I have been covering Sixth Street Specialty Lending, Inc. (NYSE:TSLX) since the very beginning of 2024, when I issued a bullish thesis referring to the resiliency and defensive structure (or investment approach) of TSLX. The overall idea was that TSLX offers as sustainable dividend streams as it gets in the BDC space, thus making the investment case attractive for yield-seeking investors. It was not so much about the potential price appreciation as back then the leverage was at optimum and we could already see some signs of flattening adjusted net investment income growth.

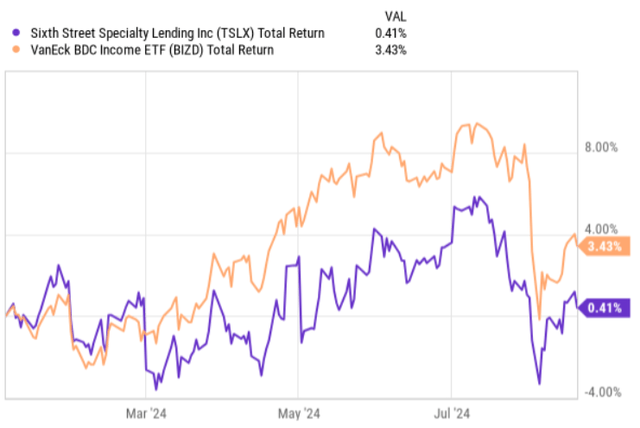

In the total performance chart below, we can see just that – i.e., TSLX recording a flat performance, while keeping the dividend streams alive. If we subtracted the dividend income component, we would arrive at a negative price performance of ~4.5%.

Ycharts

After TSLX circulated its Q1, 2024 earning deck, I made a follow-up article, where the key conclusion remained unchanged – i.e., TSLX continued to offer a de-risked dividend. The total returns performance since then has been also flat.

Now, relatively recently TSLX issued its Q2, 2024 earning report, which, in my opinion, reveals a couple of interesting data points that are worth considering the current investment case.

Thesis review

In a nutshell, the Q2, 2024 earnings results came in solid, showing signs of a stabilization at level that are clearly supportive for easily covering the existing dividend.

In Q2 TSLX generated net investment income per share of $0.58, which translates to an increase of $0.01 per share relative to the same quarter last year and a flat movement on a quarter-to-quarter basis. The adjustment net investment income, which takes into account the effects of incentive fees on net capital gains, landed at the exact same result of $0.58 per share, which is also perfectly in line with the result achieved in Q1, 2024.

Speaking of the NAV per share, there was a slight increase, although the potential for growing this metric is clearly bigger.

On the one hand, there was a positive contribution stemming from surplus dividend coverage, where TSLX added $0.58 per share from adjusted net investment income against its base dividend of $0.46 per share and a supplemental one of $0.06 per share. Then, TSLX achieved a nice uplift in the NAV of $0.02 per share from the accretive equity raise (i.e., issuing stock when it trades at a premium over NAV).

On the other hand, the effects from the net unrealized losses from portfolio company-specific events were so material that they almost entirely offset the aforementioned aspects. This was mostly driven by some write-offs of investments in lithium technologies, where the recipient of the funding has been exhibiting clear signs of a potential distress. An additional pressure came from reversal of net unrealized gains, which in essence is a non-cash like item. As a result of this, TSLX record NAV growth of only $0.02 per share compared to the prior quarter.

Here what is important to take into account is that TSLX continues to outearn the dividend, which allows building the NAV base going forward, and the negatives we saw this quarter that affected the NAV are not structural.

With that being said, the portfolio quality has remained robust with the weighted average debt to EBITDA of 5x and interest coverage of 2.1x, which ticked higher by 0.1x from the prior quarter. These metrics could be safely deemed conservative in the context of other BDC portfolios. On top of this, there is an extra layer of safety, which comes from the fact that the weighted average EBITDA (annualized basis) for TSLX investment companies stands at circa $104 million, which brings size advantage (e.g., already established business, better access to various financing sources, greater base for diversification). As a testament of strong credit quality we can take the nuance that during Q2, 2024 no new non-accruals were recorded despite the pressures we have seen for several other larger cap BDCs.

While the quality is still there, what else is critical is TSLX’s ability to shield the spreads and / or offset the spread compression by increased portfolio size. On a quarter-to-quarter basis, TSLX experienced relatively minor drop in portfolio yield from 14% to 13.9%. On the leverage front, the cost of debt went up by exactly the same percentage point, increasing from 7.6% in Q1 to 7.7% this quarter. The ~ 10 basis points of an increase in TSLX’s cost of debt profile was driven by the funding mix shift towards unsecured financing through organic debt repayment process. However, the estimate is that once TSLX repays its November, 2024 note, the adjusted NII could benefit from an incremental boost of ~ $0.01 per share in Q1, 2025 as the outstanding funding mix will consist of more favorable borrowings.

Speaking of portfolio growth, TSLX managed to grow the underlying portfolio asset base even though the M&A markets have not yet recovered and still introduce headwinds for the entire BDC industry. In Q2, 2024, TSLX funded new investments at an amount of $164 million, which slightly exceed the net repayment activity. Granted, the YTD net investment activity is still negative, but the cumulative difference is relatively immaterial at about $72,000.

Finally, before I summarize, I would like to specifically highlight the comment in the recent earnings call from Joshua Easterly – Chief Executive Officer & Chairman – that sent a clearly positive message for dividend investors, confirming my underlying thesis on TSLX:

As we assess our projected dividend coverage over the long term, we look at the shape of the forward interest rate curve. As of today, the forward rate curve bottomed out at a terminal rate of approximately 3.5%. Based on this curve, we believe that our base dividend of $0.46 per share remains well supported by operating earnings in this interest rate environment.

The bottom line

The recent earnings data showed that TSLX is not totally immune to the structural market dynamics that are currently shaping the BDC space. The spread compression and reduced M&A activity put a pressure for TSLX in growing the business further.

At the same time, it is important to recognize that while the business is not necessary growing, it has remained stable as TSLX has managed to keep the spread tightening at relatively minor levels and the deal flow sufficient to avoid notable drops in portfolio size. Plus, the overall portfolio characteristics have not been sacrificed at the expense of size protection (i.e., deal flow).

Given this as well as the positives that stem from slightly improved portfolio credit metrics and forthcoming savings on the cost of debt end, Sixth Street Specialty Lending remains a solid (and defensive) dividend pick.

Read the full article here

Leave a Reply