to $3.3BB-$6.7BB

- A marine terminal generating $50-$70MM in FCF that is worth $500MM-$900MM

- Synergies of $60-$100MM at a 15% yield =$400-$700MM in value

- $4.9BB – $10.8BB in market value – (down of 14% vs an upside of 90+%) using a 15% FCF yield

The above is a very rough calculation and shows the wide margin of safety baked into the price. I believe the operating business should command a better valuation implied by a 15% FCF yield…. but for now, we do not have to make any big leaps with respect to valuation. I wouldn’t be surprised to see these businesses surprise to the upside given the worldwide looming high grade met coal shortage and cost-advantaged production/shipping.

Warrior Met Coal (HCC) – 11% of AUM

Warrior was down 22% during the month of December, likely for similar reasons that ARCH/CEIX sold off. Similarly to BLDR, CEIX, and ARCH we used this weakness as an opportunity to buy more stock.

Please reference the met coal discussion above, as it applies to Warrior Met Coal. Currently the bulk of HCC’s FCF is being invested in a capital project that will be concluding this year. Once the business winds down their investment period they will gush cash.

Rough math on HCC looking out 2 years from now (vs. a $54 year-end stock price)

- Accumulated FCF net of liabilities: $14-$23 per share

- The existing business generating between $6-$10 in FCF

- Let’s presume non-heroic FCF yield of 15% which comes to $40-$67 per share

- A low-cost/best-in-class new asset (Blue Creek) that is worth $7-$18 a share using 15% FCF yield

- $67-$118 vs. a year-end price of $54–using a 15% FCF yield

Like the prior discussion, the above is a very rough calculation and shows the wide margin of safety baked in the price. I believe the operating business should command a better valuation implied by a 15% FCF yield…. but for now, we do not have to make any big leaps with respect to valuation.

Asbury Group (ABG) – 10% of AUM

Asbury Group operates auto dealerships across the United States. The strength of the model comes from the back of the house in parts and services where more than 50% of the profits come from.

When an auto dealer sells a car to a consumer, they capture both the trade-in (inventory to sell) and the relationship between parts and services. It is a razor-razorblade model in a highly fragmented industry (many dealerships are owned privately by families). The large dealer groups have transitioned to an omni-channel model where much of the selling/pre-buy activity can be done online, reducing the need for headcount and making the transaction smoother for their customers. The lower operating costs of the business are not appreciated by the market. They are appreciated by us and the management teams as most dealers, including ABG, have been buying in lots of stock with their free-cash flow.

ABG should be able to earn $25-$35 in free-cash flow per share in a “normal” year. At year-end pricing that implies a 10-14% annual yield. I hope management continues to buy back a lot of stock at these levels!

Flagstar Financial (FLG)– 10% of AUM

Flagstar Financial was down 22% in the month of December, potentially exacerbated by tax-loss selling. The fundamental story (below) did not change, and we meaningfully added to our position to take advantage of the selloff.

Flagstar Financial is the former New York Community Bank (a mashup of Flagstar Bank, New York Community Bank and assets from Signature Bank). Like our SHORT investments in Silicon Valley Bank and First Republic, FLG had a hole in their balance sheet (from soured multifamily and office real estate vs. long- duration securities). That is where the similarities end.

FLG raised over $1BB in additional capital, led by former Treasury Secretary Steven Mnuchin. They revamped the management team and brought in a superstar CEO in Joseph Otting who successfully turned around OneWest Bank post GFC (formerly known as IndyMac Bank). In 9 months, the management team has accomplished more than most teams can do in 2+ years. They have reviewed nearly all the loans on the books, sold off non-core assets raising additional capital and are focused on delivering a narrowly-focused, well- capitalized boring regional bank. In this case boring is good. Importantly, they have taken a conservative view of their loan book and a large credit reserve. This contrasts with several bank/private credit lenders we are short who have taken minimal reserves. Mr. Otting and his team are my kind of managers – they are plain- spoken, hardworking and plan for the worst while hoping for the best.

The valuation is extremely compelling. At year-end the bank was trading at ~51% of a conservatively marked balance sheet. This is in contrast with similar banks (who are NOT conservatively marked) trading at 140- 160% of their tangible book value. FLG should complete working thru the bulk of their issues by the end of 2025 and approach “normal” during 2026. Given the conservative nature of the management team, I wouldn’t be surprised if it happened sooner. At 100% of TBV (still a discount to the market) the stock would roughly double. At these prices the downside seems minimal and could see this business up 50-150% over the next 1-3 years as it is more appropriately valued.

Fund Updates/Tax Discussion

It is anticipated that investors will receive some long-term capital gains as well as short-term losses that could be used as an offset for other parts of your portfolio.

Giving Thanks

I know that being patient is easier when there is a “+” in front of our returns but we have a cultivated group of investors that range from individuals to family offices that understand we are making multi-year investments. I appreciate your trust and partnership.

A big thank you to our service providers (BTIG, Opus Fund Services, EisnerAmper and Kleinberg Kaplan) for helping throughout the year. They are timely and helpful in their work and help the business hum. Thank you to our CFO, Dave Proskin, for helping take a lot of the financial blocking and tackling off my plate allowing me to focus on the portfolio.

Lastly, thank you to Lauren and the kids. A supportive family is required in this business (at least for me) and it would be hard to manage if not for them.

Concluding Thoughts

Our portfolio is a coiled spring. When it snaps up, I don’t know. We own healthy companies, with the wind at their back, run by excellent management teams at extremely cheap prices. As many of them exit investment cycles they’ll be able to deploy massive amounts of capital and buy in cheap stock…which may already have happened in Q4. Our short book has a collection of companies that may be popular today but have fragile economic underpinnings.

As I mentioned before, if you were contemplating adding to your investment (or joining us) I would strongly consider doing so now. I have no idea if the prices will be lower in the coming months, but I do know what is in front of us now and it is as compelling as at any time since I started the Fund.

Thank you for your trust and support.

Adam Schwartz

Black Bear Value Partners

Read the full article here

Leave a Reply