Dear readers/followers,

By now you know that my investing style is fairly conservative. I don’t try to time the market and I don’t invest in companies that trade at high valuations, regardless of how bright the future might seem.

I stick to my approach of buying undervalued (mostly dividend-paying) companies in sectors which I expect to outperform over the next 3-5 years.

Occasionally I also buy into a small swing trade, if the conditions are right, and if I feel that the market has over-reacted in the short-term – a good example of this was my recent trade on Blackstone Mortgage Trust (BXMT).

Nonetheless, from time to time, I think it’s valuable to consider alternatives to one’s investing style. After all, this is the best way to learn from each other. That’s why I’ve decided to share my “conservative” outlook Tesla, Inc. (NASDAQ:TSLA) today.

Most readers will be familiar with the company and will argue that it should not be viewed purely as a car company. And I have to say, I agree.

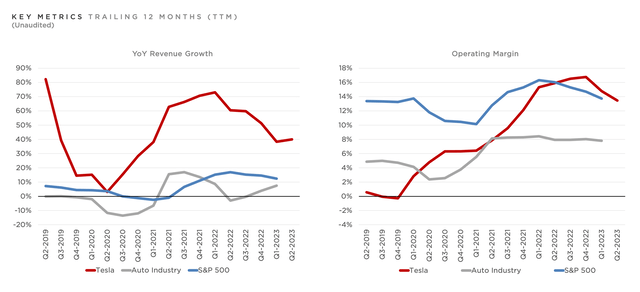

Tesla is fairly unique in that it: (1) has been able to grow its vehicle deliveries substantially faster than competition; (2) still has an incredibly long runway for growth as their market share in the U.S. stands around 4% and Europe and China at only half that; (3) it is able to generate operating margin 75% higher than traditional car manufacturers; and (4) it has multiple business segments beyond car production, many of which may become extremely valuable in the future.

Tesla Presentation

Moreover, their recent Q2 2023 results have been quite good with record quarterly vehicle deliveries at nearly 480,0000 vehicles, up 86% YoY and record quarterly revenue of nearly $25 Billion.

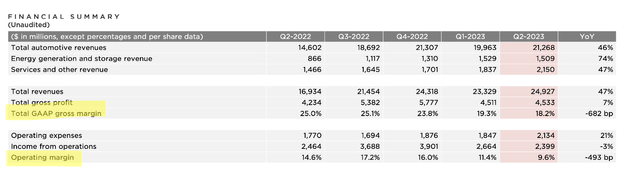

One area where the company took a hit was their gross and operating margin.

Gross margin dropped from an average of almost 25% last year to 18.2%, while operating margin dropped from an average of about 15% last year to 9.6%.

The drop in both was mainly a result of price reductions for many of Tesla’s models, which the company has resorted to in an effort to increase demand. I find this very worrying, especially as we continue to face a potential recession which would inevitably lead to lower consumer spending.

Tesla Presentation

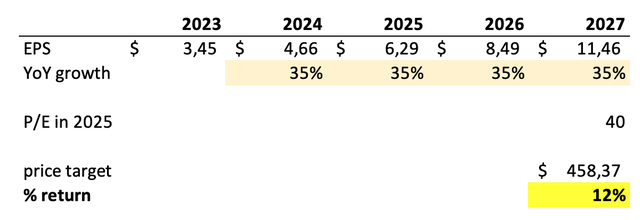

So far, Tesla remains on track to hit the consensus EPS target for this year of $3.45 (-15% YoY) and despite a drop in profitability, the consensus remains for 30-40% annual growth in 2024 and 2025.

At $256 per share, that implies a forward P/E of 74x and forward P/S of 7.8x. I don’t have anything against Tesla and do believe that they will continue to do well and continue to grow. But here’s the thing. None of that matters if we overpay for shares today. And I worry that is indeed the case. So let’s look some basic math.

A P/E of 74x is analogous to an earnings yield of 1.3% (+ of course zero dividend yield). No investor could possibly be happy with such a low yield, which is why anyone investing in Tesla today is relying either on: (1) further multiple expansion; or (2) substantial EPS growth for their upside.

The multiple could, of course, easily expand in the short-term, but as (if) Tesla matures, the P/E will tend to decrease to a more reasonable level, where established tech companies trade, my long-term target would be 30x earnings for fully mature Tesla.

So, from an investing standpoint (not short-term trading), we rely entirely on EPS growth to deliver upside. We already know that analysts are expecting 35% growth on average for the next two years. For the sake of the argument, I will assume that Tesla can continue to deliver that level of growth until 2027, which would result in 2027 EPS of $11.46.

By then, the company will have growth by a factor of 4.5x, which would put its market share in the U.S. close to 25% (and half that in Europe and China).

With that in mind, it’s fair to say that Tesla will have matured quite a bit, and therefore a 40x P/E seems reasonable. This set of assumptions results in a total annual return of 12%, which isn’t bad, but isn’t spectacular either given a relatively high level of risk and many things that could go wrong.

Author’s calculations

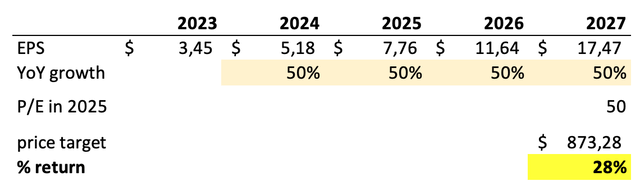

Now, I know what you’re going to say. The analysts are low-balling Tesla’s potential and will gradually increase their estimates. That could, of course, happen. If we assume 50% annual growth for the next five years and a more aggressive 50x earnings exit multiple, we get a total annual return of 28%.

That sounds exciting, but unfortunately I don’t think achieving this level of growth will be easy for Tesla and even if it does, it will have grown by a factor of 8x in the process, increasing its U.S. market share to almost 35%. It’s hard to imagine that at that point, the market would still be comfortable with a 50x earnings valuation.

Author’s calculations

All things considered, I think the upside is capped around 20% per year at the current valuation, even if things go very well for Tesla. On the other hand, if margin continues to decline and we enter a recession and consumer spending slows, Tesla could easily find its share price cut in half due to a combination of lower earnings and a multiple decline as a result of much worse growth prospects. That’s not a risk reward I’m comfortable with, and therefore rate Tesla a SELL here at $256 per share.

So let’s talk about alternatives.

Nr. 1 – Treasuries: I don’t think short-term treasuries are a solution, which I’ve explained in this article.

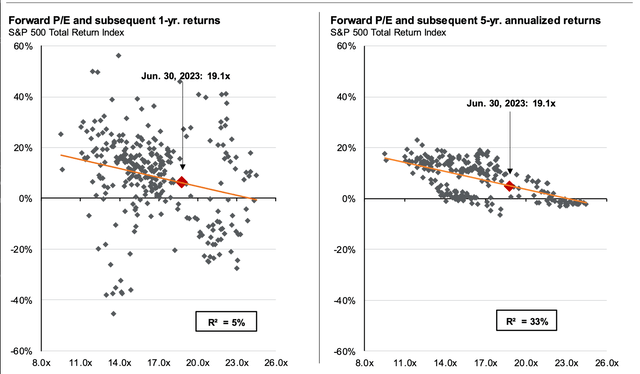

Nr. 2 – S&P 500: I don’t like this either as argued in my article here, because according to J.P.Morgan, the index is likely to return less than 5% annually from today’s elevated levels. In other words, they see high risk of a dead decade with subpar returns.

J.P. Morgan Asset Management

Nr. 3 – Undervalued dividend paying stocks: By far my favorite way of investing in today’s environment, because investors: (1) retain significant upside potential if positive catalysts play-out; (2) protect themselves against a dead decade scenario with higher dividend; and (3) avoid significant volatility and potential downside that investing in high P/E stock brings.

And the thing is, there are many great sectors where such stocks can be found. I like real estate investment trusts, or REITs, because of my real estate background and because I think they are very well positioned to rally, but there’s also Financials, Energy and Utilities.

Whichever sector you prefer, if you’re an income-oriented (perhaps older) investor looking to sleep well at night, rest assured that you will not miss out by ignoring Tesla at current valuations.

Read the full article here

Leave a Reply